What’s Changing?

The ability to amend a Full Payment Submission (FPS) file for a previous tax year (2020/2021 onwards), allowing the adjustment of employees’ year to date figures without the use of an Earlier Year Update (EYU).

Release date: 31st March 2021.

Reason for the Change

Employers will be unable to submit an Earlier Year Update (EYU) to make amendments to the 2020/2021 tax year onwards. Instead, amendments to Full Payment Submission (FPS) files can be submitted to amend year to date figures for a previous year.

Customers Affected

All Payroll module customers.

Information

The Earlier Year Update (EYU) will still be used to make amendments to years prior to 2020/2021.

HMRC will no longer accept EYU submissions for 2013/2014 and, after 19th April 2021, they will no longer accept submissions for 2014/2015.

Release Notes

A new link has been added to the Full Payment Submission screen in the Payroll module which leads to the new screen where corrections to a previous year’s FPS can be made.

- Go to Payroll > HMRC Data Exchange > Full Payment Submission (FPS)

- Select Corrections to a Previous years FPS (EYU replacement)

This FPS correction screen can also be accessed via the current Earlier Years Update (EYU) screen – see below.

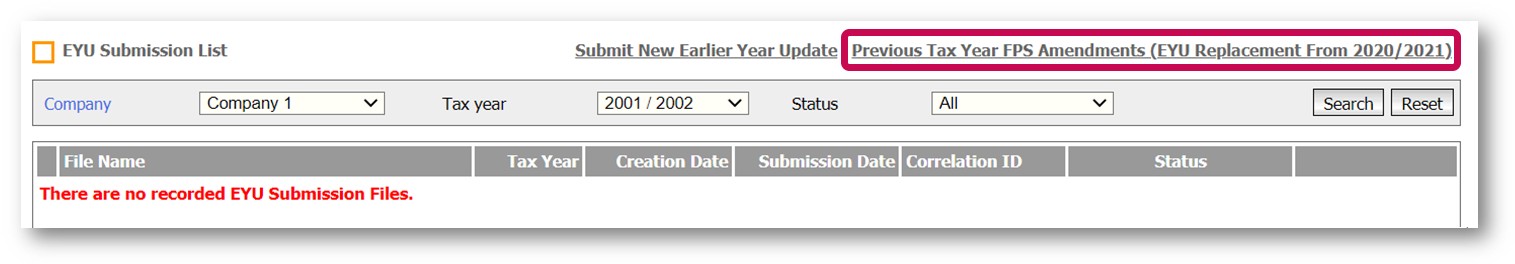

- Go to Payroll > HMRC Data exchange > Earlier Years Update (EYU

- Select Previous Tax Year FPS Amendments (EYU replacement from 2020/2021)

Fig.1 – Accessing the FPS Correction screen via Earlier Year Update (EYU)

Fig.1 – Accessing the FPS Correction screen via Earlier Year Update (EYU)

