Overview

Following the recent Supreme Court Ruling, employers who calculate employees' holidays using the 12.07% method should review their holiday calculations and make changes according to the Employment Rights Act 1996.

Employment Status

![]() In Workforce Management, the 'Flexible Employment' status exists for employees who work variable hours per week.

In Workforce Management, the 'Flexible Employment' status exists for employees who work variable hours per week.

The holiday calculation attached to this employment type is 'Weekly Calendar', which uses an average of time worked over the past 52 worked weeks (as per the Employment Rights Act 1997) and the more recent changes brought about by the Good Work Plan in April 2020.

Details of how the Flexible calculation works can be found here.

Moving Employees from Casual to Flexible Employment Status

An employee's employment status can be changed easily within their Employment Details page.

- Go to HR > Employees > Employee List> search for and select the employee

- Select Employee Info> Employment Details

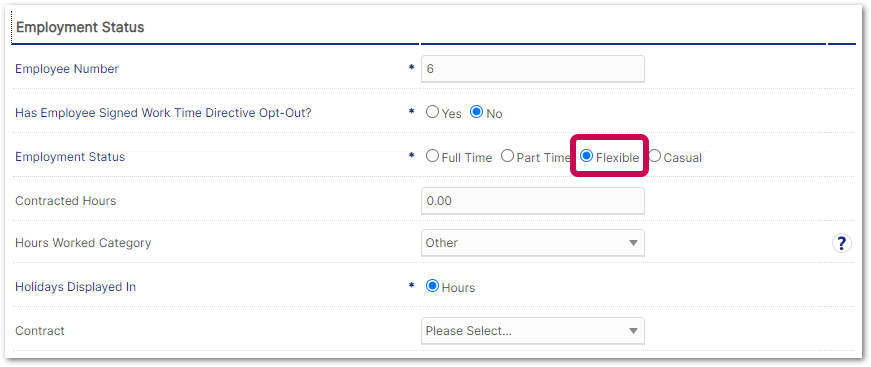

- Against Employment Status, change the radio button to Flexible and then Save

Fig 1. Employment Status

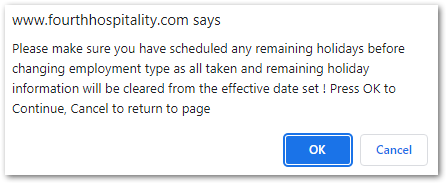

A pop-up box (Fig.2) will appear, advising to pay out any remaining holidays to employee before changing the status. This is because when the changes are saved the Casual Holiday Balance will reset to zero and the new Weekly Calendar method will start to calculate from the effective date of the change.

- Select OK

Fig.2 - Confirm change to Employment Status

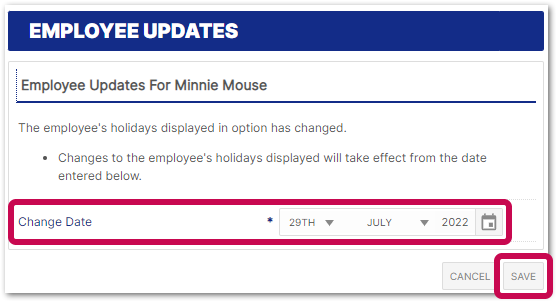

There will then be an option to specify an effective date.

- Enter the required Change Date and then Save

Fig.3 - Confirm Effective Date

The employee's employment status will then change to 'Flexible', and the holiday calculation will be the 52-week average 'Weekly Calendar'.

The Holidays Allowed calculation will backdate to the effective date that has just been set.

The Holidays Accrued calculation will use the 'Holidays Allowed' total remaining for the rest of the holiday year, to calculate how much holiday the employee has accrued for the whole holiday year as of today's date

![]() Please note - To ensure the new, Flexible, holiday allowance to only calculate from the date that the employee changed to flexible, ensure that the Pro Rata Holiday when moving between full/part time and flexible Global Setting has been enabled

Please note - To ensure the new, Flexible, holiday allowance to only calculate from the date that the employee changed to flexible, ensure that the Pro Rata Holiday when moving between full/part time and flexible Global Setting has been enabled

- Enable the Pro rata Setting in HR > Administration > Global Settings > Default Holiday Settings > Holiday Calculations > Pro Rata Holiday when moving between full/part time and flexible

Impact of Making the Change

- Any holidays accrued during the Casual employment will not carry over to the Flexible holiday allowance

- Accrued holiday accumulated whilst the employee was on a Casual employment type should be paid out manually through payroll

- Any holiday already taken will not be accounted for in the 'Holidays Remaining' balance for the Flexible employment

- Any taken holidays should be deleted and recreated, using the same length of time that the employee has already used

- Any holiday already booked (not yet taken) will not be accounted for in the 'Holidays Booked' balance, and will not automatically be paid. This is because the hours booked while Casual will not use the same holiday function as Flexible.

- Any booked holiday should be deleted and recreated

![]() Please note - Holidays from when the employee was Casual will not carry forward into the new Employment Status.

Please note - Holidays from when the employee was Casual will not carry forward into the new Employment Status.

Frequently Asked Questions

- What is the difference between Casual holiday and Flexible holiday?

- Casual holiday uses a 12.07% of every hour worked to accrue holiday, whereas Flexible holiday uses the average days worked over the past 52 worked weeks to calculate an allowance of holiday. More information can be found here

- Why are Casual holidays not carried over when the change is made?

- Casual holiday works on the basis of calculating accrued holiday for every hour worked. It does not store data as holiday 'allowed'. therefore the data cannot be converted to be used in that way

- If the change is made due to the recent ruling, what effective date should be used?

- The employer should decide what the effective date of the change should be. The new holiday calculation will start from whatever is set as the effective date. So, if it is backdated, the holiday calculation will be backdated too

- What other options do I have?

- The employee could be moved to a Full or Part-time Employment type. Holidays for Full or Part-time calculate based on the FTE Days and Hours (full-time equivalent) set in the job title, or at the employee level using the FTE Override

- Can the Casual employment type be removed as an option?

- Yes, but all employees currently on the employment type should be moved to a different one beforehand. Once the employees have been changed, please contact Fourth's support team to arrange for the setting to be switched off

- Will the Casual Holiday option be switched off automatically? If so, when?

- The plan is to decommission the Casual Employee functionality eventually. When this is done, any employee still on a Casual Employment type will have their Holidays revert to Zero. There is no planned date for this to be done yet, but every effort will be made to communicate the date within plenty of time to allow customers to make their changes

- Why does the Pro rata setting specify full/part time, and not casual

- Following the announcement of the supreme court ruling, this setting has been updated to include the pro-ration of holidays allowed when moving from casual employment type.

Disclaimer

The materials available on this website are for general informational purposes only and not for the purpose of providing legal advice. You should contact your attorney to obtain advice with respect to any issue or problem particular to your situation. Use of and access to this site or any of the e-mail links contained within the site do not create an attorney-client relationship between Fourth and you or any other user or browser. The opinions expressed at or through this site are the opinions of the individual presenter based on the information provided on governmental websites and should not be acted upon without first seeking specific guidance from your attorney. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.

Comments

Please sign in to leave a comment.