Overview

This article explains how custom tax, or value added tax (VAT) rates can be set up and used within the FnB Manager application. The setup of this feature is access-driven within FnB Enteprise Manage, therefore the initial configuration should be completed by an internal administrator.

What is Value Added Tax (VAT)?

VAT is an indirect tax. Occasionally it is referred to as a type of general consumption tax. In a country which has a VAT, it is imposed on most supplies of goods and services that are bought and sold.

FnB Manager as a procurement system already caters to VAT globally. The system functionality is explained below.

Setup of VAT rates in FnB Enterprise Manager

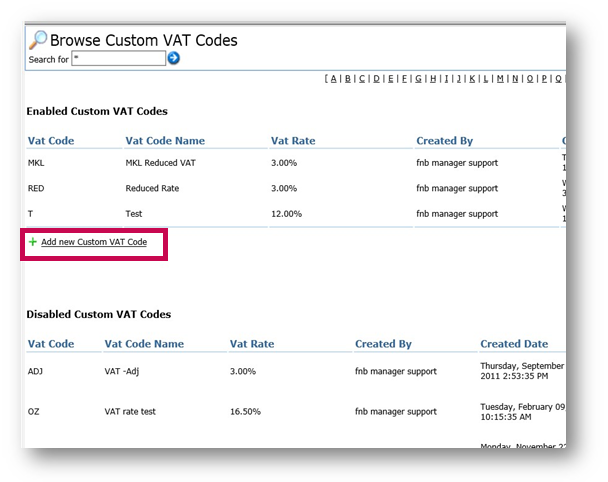

- Go to FnB Enterprise > System Administration > General Admin > Custom VAT codes > Add new Custom VAT Code

Fig.1 - Add new Custom VAT Code button in System Administration

- Enter a new code (R, for example)

- Enter the rate that should be applied (5%, for example)

- And enter a name for the new code (Reduced 2020, for example)

- Save changes

The new rate will then be available to assign to products within the system.

Using Custom VAT Codes with Products

A VAT code can be added to each product at Enterprise level.

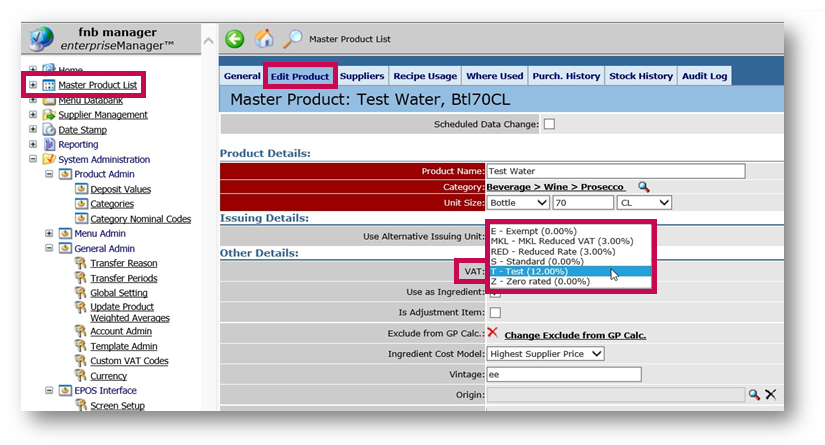

- Go to Master Product List

- Locate and open a Product

- Go to the Edit Product tab, and under ‘Other Details’, make a selection from the VAT drop-down to apply the new code

