Overview

The General Ledger interface is used to export journal entry details related to un-billed receivings, product movement, and inventory changes/variances to a company’s accounting software. This article describes the process of using the General Ledger Interface, including setup, relevant transactions and exporting files.

The article is split into two sections, the first is General Ledger Interface Information and the second focuses on using the General Ledger Interface.

Further information on Interface configuration can be found here - Purchasing & Inventory - Administration - Interfaces

General Ledger Interface Information

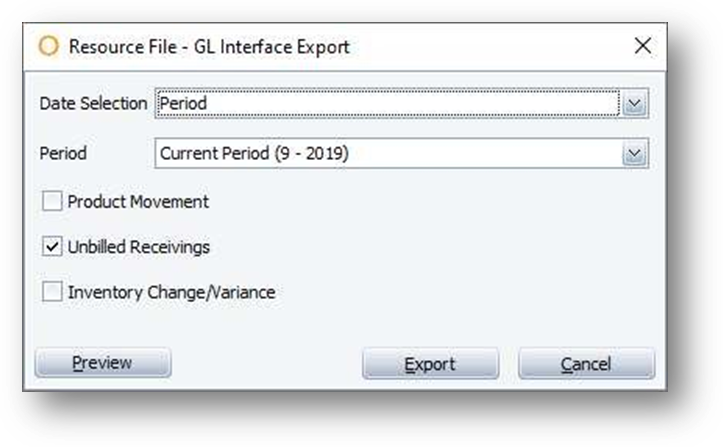

To access the General Ledger Interface go to Accounting > General Ledger >GL Interface Export - see Fig.1

Fig.1 – GL Interface Export Screen

|

Description |

Functionality |

|

Date Selection |

Period: Select the financial period for report |

|

Period / From Date To Date / Cut off date |

Label will change based on date selection made |

|

Product Movement |

Will export all requisitions and transfer values including InterProperty if enabled |

|

Unbilled Receivings |

Will export received purchase order values without invoice applied |

|

Inventory Change/Variance |

Inventory Change: The difference between starting and ending inventory for non perpetual outlets |

|

Preview |

See Fig.2 |

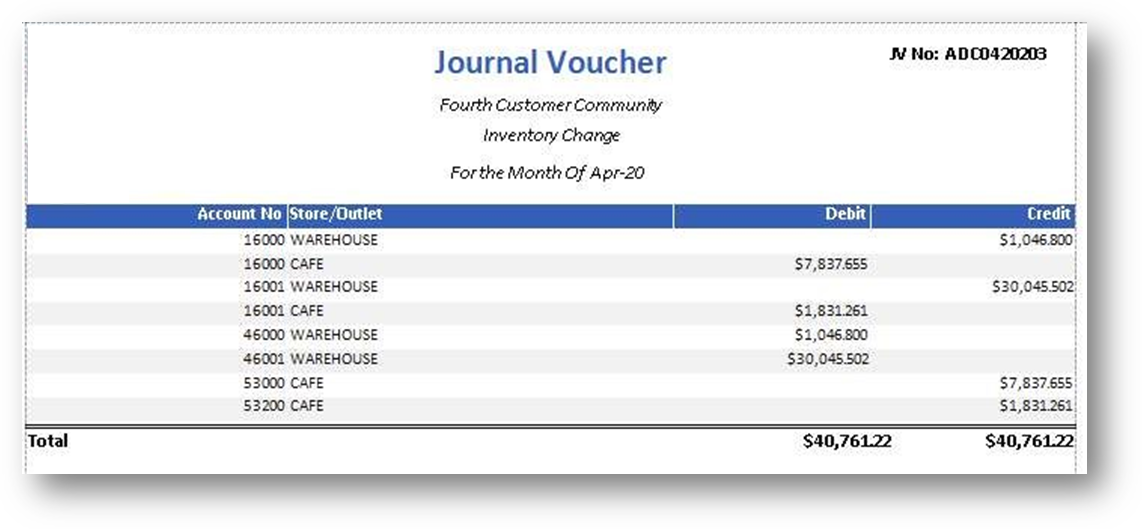

Fig.2 – Preview Inventory Change/Variance

|

Column Header |

Description |

|

Account No |

Adaco Account Cross reference or the General Ledger Group assigned to the account |

|

Store/Outlet |

Outlet Name within the property or reference to InterProperty transaction |

|

Debit |

Net positive values for relevant transactions |

|

Credit |

Net negative values for relevant transactions |

Using the General Ledger Interface

Product Movement

This export is for Journal Entry Values including requisitions, transfers and InterProperty where enabled.

