What’s Changing?

A new export is being added to the Payroll module which will calculate employer National Insurance and minimum pension contributions in relation to payments made to furloughed employees.

Proposed Release Date: 30th April 2020

Reason for the Change

Following the recent announcements relating to the Coronavirus Job Retention Scheme (CJRS), it has been necessary to add additional functionality for customers to apply for the CJRS grant.

Customers Affected

All HR & Payroll customers using the Payroll module.

Release Notes

Within the Payroll module there is a new option to run an export which will calculate the employer costs associated with furlough payments paid to employees.

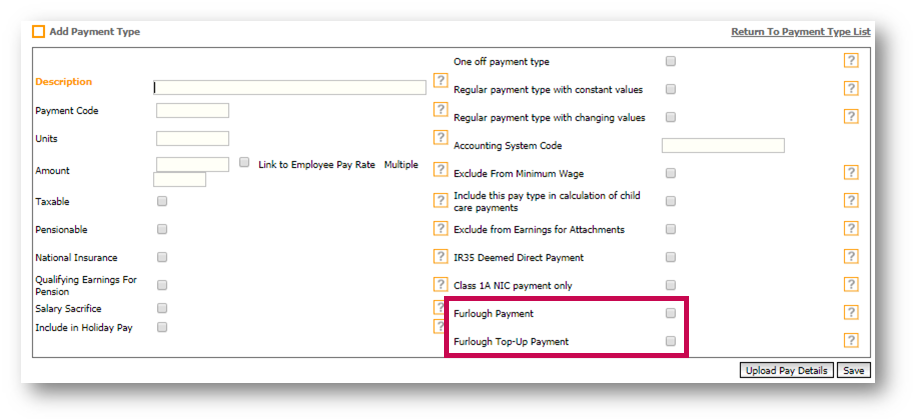

For the calculations to work correctly on the 80% furlough payments, there are two new Payment Type flags that need to be configured before running the report.

Payment Type Flags

- Go to Payroll > Administration > Payment Types > Add New Payment type

Fig.1 – New ‘Furlough’ settings in Payment Type setup

Fig.1 – New ‘Furlough’ settings in Payment Type setup

- To view the new flags within the calculated payment types, go to Payroll > Administration > Payment Types > Add New Calculated Payment type

Fig.2 - New ‘Furlough’ settings in Calculated Payment Type setup

- If the Payment Type relates to the 80% furlough pay, select the tick box against Furlough Payment

- If the Payment Type relates to the 20% top-up pay or any other aspect of pay that cannot be claimed back from HMRC, select the tick box against Furlough Top-Up Payment

Please note: Both flags should not be selected in a single Payment Type

Example Setup of Payment Types

80% furlough payment only

- If the employee is only being paid the 80% furlough payment, flag the Payment Type being used as Furlough Payment

100% Salary with 20% deduction

- If the employee is paid a full salary and has a gross deduction payment for the 20%, flag both Payment Types as Furlough Payment

80% furlough payment with 20% top-up

- If the employee is paid an 80% furlough payment and has a top-up payment for 20%, flag the 80% payment type as Furlough Payment and the top up payment type as Furlough Top-Up Payment

80% furlough payment with additional pay

- If the employee is paid 80% furlough payment plus additional pay such as Tronc, Car Allowance etc, flag the 80% Payment Type as Furlough Payment. The ‘additional pay’ Payment Types should remain unflagged

100% salary payment only

Unfortunately, the export will not be able to work out 80% payment in this scenario, so it will not calculate accurate NIC and Pension amounts.

