Summary

Select the release feature from the table below to be taken directly to that section of the release note.

| Feature 1 | Feature 2 | Feature 3 |

|

Page formatting updates. Part of the work to make the Pension module accessible by multiple browsers |

Aligning the look and functionality of certain pages with the rest of the Workforce Management solution |

New Field to record Company Unique Taxpayer Reference In preparation for the 2022/2023 tax year, a new field has been added to record corporation tax Unique Tax Reference |

Release date for all features: 4th November 2021

Pension Module Enhancements

- Enabled by Default? - Yes

- Set up by customer Admin? - No

- Enable via Support ticket? - No

- Affects configuration or data? - No

What's Changing?

The following pages within the Pension module are being updated to align the look and feel with the rest of the Workforce Management solution.

- Company Details

- Pension Scheme Details

- Pension Diary

Reason for the Change?

To improve the overall customer experience.

Customers Affected

All Pension module users.

Release Note Info/Steps

Company Details Page

- To view the Company Details page, go to Pension module > Administration > Company Setup > select Company

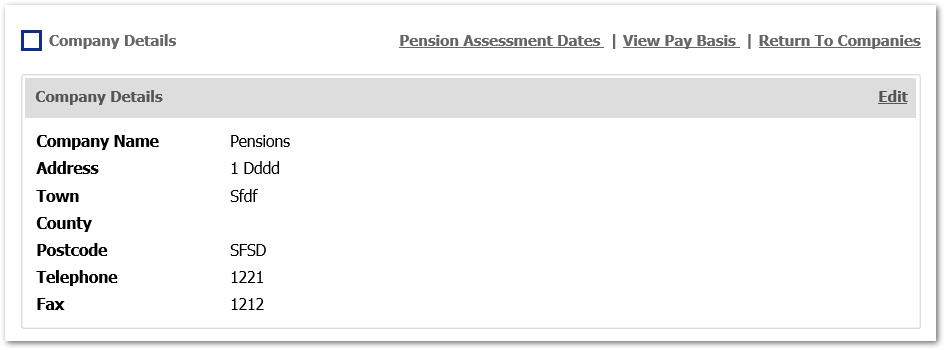

The page that currently displays is shown in Fig.1.

Fig.1 - Existing Company Details page

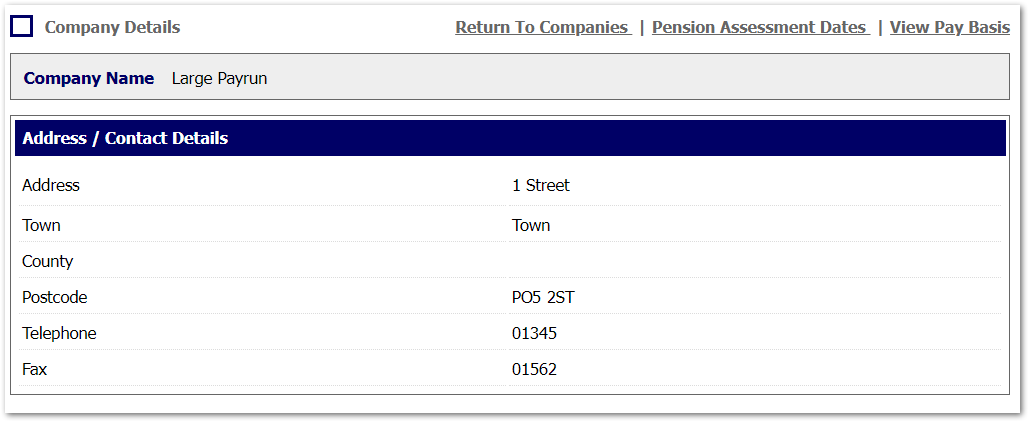

In the new page, the company information has been aligned to the centre of the page - see Fig 2.

