Summary

Select the release feature from the table below to be taken directly to that section of the release note.

| Feature 1 | Feature 2 |

| Student & Postgraduate Loan refunds through Payroll New option for student and postgraduate refunds to be made through the Payroll module |

National Insurance Primary Threshold Changes Changes to NI thresholds used in the Employee National Insurance calculation. PAYE – National Insurance Threshold rates for 2022 can be found at the bottom of this release note - click here |

Release date for all features: June 16th 2022

Student & Post Graduate Loan Refunds through Payroll

- Enabled by Default? - Yes

- Set up by customer Admin? - No

- Enable via Support ticket? - No

- Affects configuration or data? - No

What's Changing?

A new option in the Payroll module that allows for the processing of student & postgraduate loan refunds.

Reason for the Change

HMRC are now requesting that employers refund overpaid student and postgraduate loans directly through their payrolls.

Customers Affected

All customers using the Payroll module.

Release Note Info/Steps

- To view a student loan, go to Payroll > Employees > Employee List

- Search for and select an Employee

- Go to Payroll Info > Student/Postgraduate Loans

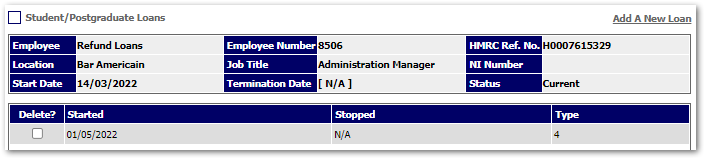

Fig.1 - Student/Postgraduate Loan page

To process a refund, a stop date must be added to the student loan record.

- Select the Student Loan record to be refunded

- Enter a date for Loan Completed and then Save

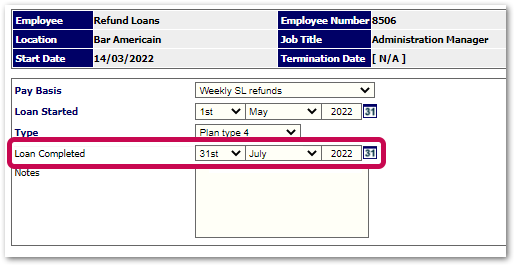

Fig.2 - Editing a loan - Loan Completed field

- Select the Student Loan record and then Click Here to Process a Refund

A new field will appear, where the amount to be refunded to the employee can be entered. The Year To Date (YTD) deduction for the loan is also displayed (see Fig.3). This YTD includes any amount deducted for the employee in the current tax year.

- In the Current Refund Amount, enter the amount that should be refunded to the employee

- Select Save

Fig.3 - Student/Postgraduate loan refund

![]() Please note: The refund amount cannot exceed the YTD total for the current tax year

Please note: The refund amount cannot exceed the YTD total for the current tax year

Once a refund has been processed the 'current YTD deducted' figure will reduce by the amount refunded. A negative loan amount will show in the employee's payslip and the amount will be added to their Net Pay amount - see Fig.4.

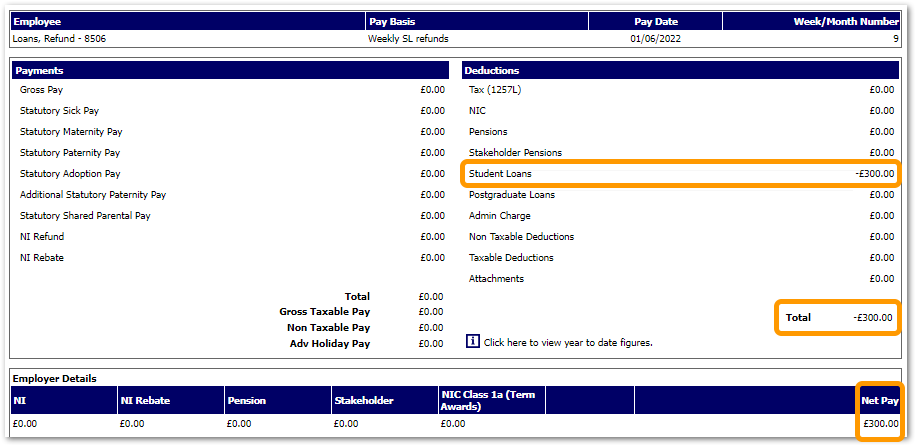

Fig.4 - Employee payslip summary - negative Student Loans figure and Net Pay

Fig.4 - Employee payslip summary - negative Student Loans figure and Net Pay

The refund will also show on all payroll reports and exports that display student/postgraduate loan deductions.

