Summary

Select the release feature from the table below to be taken directly to that section of the release note.

| Feature 1 | Feature 2 |

Feature 3 |

|

1.25% increase of rates for all National Insurance categories, and notifications in payslips |

Veterans' National Insurance Relief A National Insurance contribution holiday for employers for a veteran's first year of civilian employment after leaving HM Armed Forces |

Freeport National Insurance Relief A National Insurance contribution holiday for employers who recruit new employees within a freeport site |

Release date for all features: March 17th 2022

Social Care Levy

- Enabled by Default? - Yes

- Set up by customer Admin? - No

- Enable via Support ticket? - No

- Affects configuration or data? - No

What's Changing?

Rates for all National Insurance categories are increasing by 1.25% from 6th April 2022.

Reason for the Change

On 7th September 2021, the UK Government announced a new Health and Social Care Levy to fund investment in the NHS and health and social care. The levy will be effectively introduced from April 2022 when the rate of National Insurance Contributions (NICs) for working-age employees, self-employed people, and employers will increase by 1.25% and be added to the existing NHS allocation.

From April 2023, the levy will be formally separated from NICs and will also apply to the earnings of individuals working above the State Pension Age. The NICs rates will then return to 2021-2022 levels

Customers Affected

All customers using the Payroll module.

Release Note Info/Steps

Each tax year, all legislative rates and thresholds are updated within the Payroll module so that they automatically take effect at the beginning of the tax year. Details of the 2022/2023 updates can be found here.

From 6th April 2022, there is an additional update to the NIC percentage for both employees and employers which will increase by 1.25%.

As with all legislative changes, these will update automatically when portals are rolled over to the new tax year.

New Contribution Rates

Below is a table detailing the new NIC rates.

| Employee's Contributions | Employer's Contribution | ||||||||

| Table Letter | Earnings below LEL | Earnings above LEL up to PT | Earnings above PT up to UEL | Earnings above UEL | Earnings below LEL | Earnings above LEL up to ST | Earnings above ST up to FUST | Earnings above FUST up to UST / AUST / VUST | Earnings above UST / AUST / VUST |

| A | NIL | 0% | 13.25% | 3.25% | NIL | 0% | 15.05% | 15.05% | 15.05% |

| B | NIL | 0% | 7.1% | 3.25% | NIL | 0% | 15.05% | 15.05% | 15.05% |

| C (over state pension age) | NIL | NIL | NIL | NIL | NIL | 0% | 15.05% | 15.05% | 15.05% |

| F (Freeport Standard) | NIL | 0% | 13.25% | 3.25% | NIL | 0% | 0% | 15.05% | 15.05% |

| H (Apprentice under 25) | NIL | 0% | 13.25% | 3.25% | NIL | 0% | 0% | 0% | 15.05% |

| I (Freeport MWRRE) | NIL | 0% | 7.1% | 3.25% | NIL | 0% | 0% | 15.05% | 15.05% |

| J (Deferment) | NIL | 0% | 3.25% | 3.25% | NIL | 0% | 15.05% | 15.05% | 15.05% |

| L (Freeport deferment) | NIL | 0% | 3.25% | 3.25% | NIL | 0% | 0% | 15.05% | 15.05% |

| M (Under 21) | NIL | 0% | 13.25% | 3.25% | NIL | 0% | 0% | 0% | 15.05% |

| S (Freeport over pension age) | NIL | NIL | NIL | NIL | NIL | 0% | 0% | 15.05% | 15.05% |

| V (Veterans Standard) | NIL | 0% | 13.25% | 3.25% | NIL | 0% | 0% | 0% | 15.05% |

| Z (Under 21 deferment) | NIL | 0% | 3.25% | 3.25% | NIL | 0% | 0% | 0% | 15.05% |

Table 1. National Insurance Contribution Rates 2022/2023

For a Standard A category,

- Employees will pay 13.25% (previously 11%) of earnings above the Lower Earnings Limit up to the Upper Earnings Limit

- Employers will pay 15.05% (previously 13.8%) of earnings over the Lower Earnings Limit

Electronic Payslips

As part of the UK Government guidance, all employers have been advised to include a note on payslips, advising employees of the change in contribution rates. They have communicated:

"To ensure taxpayers understand that their increased NICs is helping fund public services, we are requesting that employers and payroll agents put a message on payslips explaining what these funds will be used for. The message applies to all payslips for the tax year 2022-23 and should read "1.25% uplift in NICs funds NHS, health and social care."

