The following document outlines the impact of transferring goods in to stock, or out of stock from accounts that do or do not affect the cost of sale (COS) calculation.

When conducting a transfer of goods, regardless of the COS status, the quantity of stock is always accounted for, however the value of the stock will be absorbed into the overall COS calculation in one instance, wastage for example. In other scenarios the cost of the goods will be added or removed from the COS calculation, such as petty cash.

Following a change in the logic of the COS status of an account, this document explains the various scenarios where goods are transferred to or from accounts with different ‘affects COS’ status’ and the impact to the COS calculation from each transfer is explained.

Overview

An amendment was made to how an account is configured to affect the COS calculation in the system. The change in logic means that the direction of the transfer is now taken into account when the logic is applied. When configuring accounts users as advised to consider the direction of the account and decide whether it should affect the cost of sale or not and set the COS status to reflect this. Typical examples of the different configuration of accounts are shown below; however each account configuration is dependent on a customer’s business rules.

| Account Name | Affects COS? |

|---|---|

| Wastage (all types) (transfer out of stock) | Yes |

| Petty Cash (transfer into stock) | Yes |

| Marketing (transfer out of stock) | No |

| Staff Food/Drink (transfer out of stock) | Yes |

| Complimentary (transfer out of stock) | No |

| Conferencing Events (transfer out of stock) | No |

| Conferencing Events (transfer into stock) | Yes |

| Inter-department (to department that captures any associated revenue) (transfer out of stock) | No |

Configuring Accounts

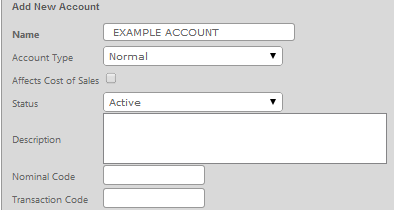

- To create a new account follow the path: ‘Setup’ Tab > Account Admin > Add New Account.

- The name field (highlighted in bold shown below in Fig 1) is the only mandatory field where the name of the account required can be added.

Fig 1 - New Account Details

- The account type options can be chosen from ‘Normal’ or ‘Wastage’ options as shown in Fig 2 below. This field dictates where the account will be made available on the system; when a user selects to create a wastage transfer or a cash purchase transfer.

Fig 2 - Account Type Drop-down List

- The ‘Affects Cost of Sales’ check box should be selected when creating accounts that should affect the COS calculation. If an account should not affect the COS the check box should not be selected.

- The status of the account will default to ‘Active’; this can be amended to disabled if the account should no longer be in use. The nominal and transactional codes are only relevant for exporting data to financial packages and can be left blank if not required.

- Once all fields have been populated accordingly click the ‘Next’ button.

Fig 3 - Organisation Hierarchy

- The organisational hierarchy will be displayed and the relevant sites where the account should be available can be selected and the information saved.

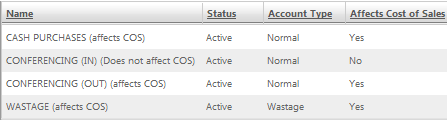

The ‘affects COS’ status of each account will determine how the transfer will affect the management figures, and therefore the COS calculation at the end of the period. When conducting a transfer of goods, regardless of the COS status, the quantity of stock is always accounted for, i.e. the item will not appear to be missing from the stock reconciliation. However the value of the stock transferred will behave differently dependant on this configuration. Sample accounts have been created to illustrate the behaviour of transfers to different accounts.

Fig 4 - Example of Account Types

Transferring to an Account That Affects COS

Recording Items to Wastage (Transferring Out of Stock)

- A transfer of 2 bottles of champagne is recorded to a wastage account that has been ticked to affect COS.

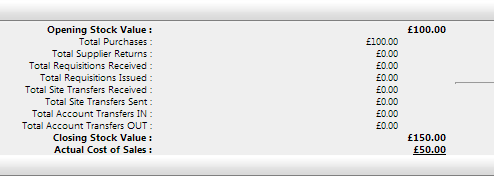

- When the stock period is closed the transfer of the stock is recorded from a quantity perspective and this is shown in Fig 5 below on the stock reconciliation report.

Fig 5 - Effect of The Transfer on The Stock Reconciliation Report

- On the management figures, this is not shown as a transfer out of stock because the cost of the items wasted is not transferred out of the cost of sales calculation. If the value of the wastage was to appear here as a negative value going out, it would reduce the overall cost of sale, and improve the gross profit. In theory, this would be rewarding the manager for wasting goods, which is not the desired option.

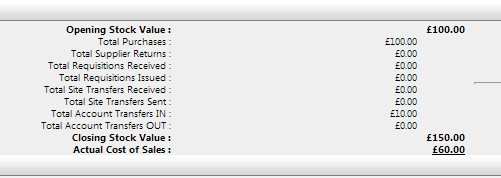

Fig 6 - Effect of The Transfer on Management Figures

- As wastage accounts are always transferred out of stock if the account is set to affect COS the cost of the goods will not be shown as a transfer out (as it is included in the actual cost of sale value on the bottom), and therefore the cost of sales will not be decreased by the wastage transfer.

Recording Items to Petty Cash (Transferring into Stock)

- A transfer of 2 bottles of champagne is recorded into stock to a petty cash account that has been ticked to affect COS.

- When the stock period is closed the transfer of the stock is recorded from a quantity perspective and this is shown in Fig 7 below on the stock reconciliation report.

Fig 7- Effect of The Transfer on The Stock Reconciliation Report

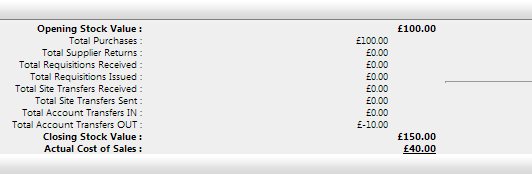

- On the management figures the value is shown as a positive transfer into stock as the cost of the items recorded is included in the cost of sales calculation and therefore should increase the COS for that period.

