Under the Coronavirus Job Retention Scheme, all UK employers will be able to access support to continue paying part of their employees’ salary for those employees that would otherwise have been laid off during the crisis.

Please Note: The details within this article have not yet been published by HMRC. We have analysed the information provided by various outlets and detailed our understanding of the announcement below.

Further information can be found here - https://www.gov.uk/government/publications/guidance-to-employers-and-businesses-about-covid-19/covid-19-support-for-businesses#support-for-businesses-through-the-coronavirus-job-retention-scheme

For additional knowledge articles relating the the Covid-19 epidemic, please visit - Fourth Products and Covid-19

Product Team Update 01.04.2020

At Fourth, we understand that the current situation is an extremely worrying time for everyone. We would like to reassure you that our Product team are working hard to provide our customers with the functionality to be able to manage your employee’s Furloughed status, and payments, as efficiently as possible.

The following new pages and features are currently available for customers:

- A page to record an employee’s Furloughed Status

- The ability to quickly establish an employee’s contracted or average weekly hours

Following customer feedback, the following aspects are being prioritised to be available as soon as possible:

- The ability to edit the effective start date

- The Average Pay calculation according to HMRC Guidelines

- A Global Setting to switch the functionality off for customers who do not require it

As well as the above, we are also working on the following:

- The ability to batch-update an employee’s Furloughed status

- An Export to extract Furlough status, contracted/average hours, or average pay for employees to help calculate Furlough pay

- The ability to create multiple Furlough periods for employees

Conversations are also ongoing to discuss what else we can do to help our customers and, as such, this is not a complete list of everything we will be doing for you.

When will this be available?

We are working through a list of smaller deliverables so we can deploy the new functionality as and when it is ready and we aim to deliver the functionality over the next couple of weeks.

Release Notes will be made available on the Fourth Customer Community prior to the changes being deployed.

Who is Eligible?

All UK Business are eligible.

How to Access the Scheme

Employers need to:

-

Designate affected employees as ‘furloughed workers’ and notify them of this change

- Changing employees’ status remains subject to existing employment law so the status change may be subject to negotiation depending on the terms of the employee contract

-

Submit information to HMRC about the employees who have been furloughed and their earnings through a new online portal

- HMRC will set out further details on the information required

HMRC will reimburse 80% of furloughed workers wage costs, up to £2,500 per month.

How do I get the Wage Costs Back?

HMRC are working urgently to set up a scheme for reimbursement as existing systems are not in place to make payments to employers.

How Should I Pay Employees?

Specific details of how Employers should pay employees have not yet been defined by HMRC. HMRC are working hard to provide more information, as soon as possible, so Employers can manage their furloughed employees.

The Government website states:

‘HMRC will reimburse 80% of furloughed workers wage costs’

This suggests that employers will receive a refund for 80% of the amount paid to employees. However, under the guidance for employees, it eludes to the employer choosing whether to make up the 20% shortfall, so HMRC will have to provide clarity on this.

How do I Calculate what to Pay for Flexible, Casual and Zero Hours Workers?

Specific details of the calculations have not yet been published by HMRC. A suggestion may be to use an average of the last 12 weeks’ pay, which, for most employees is done automatically as part of the flexible holiday calculation.

Details of:

- Average hours

- Average days

- Daily rate

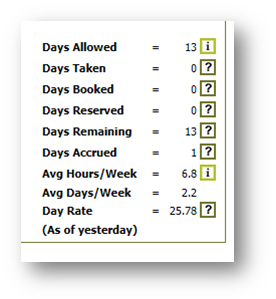

…are currently available for flexible employees who are paid holiday by the day (rather than hours) and can be found by going to…

- HR module > Employees > Employee Info > Holidays

Fig.1 – Example flexible holiday information

Once the guidance has been published by HMRC on how to calculate and pay Furloughed employees, we will update the details in this section.

What do Employees Need to Know?

Employees must be told they have a new employment status of ‘Furloughed Worker’. It means that they will remain on their employer’s payroll rather than being made redundant.

During the time that they are a furloughed worker, employees must not undertake any work for their employer.

How do I Remove an Employee’s Termination from the System?

If an employee’s termination date is in the future:

• Go to their Termination Details page and select Delete at the bottom of the page

This will delete the termination and keep them as a current employee.

If an employee’s termination date is in the past, but they have not yet had their final pay and P45 processed:

- Go to their Employment Details page and change the Status from 'Former' to Current

This will make them a current employee again and delete out the termination details.

Please note: If the employee was part of a pension scheme, then the end date needs to be removed from the pension record too.

- To do this, go to the employee’s pension record in the Payroll module, and open the Pension Scheme

- Remove the Contribution Stop Date and the Reason For Stopping Contribution and then Save

- If the employee’s termination date has past and their final pay and P45 have been processed, a full rehire will need to happen

If you wish to mass re-hire and you have 51 or more employees, Fourth will be able to support with this and restore the employees back to current status. This process will affect all modules in the system, and will include start dates, holidays and documents etc.

To request this process please raise a technical case with our support team via the Customer Community.

Please note: If payroll has been processed, then a full rehire will need to be carried out from the former employee record. The script will exclude these employees.

Please note that employees who have received a P45 will have had their termination date submitted to HMRC via the normal FPS submission. As yet, there is no guidance of whether employees who have received their P45 can be re-instated with a new status of ‘Furloughed’.

Comments

Please sign in to leave a comment.