Overview

This article describes the Best Practice method for counting and entering a stock count.

It is important when stock counting that the process is easy and straightforward for users of the system. Therefore, there are some key practices which can make the entry of stock data more effective.

Preparation is key when counting stock, having an organized methodical manner for the process and the necessary time and resource available is crucial.

Before Stock Counting

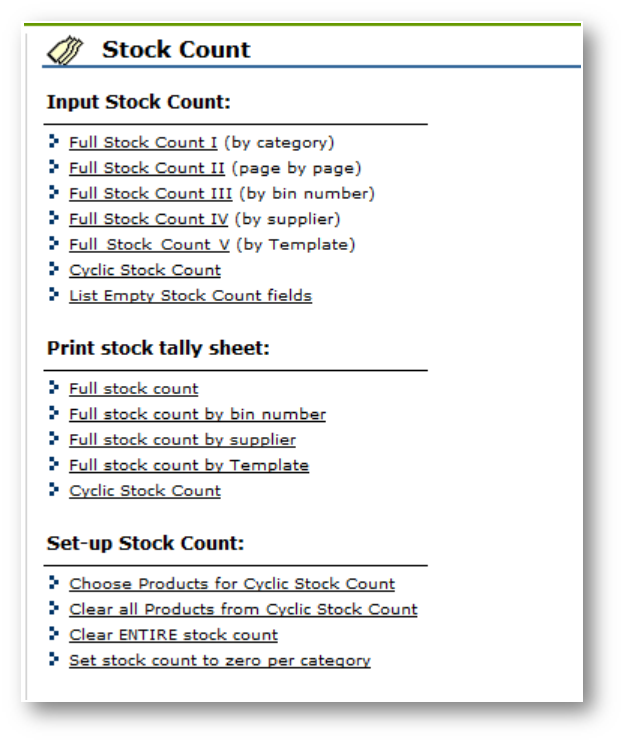

- Select the Stock Count page and print the appropriate Stock Tally Sheet, once the relevant sheet has been printed, ensure that the areas to count are neat and well organized

Fig.1 – Stock Count Options

Stock Counting

Before the count, areas should be clean and tidy. Any partial cases should be tidied and grouped where possible and any rubbish removed. Labels should be facing forward for easy reading and grouping of like for like products.

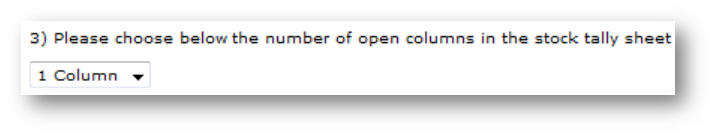

When stock counting, it is important to move around the business in an organized and methodical manner counting from left to right in the sub-section of the business to be counted. If multiple stock areas are to be counted, i.e. bar and cellar, multiple columns should be selected on the stock tally sheet.

Fig.2 – Column Selection

- Selecting Multiple Counting Columns allows the user to count each area independently and add up the total values when the count has been completed

It is useful to have more than one person conducting the stock count, as this aids with the speed of the count. This also ensures that the count is being checked and verified by two users.

-

Conduct the stock count before business opens on the first day of the next stock period, ensure that enough time is allowed for any re-counts or investigations required

- Ideally, the count should be conducted when the holding stock is at the lowest possible amount, as this will reduce errors in counting

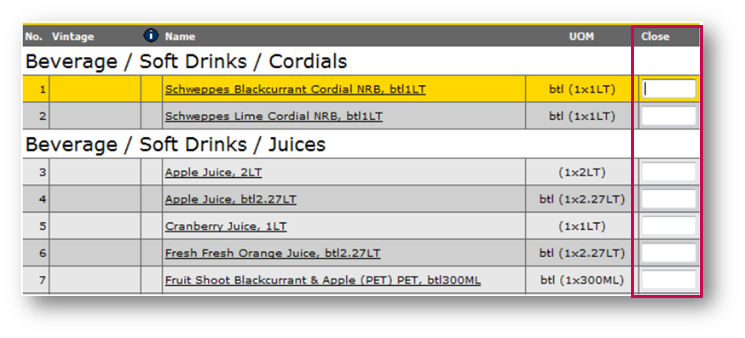

- Ensure that the Unit of Measure is referenced when counting the stock

Fig.3 – Unit of Measure Displayed

Entering a Stock Count

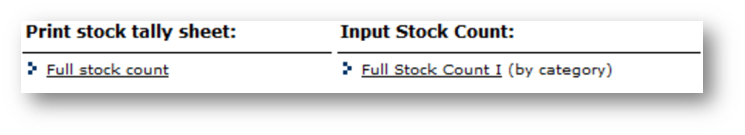

Dependent on the Stock Tally sheet option selected, a relevant partner input stock count option is available.