Information regarding the calculation of both NIC and Pension for the grant claim can be found in the following article:

https://fc.force.com/customer/s/article/Updated-Furlough-Guidance-from-20th-April

Running the Export

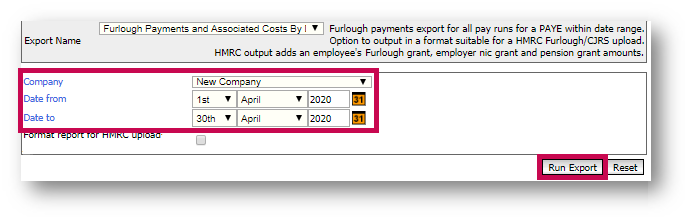

- To run the export, go to Payroll > Reports > Exports > Furlough Payments and Associated Costs by date range

- Select the Company

- Select the date range (the date the claim is being made for)

- Select Run Export

Fig.3 – Running the Export

Fig.3 – Running the Export

Please note: The export will return details of all payments that have been paid within the date range. Employees with more than one pay period within the range will appear on the export multiple times.

The export will generate as a CSV file and will show the following fields:

- Employee Number

- First Name

- Surname

- NI Number

- HMRC Reference Number

- Location

- Division

- Pay Basis

- Pay Frequency

- Pay Date

- NI Category

- Furlough Payment Gross Total

- Total Employer NIC

- Furlough Employer NIC

- Furlough AE Employer Contributions

- Furlough top-up Payment Gross Total

- Number of Furlough Days

- Furlough Effective Start Date

- Furlough Effective End Date

- Pay Period Start Date

- Pay Period End Date

- Company Name

- Tax Office Number

- PAYE Reference Number

- Furlough Pay Type Name

Please note: For employees with multiple furlough status records, the export will show the earliest start date and the latest end date. Please bear this in mind when running the report

Please note: The export does not calculate the maximum amount that is claimable (£2500) as it assumes that this has already been calculated at the point of payment. This is to help customers to claim back payments over £2500 if they include backdated furlough payments for previous periods.

HMRC Upload Template

For customers who need to furlough over 100 employees, the details can be uploaded to HMRC. The export has the option to formatted with the HMRC upload template.

- Select the Company

- Select the date range (the date the claim is being made for)

- Select Format report for HMRC upload

- Select Run Export

Fig.4 – Running the export for HMRC upload

Fig.4 – Running the export for HMRC upload

The export will sum the values for each employee and display in the HMRC upload format. This can then be saved and uploaded into the HMRC portal when prompted.

For more information about how to make a claim in the HMRC portal, please see the following article -

Making a Claim Through HMRC’s Coronavirus Job Retention Scheme (CJRS) Portal

Please note: For employees with multiple furlough status records, the export will show the earliest start date and the latest end date. Please bear this in mind when running the report

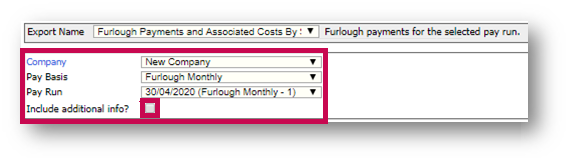

Running the Export per Pay Period

The export is also available to run by pay period if individual period reporting is required.

- Go to Payroll > Reports > Exports > Furlough Payments and Associated Costs by single pay run

- Select the Company, Pay Basis and Pay Run

- Tick Include additional info? if required – see description below

- Select Run Export

Fig.5 - Furlough Payments and Associated Costs by Single Pay Run export

The export will generate as a CSV file and will show the following fields:

- Employee Number

- Name

- NI Number

- HMRC Reference Number

- Location

- Division

- Pay Basis

- Pay Frequency

- Pay Date

- NI Category

- Furlough Payment Gross Total

- Total Employer NIC

- Furlough Employer NIC

- Furlough AE Employer Contributions

- Furlough Top-up Payment Gross Total

If Include additional info? is selected, the following fields will also be included. This is for customers who require additional details to create their grant claim application:

- Furlough Effective Start Date

- Furlough Effective End Date

- Pay Period Start Date

- Pay Period End Date

- Company Name

- Tax Office Number

- PAYE Reference Number

- Furlough Pay Type Name

Comments

Please sign in to leave a comment.