Overview

To help the hospitality industry during the challenging trading conditions caused by the Covid-19 pandemic, the UK Government applied varied reduced rates of VAT to supplies of food and non-alcoholic drinks. At the time of writing (10th Feb 2022) the VAT rate on such products is due to return to the standard 20% on 1st April 2022.

This article shows how to change VAT rates for standard recipes within Recipe and Menu Engineering (RME) and how to update to sites in Inventory.

![]() There is a small chance that the return to 20% VAT will be postponed or changed somehow. Fourth recommends that its customers follow developments closely!

There is a small chance that the return to 20% VAT will be postponed or changed somehow. Fourth recommends that its customers follow developments closely!

What Changed?

- New system VAT values were added to all UK Inventory (formerly known as 'FnB R9') customers. These were highlighted as “Reduced Rate” of 5%, and "Temporarily Reduced Rate" of 12.5%

- New Sales Tax list items were added to all UK Recipe and Menu Engineering (formerly known as 'StarChef') customers. These were highlighted as “Reduced Rate” of 5% and "Temporarily Reduced Rate" of 12.5%

Changing Rates for Existing Recipes

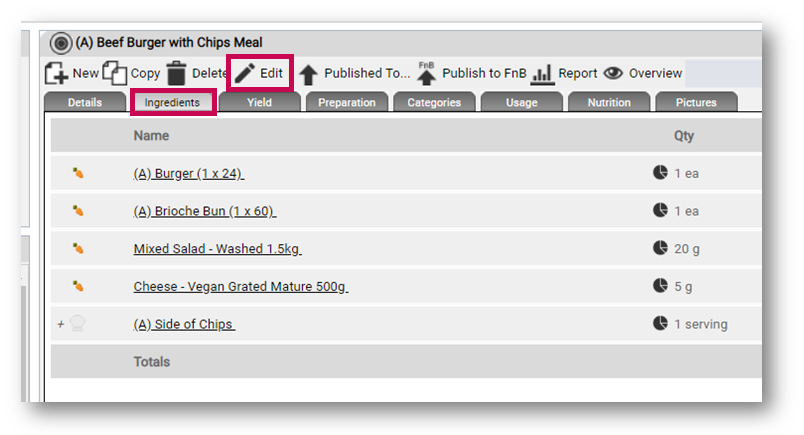

- Within the Recipe and Menu Engineering solution select the recipes tab and search for the recipe(s) that require updating

- Select the recipe and go to the Ingredients tab

- Then select Edit

Fig.1 - Editing an existing recipe

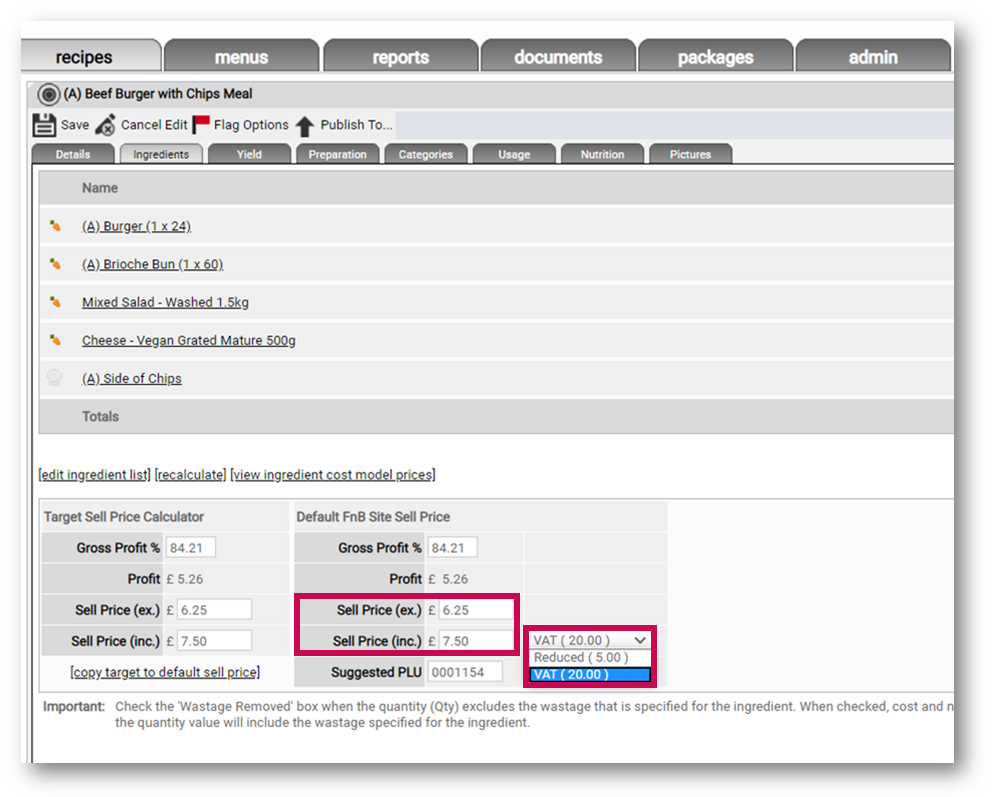

- Select the VAT drop-down

- Select the new required rate - (most likely will be VAT (20.00))

