Overview

When products have to be purchased locally using petty cash, they must be recorded in the system to ensure that the stock count is correct.

It is only worth recording items that affect the GP, as other purchases are usually managed outside of the system.

This article describes the best practice method for creating and maintaining Petty Cash accounts.

Creating a Petty Cash Account

-

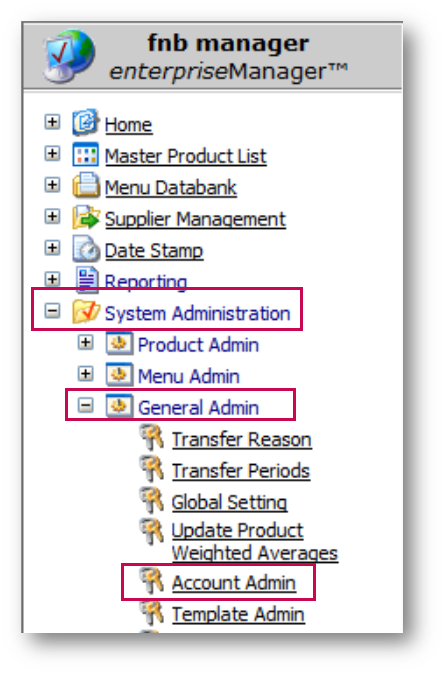

To add a Petty Cash account, go to Enterprise > System Administration > General Admin > Account Admin

Fig.1 Account Admin Link

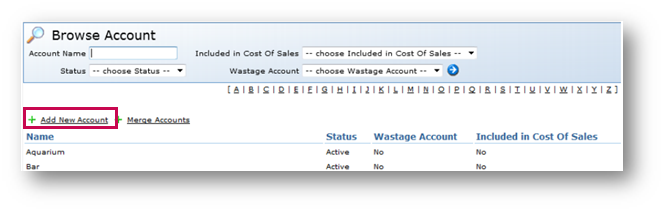

- Select Add New Account

Fig.2 - Add New Account Link

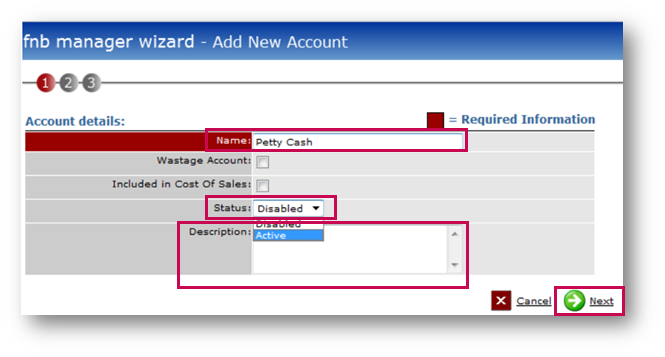

- Enter the Account Name

- Ensure that Wastage Account and Included in Cost of Sales boxes are not checked

- Select Active from the Status drop-down

- Enter a Description if necessary

- Select Next

Fig.3 - New Account Details

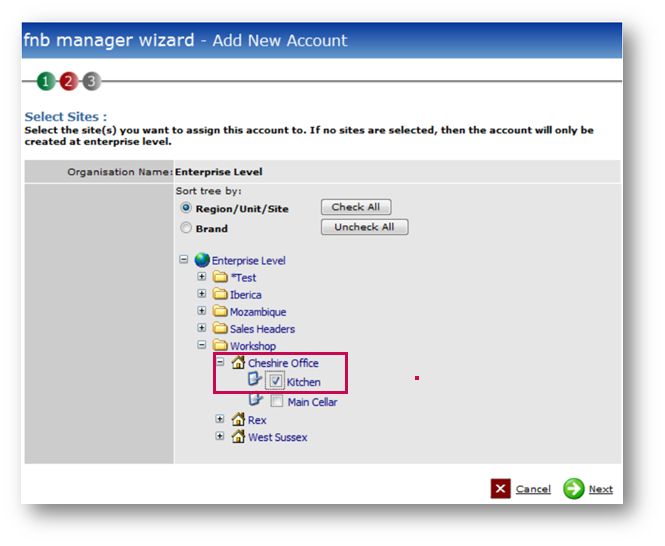

The Petty Cash account can then be added to any site that will use it.