Fig.2 - New Company Details page

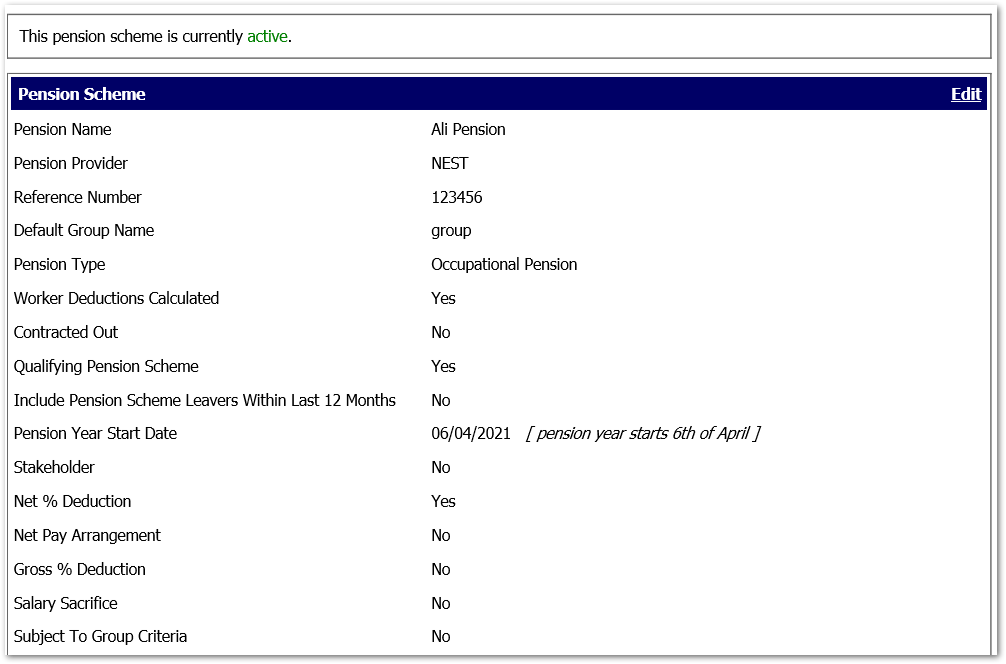

Pension Scheme Details

- To view the Pension Scheme Details, go to Pension > Administration > Pension Schemes > select Pension Scheme

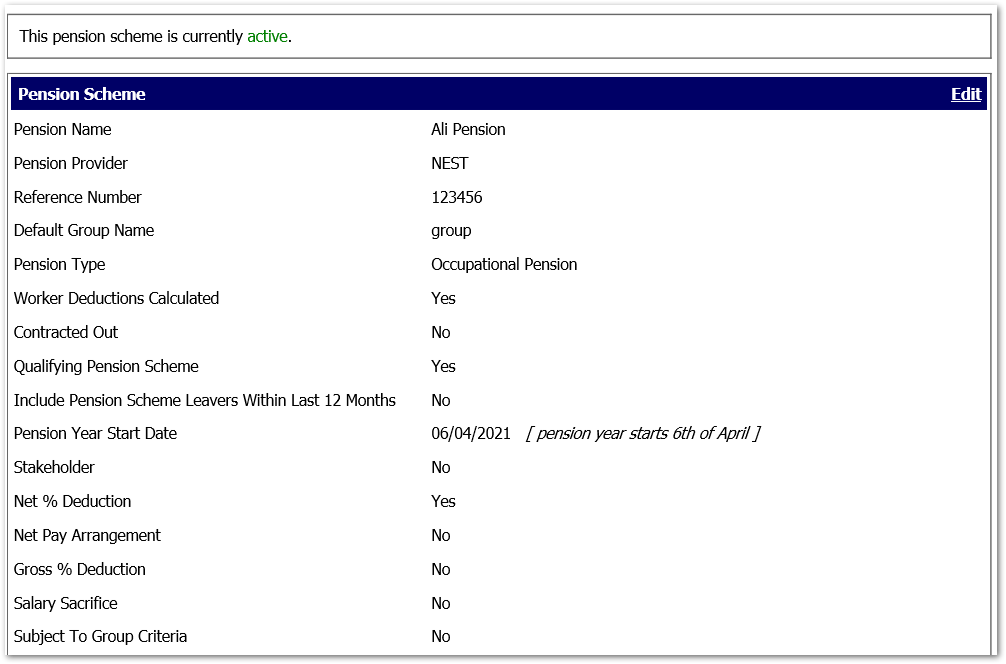

The page that currently displays is shown in Fig.3.

The Pension Scheme Details, whilst split into sections, are divided into two columns.

Fig 3. Existing Pension Scheme Details

In the new page, the Pension Scheme Details are shown in a single column - see Fig.4.