- The Sell Price can also be amended at the same time if required - either ex. or inc. field, they will calculate automatically

- Select Save once complete

Fig.2 – Amending VAT rate and Sell Price against a recipe

Fig.2 – Amending VAT rate and Sell Price against a recipe

Updating Recipe Changes to Inventory

Once the VAT rate has been applied it can then be updated to the sites within Inventory.

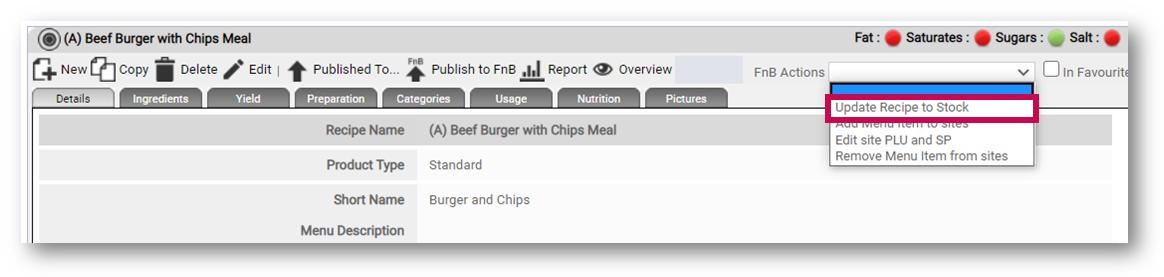

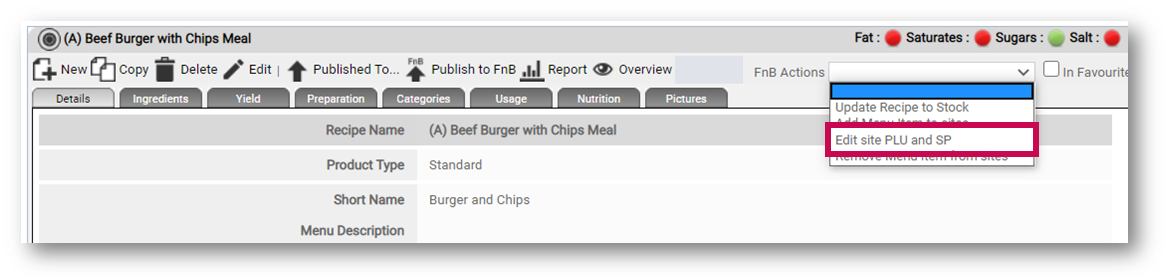

- From the FnB Actions drop-down, select Update Recipe to Stock

Fig.3 - Updating a recipe to stock

Fig.3 - Updating a recipe to stock

This action will update the recipe with the changed VAT code against all sites that it is currently published to.

