What’s Changing?

The new functionality allows salaried employee costs to be calculated based on the working days in a calendar month instead of Annual Salary/52/actual days worked.

Proposed Release Date: 18th July 2019

Reason for the Change

A number of Fourth customers view costings on a monthly basis. As such, due to the current Employee Cost Calculation, there can be large discrepancies between what is paid within Payroll and what is costed within the Rotas for Salaried employees.

Customers Affected

All HR & Payroll customers.

Release Notes

Global Settings

Two new Global Settings will be added to the Rota module.

These are:

- Calculate Weekly Rate Cost over 12 Months not 52 Weeks

- Use FTE Days for Weekly Rate Cost over 12 Months

The functionality and an explanation of the Settings are detailed in the sections below.

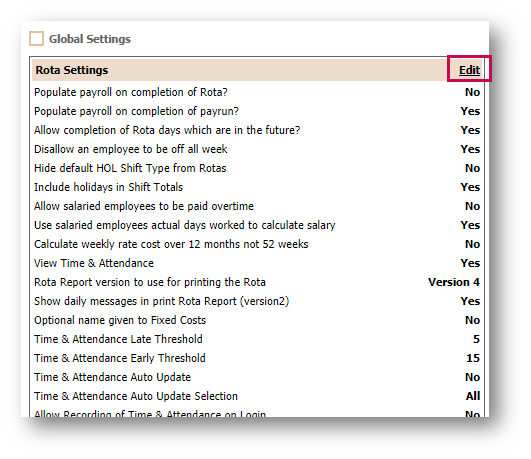

- To access the settings, go to Rota > Administration > Global Settings > Rota Settings > select Edit (see Fig.1)

Fig.1 – Edit Rota Settings

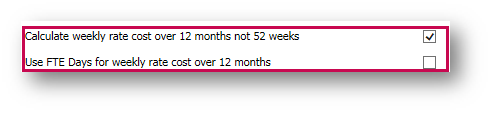

- To calculate the weekly rate cost over 12 months instead of 52 weeks, tick the Calculate weekly rate cost over 12 months not 52 weeks box

- The Use FTE Days for weekly rate cost over 12 months setting will only be available to be selected when Calculate weekly rate cost over 12 months not 52 weeks is selected

Fig.2 – Global Settings

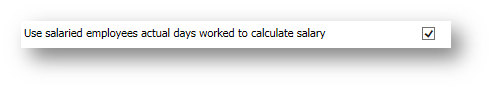

- Select Use salaried employees actual days worked to calculate salary if required

Fig.3 – Use Salaried Employees Actual Days Functionality

Calculate weekly rate cost over 12 months not 52 weeks

If this setting is selected and saved into the Rota, the calculation of the salaried employee’s cost within a Rota will change to be based on their hourly rate, calculated as follows:

Daily Rate

The monthly salary/actual working days in the month.

Working days are based on a Monday to Friday working pattern. The number of days can vary depending on the month. Below is a table of working days for each month based on a Monday-Friday working pattern for 2019.

| 2019 | Number of Days |

| January | 23 |

| February | 20 |

| March | 21 |

| April | 22 |

| May | 23 |

| June | 20 |

| July | 23 |

| August | 22 |

| September | 21 |

| October | 23 |

| November | 21 |

| December | 22 |

Due to the varying number of working days in a month, this will result in variations of an employee’s daily rate depending on what month that day falls within.

For example, an employee that is paid £20,000 per annum and works 8 hours a day would have a daily rate in June of £83.33. However, in July it would be £72.46.

This does not follow the standard 260 or 365 rule of Payroll. However, it will result in a closer reporting of costs within the Rota in relation to what an employee is then paid in Payroll.

Hourly Rate

The Hourly Rate calculation of an employee’s costs is as follows:

Contracted hours per week / 5

This will result in the number of hours an employee works each day.

Overtime

Employees that are salaried and entitled to overtime at Contract Level will have their Daily Rate calculated to incorporate the cost of this Overtime.

This will only be included when an employee has worked more hours in total over a week than they are contracted to. This will then be added to their basic Hourly Rate.

For example:

An employee is contracted to 40 hours a week over 5 days. They work a total of 10 hours on the first day, which is 2 hours over what their contracted time for the day is. The daily rate will be capped at 8 hours based on the calculation outlined above. However, as the week progresses, if the employee goes over 40 hours for the week in total, then the Daily Rate for the first day will be recalculated with the cost of the extra hours based on their base Hourly Rate.

Use FTE Days for weekly rate cost over 12 months

This setting can only be selected in conjunction with the Calculate weekly rate cost over 12 months not 52 weeks setting.

Once selected the calculations will be as follows:

Daily rate:

(Monthly salary/actual working days in the month) x FTE value

Hourly rate:

(Contracted hours per week / 5) x FTE value

This will give the result for the number of hours an employee works each day.

Comments

Please sign in to leave a comment.