What’s Changing?

A new option to calculate Additional Holiday pay using 52 weeks has been added to within HR & Payroll

Release Date: Thursday 13th August

Reason for Change

The rules around flexible holiday calculations changed in April 2020, meaning calculations now need to be made using the past 52 weeks pay. To align the additional holiday pay to this change, a new option to calculate using 52 weeks payroll data has been added.

Customers Affected

All HR Customers using the Payroll Module. The setting will be turned off by default when the release is made. The system will continue to function as it currently does.

Information

Additional Holiday functionality already exists within HR and Payroll which looks at any additional payments that are flagged to be included, over a 12-week period.

Currently, there are two options:

The first option looks back over the last 12 weeks/3 month’s payslips and uses the flagged additional payments to calculate how much additional pay is due for each holiday paid in the current period. The original release notes for this functionality can be found here – Release Note: Additional Holiday Pay

The second option uses the flagged additional payment in the current payroll along with previous payslips up to a 12 week/3-month period to calculate how much additional holiday pay is due for each holiday paid in the current pay period. The original release notes for this functionality can be found here – WFM Release Note: Back Pay for Additional Holiday Pay

The most recent changes allow customers the ability to use the past 52 weeks/12 months in each calculation rather than the past 12 weeks/3 months.

Release Notes

Additional Holiday Pay calculation options

There are two different options when setting up how the additional holiday pay is calculated.

Standard set-up

With the standard set up, the calculation will use the payments paid to employees in previous payrolls only when calculating how much to add to the basic holiday pay amount.

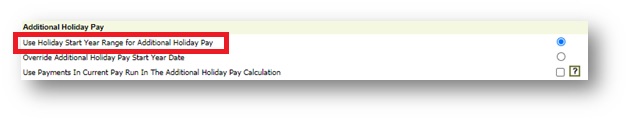

- To select the standard set-up, go to HR > Administration > Global Settings > Edit Default Holiday Settings > Holiday Calculations

- Select Use Holiday Start Year Range for Additional Holiday Pay

Fig 1. Set up Standard Additional Holiday Pay Calculation

Flagging this setting alone will turn on the additional holiday calculation over 12 weeks.

Include Current Period

An alternative to using the previous 12 weeks previous pay, is to use the current pay period’s payments along with previous pay periods when calculating how much to add to the basic holiday pay amount.

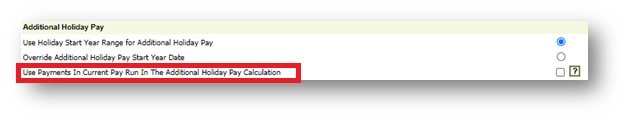

- To select the standard set-up, go to HR > Administration > Global Settings > Edit Default Holiday Settings > Holiday Calculations

- Select Use Payments in the Current Pay Run in The Additional Holiday Pay Calculation

Fig 2. Set up Include current pay run in Additional Holiday Pay Calculation

Flagging this setting alone will turn on the additional holiday calculation over 12 weeks.

Selecting the 52 week calculation for Additional Holiday Pay

The new option to calculate additional holiday pay over 52 weeks has been added, which will change either the standard set-up or include current period set-up to use payments in a 52-week period in the calculation of additional holiday pay.

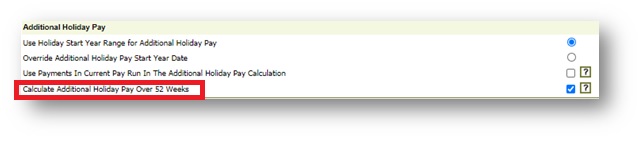

- To select the standard set-up, go to HR > Administration > Global Settings > Edit Default Holiday Settings > Holiday Calculations

- Select Calculate Additional Holiday Pay Over 52 weeks

Fig 3. Calculate Additional Holiday Pay over 52 Weeks

This setting must be flagged in conjunction with either the standard set-up or the ‘include current period’ set-up.

For more information about the two settings, please see the release notes listed in the Information Section above.

Additional Holiday Pay Calculations

The Additional Holiday Pay is calculated only on the first 4 weeks of statutory leave entitlement within a holiday year. It is paid in addition to the employee’s basic holiday payment and the amount is calculated within the pay period in which the holiday days are taken.

As with the existing functionality, the new 52-week Additional Holiday Pay calculation uses a 3 step process:

- Identify the relevant period

- Calculate the Average Weekly on Additional Holiday Pay elements (AWAHP) within the relevant period

- Calculate the Additional Holiday Pay

- Identify the relevant period

With the 52-week setting on, this will be the 52-week period in which the employee was paid before the current pay period where the employee is on holiday.

The end of the relevant period is the last day before the start of the current pay period. The start of the relevant period is the first day of week one of the 52-week period preceding the end date.

For Example:

An employee is paid four weekly -

- They take 1-day holiday on 15th July 2020

- The holiday falls within the period from 6th July 2020 – 2nd August 2020

- The relevant period to calculate average earnings for additional holiday Pay is 8th July 2019 to 5th July 2020

Where a holiday day is entered into the system and authorised retrospectively, the relevant period used for the calculation is the 52 week period immediately preceding the pay period in which the holiday fell.

Where 52 weeks of data is not available in the system, the time period for relevant period will be identified using only the available data.

Please Note: where the ‘Include Current Period’ is selected, all calculations will use the current period plus previous periods to a total of 52 weeks.

2. Calculation of Average Weekly on Additional Holiday Pay elements (AWAHP) within the relevant period

AWAHP is the weekly average of the sum of all earnings for payment types flagged as ‘include in holiday pay’ and paid within the relevant period. Then divide this by the number of whole weeks in the relevant period

Note: Where an employee has not received any payment for all payment types flagged as ‘include in holiday pay’ within the relevant period, the average value will be zero.

3. Calculation of Additional Holiday Pay

The following table describes the calculation of Additional Holiday Pay for full time, part time and flexible employment types:

|

Employment Type |

Holiday Taken in Days |

Holiday Taken in Hours |

|

|

Full Time / Part Time |

AHP = Holiday Days Booked x (AWAHP / FTE Days) |

AHP = Holiday Days Booked x (AWAHP / FTE Hours) |

|

|

Flexible |

AHP = Holiday Days Booked x (AWAHP / Average Days) |

N/A |

Additional Holiday Pay Audit

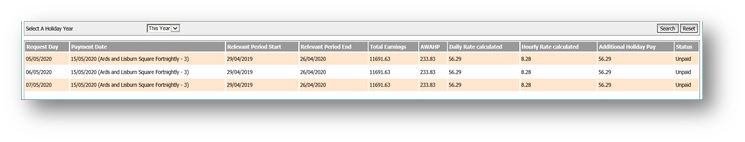

Details of Additional Holiday Payments made, is recorded in the employee’s holiday record.

- To view the Additional Holiday Pay screen, go to Payroll > Employees > Employee List

- Select Employee

- Select Employee Info > Holidays

Fig 4. Additional Holiday Pay Audit

Comments

Please sign in to leave a comment.