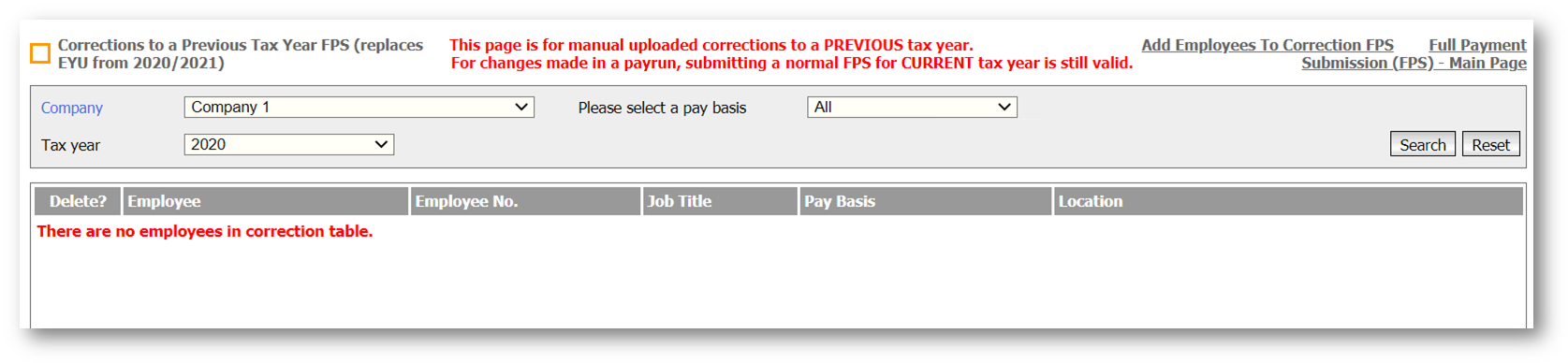

Fig.2 - Corrections to a previous tax years FPS (EYU Replacement) screen

Fig.2 - Corrections to a previous tax years FPS (EYU Replacement) screen

Preparing the FPS Amendment

- To prepare for the Amendments, select the Company

- Select the Tax Year (the earliest year that can be selected is 2020/2021)

- Select the Pay Basis

- Select Add Employees to Correction FPS

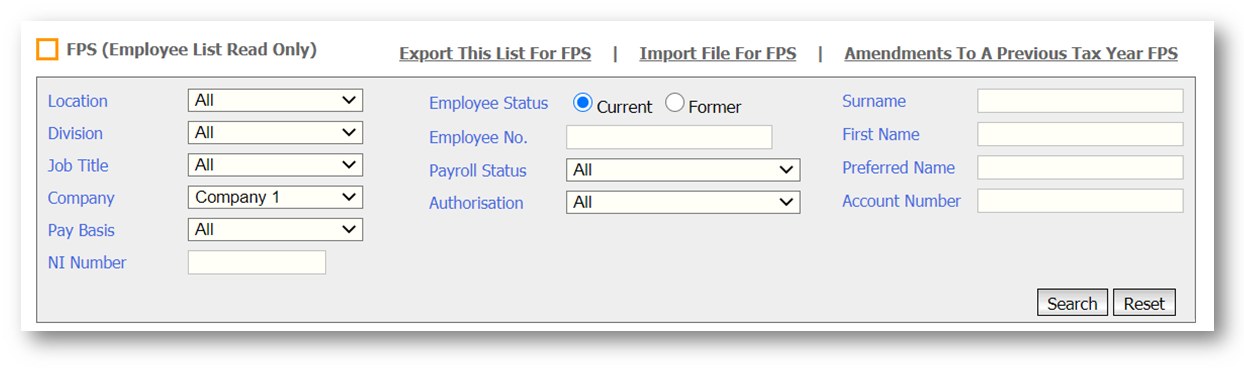

A screen similar to the Employee List will be displayed.

Fig 3. Earlier Year Update (EYU) Page

The search criteria should be used to specify the employee or employees that amendments need to be made for.

For example:

- To update a single employee, search for the Employee No.

- To update a whole location, select the specific Location

- For current employees (current at the point of searching), select Current for the Employee Status

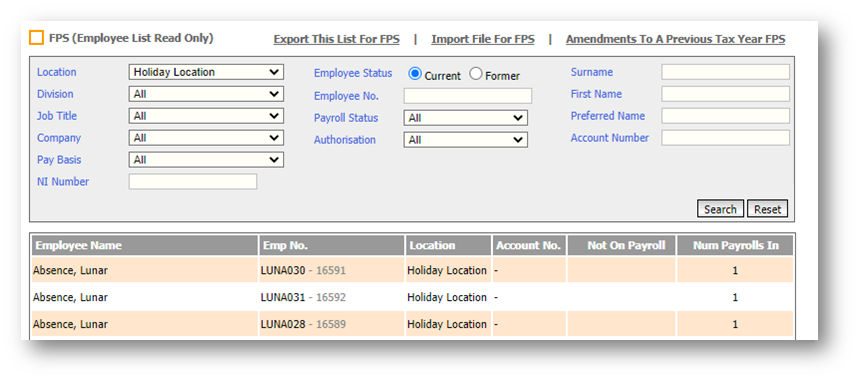

Once selected, the employees will appear in the employee list (Fig.4).

