Invoice Management

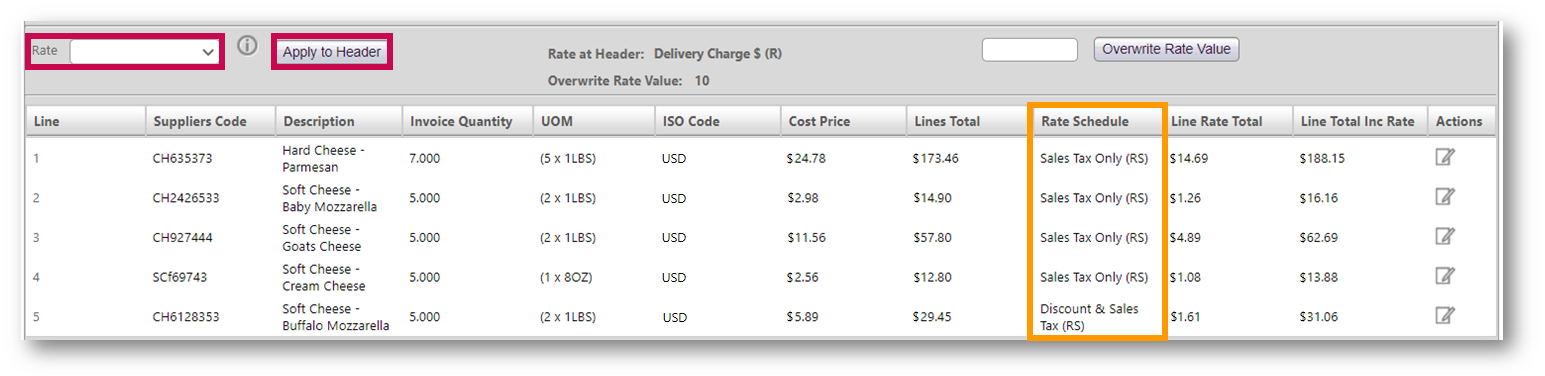

When manually recording an Invoice within Inventory, Rates and Rate Schedules applied to a Goods Received Note (at both header and line level), are carried to the Invoice.

Rates can be edited and updated on the Invoice in the same way as on the Goods Received Note.

- Use the Rate drop-down in the top-left corner and make a selection

- Then select Apply to Header

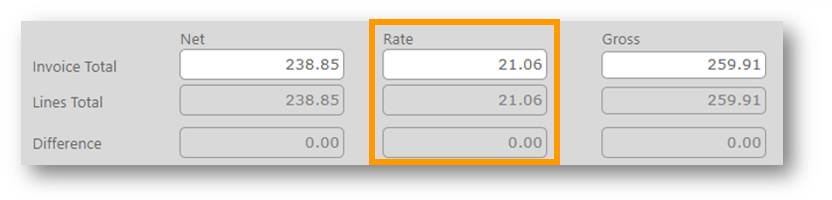

The Rate total in the document header is the sum of Rates distributed at the line level.

Fig.3 - Invoice totals in the Invoice header

Electronic Invoices

When an electronic invoice is processed in Inventory the tax amount applied to a line is already calculated. However, the Rate Schedule to be applied to the line is not applied by default.

The following applies:

- The Rate Schedule for a purchased product on an Invoice will be looked up from the threaded Goods Received Note. Or, if the product cannot be found on the Goods Received Note, then...

- The Rate Schedule for the purchased product will be looked up from the stock item

When the Rate Schedule is applied to the Invoice line, the amount is distributed to the individual Rates contained within the schedule. For example:

|

Line Total |

Line Rate Total |

Rate Name |

Rate Value |

Distributed Amount |

|

100 |

$7.10 |

Local Tax |

2% |

$2.00 |

|

|

|

State Tax |

5% |

$5.10 |

However, in some cases the line total presented on the electronic invoice from the supplier may not match to the line rate total that would have otherwise been calculated in Inventory. In this case the distributed amount is calculated proportionally relative to the calculated amount, for example:

|

Line Total |

Supplier Line Rate Total |

Calculated Line Rate Total |

Rate Name |

Rate Value |

Calculated Distributed Amount |

Actual Distributed Amount |

|

100 |

$10.00 |

$7.10 |

Local Tax |

2% |

$2.00 |

$2.82 |

|

|

|

|

State Tax |

5% |

$5.10 |

$7.18 |

Invoice Matching

Rates are not considered within the Invoice matching process. The comparison to identify a discrepancy, for each line, continues to be:

- Goods Received Note quantity <> Invoice quantity

- Goods Received Note net unit price <> Invoice net unit price

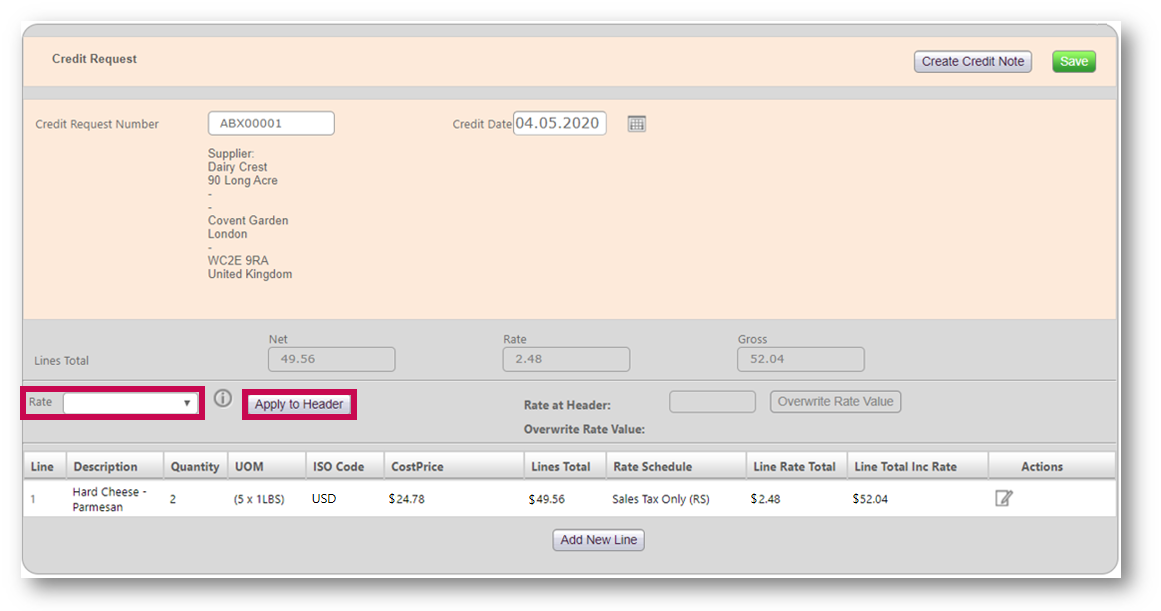

Further to Invoice matching, if the outcome of discrepancy resolution is that a Credit Note is due, Rates can be applied to a Credit Request in the same way as on the Goods Received Note and Invoice.

In a Credit Request, the rate applied carries to the same line on the Invoice, but the rate applied to the header does not.

Applying Rates on Manual Credit Notes

Rates are applied on Credit Notes in the same way as on Goods Received Notes, Invoices and Credit Requests. Rates will be carried from the corresponding Credit Request that the Credit Note is created from.

For additional information on Rates and Freight functionality, please see: Inventory | Restaurants - Rates and Freight - Article Contents Page

Comments

Please sign in to leave a comment.