Fig 8 - Effect of The Transfer on Management Figures

- As petty cash accounts are always transferred into stock if the account is set to affect COS, the cost of the goods will be shown as a transfer in, and therefore the cost of sales will be increased by the transfer.

- When an account is set to affect COS the direction of the transfer will impact if the cost is displayed on the management figures:

- Transfer into stock – cost is visibly transferred in, and will be displayed on the management figures. This will have the effect of increasing the actual cost of sales.

- Transfer out of stock – cost is not visibly transferred out, and will not be displayed on the management figures. This will not change the cost of sales calculation and therefore the actual cost of sales stays the same, as the value of the goods will not be transferred out.

Transferring to an Account That Does Not Affect COS

If a business runs events, goods may be transferred out of stock to an event account to report on this cost; however any excess stock may be transferred back to the original site. Depending on the requirements of the business; if the cost of the goods is required to be transferred out of stock and back into stock upon the return of the good, two different accounts will need to be used. If the account is not affecting cost going out, then it will reduce the overall cost of sales. If the same account is used coming into stock then it will not increase or reduce the COS.

Recording Items to Staff Training (Transferring Out of Stock)

- A transfer of 2 bottles of champagne is recorded out of stock to an account that does not affect COS.

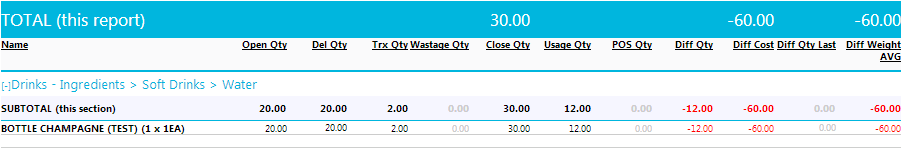

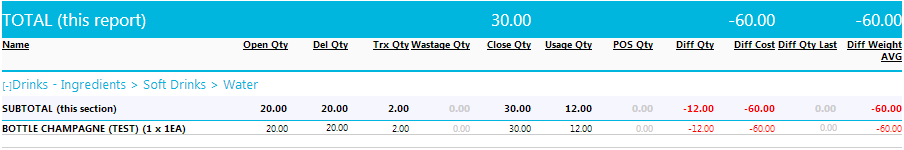

- When the stock period is closed the transfer of the stock is recorded from a quantity perspective and this is shown in Fig 9 below on the stock reconciliation report.

Fig 9 - Effect of The Transfer on The Stock Reconciliation Report

- If the account is set not to affect COS then the transfer will be shown as a negative going out on the management figures, and the cost of sales will be reduced by the transfer value. This means that the value of the 2 bottles of champagne the site paid when delivered is returned to them as if it never happened. The transaction of the champagne coming in and going out is captured and accounted for.

Fig 10 - Effect of The Transfer on Management Figures

Recording Items to Excess Events Stock (Transferring into Stock)

- A transfer of 2 bottles of champagne is recorded into stock to an account that does not affect COS.

- When the stock period is closed the transfer of the stock is recorded from a quantity perspective and this is shown in Fig 11 below on the stock reconciliation report.

Fig 11 - Effect of The Transfer on The Stock Reconciliation Report

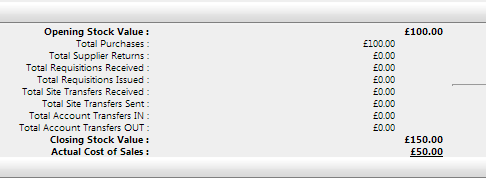

- If the account is set to not affect COS then the transfer will not be shown as a positive value on the management figures, and the cost of sales will not be increased by the transfer.

Fig 12 - Effect of The Transfer on Management Figures

- When an account is set to not affect COS the direction of the transfer will impact if the cost is displayed on the management figures:

- Transfer into stock – cost is not visibly transferred in, and will not be displayed on the management figures. This will not change the cost of sales calculation and therefore the actual cost of sales stays the same as the cost of the goods will not be transferred in.

- Transfer out of stock – cost is visibly transferred out, and will be displayed on the management figures. This will decrease the overall cost of sales, as the value of the goods will be transferred out.

Transferring Goods In & Out of Stock

For example, if a user transfers goods out of stock to an account called ‘conference rooms’ which does not affect COS the cost of this transfer will be transferred out of stock as well as the quantity of goods. If there was an excess of items transferred to this account and a portion of the goods needs to be transferred back into stock, along with the cost, this cannot be completed on the same account as the cost will not be transferred in as well as the quantity of stock. In order for the cost of the transfer to be included in the transfer back into stock, the transfer must be completed against a different account included in COS, to ensure that it does ‘affects COS’.

Summary

Transfer to an Account That Affects COS

- Transfer into stock – cost is visibly transferred in, and will be displayed on the management figures. This will have the effect of increasing the actual cost of sales.

- Transfer out of stock – cost is not visibly transferred out, and will not be displayed on the management figures. This will not change the cost of sales calculation and therefore the actual cost of sales stays the same, as the value of the goods will not be transferred out.

Transfer to an Account That Does Not Affect COS

- Transfer into stock – cost is not visibly transferred in, and will not be displayed on the management figures. This will not change the cost of sales calculation and therefore the actual cost of sales stays the same, as the cost of the goods will not be transferred in.

- Transfer out of stock – cost is visibly transferred out, and will be displayed on the management figures. This will decrease the overall cost of sales, as the value of the goods will be transferred out.

Comments

Please sign in to leave a comment.