Overview

Payroll deductions can be updated within Fourth HR/Payroll. This article provides steps for managers on how to complete the process.

Entering Payroll Deductions

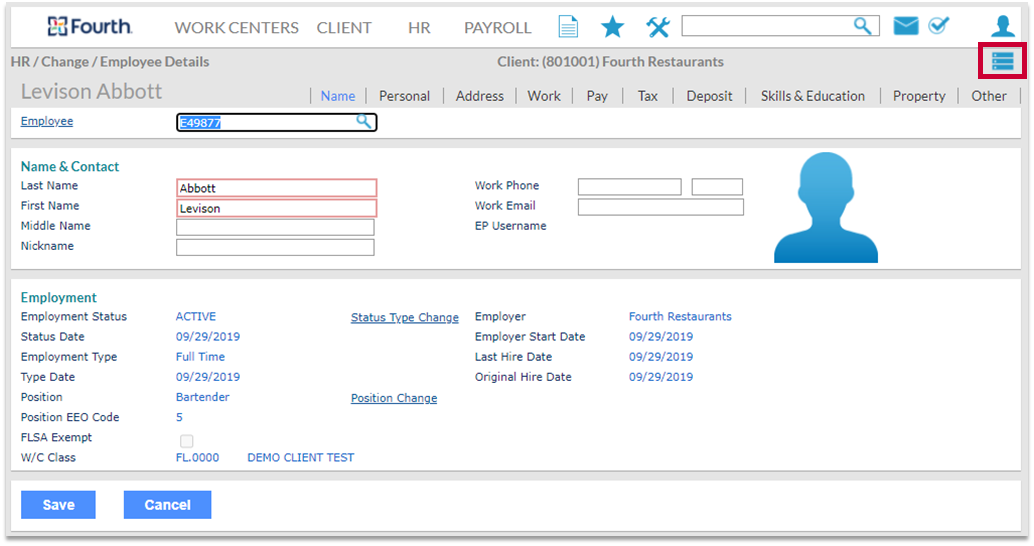

- Once the desired employee has been located and selected within Fourth HR/Payroll, select the menu in the upper right-hand corner of the employee file

Fig.1 - Menu [select image to enlarge]

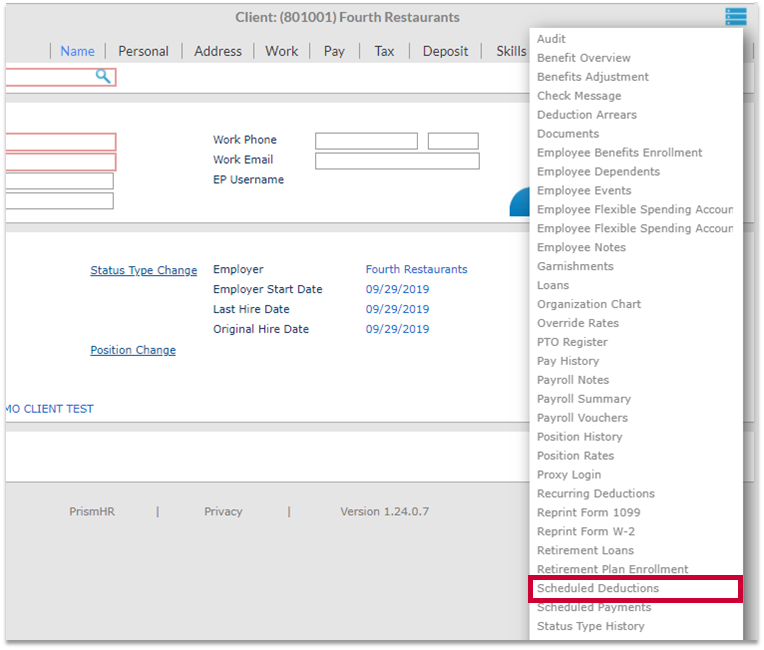

- From the drop-down menu, select Scheduled Deductions

Fig.2 - Scheduled Deductions [select image to enlarge]

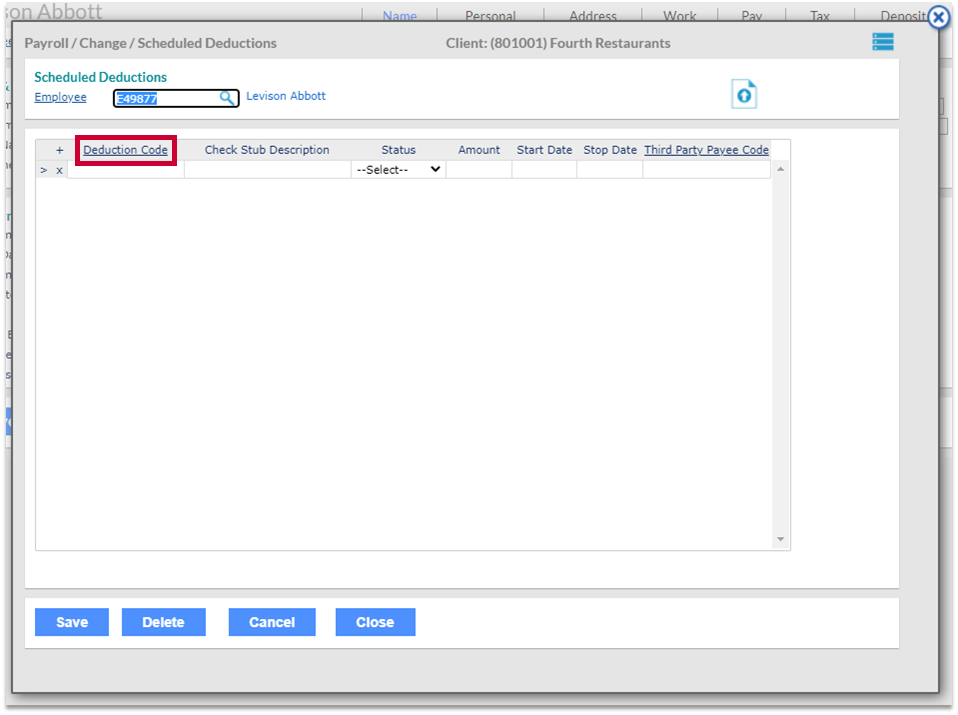

- Select Deduction Code to open the available list of deductions

Fig.3 - Deduction Code [select image to enlarge]

