Overview

For various reasons, a customer may receive stock which is free of charge. Providing that these items are received against, or added to, a Purchase Order in Purchasing & Inventory then the quantity of free stock will be always added to the inventory of the receiving outlet.

Example: 12 bottles of whisky are delivered. The usual cost price is £10 per bottle.

On this delivery the vendor will only charge for 10 bottles (10 @ £10 each = £100) and will provide 2 bottles free of charge.

Managing Free of Charge Stock

There are two ways in which the monetary value of the free stock can be managed:

Scenario 1: Free stock is considered to have zero value

In this scenario all 12 bottles will be received and the overall extended cost for the 12 bottles will be £100 (10 x £10).

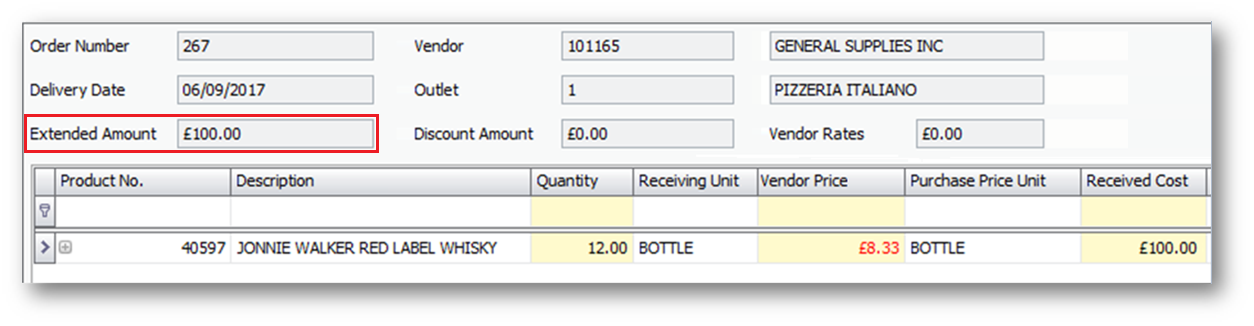

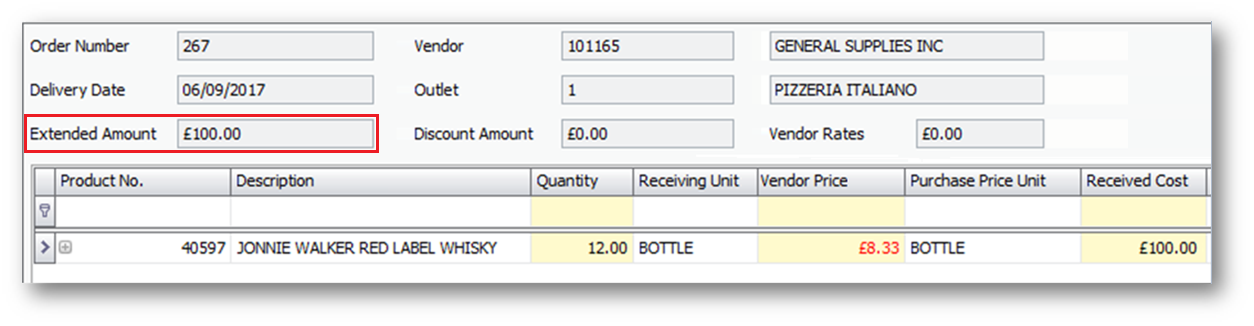

Fig.1 - Extended Amount showing as £100

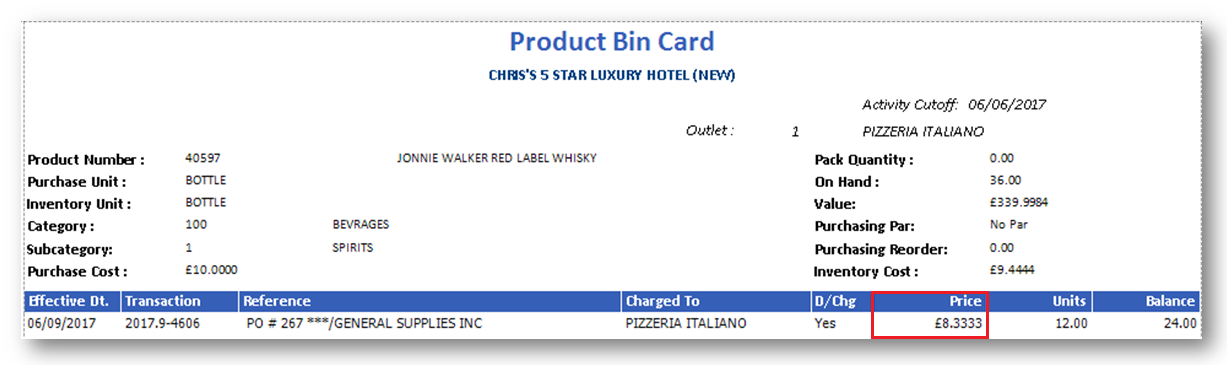

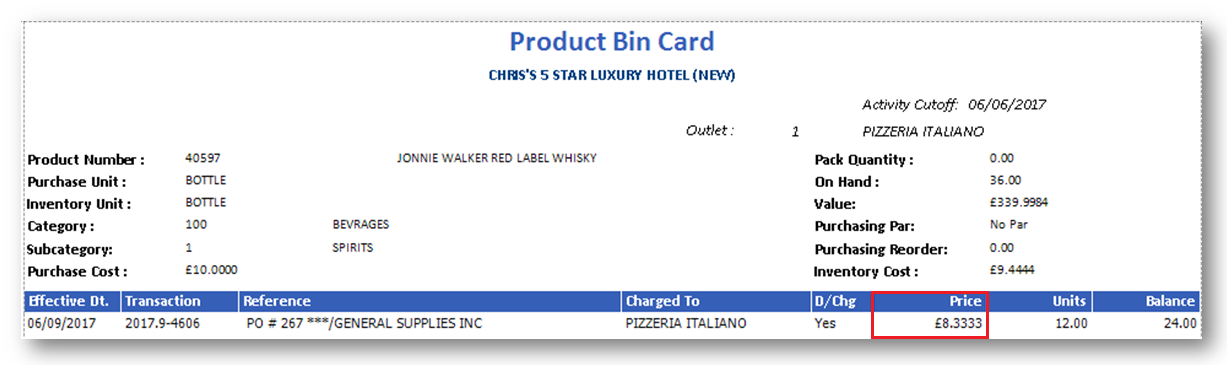

Fig.2 - Weighted average Vendor Price showing as £8.33

Scenario 2: Free stock is considered to have the same value as the paid for stock (£10)

In this scenario the free items are not specifically treated as “free” (i.e. with a zero cost) but are treated as “sponsored” meaning that they have full cost price value but have been paid for by a third party (i.e. the vendor).