A Product Movement journal will contain details of Outlet Requisitions, InterProperty Outlet Requisitions, Transfers and InterProperty Outlet Transfers which have a transaction date (effective date) within the selected date range. The details of interproperty transactions will be included in equal, but opposite, journals exported from each of the properties involved in the transaction.

Once exported, product movement records will be marked as such and cannot be exported a second time. InterProperty Transactions can be included or excluded per format requirements.

For an interproperty transfer the movement will always be recorded against the correct account in the “host” property and the corresponding offset should be posted to an intercompany account. Posting directly to accounts of the “other” property is not correct as the transaction would get counted twice.

A customer’s Finance team will be able to dictate the way they want to post the InterProperty Accounts, in one of the following ways:

- One account for both receivables and payables regardless of which hotel

- One account for receivables and one account for payables regardless of which hotel

- Each hotel has its own set of accounts for both receivables and payables

- The final option is to use a different account for receivables and payables for each property, so each hotel would have its own pair of accounts

For the Narrative in the export, the Account and Outlet Names are delivered for the Property that is running the Product Movement export. "Other Property” or another specified text can then be used for the Narrative to indicate that it is an InterProperty movement.

For further information on Requisitions and Transfers, see the articles below:

Purchasing & Inventory - Outlet Requisition Recap Report

Purchasing & Inventory - Transfers Report

Purchasing & Inventory - InterProperty Transfer Recap Report

Unbilled Receiving

The Unbilled Receiving Journal is used to create an accrual for goods received not invoiced (GRNI). The journal contains details of any items received on or before the selected date, which either does not have an invoice applied or has had an invoice applied to it after the selected date. The journal is used to create an accrual in the current period for costs and expenses incurred but not yet invoiced. The accrual is an accounting mechanism used to temporarily move non-invoiced expenses from a future period into the current period.

An unbilled receiving (or GRNI) accrual is always reversed in the accounting system when the period is closed by posting an equal and opposite reversing journal at the start of the next period. The reversing journal can either be generated within the 3rd party accounting system or optionally as part of the GL export.

An unbilled receiving journal can be run at any time and will include details of any received orders which were not invoiced within the selected date range. Unbilled receivings can be exported multiple times.

For any purchase order received but not invoiced please refer to - Purchasing & Inventory - Unbilled Receiving Report

Inventory Change/Variance

The Inventory Variance/Change Journal is used to record the value of changes in inventory levels. This journal only includes details of inventory variance/change in outlets that are marked for inventory. For any change in inventory there will be an inventory variance detail record and a corresponding offset record. Changes in inventory levels can be treated either as 'Inventory Variance' or 'Inventory Change' depending on whether the outlet is set for Perpetual Inventory or not.

For the difference between 'System on-Hand' and 'Theoretical' – refer to:

Purchasing & Inventory - Inventory Valuation (Historical) Report - for non-perpetual outlets

Purchasing & Inventory - Outlet Variance Report - for perpetual outlets

Depending upon the outlet setup configuration, the data calculations will calculate in the following ways:

Scenario 1: Inventory = False, Perpetual = False

GL Inventory Variance / Change Journal:

There would be no entry in the GL Inventory Variance Journal for this type of outlet.

Scenario 2: Inventory = True, Perpetual = True

GL Inventory Variance / Change Journal:

When the period is closed the variance will be calculated as follows:

A theoretical “on-hand” count will be calculated by taking the opening stock, plus or minus any purchases or returns and plus or minus any outlet requisitions or transfers.

Please Note: Sales transactions are not considered when calculating the theoretical closing stock for the purposes of inventory variance calculations so the calculated system on-hand value may differ from that shown in the Outlet Variance Report.