Fig.4 – Stock Count Options

The full Stock Count Tally Sheet is ‘partnered’ with both the ‘Full Stock Count I (By Category)’ option and the ‘Full Stock Count II (Page by Page)’ option, the count sheet groups the products by category and then alphabetical within each category.

The tally sheets displaying the products by bin number, supplier and by template are paired with the corresponding input interface, as is the cyclic stock count.

- Select an Input Option to display the relevant Products and Batches in the appropriate order to enter a stock count

- To enter a stock count, enter either the quantity of the item, or 0

- Use the Tab key on the keyboard to move down the lines

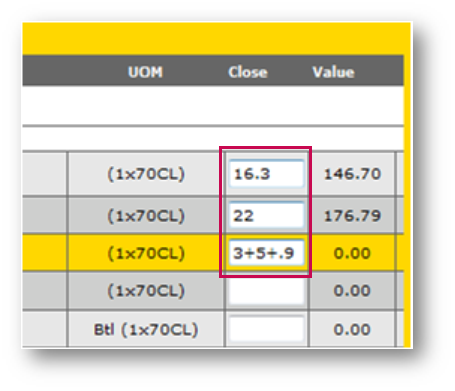

Fig.5 – Entering Stock Count

- Use the Hide Products Not in Use tick box to hide any products which are assumed to have no stock on the input sheet

Fig.6 – Hide Products Not in Use Option

- Deselect the Hide Products Not in Use box to bring back the entire list with zeroes against the products which are assumed to have no stock

This can be used as a way of checking all processes have been carried out accurately in the period.

If the system logs that there is zero stock, but the user has physically counted stock against the same product, then it is a prompt that a delivery or transfer wasn’t entered/the stock wasn’t counted correctly.

- To ensure ease of calculation, use the + or – keys when entering the closing stock

Please Note: The * and / keys will not work.

Fig.7 – Calculation Options in Stock Count Sheet

- Save at regular intervals as users are often timed out of the system

Fig.8 – Save / Save & Return Options

- Select Save and Return to return to the Stock Management page

- Finalise the stock count before closing the period

Finalising the stock means the closing quantity cannot be changed unless the user is authorized to do so.

- When Save & Finalise is selected, an additional security setting is in place to ensure that all products have a value populated against them and that all lines have been checked

Fig.9 – Save & Finalise Options

The ‘Confirm Finalisation of Stock Count’ screen will display.

- Enter the user’s name in the Counted By field as an additional audit of the stock entry process

The Sales, Purchase and Transfer Data must be checked and verified before the period can be closed.

Checking Sales & Purchase / Transfer Data

A final check must be conducted to ensure that all information relevant to the stock period is up to date and has been correctly approved into stock holding.

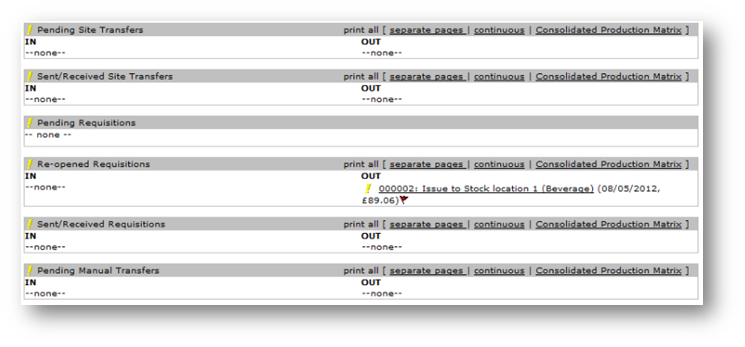

- Check the Pending tab in the ‘Stock Management’ page to ensure that all relevant transactions have been approved into the stock period

Fig.10 – Pending Tab

- Check that all purchases for the period have been approved into stock, or deleted from the system if not relevant

- Ensure that there are no pending delivery notes for the stock period dates

Fig.11 – Pending Delivery Notes

When all Purchase and Transfer data is up to date, the Sales must be checked before the stock period can be closed.

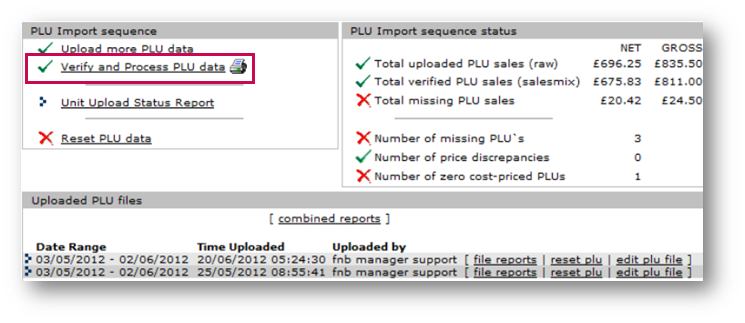

- Select Stock Management > Import POS Figures to verify the PLU data uploaded from the Epos provider

- Ensure that a Sales File is present for each day of the period in the Uploaded PLU Files section

PLU data uploaded from the Epos provider is displayed against the ‘Total Uploaded PLU Sales (Raw)’ line. This indicates the total net and gross sales value uploaded from Epos. This must be confirmed that this figure is as expected based on reports from Epos.