- To do so, expand down to the relevant sites and tick the boxes

- Select Next

Fig.4 - Adding the Account to Site(s)

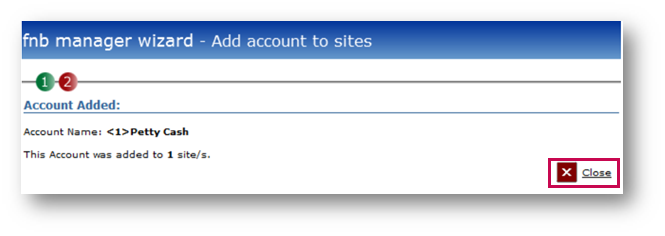

- Select Close

Fig.5 - Account Added to Site(s) Confirmation

Petty Cash Adjustment Items

As the purchases from the local shops are likely to have different Cost Prices to the price in the system from the Supplier, this must be managed correctly to ensure the correct Cost of Sale for the goods.

It is not possible to adjust the Cost Prices of a product entered into a Petty Cash account, and so this must be managed using Adjustment Items.

Creating the Petty Cash Adjustment

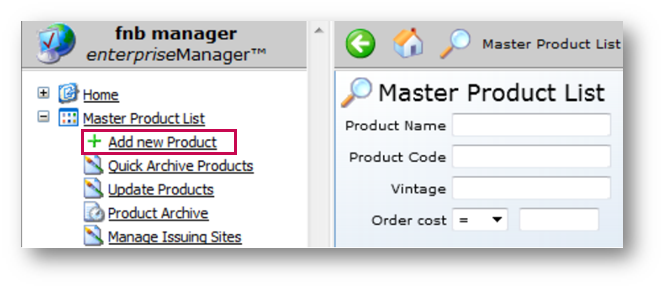

- To create a Petty Cash adjustment, go to Enterprise > Master Product List > Add new Product

Fig.6 - Add new Product Link

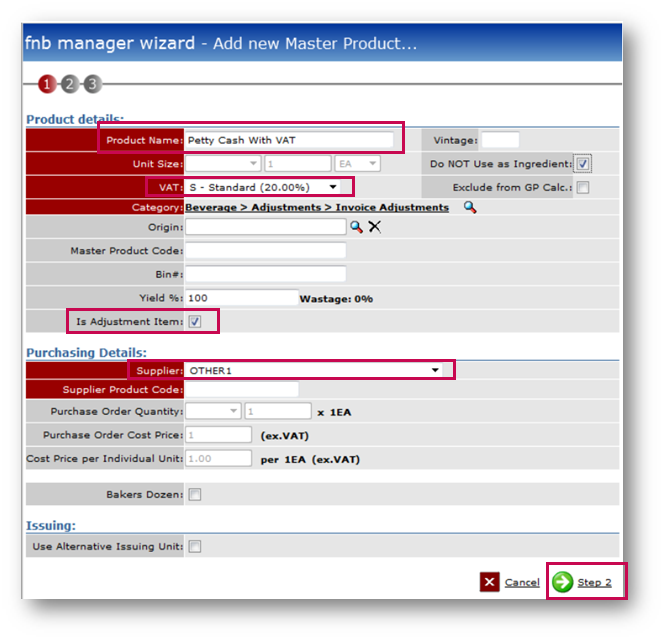

There will likely be a requirement for two products, one for food with no VAT, and one for beverage with VAT.