- Save Changes

Fig.2 - Adding a VAT code to a product

Fig.2 - Adding a VAT code to a product

Using Custom VAT Codes with Menu Items

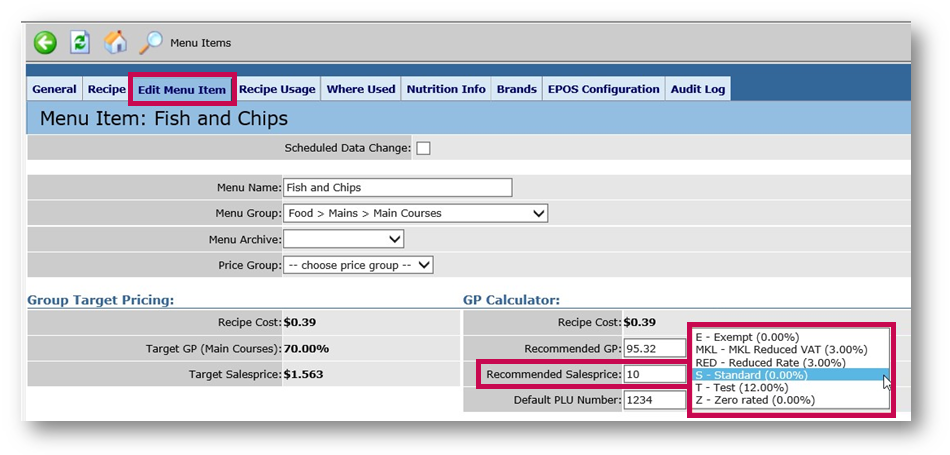

A VAT code can also be added to each Menu Item at Enterprise Level.

- Go to > Menu Databank > Menu Items

- Locate and open a Menu Item

- Go to the Edit Menu Item tab, and under ‘GP Calculator’, make a selection from Recommended Salesprice

Fig.3 - Adding a VAT code to a Menu Item

Fig.3 - Adding a VAT code to a Menu Item

Scheduling Data Changes

Steps for changing VAT codes via a scheduled data change:

- Create a new custom VAT code at the new 5% rate

- Set up a scheduled data change at Enterprise level for the VAT codes for the required products and/or recipes to change to the new VAT code on July 15st 2020

- The scheduled data change will need to be approved by July 14th 2020 at the latest to ensure the update happens on July 15st

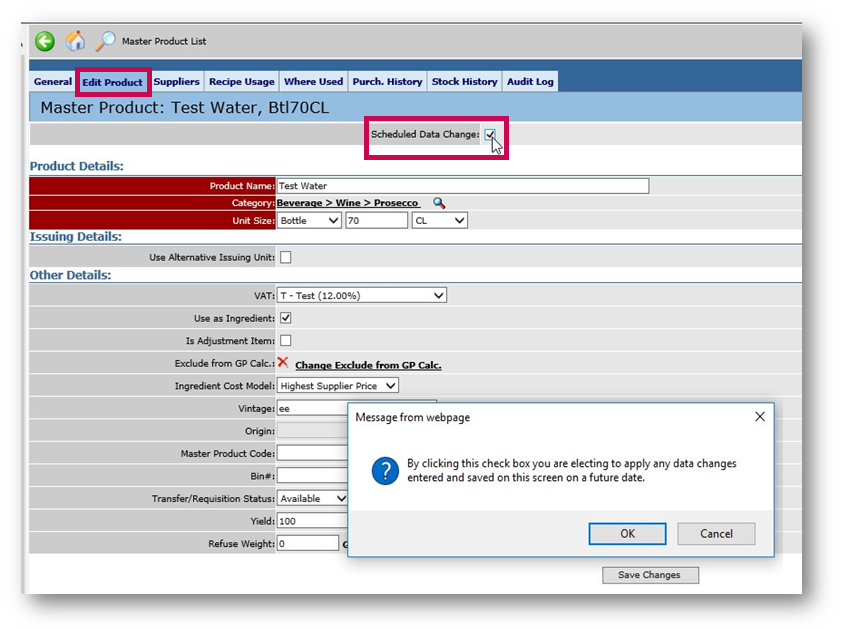

Amendments to a product or recipe VAT code can also be scheduled to take effect on a specified date:

- Go to Master Product List/Menu Databank > locate and open a product

- Go to the Edit Product tab and tick Scheduled Data Change

- Make required changes to the VAT rate and add the Date to apply it for

- Also ensure this change is assigned to Sites as required

Fig.4 - The Scheduled Data Change tickbox

Fig.4 - The Scheduled Data Change tickbox

For more information on Scheduled Data Changes, please see FnB Live - Applying Scheduled Data Changes.

Comments

Please sign in to leave a comment.