The physical entered inventory is then deducted from the calculated system on-hand stock to calculate the variance.

For example:

| Opening Stock | 100 |

| Purchases | +40 |

| Requisitions / Transfers | +30 |

| Sales Transactions | -60 |

| Calculated Stock on-Hand | 170 (Opening stock + Purchases + Requisitions / Transfers) |

| Actual Physical Stock on-Hand | 108 |

| Variance | -62 (Actual stock on-hand – calculated stock on-hand) |

In this example, a credit to the account cross reference would be created for -62, which would reduce the value of inventory and a corresponding debit for +62 will be posted to the offset account which would typically be the corresponding cost of sales account. The value of 62 would represent the total consumption, which would include the 60 sold and a further 2 of stock take variance.

Scenario 3: Inventory = True, Perpetual = False

GL Inventory Variance / Change Journal:

When the period is closed the variance will be calculated as follows:

The current physically entered stock on-hand less the opening stock (i.e. the closing stock from the current period less the closing stock from the previous period)

For example:

| Opening Stock | 100 |

| Purchases | +40 ignored in inventory change calculation |

| Requisitions / Transfers | +30 ignored in inventory change calculation |

| Sales Transactions | -60 ignored in inventory change calculation |

| Calculated Stock on-Hand | 170 ignored in inventory change calculation |

| Actual Physical Stock on-Hand | 108 |

| Variance | 8 (Actual stock on-hand – previous period stock on-hand) |

In this example where there is a positive inventory change, a credit to the account cross reference would be created for -8, which would reduce the value of cost of sales and a corresponding debit for +8 will be posted to the offset account, which would typically be the corresponding inventory account.

Important Note

For perpetual outlets a negative variance is treated as a credit and will be applied to the Account Cross Reference of the item. For non-perpetual outlets a negative variance is treated as a debit and will be applied to the Account Cross Reference of the item.

Exporting

All three GL exports can be done at the same time or independently, as seen in Fig.1.

The export is determined by the solution configuration combined with output requirements from the Financial provider.

A few things to note regarding each component of the available GL Exports:

Unbilled

Frequency = Monthly

Date Range = Cut Off Date

Can be re-exported = Yes

Can be run anytime, before or after the period is closed

Product Movement

Frequency = Daily/Weekly/Monthly

Date Range = Cut Off Date

Can be re-exported = No

Can be run anytime, before or after the period is closed

Inventory Variance

Frequency = Monthly

Date Range = N/A

Can be re-exported = Yes (Until the next period is closed)

Can only be run after the period is closed

Troubleshooting

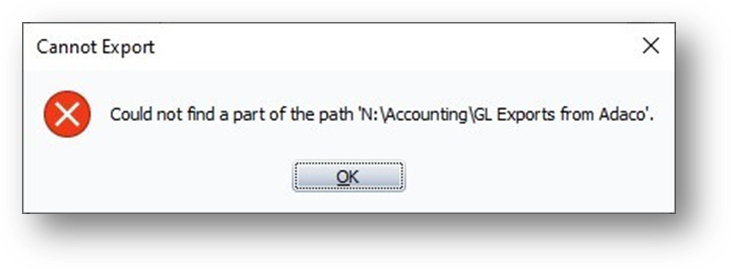

Exporting to Local

- Before exporting the Journal Entry Values to Local, first ensure that the Export Directory within the system is correct and that the user has access to the required path

If the user does not have 'write' access to the Export Directory, the error message shown in Fig.3 will display when Export is selected.

Fig.3 – Unable to Export General Ledger, Could not find part of path

- If this error occurs, contact your Internal IT Department to request write-access to the Export Directory.

Exporting to FTP/SFTP

- If FTP/SFTP is chosen to export to, please ensure that an FTP Location is available to receive the export

This setting will need to be configured with the assistance of Fourth.

- If exporting invoices to a FTP/SFTP Location fails, first confirm the login credentials (URL, username and password) are correct

‘FTP Transmission Failed’ error messages can display for other reasons, so if the login credentials have been confirmed and the export is still failing, please contact Fourth’s Technical Support Team in order to resolve.

Comments

Please sign in to leave a comment.