Overview

Rates are used to manage extra charges on receivings. These could include Sales Tax, VAT or Shipping.

Process

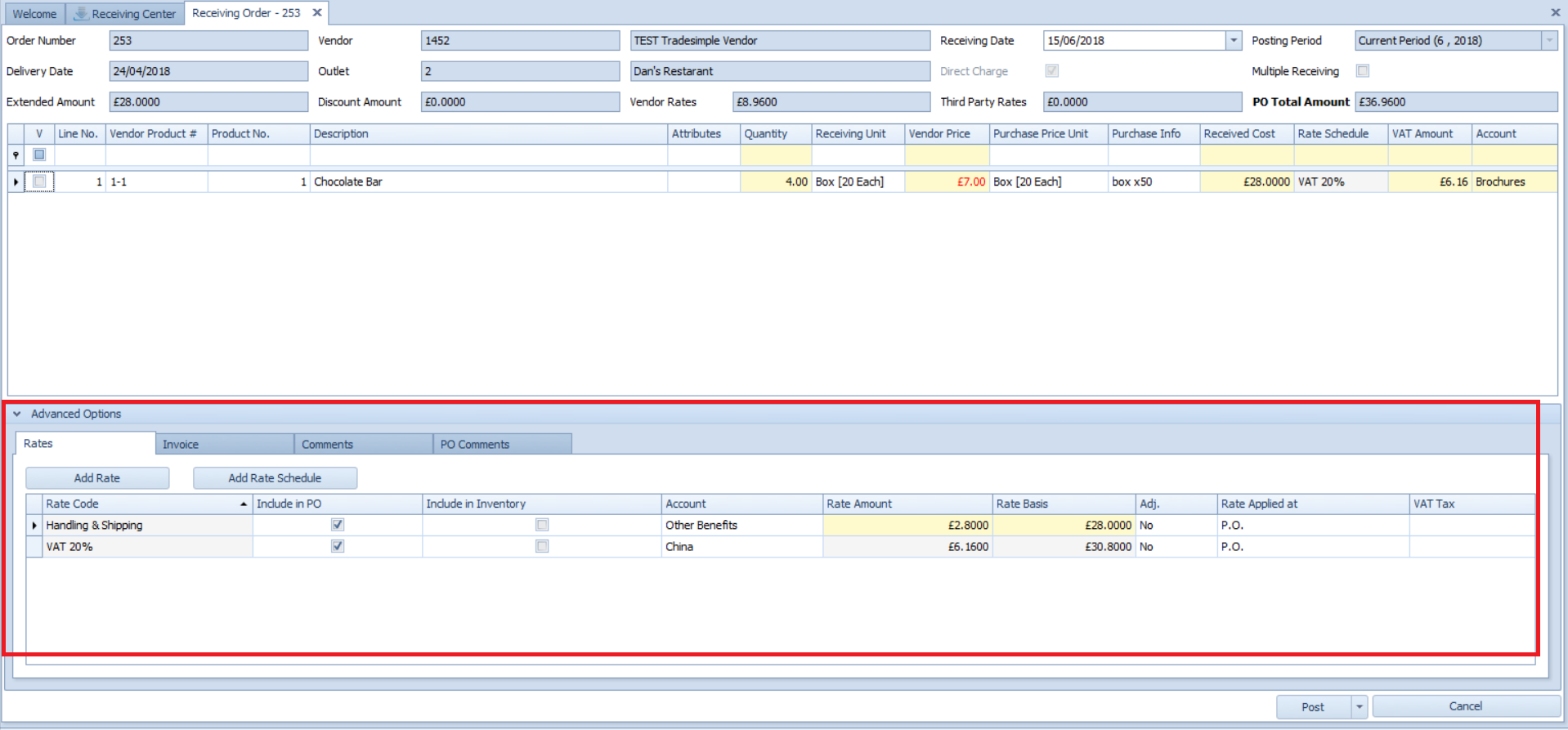

- To enter a receiving rate, go to Receiving > Receiving Centre > Select Receiving >Details > Rates tab