- It is advised to add this into the Product Name so that when sites use the product, the correct one will be chosen (see Fig.7)

- The Petty Cash product should be added to a fake Supplier on the system

- The product must be selected to be an Adjustment item by selecting Is Adjustment Item

This will default the item to be at a cost of £1 and will not be available for ordering.

- If there is a requirement to create a Petty Cash without VAT, then copy the Product and change the name to state there is no VAT

- Change the VAT to zero and the category if required, then select Step 2 and Finish

Fig.7 - Product Details

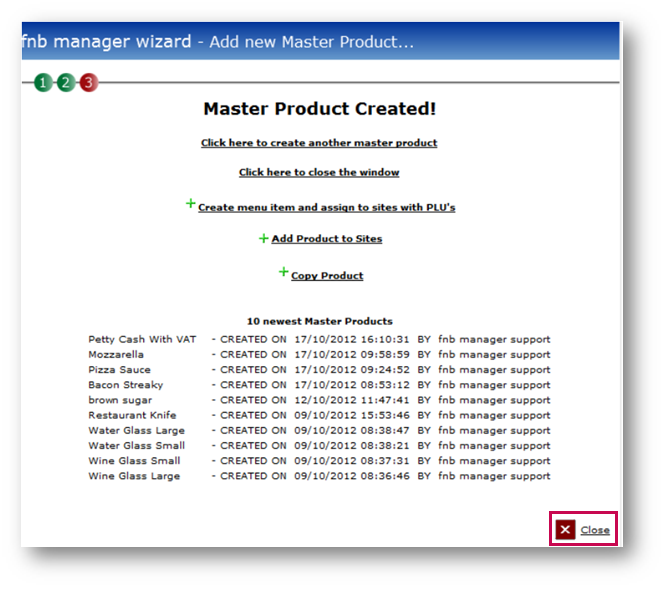

- Select Close

Fig.8 - Product Created Confirmation

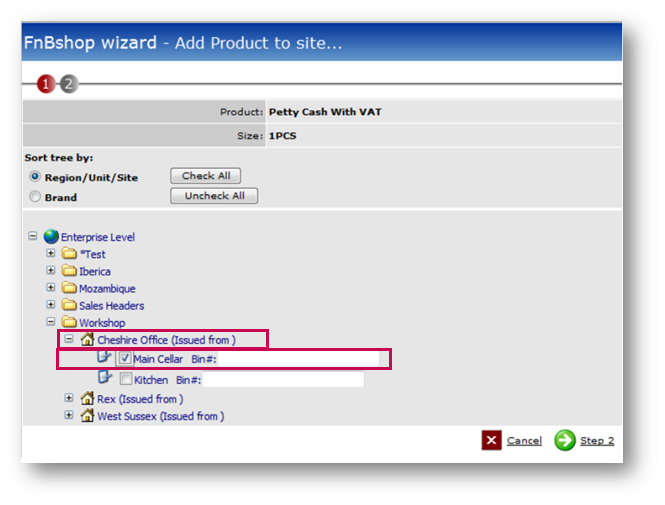

To assign Petty Cash products to the required sites:

- Go to the Where Used tab on the Product and select Add Product to Sites

Fig.9 - Add Petty Cash Item to Site(s)

Things to Note About Accounts

Accounts are used to track stock that has come in and out of the system when it was not ordered from a Supplier or Returned, when it was not Site Transferred, Requisitioned or Sold.

- If the account is a Wastage account, it generally will affect the COS and will be ticked as such

- If the stock is going out to an account that affects the Cost of Sale, e.g. staff food, it must be ticked to affect the COS, as it will mean that the actual COS will be greater than the theoretical COS by this amount

- If the stock is going out to an account that does not affect the Cost of Sale, then it must not be ticked to affect the COS and it will credit back to the Management figures

- If the stock is coming into an account that affects the COS, e.g. from Petty Cash, then the account must not be ticked for it to affect the COS

Comments

Please sign in to leave a comment.