Fig 4. New Pension Scheme Details

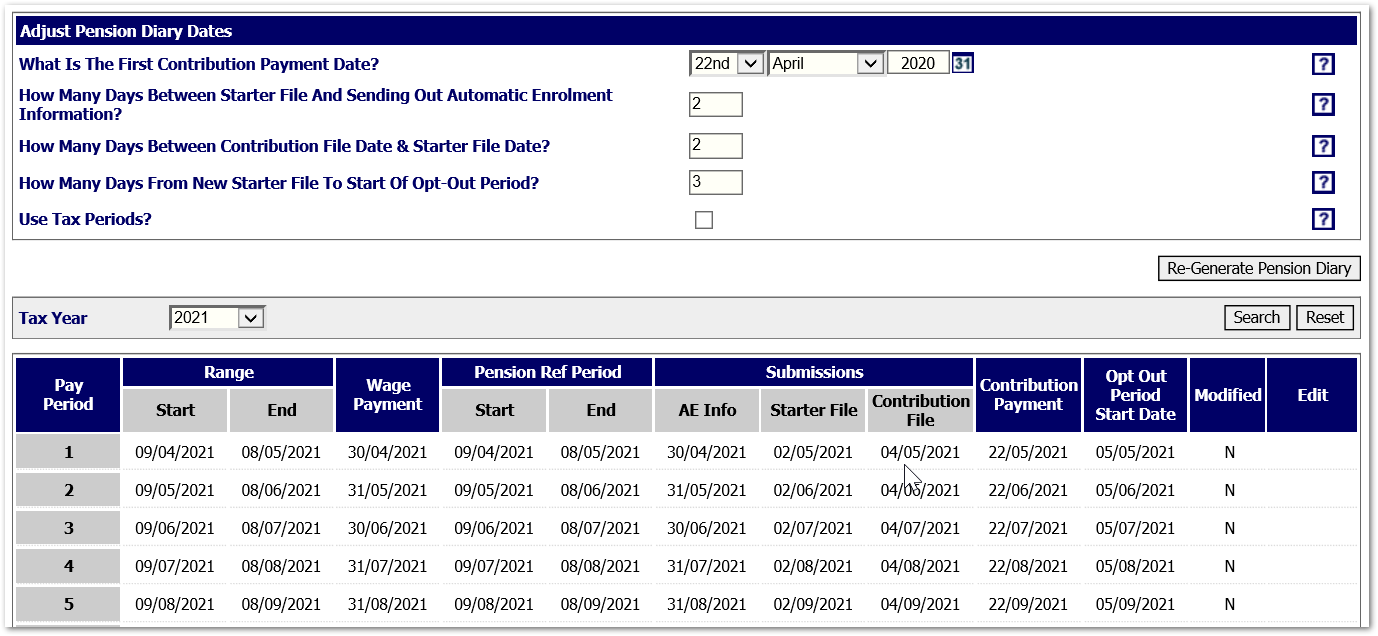

Pension Diary

- To view the Pension Diary, go to Pension > Administration > Pension Schemes > select Pension Scheme > Pension Diary