Fig.4 - FPS Amendment Employee List

Fig.4 - FPS Amendment Employee List

Although the employee list appears, amendments cannot be made here. To amend an employee’s previous year to date figures, an amendment template needs to be downloaded.

Downloading the Template

- To download the template, select Export this List For FPS

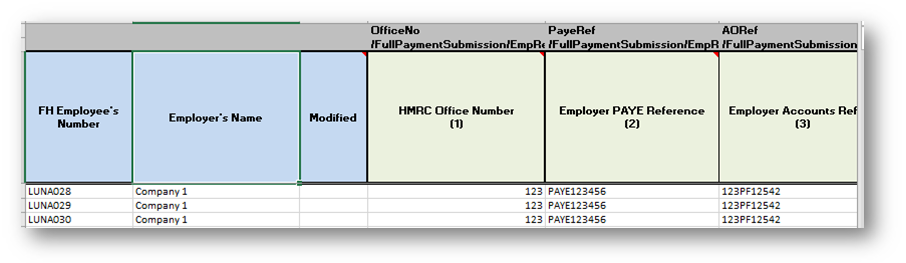

Fig.5 - FPS Amendment Template

Fig.5 - FPS Amendment Template

The template will appear in CSV format.

All of the year to date fields that appear on the standard FPS are available to update on the FPS amendment template.

- To modify an employee, ensure that a Y is added in the Modified column against the employee - if the field is left blank, an amendment record will not be created when it’s uploaded

- To modify a year to date amount for an employee, enter the total amended value against the correct column within the template. Be sure to add the adjusted year to date values to the template, not the amount that it needs to be adjusted by*

*This is different to the Earlier Year Update where only the value of the adjustment is added.

Once all adjustments have been added to the template, save the template to a local or shared drive.

- Save the file in a CSV format

- Do not change the filename (for 2020/2021, the sheet name is FPSData20-21)

Uploading the Template

Once the template is completed with all required adjustments, it can be uploaded into the system.

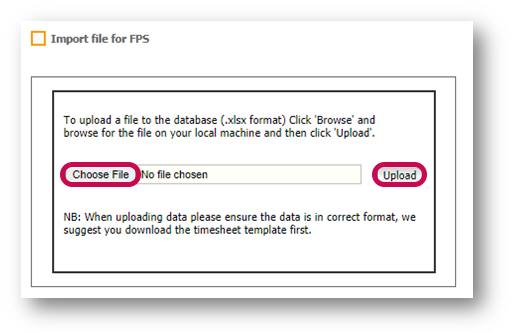

- On the FPS screen, select Import File for FPS

Fig.6 - Import FPS Amendment template

- Select Choose File, and select the recently saved template

- Select Upload

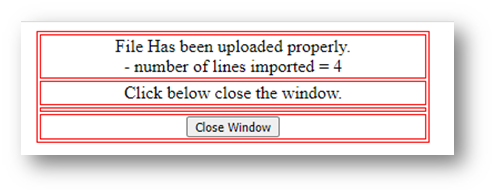

Once uploaded, an on-screen confirmation will display.

Fig 7. Import FPS confirmation

- Select Close Window

The page will refresh to show no employees listed.