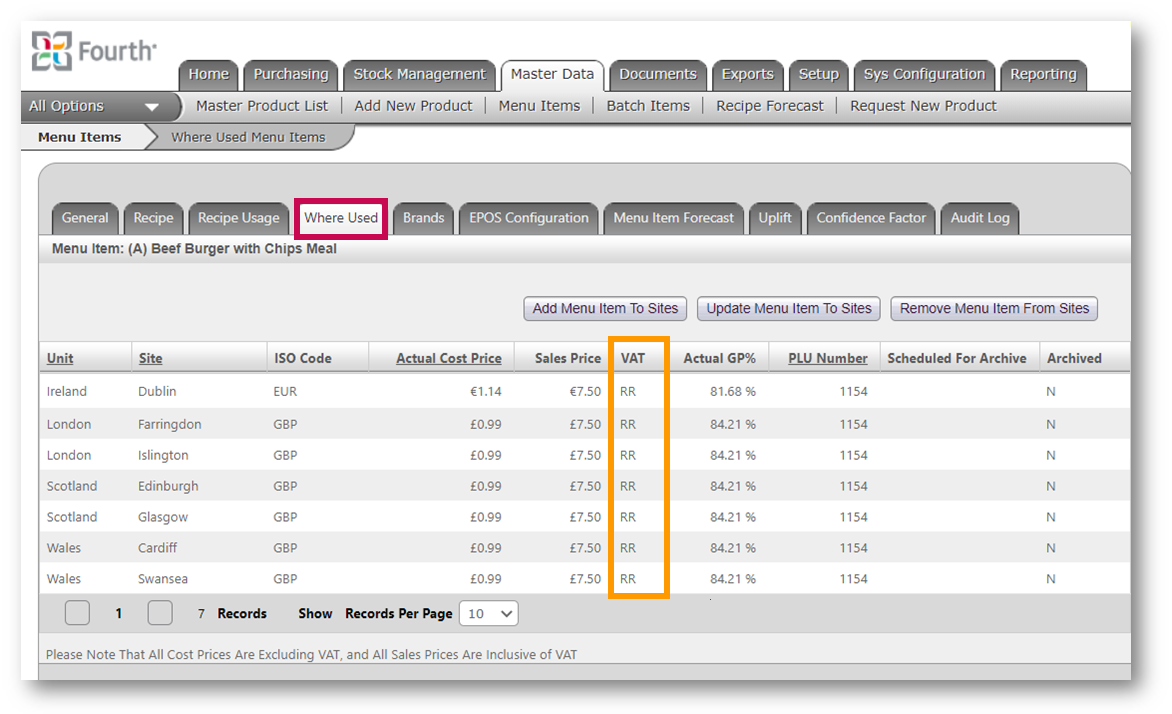

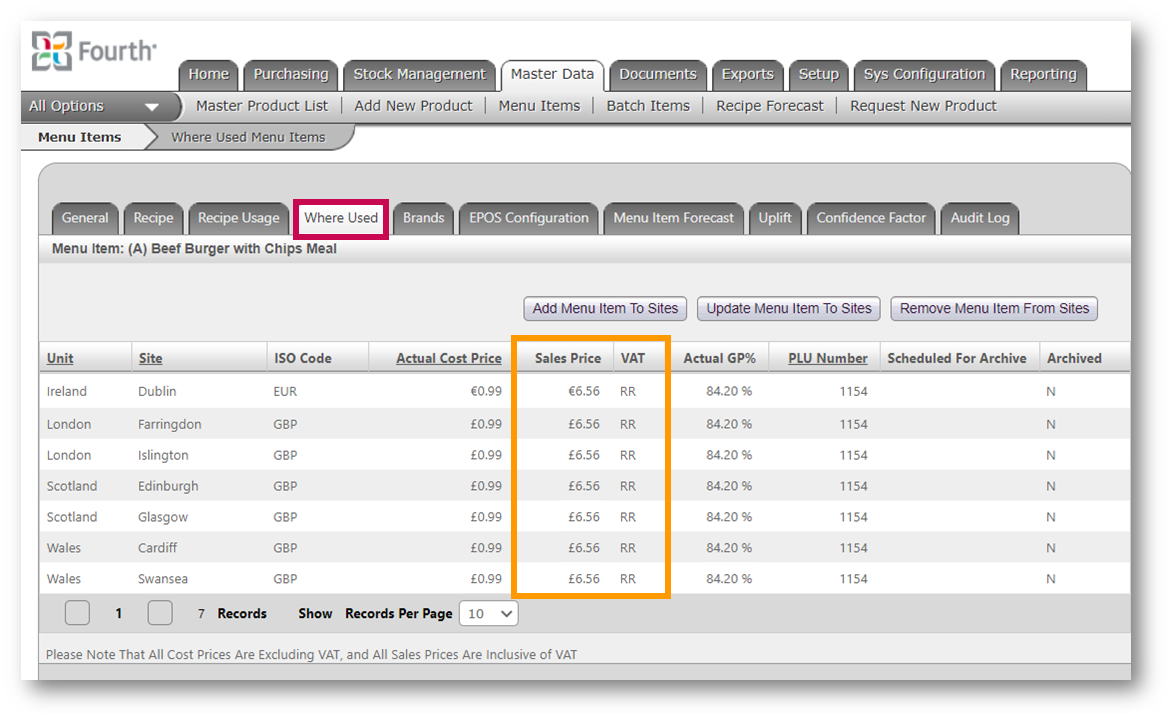

To see this within Inventory:

- Log in to Inventory and go to Master Data > Menu Items

- Search for and select the updated Recipe

- Go to the Where Used tab

Fig.4 – Updated VAT rate against sites in Inventory

Fig.4 – Updated VAT rate against sites in Inventory

- If both the VAT rate and Sell Price have been updated then the Edit site PLU and SP option should also be selected from the FnB Actions drop-down to update to the sites

Fig.5 - Updating Sell Price to sites

Fig.5 - Updating Sell Price to sites

To see the updated selling price(s) Inventory:

- Log in to Inventory and go to Master Data > Menu Items

- Search for and select the updated Recipe

- Go to the Where Used tab

Fig.6 - Updated VAT rate and Sell Prices against sites in Inventory

Fig.6 - Updated VAT rate and Sell Prices against sites in Inventory

Comments

Please sign in to leave a comment.