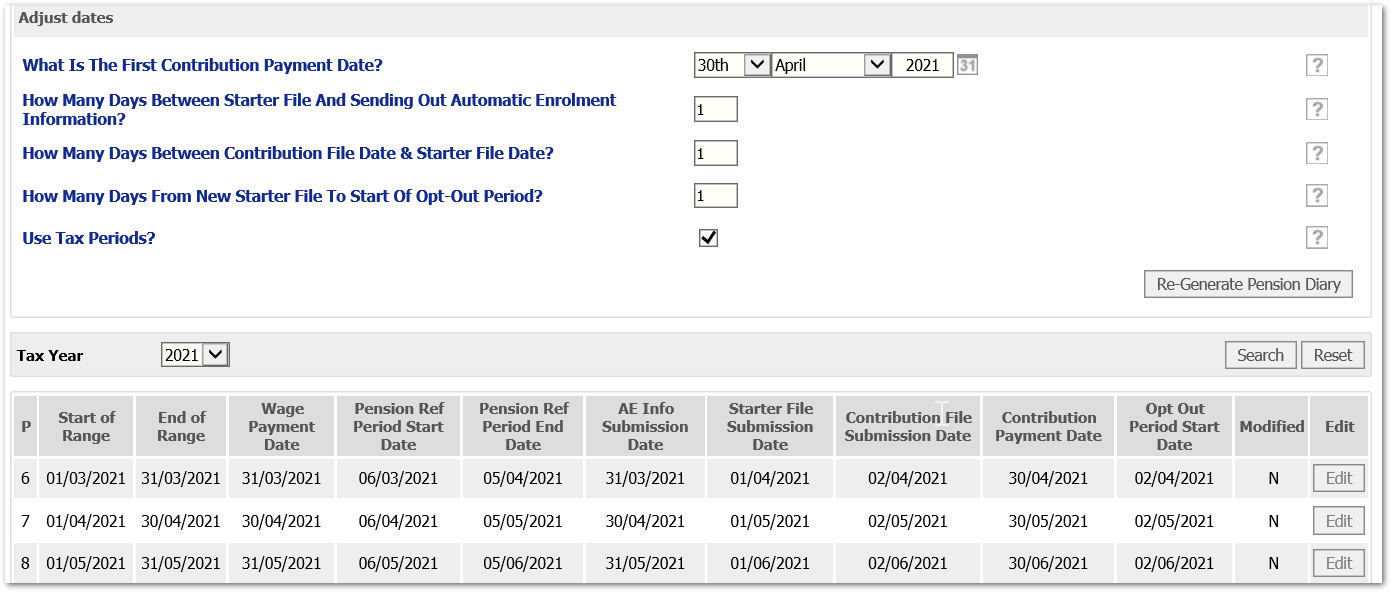

The page that currently displays is shown in Fig.5.

Fig 5. Existing Pension Diary

Fig 5. Existing Pension Diary

In the new page, the diary table has been tidied up to display each aspect of the pension lifecycle more clearly - see Fig.6.

Fig 6. New Pension Diary

Fig 6. New Pension Diary

Payroll Module Enhancements

- Enabled by Default? - Yes

- Set up by customer Admin? - No

- Enable via Support ticket? - No

- Affects configuration or data? - No

What's Changing?

The following pages within the Pension module are being updated to align the look and feel with the rest of the Workforce Management solution.

- Company Details

- Pension Scheme Details

Reason for the Change?

To improve the overall customer experience.

Customers Affected

All Payroll module users.