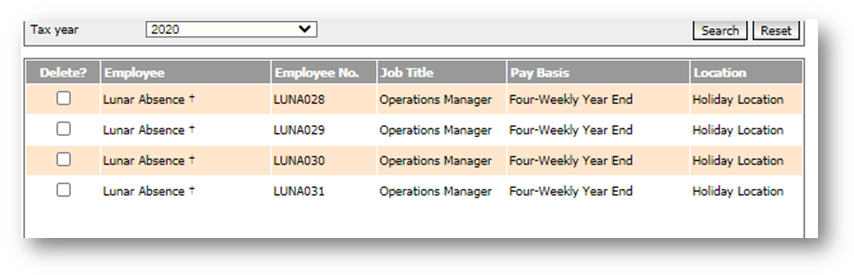

- To view the imported detail, select Amendments to A Previous Tax Year FPS

Employees with amendments uploaded will appear in the list – see Fig.8.

Fig 8. Employee FPS Amendment records

- To check the details have been uploaded correctly, select an employee record

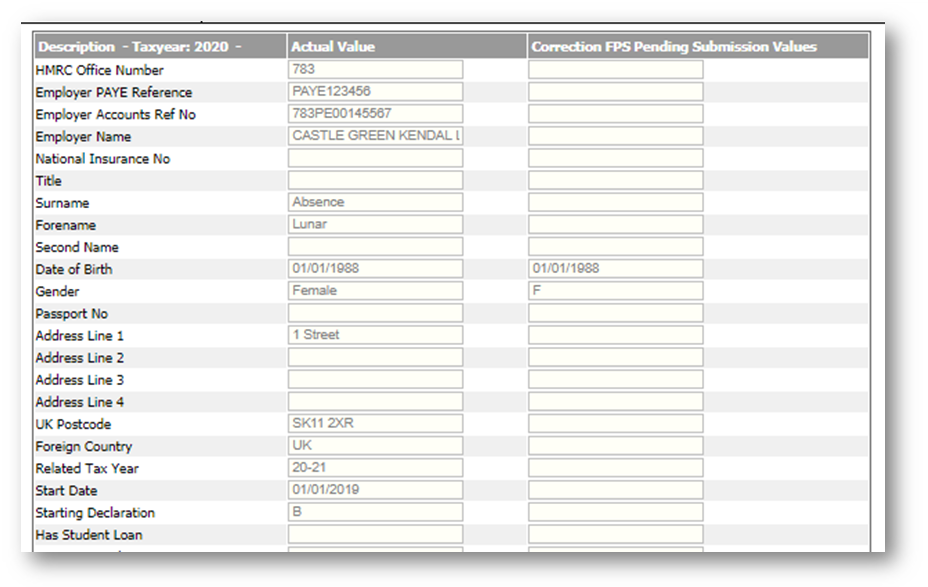

There are two columns displayed:

- Actual Value – this is the original value of the last FPS submission the employee was included in, in the previous tax year

- Correction FPS Pending Submission Values – this is the adjustment value that will be sent to HMRC. This amount will overwrite the Actual Value within HMRC’s records*

Fig 9. Employee FPS Amendment file

Fig 9. Employee FPS Amendment file

*The Amount within an employee’s payslip and P11 record within the system will not be changed.

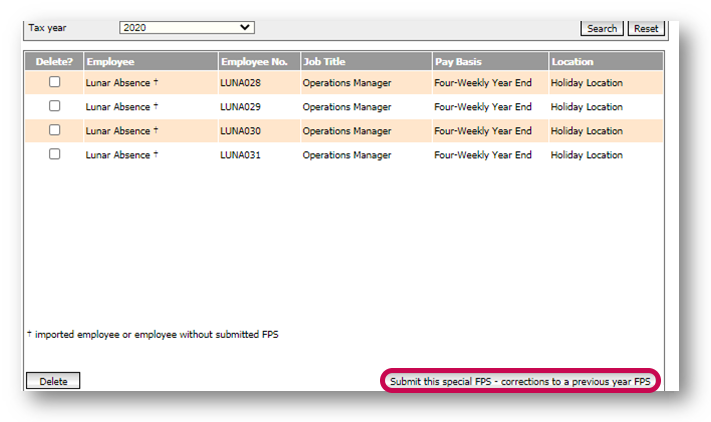

Submission of the Amended FPS

Once all amendment data has been uploaded, the amended FPS can be submitted to HMRC.

