Sonic Franchisees are able to opt-in to processing Tax Credits with Synergi Partners.

Complete these steps to use Tax Credits with Synergi Partners:

- General Settings:

- Click Settings. Click General Settings.

- Client updates FEIN field with FEIN.

- Units Settings:

- Click Settings. Click Units.

- Client updates each unit with FEIN. Click Save for each unit.

- Tax Credit Settings:

- Click Settings. Click Tax Credits.

- Client enters Primary Contact, Secondary Contact, & Fiscal Year End Date. Click Save.

- Client fills out forms. Available below.

- Note: Synergi Partners requires forms to be returned with original signature.

- Client completes and mails forms to Synergi Partners:

Synergi Partners

PO Box 5599

Florence, SC 29502

PO Box 5599

Florence, SC 29502

- Client emails tmachen@synergipartners.com and includes:

- “My Company Name is [insert]. My projected go-live date is [insert]. I have mailed in the Synergi paperwork.”

- Client completes configurations below:

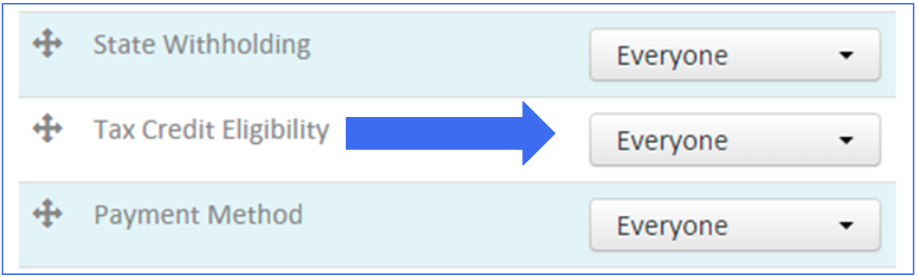

Required: Onboarding Task:

- Click Settings. Select your organization.

- Click Onboarding.

- Set Tax Credit Eligibility task to Everyone.

Required: To pre-screen applicants on the job application:

Note: It is recommended that you screen applicants on the job application for possible tax credits. The reason for this is that the answers to the Tax Credit Questionnaire should be given by the applicant prior to a job offer being made. They can sign the 8850 Form later (during Onboarding) but the questions/answers need to be provided prior to a job offer.

- Click Settings. Select your organization.

- Click Application Questions.

- Set Tax Credit Eligibility section to Everyone.

Please note that Synergi Partners requires additional training.

Related Articles:

- PeopleMatter: Tax Credit Process

- PeopleMatter: Manager Workflow: How do I Complete Tax Credit Processing? (video)

Contact Marla Caplan at Synergi at (301) 922-0255 or mcaplan@synergipartners.com to sign up or receive more information.

Comments

Please sign in to leave a comment.