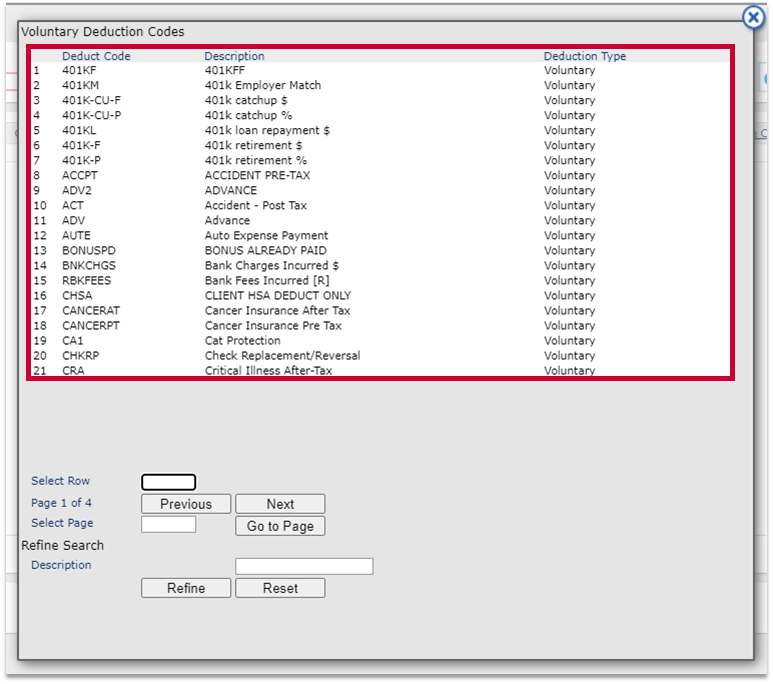

- Select the appropriate code for the deduction needed

Fig.4 - Deduction Code selection

- Once a deduction has been selected, the additional sections described below must be filled out:

- Status

- Active (will occur every payroll on every check)

- One time (will only happen once. Once taken, the status will automatically change to Inactive)

- Inactive (Select if you are stopping an existing deduction)

- Amount

- The amount that needs to be deducted from the paycheck

- Start and Stop Dates

- Use if there is an end date to the deduction

- If the deduction does not have an end date, it will be left blank

- Status

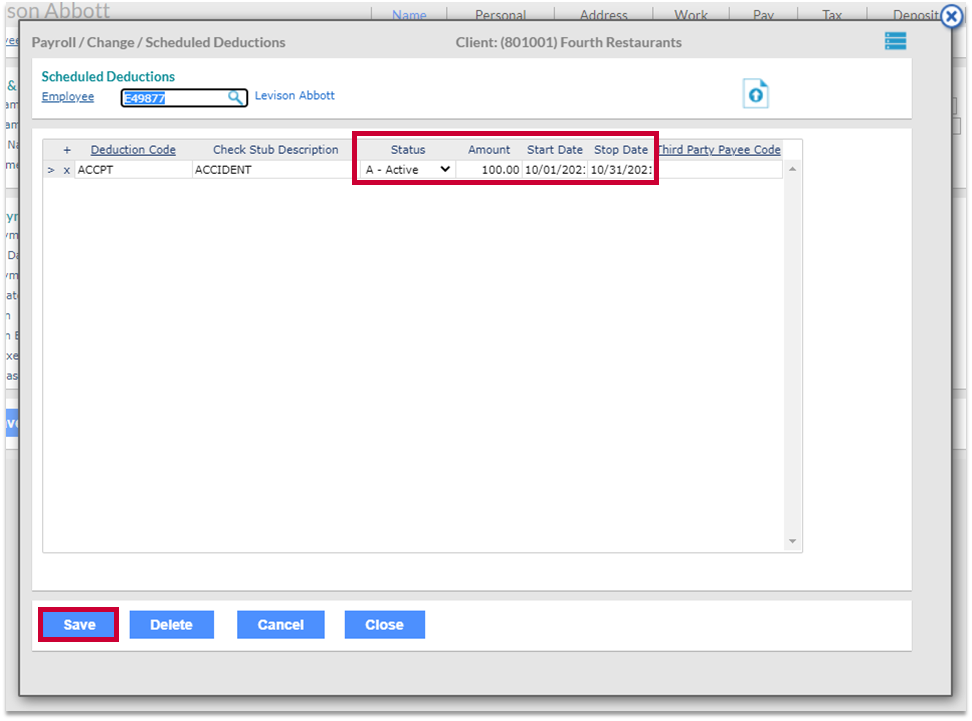

- Once all required fields are completed, select the Save button

Fig.5 - Enter details & Save [select to enlarge]

Comments

I already purchased this app while working at Texas Roadhouse

@undoubtedly determined: If you are having trouble with the app, please reach out to support for assistance. There are multiple ways to contact them: https://help.hotschedules.com/hc/en-us/articles/222476127?page=1#comment_360013493972

Please sign in to leave a comment.