- To submit the amended FPS, select Submit the Special FPS – Corrections to a previous years FPS

Fig.10 - Submit Amendment FPS records

Fig.10 - Submit Amendment FPS records

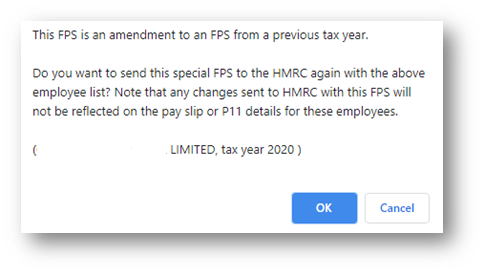

An information box will display to confirm the details of which company and which tax year is being submitted as an amendment.

Fig 11. Submit Amendment FPS information box

- To confirm the submission, select OK

The correction FPS will then be submitted to HMRC.

Checking the Submission

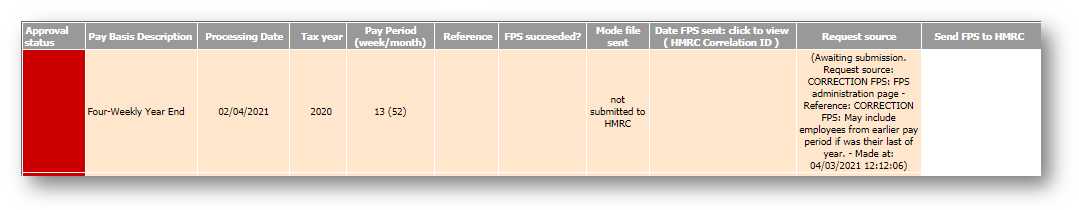

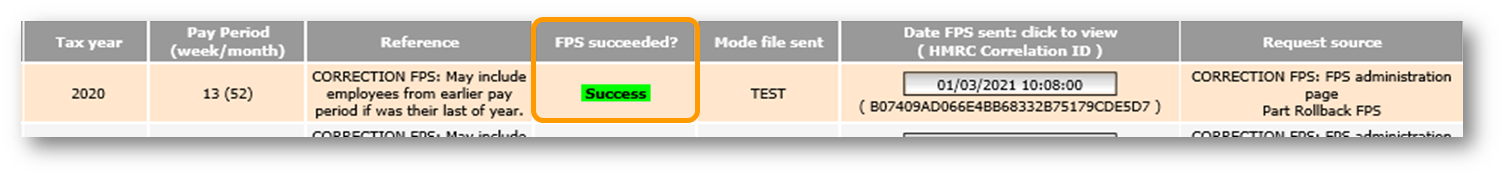

Once it has been submitted, the details will display on the standard Full Payment Submission (FPS) screen.

- To return to the FPS screen, select Full Payment Submission (FPS) – Main Page

Fig 12. FPS Amendment Submission

Fig 12. FPS Amendment Submission

The submission will be sent to HMRC along with the normal submissions. These run regularly throughout the day, on the odd hour.

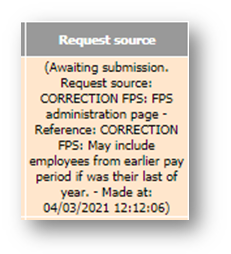

Whilst the file is awaiting submission, the ‘Request source’ will display details about the status and the type of submission.

Fig.13 - FPS Request Source (Awaiting Submission)

Once the submission is successful, the FPS screen will show the usual status of ‘Success’, and a correlation ID will be recorded for future reference.

Fig.14 – Indication of successful submission

The ‘Request source’ will display 'CORRECTION FPS' once the submission has been successful.

Comments

Please sign in to leave a comment.