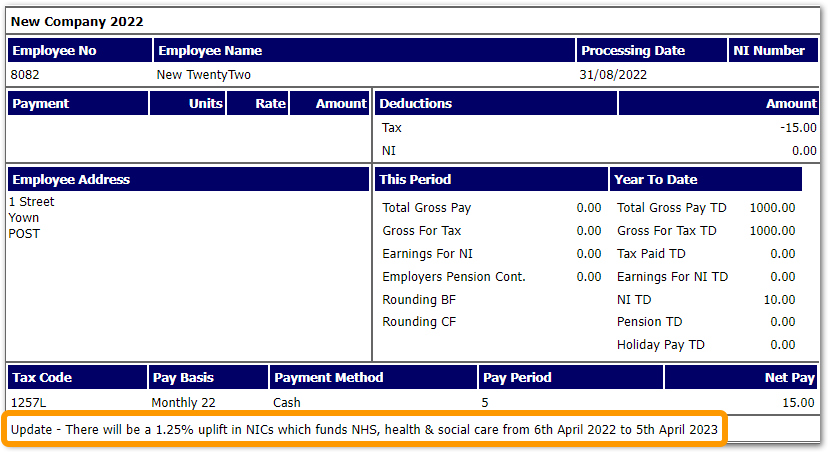

![]() As per this request, a payslip message will be added to emailed payslips and the PDF version available to download within Employee Self Service (ESS).

As per this request, a payslip message will be added to emailed payslips and the PDF version available to download within Employee Self Service (ESS).

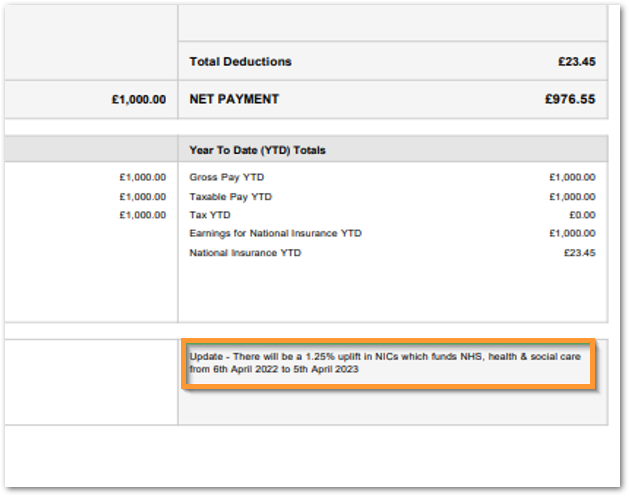

From April 6th 2022 until April 5th 2023, a message will display automatically on all emailed payslips (see FIg.1) and those that are available within employee ESS (Fig.2).

Fig.1 - Email NICs Payslip Message

Fig.2 - PDF Downloaded Payslip in ESS NICs Payslip Message

Paper Payslips

A message can be added to paper payslips which will display when printed. For more information about setting a payslip message, please see here.

Veterans National Insurance Relief

- Enabled by Default? - Yes

- Set up by customer Admin? - No

- Enable via Support ticket? - No

- Affects configuration or data? - No

What's Changing?

The introduction of a new National Insurance category for veterans for their first year in their first job since leaving the Armed Forces.

Reason for the Change

On 11th January 2020, the UK Government announced a new National Insurance relief for companies that employ veterans for their first year of employment after they leave the Armed Forces.

The relief provides a zero rate of Employers National Insurance on earnings of a qualifying veteran for up to 12 months from the first day of civilian employment. The zero rate will apply up to a new Veterans Upper Secondary Threshold (VUST)

More information on eligibility can be found here.

Customers Affected

All customers using the Payroll module.

Release Note Info/Steps

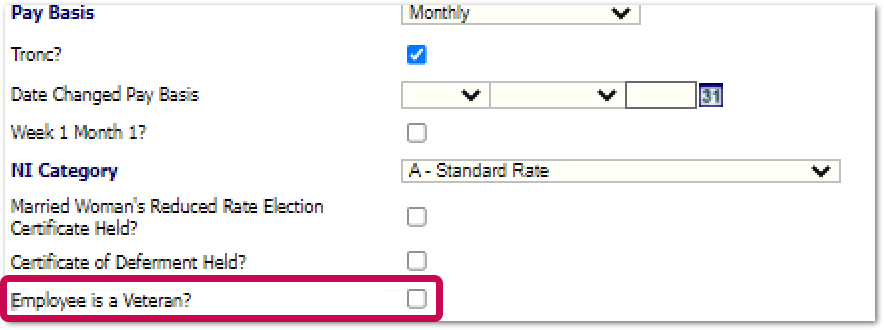

From the 2022/2023 tax year, a new option will be available within the employee Pay & Tax Details page to flag them as a veteran.

