Overview

If several orders for goods are placed from overseas, these will be delivered in a single shipment via a shipping company. For example, if both crockery and linen are ordered from China, but from two different suppliers, both will be delivered in a single shipping container managed by a freight company. The cost of the freight and any imported taxes need to be included in the cost of the crockery and linen.

However, this presents a challenge because the rate applied to the receiving for both products is inflated to allow for freight costs. As a result of this, the invoice cannot be posted as it will not balance.

For example, if the value of the crockery order is £3,800 and a rate of £150 is added to cover the shipping costs, then the value of the receiving will be £3,950. Yet, the value of the invoice from the crockery vendor is £3,800 and cannot be posted due to this mismatch.

This article will guide through the configuration, receiving, and invoice processes required when products are delivered by freight forwarders.

Setup

Accounts

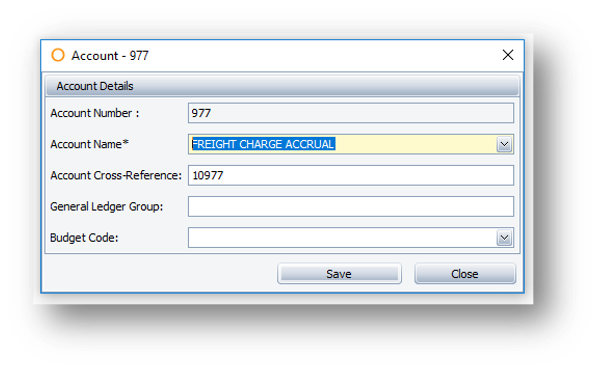

An account set up in both Purchasing & Inventory (P&I - formerly known as Adaco) and the user’s finance system for ‘Freight Charge Accruals’ is required.

Fig.1 - Account setup required

Rates

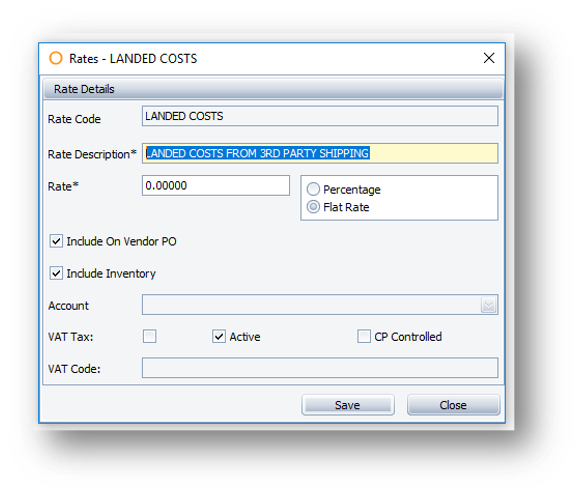

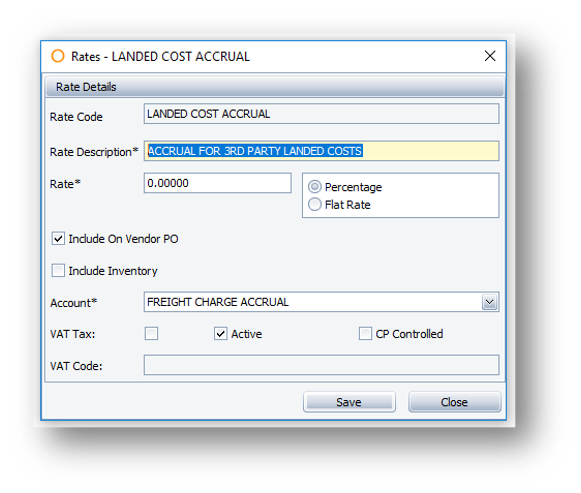

Two rates for freight are required as followed:

- LANDED COSTS FROM 3RD PARTY SHIPPING - this rate is used to apply the cost of the shipping to products, e.g. crockery and linen

Fig.2 - First-rate for freight

- ACCRUAL FOR 3RD PARTY LANDED COSTS - this rate is used to accrue for the freight costs

