What’s Changing?

Enhancements to the Furlough Batch Update upload functionality.

- Amendment to ‘Complete Initial Furlough Periods’ upload to allow users to end the most recent active furlough period

- Amendment to ‘Complete Initial Furlough Periods’ upload to allow removal of furlough period end dates that are set to 31st October 2020

- Renaming of ‘Complete Initial Furlough Periods’ upload to ‘End Active Furlough Period’

- A new upload template to create a new furlough period for employees whose initial period has ended

Proposed release date: 12th November 2020

Reason for the Change

Following the recent extension to the Coronavirus Job Retention Scheme (CJRS), enhancements are being made to the batch upload functionality for furloughed employees, that allow users to amend existing furlough periods or create new ones.

Customers Affected

All HR & Payroll customers.

Information

The original Batch Upload release notes can be found here

Release Notes

The Batch Upload functionality has been enhanced to allow users to amend existing furlough periods, or add a new period if their initial one has already ended.

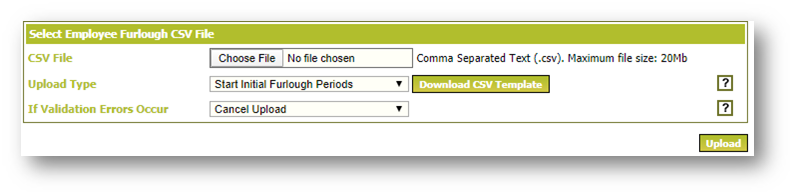

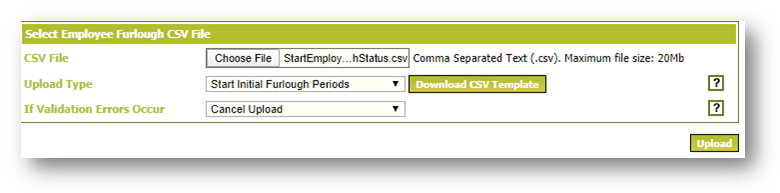

- To view the Batch Upload page, go to HR module > Employees > Employee List > Batch Update COVID19 Furlough Status > Batch Upload from CSV

Fig.1 - Batch upload from CSV

Fig.1 - Batch upload from CSV

Within this page, a number of different actions can be carried out on a large number of employees using a simple upload template.

There are 5 templates that can be downloaded.

- From the Upload Type drop-down, select one of the following template options:

-

- Start Initial Furlough Periods - to batch-update furlough start dates

- Complete Active Furlough Periods - to batch-update furlough end dates

- Furlough Periods: Start and End Dates - to batch-create furlough periods after one has ended

- Usual hours furlough upload - to upload employees’ usual hours

- Actual Hours Furlough Upload - to upload employees’ actual hours

-

- Then select Download CSV Template

- Open the template (in Excel – it will be a .csv file) and save it in a local or shared folder

Please note: Please do not change the format of the template as it will not load.

Template Details

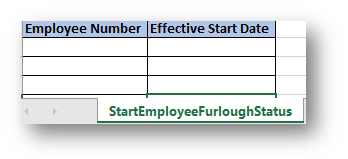

Start Initial Furlough Periods

This template should be used to create a furlough period for employees who have not been furloughed previously.

The template consists of two columns and requires the following information:

- Employee Number

- Effective Start Date (the furlough period start date - format DD/MM/YYYY)

Fig.2 - Start Initial Furlough Periods upload template

Once uploaded, a new furlough period will be created within the employees’ Furlough pages.

Validation exists to:

-

- Error if an employee number does not exist

- Error if the date is in the incorrect format

- Error if a furlough period already exists

- Error if an employee’s record has been terminated

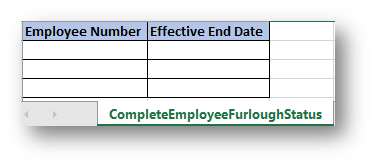

Complete Active Furlough Period (formally called ‘Complete Initial Furlough Periods’)

This template should be used to end employees’ furlough periods.