Release Note Info/Steps

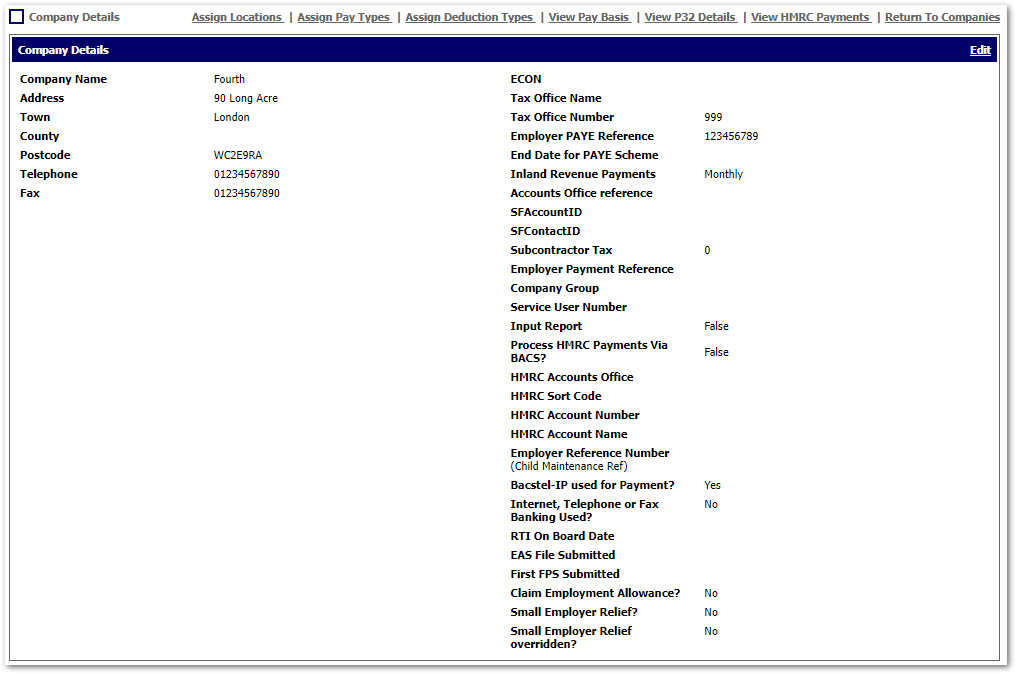

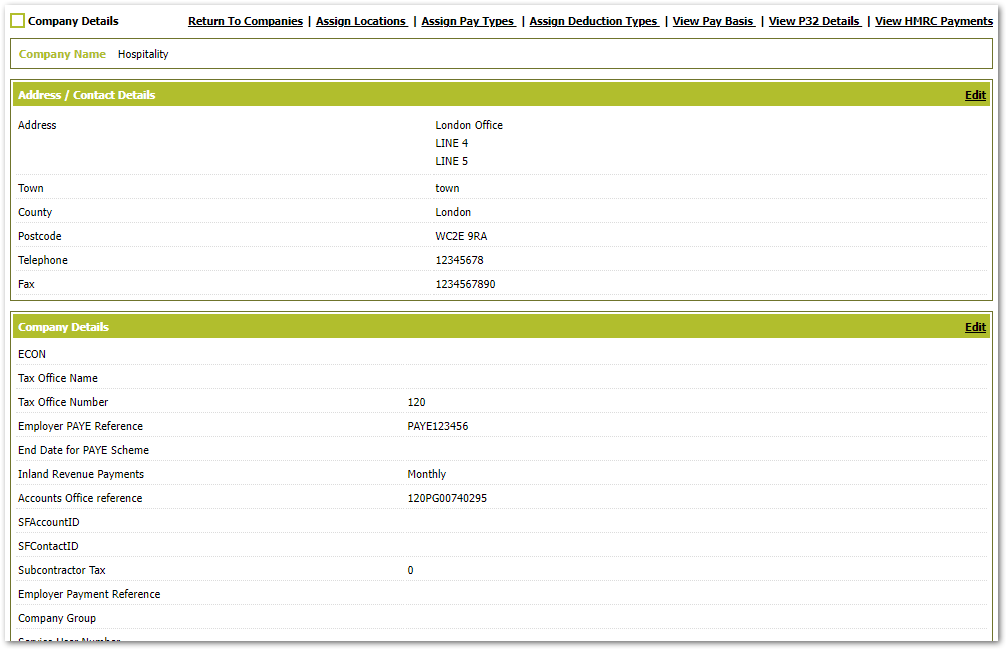

Company Details Page

- To view the Company Details page, go to Payroll module > Administration > Company Setup > select Company

The page that currently displays is shown in Fig.7.

Fig.7 - Existing Company Details page

Fig.7 - Existing Company Details page

In the new page, the company details have been separated into different blocks, and have been aligned to the centre of the page. Each separate block can be edited independently - see Fig.8.

Fig.8 - New Company Details page

Fig.8 - New Company Details page

Pension Scheme Details

- To view the Pension Scheme Details, go to Payroll > Administration > Pension Schemes > select Pension Scheme

The page that currently displays is shown in Fig.9.

The Pension Scheme Details, whilst split into sections, are divided into two columns.

Fig.9 - Existing Pension Scheme Details

In the new page, the Pension Scheme Details are shown in a single column - see Fig.9.

Fig.10 - New Pension Scheme Details

New field to Record Company Unique Taxpayer Reference

- Enabled by Default? - Yes

- Set up by customer Admin? - No

- Enable via Support ticket? - No

What's Changing?

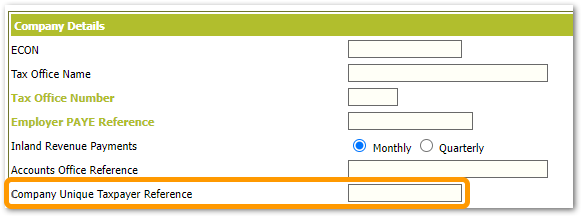

A new field for employers to record their Company Unique Taxpayer reference number has been added to the Company Details page.

Reason for the Change?

From 19th April 2022, all employers who use the Construction Industry Scheme (CIS) must provide their reference number within their EPS submission. The new field has been added to the Company Details page in preparation for the new tax year.

Customers Affected

All customers using the Payroll module.

Release Note Info/Steps

- To view the new Company Unique Taxpayer Reference field, go to Payroll > Administration > Company Set Up > Create New Company

The new field is displayed within the Company Details section of the page as shown in Fig.11.

Fig.11 - Company Unique Tax Payer Reference field - creating a Company

The field can also be updated for existing companies within the Payroll Module.

- To update the reference for an existing company, go to Payroll > Administration > Company Set Up > select Company > Edit Company details

Fig.12 - Company Unique Tax Payer Reference Field - editing Company Details

A Company Unique Taxpayer Reference is made up of 10 digits and can be found on tax returns and other correspondence about corporation tax. It may be called 'reference'; 'UTR' or 'official use'.

The field is not mandatory and will only need to be populated by customers who use the Construction Industry Scheme.

Comments

Please sign in to leave a comment.