Summary

| Feature 1 |

| New income thresholds for Attachment of Earnings Orders have been introduced for orders issued by the Welsh Government |

Release date: March 17th 2022 (already released)

Welsh Government Attachment of Earnings Thresholds

- Enabled by Default? - Yes

- Set up by customer Admin? - No

- Enable via Support ticket? - No

- Affects configuration or data? - No

What's Changing?

A new option has been added to the Attachment of Earnings Order list for the new orders that are issued by the Welsh Government.

Reason for the Change

From April 2022, new Income thresholds will be used to calculate new Attachment of Earnings Orders that are issued by the Welsh Government.

Customers Affected

All customers using the Payroll module.

Release Note Info/Steps

- To view the Attachment of Earnings List, go to Payroll > Employees > Employee List > select Employee

- Go to Employee Payroll Info > Attachments > Add Attachments

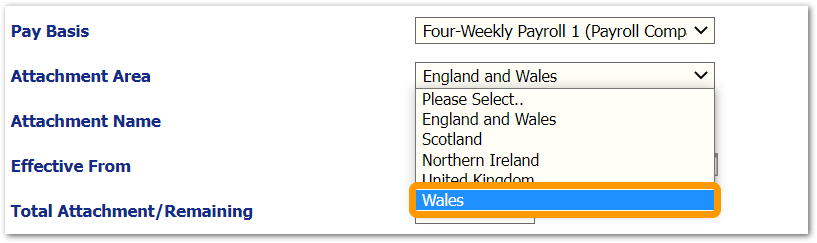

A new option for Wales has been added to the Attachment Area drop-down list (Fig.1).

Fig.1 - Attachment Area drop-down

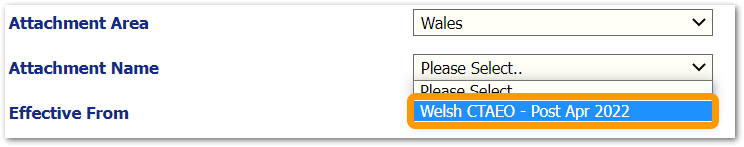

When selected, a new Welsh Council Tax Attachment of Earnings Order (CTAEO) option will be available to select within the Attachment Name drop-down (Fig.2)

Fig.2 - Welsh CTEAO - Post Apr 2022

The Welsh CTAEO - Post Apr 2022 option, once selected, will apply a new earnings threshold in the calculation of all deductions associated with the attachment.

![]() Welsh CTAEO - Post Apr 2022 should only be selected for Attachment of Earnings that have been issued by the Welsh Government after April 2022.

Welsh CTAEO - Post Apr 2022 should only be selected for Attachment of Earnings that have been issued by the Welsh Government after April 2022.

Welsh CTAEO - Post Apr 2022 Thresholds

Monthly

| Monthly Earnings | Deduction Percentage |

| Not exceeding £430 | 0% |

| £430 - £780 | 3% |

| £780 - £1,050 | 5% |

| £1,050 - £1,280 | 7% |

| £1,280 - £2,010 | 12% |

| £2,010 - £2,860 | 17% |

| Exceeding £2,860 | 17% for first £2,860 then 50% on the rest |

Weekly

| Weekly Earnings | Deduction Percentage |

| Not exceeding £105 | 0% |

| £105 - £190 | 3% |

| £190 - £260 | 5% |

| £260 - £320 | 7% |

| £320 - £505 | 12% |

| £505 - £715 | 17% |

| Exceeding £715 | 17% for the first £715 then 50% on the rest |

Comments

Please sign in to leave a comment.