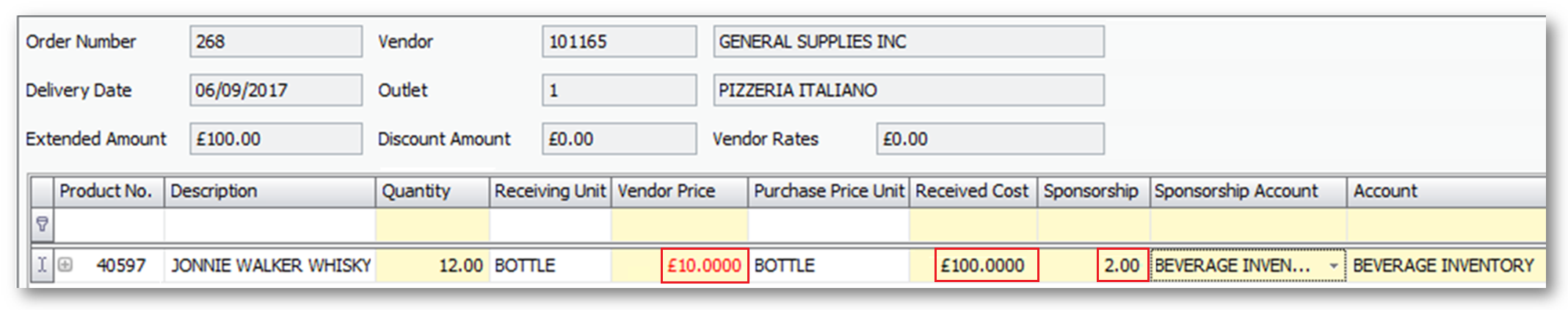

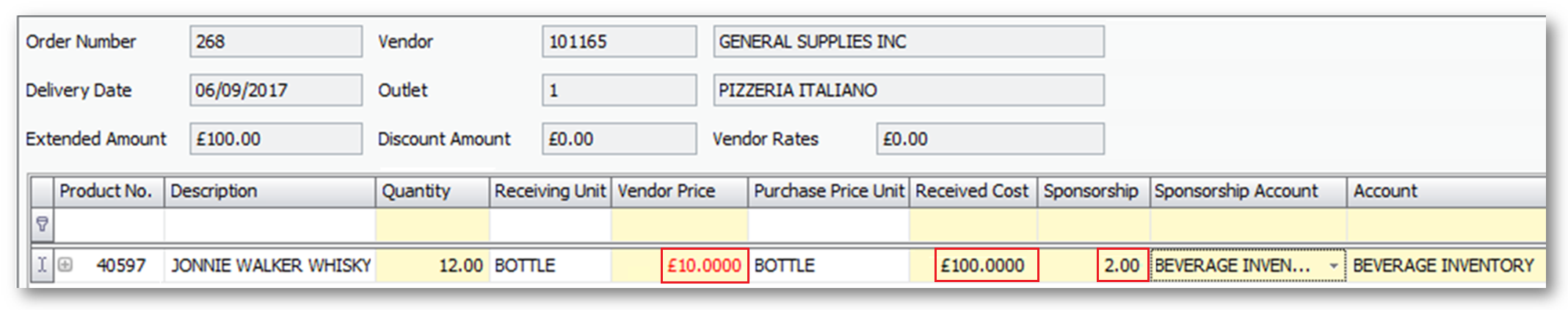

Fig.3 - Vendor Price, Received Cost and Sponsorship columns in a receiving

It is also possible to select an account to which the sponsored stock will be charged. This could either be the same account as the paid for stock (e.g. Beverage Inventory) or it could be a separate account (e.g. Vendor Sponsorship). However, the value assigned to this account is not exported to the AP system (see note below).