Fig.3 - Second rate for freight

Process

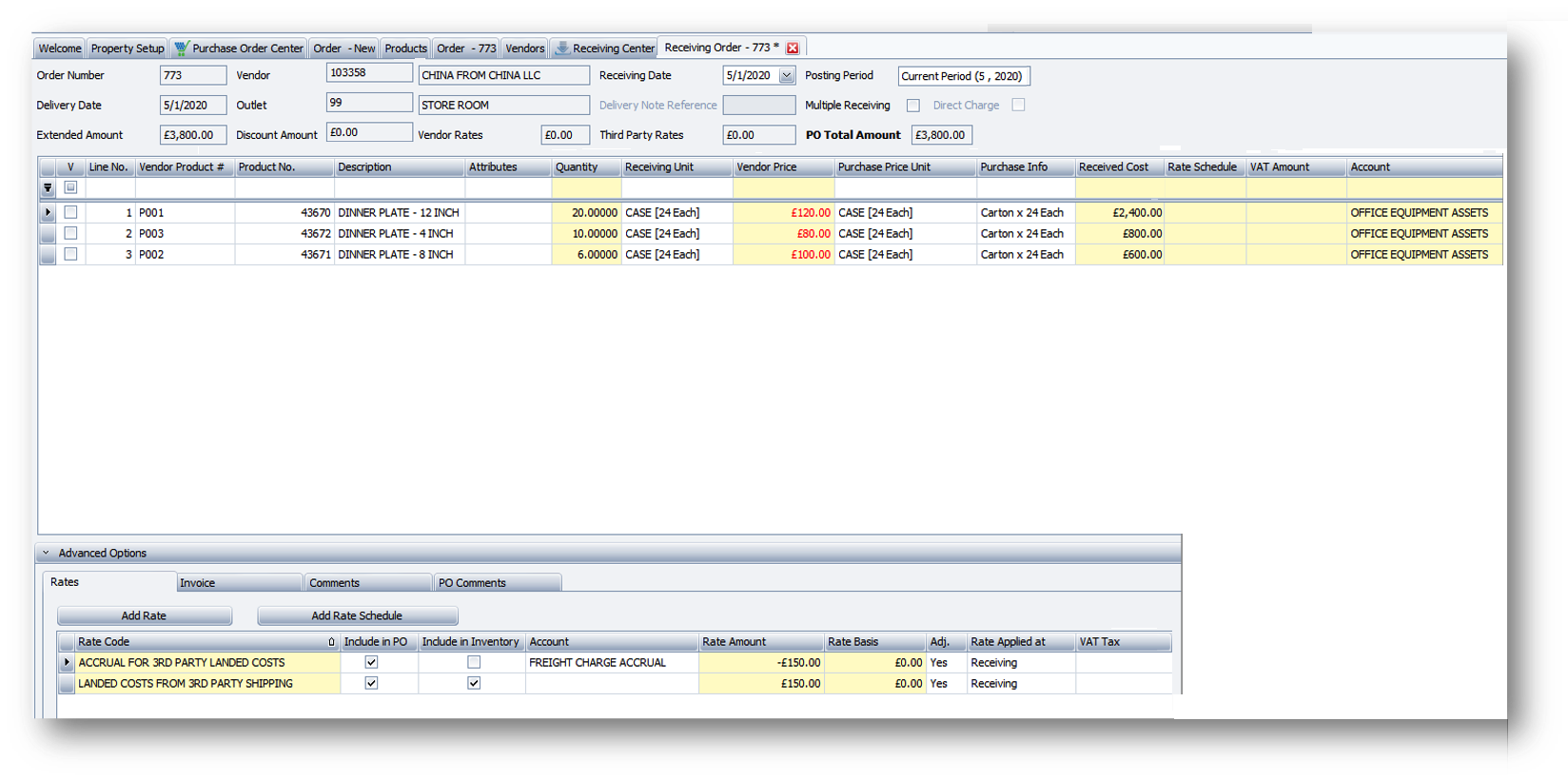

- Receive the PO for the first product, e.g. crockery

In this case, the total value of the crockery order is £3,800 which matches the value on the invoice from the crockery vendor.

- Add the rate LANDED COSTS FROM 3RD PARTY SHIPPING and give it a value of £150

As this rate is marked as 'Include in Inventory' (see Fig.4) the £150 will be added to the value of the crockery.

Please note: At this point, the value of the receiving is now £3,950 which will not balance with the value of the invoice from the crockery vendor.

- Add the second rate ACCRUAL FOR 3RD PARTY LANDED COSTS and give it a value of -£150

The value of the receiving is now back to £3,800 (£3,800 + £150 - £150).

- Post the invoice from the crockery vendor at a value of £3,800

Fig.4 - Freight forwarder process

- Do the same for the other products, e.g. linen

Assuming that the total shipping costs from the 3rd party shipping company is £300, £150 is assigned to crockery and £150 to linen.