The ‘Total Verified PLU Sales (Sales Mix) line displays the total sales value that the system ‘recognises’, i.e. the PLU number sent by the Epos company has a corresponding menu item in the system to allow the stock to be down dated.

- If these two figures match, then proceed to closing the stock period. If the figures do not match, select Verify and Process PLU Data

Fig.12 – Verify and Process PLU Data Option

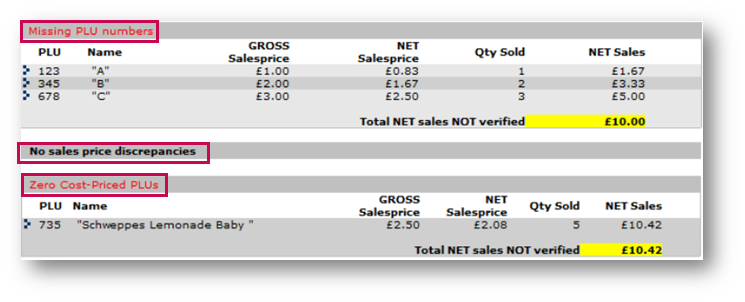

The unverified sales will then display:

- Missing PLU Numbers – These are the PLU numbers sent by the Epos company which do not have a corresponding menu item in the system. This menu item must be created before the stock is closed

- Sales Price Discrepancies – These are any price discrepancies between the Sales Price submitted by Epos and the Sales Price set on the system. This is purely for reference only as the system uses the Epos actual sales data

- Zero Cost-Priced PLUs – These are PLU numbers that have a corresponding menu item in the system, however, the menu item contains no ingredients and therefore no cost. The menu item ingredients must be updated before the stock period is closed

Fig.13 – Unverified Sales

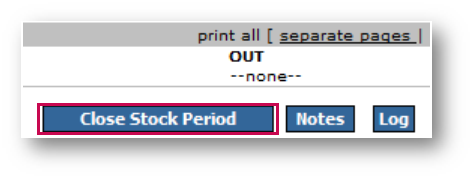

- When both the Transaction Data and Sales Data have been checked, corrected if necessary, and confirmed, close the stock period

Fig.14 – Close Stock Period Option

- To close the Stock Period, select Stock Management > Close Stock Period

- It is possible to re-open the Stock Period once it has been closed, this is contingent on User Access Rights

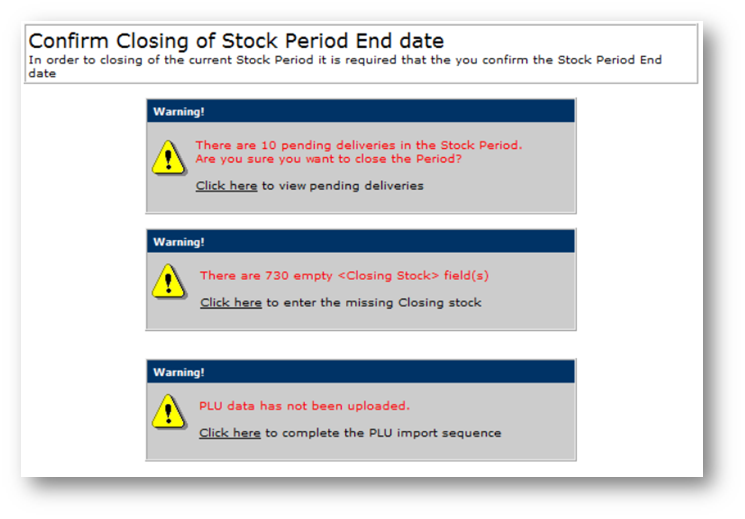

The system will generate warnings if an attempt is made to close the Stock Period and any of the above tasks have not been completed.

Fig.15 – Pending Delivery Warnings

When closing a Stock Period:

- Enter a Stock Count against each Product/Batch

- Approve or Delete all transactional data relevant to the period as necessary

- Verify, check and process PLU data

Best Practice Methods

When the Stock Period is closed, figures for the period are now accessible. Some actions that were accessible to the user in an open period can no longer be accessed. However, orders and transfers can be completed as normal as long as the effective date falls outside of the Stock Period range.

Build into the management week specific allocated times to carry out these processes required by the system:

- Ordering goods

- Receiving deliveries and invoices

- Raising credits

- Requisitions (if applicable)

- Site transfers

- Wastage

- Account transfers

- Checking sales

If users have to carry out all actions at the end of the period, this greatly increases room for error and does not allow a suitable time for checking any variances on the Stock Reconciliation.

Always ensure that adequate preparation has gone into the counting process.

Comments

Please sign in to leave a comment.