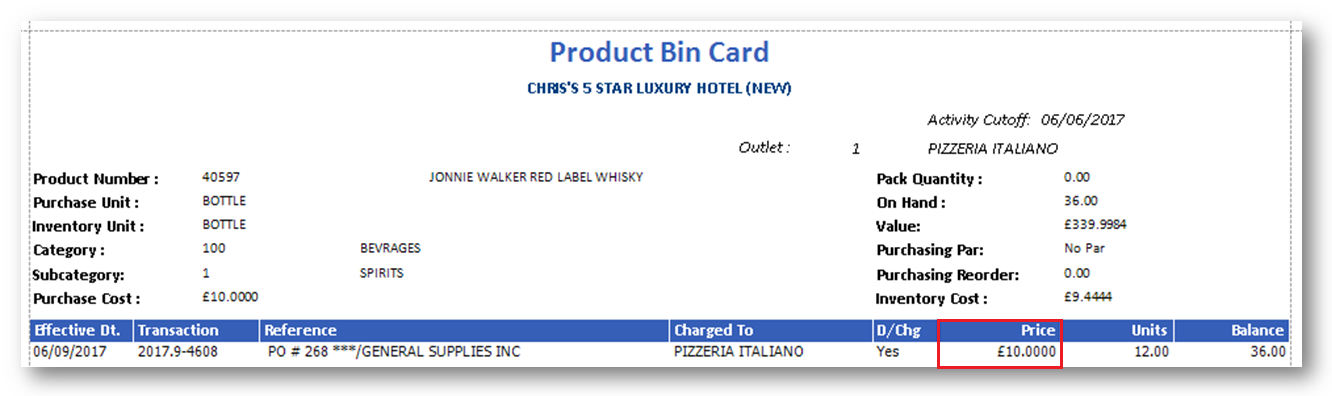

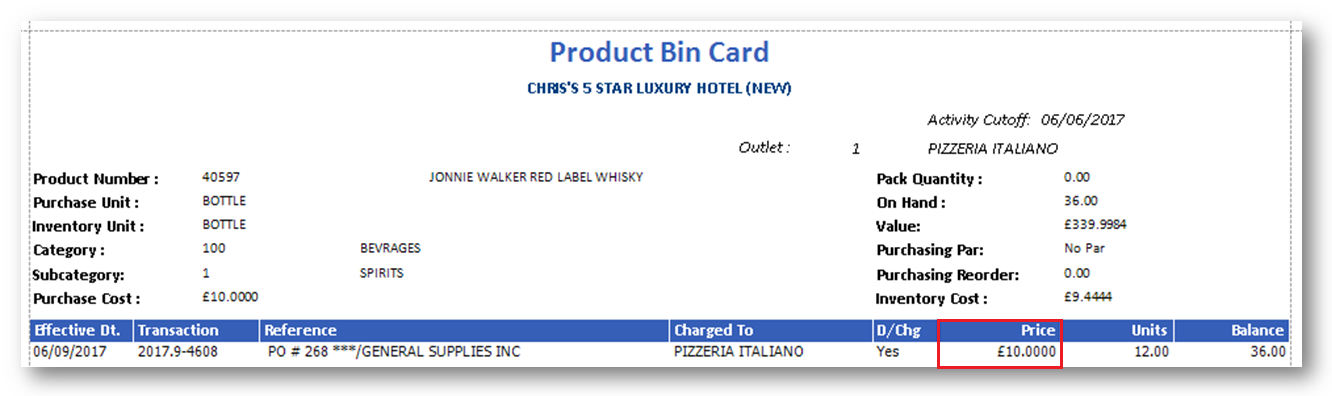

Fig.4 - Vendor Price showing as £10

Note: When using sponsorship the inventory valuation for the items will be correct as will be the value of the invoice exported to the AP system however as the value of the sponsored inventory is not exported (the additional £20) then the overall inventory value in Adaco will be different to the overall inventory valuation in the accounts system unless a journal is posted in the accounts system to allow for the £20 of additional inventory.

For various reasons, a customer may receive stock which is free of charge. Providing that these items are received against, or added to, a Purchase Order in Purchasing & Inventory then the quantity of free stock will be always added to the inventory of the receiving outlet.

Example: 12 bottles of whisky are delivered. The usual cost price is £10 per bottle.

On this delivery the vendor will only charge for 10 bottles (10 @ £10 each = £100) and will provide 2 bottles free of charge.

Managing Free of Charge Stock

There are two ways in which the monetary value of the free stock can be managed:

Scenario 1: Free stock is considered to have zero value

In this scenario all 12 bottles will be received and the overall extended cost for the 12 bottles will be £100 (10 x £10).

- An invoice for £100 will be posted against the receiving

Fig.1 - Extended Amount showing as £100

- When this receiving is posted, the 12 bottles will be added to inventory at a weighted average unit cost of £8.33 (£100 ÷ 12)

Fig.2 - Weighted average Vendor Price showing as £8.33

- An invoice for £100 will be exported via the AP interface debiting Beverage Inventory by £100 and crediting the vendor by the same amount

Scenario 2: Free stock is considered to have the same value as the paid for stock (£10)

In this scenario the free items are not specifically treated as “free” (i.e. with a zero cost) but are treated as “sponsored” meaning that they have full cost price value but have been paid for by a third party (i.e. the vendor).

- To treat the additional stock in this way the option Administration > Property Preferences > Receiving > Allow Sponsorship must be enabled

- All 12 bottles will be received at a unit price of £10 - Initially this will show an extended cost of £120 (12 x £10)

- The number of sponsored bottles will be entered into the Sponsorship column which will update the extended cost to show £100 (10 x £10). However, the unit price per bottle will remain at £10

- An invoice for £100 will be posted against the receiving

Fig.3 - Vendor Price, Received Cost and Sponsorship columns in a receiving

It is also possible to select an account to which the sponsored stock will be charged. This could either be the same account as the paid for stock (e.g. Beverage Inventory) or it could be a separate account (e.g. Vendor Sponsorship). However, the value assigned to this account is not exported to the AP system (see note below).

- When this receiving is posted, the 12 bottles will be added to inventory at a unit cost of £10 each and all future internal transactions for this item will be costed at £10 per bottle

Fig.4 - Vendor Price showing as £10

- An invoice for £100 will be exported via the AP interface debiting Beverage Inventory by £100 and crediting the vendor by the same amount.

Note: When using sponsorship the inventory valuation for the items will be correct as will be the value of the invoice exported to the AP system however as the value of the sponsored inventory is not exported (the additional £20) then the overall inventory value in Adaco will be different to the overall inventory valuation in the accounts system unless a journal is posted in the accounts system to allow for the £20 of additional inventory.

Comments

Please sign in to leave a comment.