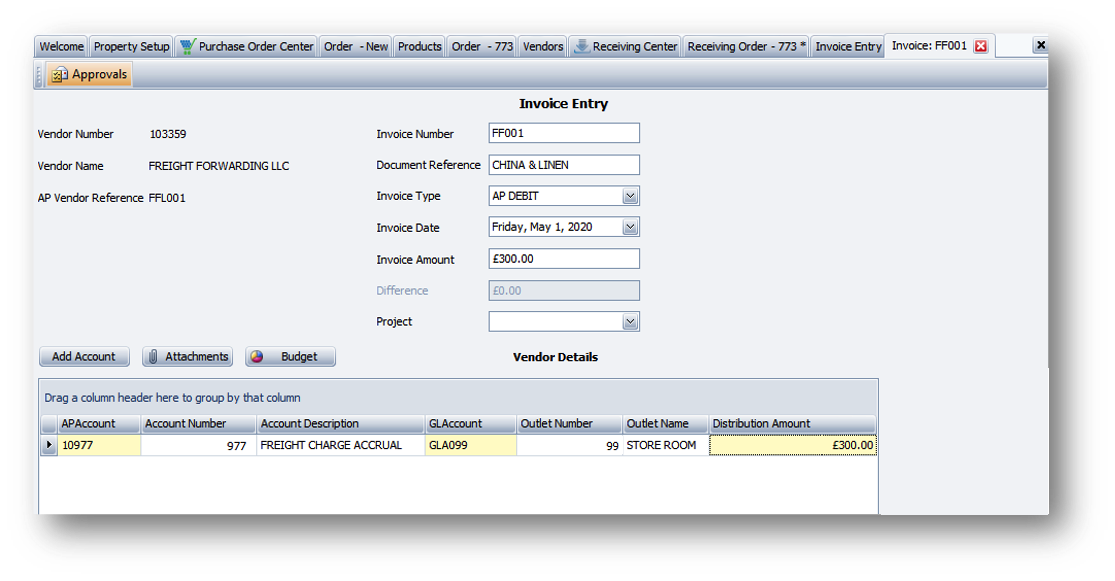

- Post an invoice for the 3rd party shipping company. This can either be against a PO or, more likely will be a non PO invoice as PO probably hasn't been created for the shipping charges

- Assign the cost of the invoice to the FREIGHT CHARGE ACCRUAL account

Fig.5 – Invoice entry

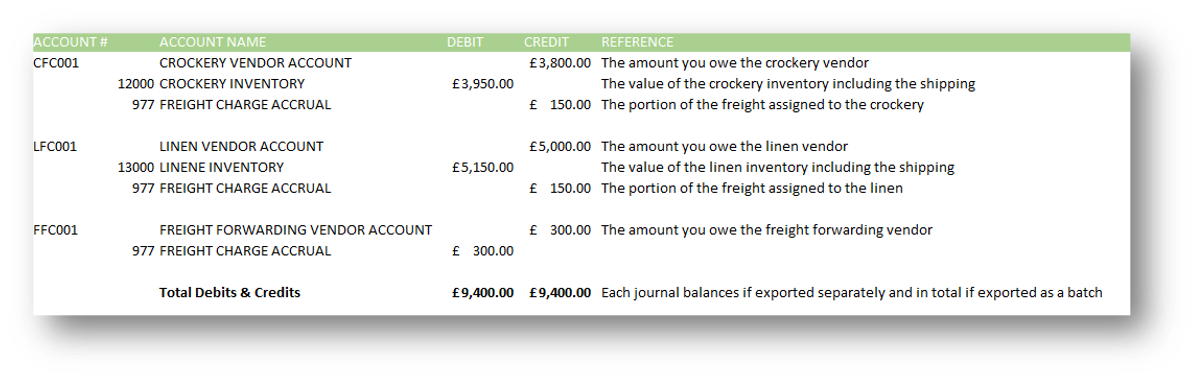

- Export all 3 invoices: The invoice from the crockery vendor, the invoice from the linen vendor, and the invoice from the freight handling company

The invoice export will create the following entries in the AP / GL ledgers - see Fig.6.

Fig.6 - AP/GL ledgers

At this point:

- All 3 vendors will be paid the correct amount for their invoices

- The value of the crockery and linen inventory will be correct and will reflect the cost of the crockery/linen, and the apportioned cost of the shipping

- The Freight Charge Accrual account will have a balance of zero

Comments

Please sign in to leave a comment.