Fig.1 - Rates Tab (at Receiving)

| Button | Description |

| Add Rate | Click this button to add a rate. Note: This rate will be applied to all the products in the purchase order. |

| Add Rate Schedule |

Click this button to add a rate schedule. Note: This rate will be applied to all the products in the purchase order. To apply a rate schedule to an individual product, select the rate schedule from the Rate Schedule field in the corresponding line in the product grid. |

Fields

| Field Name | Description |

|---|---|

| Rate Code | Displays the rate code for the corresponding rate. These are pre-set (either at Property or CP depending if Rates at CP flag is set) in Property > Set-up > Rates. |

| Include in PO | Includes the rate as part of the Purchase Order cost. Rates will have this pre-configured at Property > Setup > Rates. |

| Include in Inventory | Includes the cost of the rate as part of the Inventory unit of the products on the receiving. Rates will have this pre-configured at Property > Setup > Rates. |

| Account | This field displays the account the rate will be billed to. This will be pre-configured to the rate at Property > Setup > Rates. |

| Rate Amount | Displays the rate amount automatically calculated by the system. This value can also be edited manually within the Rates tab or by right-clicking individual line items to adjust the allocation(s). Note: The user should enter the value manually if the rate was applied manually using the Add Rate button. |

| Rate Basis | Displays the rate basis. Note: The user should enter this value manually if the rate was applied manually using the Add Rate button. |

| Adj. | If this rate represents an adjustment, this field will show the value "Yes" (If the rate was added during a receiving, or if its value was modified during a receiving). Otherwise, it will show the value "No". |

| Rate Applied at | Displays when the corresponding rate was applied. |

| VAT Tax | Standard practice would be for a user to add one VAT rate to a receiving. However, in certain cases it might be necessary to add a separate VAT rate to the rate that represents an adjustment or a service, for example, shipping. This field allows merging a VAT rate to a non-VAT rate. The option Include Inventory should be selected for this rate. The Use Vat Amount option should be disabled at Property > Administration > Property Preferences > Receiving. This functionality works as follows:

|

When Rate/ Rate Schedules are added per Product at Ordering, they’re each multiplied by the quantity received.

Best practice is to enter all Rate/ Rate Schedules at Receiving/ Receiving Correction screen to ensure correct rates are added and distributed across all products correctly.

VAT Rates on Delivery Charges consolidating for A/P Export

The file interface exported to A/P consolidates the monetary value of lines where all other values within the record are the same.

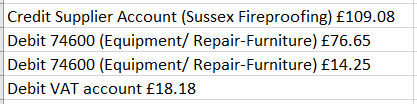

However if when adding a delivery charge via rates, if VAT has been added to the product cost but not the delivery, then when exporting to AP this will appear as two lines (as per Fig.2).

Also if the VAT rate has been increased to cover the delivery charge, rather than creating a new rate, the rate will still be assigned to just the product instead of the product and the delivery charge.

In the example (Fig.2) the £14.25 cost is the delivery charge, but is 0 VAT rated, whereas the product £76.65 is SR (Standard Rated) so has to display on a separate line in the A/P.

Fig.2 - API export with no rate against Delivery Cost

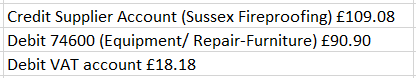

If configured correctly (with a SR rate assigned to the delivery note as well as the product), the A/P should export the consolidated figure (as per Fig.3).

Fig.3 - A/P export with identical rates against Delivery Charge & Product

Use Tax

It is recommended that all Products that should incur Sales/Use Tax are marked as such with the applicable Rate Schedule. Should the Vendor then not charge Tax on their Invoice, a negative/offset Rate for 'Accrued Use Tax' can be added, which posts directly to the Balance Sheet 'Account' rather than flagged to 'Include Inventory' as outlined in this article - Purchasing & Inventory - Creating a Rate/Rate Schedule.

This practice will result in the Product Account being increased by the value of the expected Sales/Use Tax but the 'Accrued Use Tax' offsetting the same amount so that the net total payable to the Vendor balances to the Invoice value.

Vendor Rates

Based on the combination of the 2 flags: Include on Vendor PO and Include Inventory, the rate values have different behavior for balancing to Invoices and exporting to Accounts Payable. For additional information, please also refer to Purchasing & Inventory - Creating a Rate/Rate Schedule

Comments

Please sign in to leave a comment.