Summary

Select the release feature from the table below to be taken directly to that section of the release note.

| Feature 1 | Feature 2 |

|

Furlough Status Export Enhancement 2 additional fields have been added to the Furlough Status export. |

NEST Pension API File Transfer Pension module - a New API Integration to send NEST Joiner and Contribution files automatically |

Release date for all features: 2nd September 2021

Furlough Status Export Enhancement

- Enabled by Default? - Yes

- Set up by customer Admin? - No

- Enable via Support ticket? - No

- Affects configuration or data? - No

What's Changing?

Two new fields are being added to the Furlough Status export to display the 2019/2020 average earnings for eligible employees using the different calculation methods for pre and post-May 1st 2021.

Reason for the Change?

Following the change made in May 2021 to the calculation guidance for the 2019/2020 average earnings for employees eligible for furlough, both calculations have now been added to the Furlough Status export so it is available for audit purposes.

Customers Affected

All customers using the Furlough functionality.

Release Note Info/Steps

- To view the Furlough Status export, go to Payroll > Reports > Exports > Furlough Status - list of all furloughs in employee order

- Select Company > Run Export

Two new columns have been added to the end of the export:

- Average Earnings pre-May 2021

- Average Earnings post-May 2021

The two fields will populate if the tax year (displayed in column N) shows as '2019'.

Additional Resources

The Original release notes for the Furlough Status Export can be found here.

Details of the pre-May 2021 calculation can be found here.

Details of the post-May 2021 calculation can be found here.

NEST Pension API File Transfer

- Enabled by Default? - No

- Set up by customer Admin? - No

- Enabled via Support ticket/Payroll Contact? - Yes

- Affects configuration or data? - No

What's Changing?

A new API integration with NEST Pensions has been created to automatically submit both contribution and new joiner files to customer NEST accounts, replacing the current SFTP transfer method.

Reason for the Change?

NEST Pensions has withdrawn the SFTP transfer option for new customers in favour of their API integration. The new integration with the Pension module, via API, will replace the current SFTP option.

Customers Affected

All customers using the Pension module with a NEST Pension scheme can use this new integration.

Release Note Info/Steps

Pension Diary

The new API integration will automatically send new joiner and contribution files to NEST according to the dates set within the Pension Diary.

- To view the pension Diary, go to the Pension module > Administration > Pension Scheme > select Scheme

- Select Pension Diary

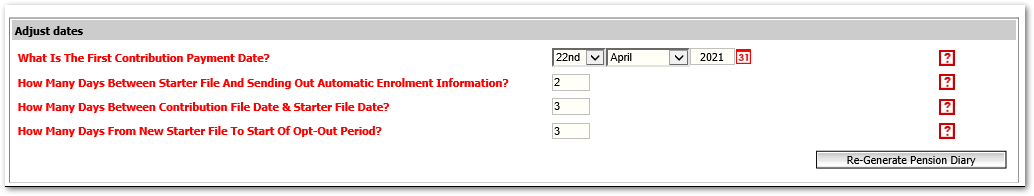

The dates within the Pension Diary can be generated using the date adjustment fields as shown in Fig. 1.

Fig.1 - Pension Diary Date selector

Fig.1 - Pension Diary Date selector

- To generate the dates, select the First Contribution Payment Date that needs to be paid

- For How many Days Between Starter File And Sending Out Automatic Enrolment Information?:

- The New Starter file will automatically generate 2 days after the payroll payment date

- 'Automatic Enrolment Information' refers to the PDF letters sent via email to employees once they have enrolled

- Enter a number for How Many Days Between Contribution File Date & Starter File Date?

- Enter a number for How Many Days From New Starter File to Start Opt-Out Period?

- The opt-out start date commences the 30-day opt-out period. It should start when the employees will receive their enrolment notifications

- When all the data is entered, select Generate/Re-Generate Pension Diary

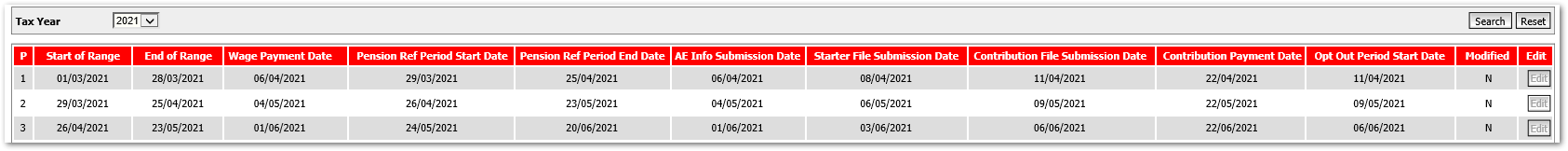

The Pension Diary will then display (see Fig.2).

Fig.2 - Pension Diary

Pension Scheme

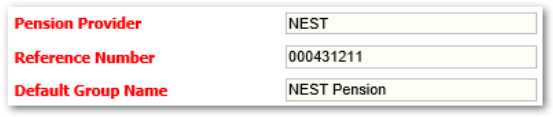

To ensure the files are accepted by NEST, the organisation's unique reference needs to be entered into the Pension Scheme.

- To view the Pension Scheme, go to the Pension module > Administration > Pension Schemes > select Pension Scheme

- Select Edit

Fig.3 - NEST Pension Scheme setup

- Ensure that the Pension Provider is NEST

- In the Reference Number field enter the unique NEST Employer ID for the organisation

The ID format will be EMP123456789. Do not include 'EMP' when entering it

The ID format will be EMP123456789. Do not include 'EMP' when entering it

- Enter the Default Group Name as it appears in the NEST portal

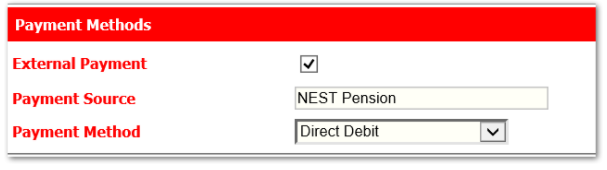

Ensure that the Payment Source and Payment Method are set up as per the configuration in the NEST Portal

Fig.4 - Payment Source and Payment Method

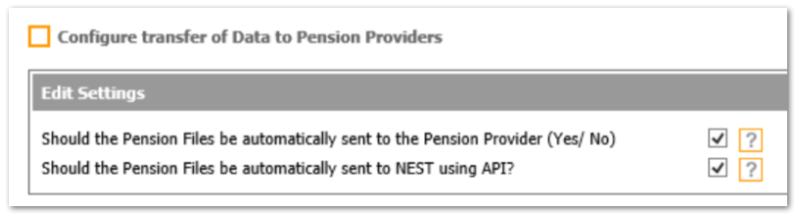

Configure API Setup

- To configure the API setup, go to the Pension module >Administration > Global Settings > Reporting Options

- Tick the box against Should Pension Files be automatically sent to the Pension provider (Yes/ No)

- Tick the box against Should the Pension files be automatically sent to NEST using API?

Fig.5 - Reporting Options

Once the configuration is complete, the NEST New Joiner file and NEST Contributions file will automatically generate and transfer to the NEST Portal on the days scheduled in the Pension Diary.

Comments

Please sign in to leave a comment.