- In the Payroll module, use the Employee List and select the required employee

- Go to Employee Payroll Info > Pay & Tax Details

- To flag the employee as a veteran, tick the Employee is a Veteran? box

Fig.3 - 'Employee is a Veteran?' setting on the Pay & Dax Details page

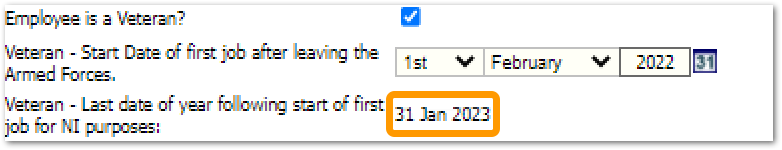

A date box will appear.

- Enter the Start Date of first job after leaving the Armed Forces

Fig.4 - Start Date of first job after leaving the Armed Forces

The 'Last date of year following start of first job for NI purposes' will automatically populate with a date 12 months from the start date (see Fig.5).

Fig.5 - Veteran's last date of year following start of first job for NI purposes - automatically populated

![]() The start and end date will be used when the appropriate National Insurance category is assigned to the employee.

The start and end date will be used when the appropriate National Insurance category is assigned to the employee.

Assigning the National Insurance Category

A new National Insurance category has been added to the NI category list within the employee Pay & Tax Details page. If a veteran's pay date falls within the Start Date of first job after leaving the Armed Forces and Last date of year following start of first job for NI purposes, a V category will be automatically assigned to the employee.

If the pay date falls outside of these dates, a standard A category will be applied.

V Category Calculations

A V category can only be applied to employees who would otherwise be assigned an A National Insurance category. A is the standard rate for employees who are over the age of 21, under State Pension age, and are not an apprentice or have an agreed deferment with HMRC.

![]() A veteran who would not normally be assigned the A category should not be assigned the new V category, and claims for the National Insurance relief should be made directly with HMRC.

A veteran who would not normally be assigned the A category should not be assigned the new V category, and claims for the National Insurance relief should be made directly with HMRC.

A V category will mean that the employee will pay:

- 0% on earnings up to the Primary Threshold (£823 per month)

- 13.25% on earnings above the Primary Threshold and up to the Upper Earnings Limit (£4189 per month)

- 3.25% on earnings above the Upper Earnings Limit (£4189 per month)

A V category will mean that the employer will pay:

- 0% on earnings up to the Veteran Upper Secondary Threshold (£4189 per month)

- 15.05% on earnings over the Veteran Upper Secondary Threshold (£4189 per month)

Existing Employees who are Veterans

The relief was introduced from April 6th 2021, although the new National Insurance category only applies from April 2022.

![]() For veterans who qualify for the relief within the 2021/2022 tax year, their Pay and Tax Details page should be updated with the Start Date of first job after leaving the Armed Forces.

For veterans who qualify for the relief within the 2021/2022 tax year, their Pay and Tax Details page should be updated with the Start Date of first job after leaving the Armed Forces.

This will ensure that any earnings that qualify for relief in the 2022/2023 tax year will be calculated accordingly.

A claim can be made for any relief due for the 20212/2022 tax year by submitting an amended FPS submission. Details of how to submit an amended FPS can be found here.

Reporting Veterans to HMRC

There is no need to report employees who are veterans to HMRC in order to claim the relief. The V category will be provided to HMRC on the FPS file for each pay date that the relief was given.

However, all employers should keep records that show:

- That an employee is a qualifying veteran

- The start date of the veteran's first civilian employment

Records should be kept for at least 4 years.

Verifying an Employee as a Veteran

To verify that an employee is a veteran, they should provide one of the following:

- Discharge papers from HM Armed Forces

- Identification card (which shows their time in HM Armed Forces)

- Letter of employment or contract with HM Armed Forces

- P45 from leaving HM Armed Forces

More information can be found at www.gov.uk.

Freeport National Insurance Relief

- Enabled by Default? - Yes

- Set up by customer Admin? - No

- Enable via Support ticket? - No

- Affects configuration or data? - No

What's Changing?

The introduction of four new National Insurance categories for new employees within a company's freeport site.

Reason for the Change

As part of the Government's work to 'Level Up' and boost economic activity, 11 new freeports will be created in locations across the UK. Freeports have different customs rules than the rest of the country and are innovative hubs that boost global trade, attract investment and increase productivity.

Part of the freeport initiative is to introduce a reduced employer National Insurance contribution for all freeport-based businesses (employers located within a prescribed geographic area). The change in rate will apply a zero secondary rate for employee earnings up to a new Freeport Upper Secondary Threshold (FUST) and will introduce four new National Insurance categories.

Customers Affected

All customers using the Payroll module.

Release Note Info/Steps

As the new National Insurance relief is only applicable for employers within a specified geographic area, a new option has been added to the Location setup in order to flag it as a freeport location.

