Calculating Sales Value

- The sales value is distributed as a % of the Cost of the Menu item

- The Sales Mix Report by product will show the breakdown of the sales per product

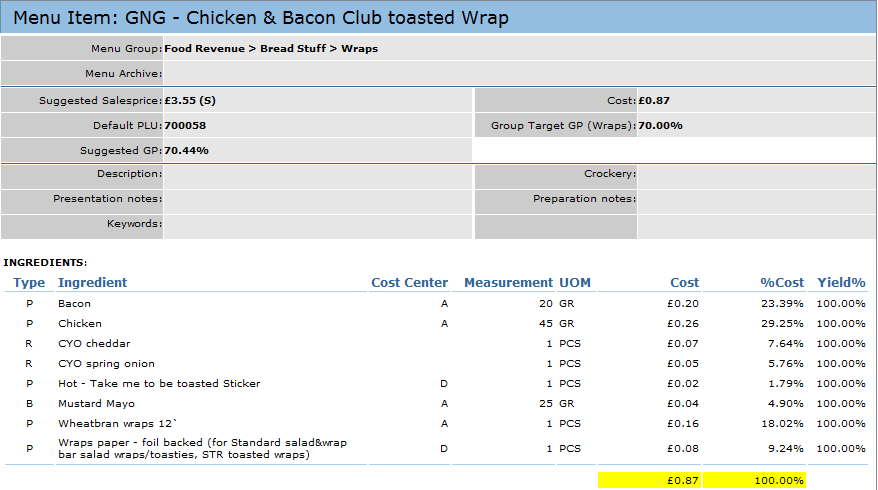

Fig 1 - Menu Item Ingredients

-

Sales are always distributed at a Net Sales value. In Fig 1 above the Sales price is £3.55. The VAT value is set as (S) for standard and 20% VAT applies

- £3.55/1.20 = £2.958

- The Net sales value if 1 item is sold of the PLU will be £2.958. Once the Net sales value is determined, the sales distribution can be calculated

- Assuming 10 items of the above PLU are sold the Gross Sales value would be £35.50.

- This would calculate to a Net Sales value of £29.58 (£35.50/1.20 = £29.58)

- The sales value is distributed as a % of the Cost of an ingredient within Menu item

- Take the net sales value of the PLU and work out the % per ingredient in the menu item

- Example above shows Bacon has a 23.39% distribution of the overall cost. £29.58 (net sales value) / 100 * 23.39% (% Cost) = £6.91

- This means that the sales value for the bacon based on £29.58 worth of sales will be £6.91

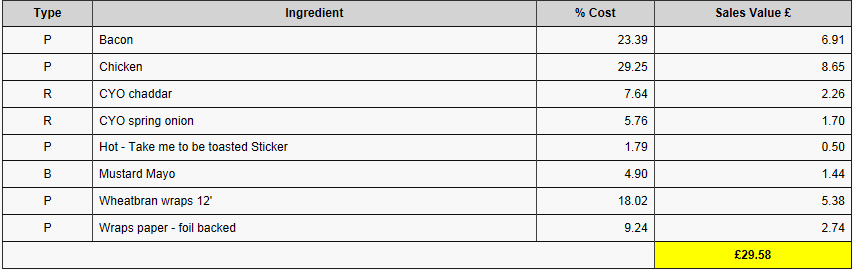

- The table below works out the distribution for the entire menu item

Fig.2 - Distribution for an entire menu item

Please Note:

- When calculating the values manually there may be a variance of up to 5p items however this is due to the amount of decimal places FnB calculates to

- Where the item in the menu is a recipe the distribution of that recipe would need to be calculated separately

- For recipe CYO cheddar take the calculated sales value of £1.70 and then use this value to work out the distribution of the items within the recipe

Calculating Sales Quantity

- To distribute the sales quantity of a product take the total sales quantity of the menu item and work out the quantity sold within an individual menu item

-

For example, Bacon with the sales quantity of 10 would mean that 200g had been sold (10*20g). The product base UOM is 1kg

- Bacon Quanity Sold = (total quantity sold of bacon) / (UOM of product)

- 200g / 1000g = 0.2

Please Note:

- There can be a difference in the sales quantity between the Sales Mix reports and the Stock Reconciliation POS sales this can be due to the Yield of a product

- Yield on the sales only applies to the stock recon POS figures not the quantity figures on the sales mix reports

- If a product has a yield cost you add the value of the yield onto the sales quantity. You do this by dividing the sales quantity by the yield%

-

For example if a 20 Salmon were sold and the salmon had a yield of 80%, then add the yield onto the sales

- 20/0.80 would give a sales quantity of 25

Comments

Please sign in to leave a comment.