The template consists of two columns and requires the following information:

- Employee Number

- Effective End Date (furlough period end date - format DD/MM/YYYY)

Fig.3 - Complete Active Furlough Period upload template

The upload will update the most recent active furlough periods with the end dates stated on the template.

- If an end date of 31st October has been entered previously and it needs to be removed due to the extension of the CJRS, leave the Effective End Date column blank and the date will be removed

Validation exists to:

-

- Error if an employee number does not exist

- Error if an Effective End Date field is blank, but the leave date in the most recent furlough period is before 31st October 2020

- Error if there are no active furlough periods

- Error if a date is in the incorrect format

- Error if an employee’s record has been terminated

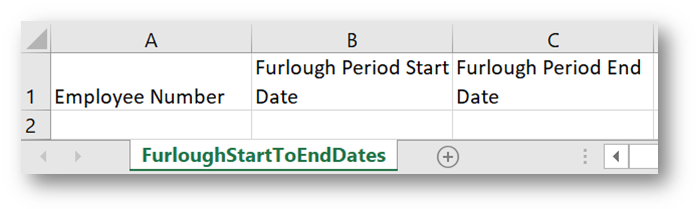

Furlough Periods: Start and End Dates

This template should be used to create a furlough period for employees who have already had a period of furlough that has ended.

The template consists of three columns and requires the following information:

- Employee Number

- Furlough Period Start Date (format DD/MM/YYYY)

- Furlough Period End Date (format DD/MM/YYYY)

Fig.4 - Furlough Periods: Start and End Dates upload template

Validation exists to:

- Error if an employee number does not exist

- Error if a date is in the incorrect format

- Error if an employee’s record has been terminated

- Error if a new start date is entered but the employee has an active furlough period

Upload Employees’ Usual Hours & Actual Hours

To upload an employee’s usual or actual hours, please see WFM Release Note – Upload Usual and Actual Hours for Flexible Furlough Claims

Uploading the File

- Go back to HR Module > Employees > Employee List > Batch Update COVID19 Furlough Status > Batch Upload from CSV

- Select the Choose File button

- Find the upload file > select save

- Select the type of upload in Upload Type

- Select how the upload should proceed If Validation Errors Occur

- Select Upload

Fig.5 - File Upload Criteria

Fig.5 - File Upload Criteria

An information pop-up box will appear to confirm the file will be uploaded.

Fig.6 - File upload information

- Select OK

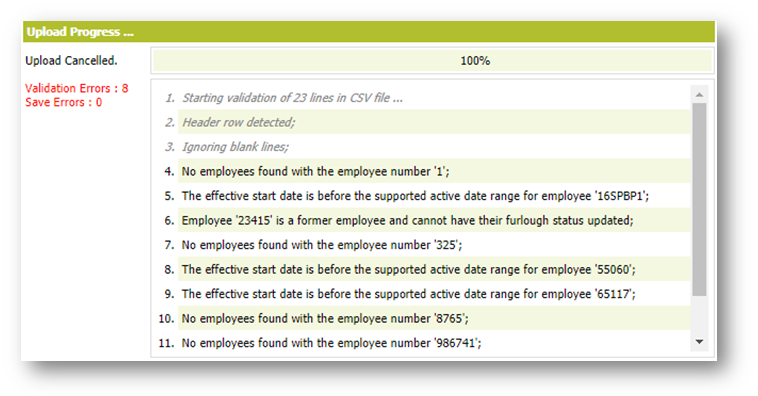

During the upload process, a validation check will happen. If any errors are discovered in the upload file, details will appear on the screen.

Fig.7 - File validation messages

If the option to Cancel upload was selected during the upload process under If Validation Errors Occur, the upload process will be cancelled, and no information will be uploaded.

- Use the errors reported to fix the upload file and follow the upload process again

If the option to Continue with Upload was selected during the upload process under If Validation Errors Occur, the upload will continue for the valid employees only.

- Use the validation error details to create a new upload file with the invalid records corrected. Once complete, follow the upload process again

Once the upload has been completed, use the Furlough Status export to check the data has been uploaded correctly.

For guidance on this, see WFM Release Note - Furloughed Status Export

Comments

Please sign in to leave a comment.