Overview

This article will demonstrate the set up of a Fiscal Calendar, to be used during a temporary site closure. Counting may not take place during the month end, and it would be preferred for stock to roll over. In this instance, a mid-month count will need to happen before the site closes, without opening the period end.

For additional knowledge articles relating the the Covid-19 epidemic, please visit - Fourth Products and Covid-19.

To Perform A Mid-Month Count

Within Purchasing & Inventory (Formerly known as Adaco), this is referred to as an Interim Inventory. Refer to Purchasing & Inventory - Setting Up and Running an Interim Inventory. for further details.

If all stock needs to be counted before the site closure, it is best practice to include all Outlets and Locations when setting up the Interim Cycle. If there are Outlets/Locations that will not be counted, do not include them in the cycle.

If it is preferred for stock to be reset to zero instead of counting it, include these on the cycle but do not enter a count against them.

After setting up and running the Interim Inventory, these can be reviewed by referring to the Interim Outlet Variance Report and Interim Inventory Valuation for further explanation of these reports.

How to Set Up the Month End

In the event of a site closing for an unknown period of time with no month end stock take occurring, it may be preferred for existing counts to roll over. To avoid disruption to the current setup, it is best to create a new Month End Inventory Cycle. The previous set up can then be reverted to, after re-opening of the site. Refer to Purchasing & Inventory - Creating and Editing an Inventory Cycle on how to do this.

If it is preferred for all existing counts to roll over, no Outlets/Locations should be selected when setting up the cycle. This will ensure the numbers remain the same, both before and after Period End without having to enter any counts.

Once the cycle is created, it can be added to the Fiscal Calendar.

Process

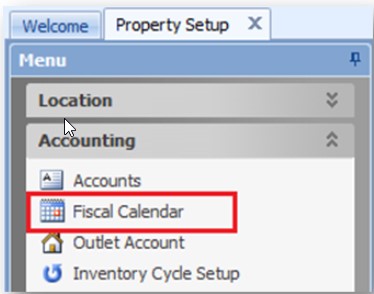

Fig. 1 - Selecting Fiscal Calendar

Once this has been set up, Start Period Inventory and Close Period can be actioned according to Fiscal Calendar dates and all counts will be carried forward.

This article will demonstrate the set up of a Fiscal Calendar, to be used during a temporary site closure. Counting may not take place during the month end, and it would be preferred for stock to roll over. In this instance, a mid-month count will need to happen before the site closes, without opening the period end.

For additional knowledge articles relating the the Covid-19 epidemic, please visit - Fourth Products and Covid-19.

To Perform A Mid-Month Count

Within Purchasing & Inventory (Formerly known as Adaco), this is referred to as an Interim Inventory. Refer to Purchasing & Inventory - Setting Up and Running an Interim Inventory. for further details.

If all stock needs to be counted before the site closure, it is best practice to include all Outlets and Locations when setting up the Interim Cycle. If there are Outlets/Locations that will not be counted, do not include them in the cycle.

If it is preferred for stock to be reset to zero instead of counting it, include these on the cycle but do not enter a count against them.

After setting up and running the Interim Inventory, these can be reviewed by referring to the Interim Outlet Variance Report and Interim Inventory Valuation for further explanation of these reports.

How to Set Up the Month End

In the event of a site closing for an unknown period of time with no month end stock take occurring, it may be preferred for existing counts to roll over. To avoid disruption to the current setup, it is best to create a new Month End Inventory Cycle. The previous set up can then be reverted to, after re-opening of the site. Refer to Purchasing & Inventory - Creating and Editing an Inventory Cycle on how to do this.

If it is preferred for all existing counts to roll over, no Outlets/Locations should be selected when setting up the cycle. This will ensure the numbers remain the same, both before and after Period End without having to enter any counts.

Once the cycle is created, it can be added to the Fiscal Calendar.

Process

- Go to Property > Setup > Accounting > Fiscal Calendar

- Expand the desired Fiscal Year and select one of the periods

Fig. 1 - Selecting Fiscal Calendar

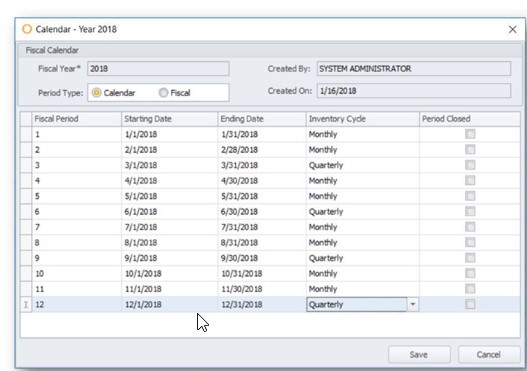

This will open the Fiscal Year Calendar.

Fig. 2 - Selecting time frame within Fiscal Calendar

- Change the Inventory Cycle to the newly created Cycle for the period of time property will be closed for

- Save changes

Fig. 2 - Selecting time frame within Fiscal Calendar

Once this has been set up, Start Period Inventory and Close Period can be actioned according to Fiscal Calendar dates and all counts will be carried forward.

Comments

Please sign in to leave a comment.