What’s Changing?

A new export is being added to the Payroll module for reporting on all employees’ furlough status information.

Proposed release date – 26th November 2020

Reason for the Change

With the number of changes and extensions to the Coronavirus Job Retention Period that have been introduced by the UK Government, this new export will help customers to keep a record of all employees’ furlough status details and manage their furlough payments.

Customers Affected

UK HR & Payroll customers.

Information

This export has been created for customers to be able to report on the average daily hours for furloughed employees. The daily rate should be used to calculate the usual hours for the furlough period by multiplying it by the number of calendar days in the period.

The new average hours calculation for employees who were not previously eligible for furlough will not be updated in their furlough records. Instead, they are available to download within this export.

Release Notes

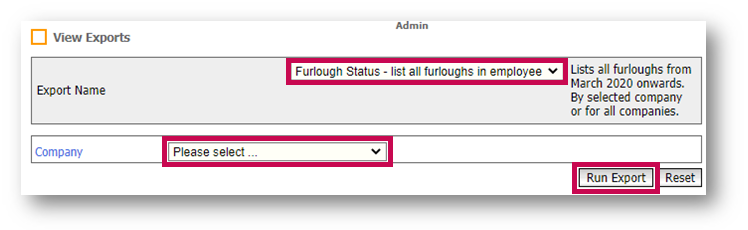

- To view the new export, go to Payroll > Reports > Export

- From the Export Name drop-down, select Furlough Status - list all furloughs in employee order

- Select the Company

- Select Run Export

Fig.1 - Furlough Status – list of all furloughs in employee order Export

The report will show the following fields:

- Employee Number

- Employee Surname

- Employee Firstname

- Location

- Division

- Job Title

- Status (current/former)

- Employment Start Date

- Termination date

- Furlough Start date

- Furlough end date

- Notes

- Average Worked Hours

- Tax Year Calculated (2019/2020)

For employees with more than one furlough period, each period will show on a separate row.

Average Worked Hours

The average worked hours will show either the daily average for the 2019/2020 tax year or the average from 6th April 2020 up to the day before the furlough start date, depending on the employee’s start date.

According to the Extended Coronavirus Job Retention Scheme (CJRS) policy paper:

- Employees who were previously eligible for furlough: The original CJRS calculations should be used

- Employees who were not previously eligible for furlough: The average hours from 6th April 2020 to the day before the furlough start date should be used.

For the purpose of this export, the start date used to decide the calculation will be displayed.

- On or before 9th March 2020 – Original average hours

- On or after 20th March 2020 – New average hours

If the original average hours are used, the export will show 2019 in the Tax Year Calculated column.

If the new average hours are used, the export will show 2020 in the Tax Year Calculated column.

Average Hours Calculation

The calculation used to display the average hours is as follows:

Total hours (including holiday hours) in Period ÷ Available days in period

- Total hours (including holiday hours) in the period

- 2019 – 6th April 2019 (or employee start date if after) to 5th April 2020 (or furlough start date if earlier)

- 2020 – 6th April 2020 (or employee start date if after) to the day before furlough start date

- Available days in period

- Total calendar days in the period, not including:

- Absence days relating to an SSP absence

- Parental Leave days (SMP/SPP/SAP/ShPP/SPBP)

- Total calendar days in the period, not including:

For example:

- Started work on 13/01/2018

- Absent for 14 days in May 2019

- Furloughed on 24th April 2020

- Calculation period – 6th April 2019 – 5th April 2020

- Total hours (incl hol hours) = 2000

Total days in period – 366

Total absent days – 14

Total available days – 366 minus 14 = 352

Average daily hours – 2000 ÷ 352 = 5.68

The materials available at this web site are for general informational purposes only and not for the purpose of providing legal advice. You should contact your attorney to obtain advice with respect to any issue or problem particular to your situation. Use of and access to this site or any of the e-mail links contained within the site do not create an attorney-client relationship between Fourth and you or any other user or browser. The opinions expressed at or through this site are the opinions of the individual presenter based on the information provided on governmental websites and should not be acted upon without first seeking specific guidance from your attorney. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.

Comments

Please sign in to leave a comment.