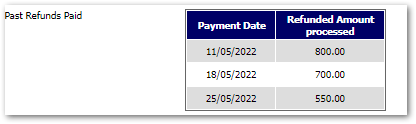

When viewing a student/postgraduate loan record, details of all refunds will display - see Fig.5.

Fig.5 - Past refunds on a student loan record

Additional Information

![]() Student/postgraduate loan refunds for a previous tax year cannot be processed through payroll. An amended FPS submission should be used to advise HMRC of the reduction, and a manual payment should be made to the employee

Student/postgraduate loan refunds for a previous tax year cannot be processed through payroll. An amended FPS submission should be used to advise HMRC of the reduction, and a manual payment should be made to the employee

![]() If the loan end date is in the future then the loan will continue to deduct until that date, at which point the refund will be made

If the loan end date is in the future then the loan will continue to deduct until that date, at which point the refund will be made

![]() Multiple refunds can be made for the same student/postgraduate loan as long as the total amount refunded does not exceed the YTD total for the current tax year

Multiple refunds can be made for the same student/postgraduate loan as long as the total amount refunded does not exceed the YTD total for the current tax year

National Insurance Primary Threshold Changes

- Enabled by Default? - Yes

- Set up by customer Admin? - No

- Enable via Support ticket? - No

- Affects configuration or data? - No

What's Changing?

Updates to the National Insurance Primary Threshold (PT), used in the Employee National Insurance calculation.

Reason for the Change

As part of the Spring Statement 2022, the UK Government introduced an increase to the Primary Threshold (PT) used in the Employee National Insurance calculation for employees and company directors. This increase takes effect from the 6th July 2022.

Customers Affected

All customers using the Payroll module.

Release Note Info/Steps

Increase of National Insurance Primary Thresholds

The Primary Threshold, the threshold at which employees start to pay National Insurance Contributions (NICs), will rise to £12,570 from 6th July 2022.

The change to the threshold is not retrospective, so for the 2022/2023 tax year there will be two different Primary Threshold amounts:

- 6th April to 5th July - £9,880

- 6th July to 5th April 2023 - £12,570

![]() Please note: The threshold updates will happen automatically for all payments made to employees on or after 6th July 2022.

Please note: The threshold updates will happen automatically for all payments made to employees on or after 6th July 2022.

Employers' National Insurance is not affected by this change. Employers will still pay National Insurance Contributions on earnings over the Secondary Threshold (£9,100 per annum).

Directors Annual Threshold

Directors National Insurance is calculated on an annual basis and, as such, for the 2022/2023 tax year, the primary threshold will be adjusted to reflect the partial year increase:

- 3 months period at £9880

- 9 months period at £12,570

Therefore, the directors' annual threshold for the 2022 tax year will be £11,908.

Additional Information

PAYE – National Insurance Threshold rates for 2022.

| NI Threshold | Weekly | Fortnightly | Lunar | Monthly | Annually |

|---|---|---|---|---|---|

| Lower Earnings Limit (LEL) | £123 | £246 | £492 | £533 | £6,396 |

| Primary Threshold (PT) Up to 5th July 2022 | £190 | £380 | £760 | £823 | £9,880 |

| Primary Threshold (PT) from 6th July 2022 | £242 | £484 | £967 | £1,048 | £12,570 |

| Primary Threshold (PT) Directors | N/A | N/A | N/A | N/A | £11,908 |

| Secondary Threshold (ST) | £175 | £350 | £700 | £758 | £9,100 |

| Freeport Upper Secondary Threshold (FUST) | £481 | £962 | £1,924 | £2,083 | £25,000 |

| Upper Secondary Threshold (UST) | £967 | £1,934 | £3,867 | £4,189 | £50,270 |

| Apprentice Upper Secondary Threshold (AUST) | £967 | £1,934 | £3,867 | £4,189 | £50,270 |

| Veterans Upper secondary Threshold (VUST) | £967 | £1,934 | £3,867 | £4,189 | £50,270 |

| Upper Earnings Limit (UEL) | £967 | £1,934 | £3,867 | £4,189 | £50,270 |

Additional Resources

Comments

Please sign in to leave a comment.