The System is designed to help those in the hospitality industry manage their purchasing, stock control and time. Creating accounts allows the recording of goods that move in or out of a business for multiple reasons such as wastage, cash purchases or staff food. It is essential to record the movement of these goods in order to achieve an accurate cost of sales figure and correct stock holding.

This article details how to create and correctly configure an account.

Creating an Account

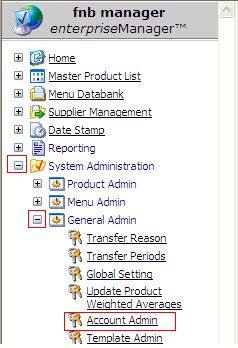

- Follow the path: System Administration> General Admin> Account Admin.

Fig 1 - Account Admin Link

- Click 'Add New Account’ link to create a new account, when selecting + Add New Account, an additional window will open up where the new Account details will need to be entered.

Fig 2- Add New Account Link

- Enter the appropriate name for the account to be created remembering that the accounts are listed in alphabetical order within the drop down at site level. It is advisable to be consistent in the naming convention of accounts such as ‘wastage – bar’, ‘wastage – food’.

Fig 3 - Account Details

- If the account being created is to be a wastage account then click the ‘Wastage Account’ checkbox. This ensures that the account will be displayed when site level users go to create wastage transfers. If this option is not checked then the account will appear when they go to create account transfers.

- When deciding whether to click the ‘Included in Cost Of Sales’ checkbox consider the below:

- When an account is included in cost of sales the cost of the goods transferred will not be included in the calculation to generate the ‘actual cost of sales’ figure i.e. no line will be displayed on the management figures report.

- Typically wastage accounts are included in cost of sales

- Accounts such as ‘petty cash’ should not be included in cost of sales to ensure that the cost of the goods purchased is shown within the cost of sales calculation.

- Once all the relevant information has been entered ensure that the status of the account is made ‘Active’ as shown in Fig 3 above.

- Click the green ‘Next’ button.

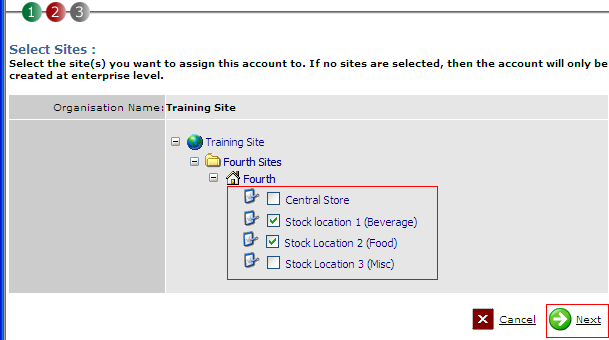

Fig 4 - Select Sites

- Ensure that accounts are only assigned to the relevant sites e.g. ‘Wastage-Bar’ is only assigned to the beverage locations etc.

- Select the relevant site(s) and click the green ‘Next’ button.

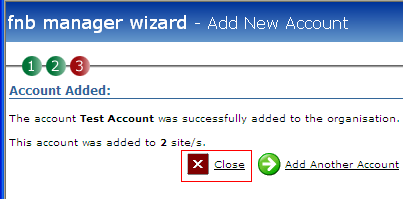

Fig 5 - Account Added Confirmation

- The new account has now been successfully created select close to complete to process.

Effect of Including Accounts in Cost of Sales

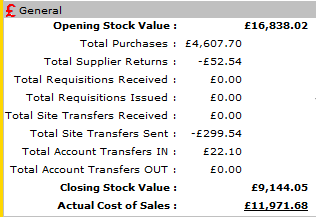

- The ‘Included in Cost of Sales’ status of each account determines how transfers to these accounts will behave on the Management Figures report.

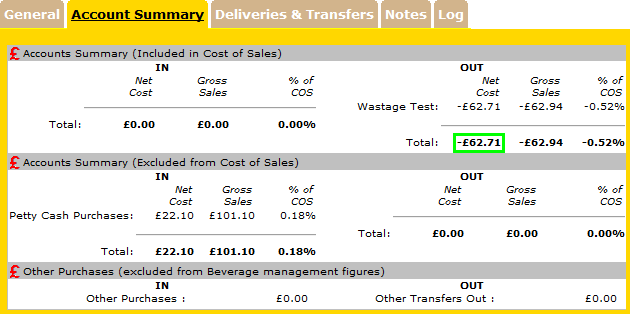

- A user can select the ‘account summary’ tab to view the transfers both included and excluded in cost of sales as shown in Fig 6 below. In the below example 62.71 was transferred to a wastage account which is included in cost of sales.

Fig 6 - Account Summary Tab

- As the account is included within the cost of sales calculation the cost of the wastage transfer out of stock is not recorded on the management figures as this is to be absorbed within the total cost of sales calculation.

Fig 7 - Management Figures Report

- If an account is ‘excluded from cost of sales’, such as the petty cash purchase shown in Fig 6 above the transfer in (or out) of stock is displayed on the management figures as the cost of the transfer is added (or removed) from the total cost of sales calculation.

Key Points of Accounts

Accounts are used to track stock that has come in and out of the system where it was not ordered from a supplier or returned, where it was not site transferred, requisitioned or sold.

When accounts are typically ‘included in cost of sales’:

- Wastage accounts are typically checked to be included in cost of sales in order to ensure that a GP/COS% benefit is not received from recording a wastage transfer.

- Other accounts, such as staff food, are sometimes included in cost of sales, although this is a business decision. If an account such as this is included in cost of sales, any transfers to this account will not transfer the cost of these goods out of stock, therefore causing a monetary variance between actual and theoretical cost of sales, whereas the quantity of goods will not flag any variances.

- Accounts that are included in cost of sales are usually accounts where transfers occur predominately out of stock.

When accounts are typically not ‘included in cost of sales’:

- Petty cash accounts are typically not checked to be included in cost of sales in order to ensure that a GP/COS% benefit is received by recording the transfer of goods into stock.

- Other accounts, such as staff food, are sometimes not included in cost of sales, although this is a business decision; if an account such as this is not included in cost of sales the cost of these goods will be transferred out of stock, therefore minimizing the impact on actual vs. theoretical cost of sales.

- Accounts that are not included in cost of sales are usually accounts where transfers

Comments

Please sign in to leave a comment.