The System is designed to help those in the hospitality industry manage their purchasing, stock control and time.

It’s important when creating invoice adjustments to remember that to gain the most benefit from them, there should be one (or more when required) per supplier. Unlike “normal” products invoice adjustments won’t be counted in the stock or added to recipes so the usual rules of adding a supplier to products doesn’t stand. The adjustments are used to balance invoices only.

The following document will outline the best practise method for creating invoice adjustments.

Creating an Invoice Adjustment

Fig 1 - Add new Product Link

- To create an Invoice Adjustment, expand Master Product List > Add New Product.

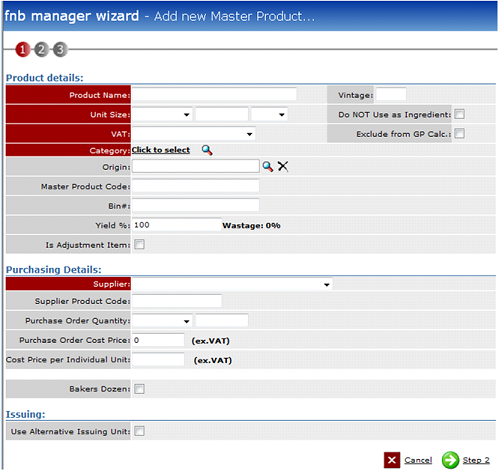

Fig 2 - Add New Product Wizard

Product Details

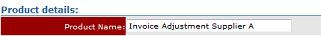

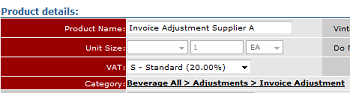

Fig 3 - Mandatory Product Name Field

- When filling in the Invoice Adjustment Name, be consistent in how it’s entered into the system. In this example the name is Invoice Adjustment then the supplier name. If required add With VAT or No Vat.

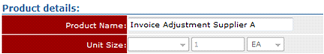

Fig 4 - Mandatory Unit Size Field

- The Unit Size for invoice adjustments will always be 1 EA.

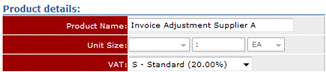

Fig 5 - Mandatory VAT Field

- The VAT for the invoice adjustment items will depend on whether the supplier is a food, beverage or miscellaneous supplier.In cases where the same supplier can deliver VAT and NON VAT items then two separate Invoice Adjustments must be created.

Fig 6 - Mandatory Category

- The aim of the Invoice Adjustments is to account for the different associated costs to food, beverage or miscellaneous invoices. For this reason it’s advised that there are categories created specifically for these items.

- There is an explanation on how to create the categories for the Invoice adjustments at the end of this document.

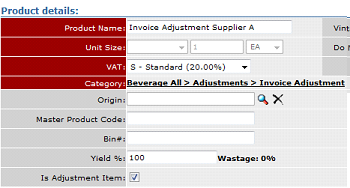

Fig 7 - Is Adjustment Item Field

- If the Is Adjustment Item button is not ticked then the system will treat this as if it’s a regular product. This means that it will be available to order and will appear on the stock counting sheets. This must be ticked for the Adjustment Items to work correctly.

Purchasing Details

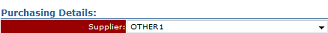

Fig 8 - Mandatory Supplier Field

- The supplier that is chosen should reflect the supplier in the name of the product.

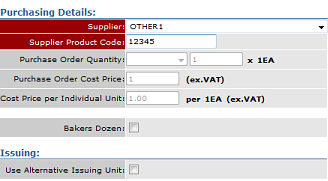

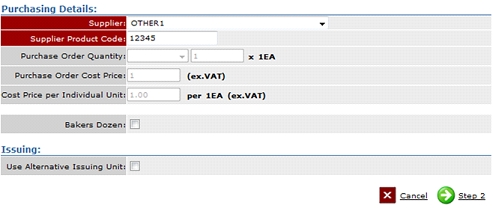

Fig 9 - Remaining Purchasing Details Fields

- Only the product code is required and as this is not a regular product it can be made up. Because the Is Adjustment Item was ticked the system automatically fills in the Purchase Order Quantity and Purchase Order Cost Price and this should be left as 1 each and £1.

Fig 10 - Completed Purchasing Details Page

- Once this page is completed click the green 'Step Two' button.

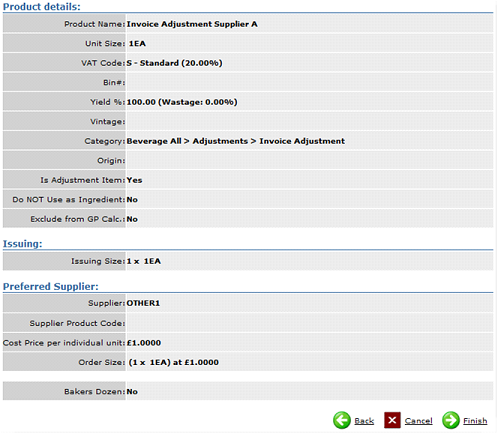

Fig 11 - Review Entered Details

- Use this page to review the details of the product to ensure they are correct. The main thing to ensure has happened is that the "!s Adjustment Item" is ticked.

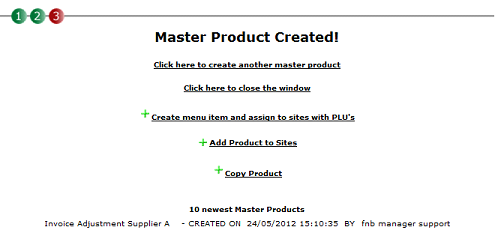

Fig 12 - Product Created Confirmation

- The product now exists and can be added to site or copied. If there are a lot of Invoice Adjustments to be created then copying will be the quickest way to go.

Creating Invoice Adjustment Categories

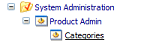

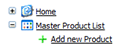

Fig 13 - Categories Link

- When creating Invoice Adjustment Categories, expand System Admin> Product Admin> Categories.

Fig 14 - Category Structure

- The Item Type must be created as the Cost Centre will already exist. After that the Category will need to be created.

- Item Type should be called Adjustments. Putting the Order number as zero ensure the adjustment items are always at the top of the product list when adding them to invoices and they will also show at the top of the page on the stock reconciliation allowing immediate visibility of overcharges and discounts.

- The Category Name should be called Invoice Adjustments. The Category Code should be a few letters and a number. This will be the category the Invoice Adjustment for beverage supplier will belong to. The same should be creating in the other relevant cost centres, e.g. Food cost centre.

By following the above method for creating Invoice Adjustments, everyone should work to the same pattern when receiving deliveries. Using invoice adjustments allows immediate visibility of any over charges for good received and also means the weighted average of the products is not impacted regularly as no longer will cost prices need to be edited upon receipt of delivery for goods.

Comments

Please sign in to leave a comment.