- To view a location, go to HR > Company Admin > Locations > select Location

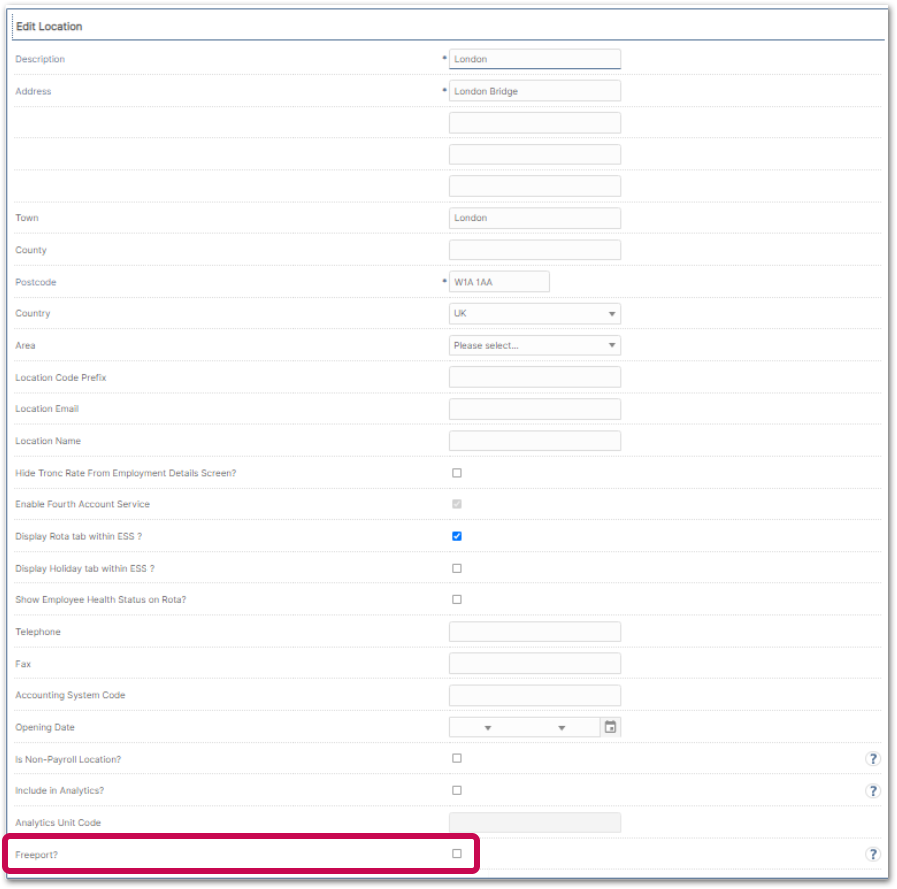

A new option to flag a location as a Freeport location has been added - see Fig.6.

Fig.6 - Freeport setting on the Edit Location page

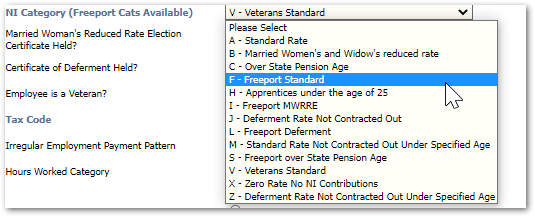

Once a location is marked as a freeport, the four new National Insurance categories will be available to assign to an employee within the employee Pay & Tax Details page

- To view the new NI Categories, go to Payroll > Employees > Employee List > select Employee > Employee Payroll Info > Pay & Tax Details

The Four new NI Categories are:

- F - Freeport Standard

- I - Freeport MWRRE (Married women's reduced Rate)

- L - Freeport Deferment

- S - Freeport over State Pension Age

Fig.7 - Freeport National Insurance categories

![]() Employers' secondary National Insurance contributions will start from the new Freeport Upper Secondary Threshold which, for the 2022/2023 tax year, is £25,000 per annum.

Employers' secondary National Insurance contributions will start from the new Freeport Upper Secondary Threshold which, for the 2022/2023 tax year, is £25,000 per annum.

Details of the new contribution rates associated with the four new freeport categories can be found here.

Eligibility for the Freeport National Insurance Relief

The freeport relief is only available for employers that:

- Are based in Great Britain

- Have physical premises in a freeport tax site

The relief can be claimed against employees who:

- Are a new hire after April 2022

- Have not worked for that employer before in the previous 24 months

- Spend 60% of their working time in the freeport tax site

![]() Eligibility to claim will expire 36 months after the employee's start date.

Eligibility to claim will expire 36 months after the employee's start date.

Assigning a Freeport National Insurance Category

Due to the strict eligibility rules surrounding the freeport National Insurance relief, the freeport National Insurance categories will not be assigned automatically.

Employers must assign the correct category within their employees' Pay & Tax Details pages, or contact their Payroll Specialist within the UK's payroll operation.

For more information about freeport National Insurance, please refer to gov.uk.

Comments

Please sign in to leave a comment.