What’s Changing?

A new batch update function is being added to HR & Payroll to upload usual and actual hours worked by employees.

Release date – 7th July 2020

Reason for the Change

On 12th July, HMRC published new guidance in relation to flexible furlough and CJRS. The new batch update is to help customers claim Coronavirus Job Retention Scheme (CJRS) grants under the new flexible furlough rules from 1st July 2020.

Customers Affected

Customers who use the Payroll module and have the Furlough functionality enabled.

Release Notes

The new flexible furlough guidelines require details of usual and actual hours worked to be available in order to complete the grant claim calculations, as well as being reported to HMRC during the grant claim.

A new upload facility has been added to the Batch Furlough Update screen for employees’ usual and actual worked hours, to be used within the new Claim Export calculations.

Although the upload option is available, the new Flexible Furlough Claim export will use system-generated values for usual hours and information from rotas for actual hours. The upload facility has been created for customers who do not wish to use the system calculation.

- To view the new upload facility, go to HR > Employees > Employee List > Batch Update COVID 19 Furlough Status

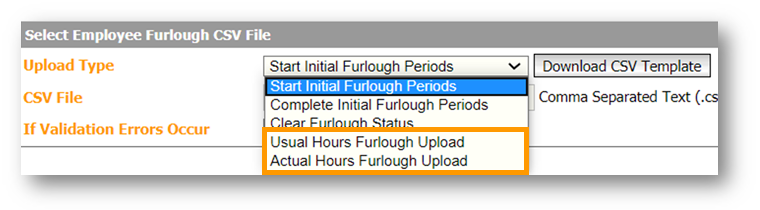

- Select Batch Upload from CSV

Two new options for upload will display.

Fig.1 – Usual and Actual Hours Furlough Upload options

Usual Hours Furlough Upload

Although employees’ usual hours will populate the export along with calculations based on information within the rotas or contracted hours, some customers may need to upload their own calculations for employees.

- To upload usual hours, select Usual Hours Furlough Upload

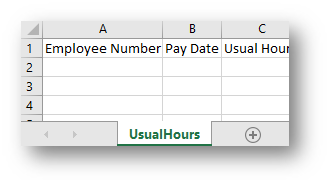

- Select Download CSV File

An Excel template will download which, when populated, can be used to upload usual hours

Fig.2 - Excel template for usual hours

The fields required for the upload are:

- Employee Number

- Pay Date

- Usual Hours

The Pay Date needs to be for the period in which the hours relate to. These hours will then be used by the claim export when calculating the claim relating to the ‘pay period’ assigned to that pay date.

The Usual Hours should be the total hours for the period. For example, if an employee is contracted to 40 hours a week, and is paid monthly, from 1st to end of July, the monthly contracted hours of 178 should be uploaded.

Actual Hours Furlough Upload

Actual hours worked, for most customers, will be entered into the rota. The Claim export will pick up hours from the rota to use in the calculation. There are, however, some customers with employees who are not included in rotas. For these employees, it is possible to upload the actual hours worked for the pay period.

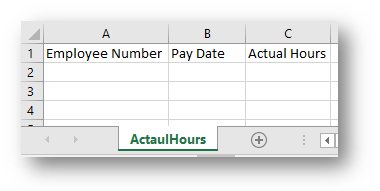

- To upload actual hours, Select Actual Hours Furlough Upload

- Select Download CSV File

An Excel template will download which, when populated, can be used to upload actual hours.

Fig.3 - Excel template for actual hours

The fields required for the upload are:

- Employee Number

- Pay Date

- Actual Hours

The Pay Date needs to be for the period in which the hours relate to. These hours will then be used by the claim export when calculating the claim relating to the ‘pay period’ assigned to that pay date.

The Actual Hours should be the total hours worked in the pay period.

Please note: The actual hours should only be used when the pay period falls within the claim month. If the pay period for the pay basis spans two months (July and August, for example), unfortunately the claim export calculation will not be able to determine which month the hours were worked in, and the results on the export will be incorrect.

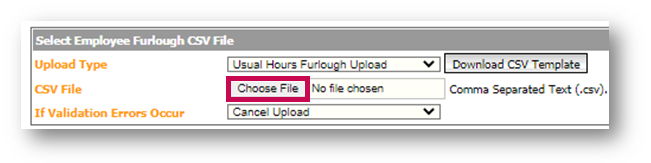

Uploading the Templates

- Once the template is populated, select Choose File

Fig.4 - Choosing a CSV template

- Search for and attach the usual hours upload template that has been populated

- Select how the upload is to be processed if Validation Errors Occur

- Select Upload

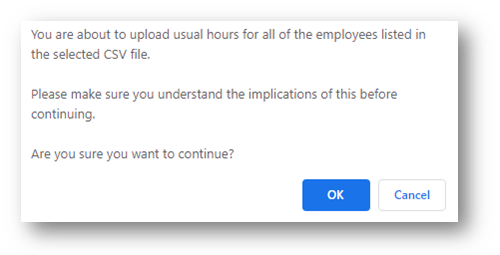

An information pop-up box will appear to confirm the file will be uploaded.

- Select OK

Fig.5 - Upload information pop-up

During the upload process a validation check will happen, which looks for:

- Employee Number – to make sure the employee exists

- Pay Date

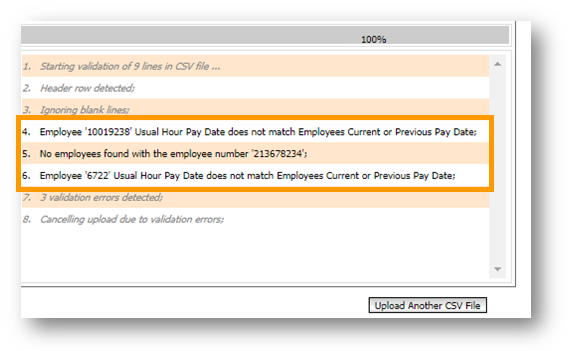

If any errors are discovered in the upload file, details will appear onscreen.

Fig.6 - Example upload errors

If the option to Cancel upload was selected during the upload process under if validation errors occur, the upload process will be cancelled, and no information will be uploaded.

- Use the errors reported to fix the upload file and follow the upload process again

If the option to Continue with Upload is selected during the upload process under if validation errors occur, the upload will continue for the valid employees only.

- Use the errors reported to create a new upload file with the invalid records and fix according to the validation error details. Once complete, follow the upload process again

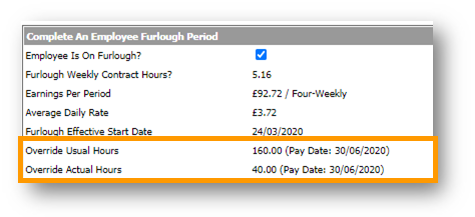

Once uploaded, the employee’s Furlough Status will show the uploaded information.

- To view this information, go to HR > Employees > Employee List > Covid 19 Furlough Status

Fig.7 - Example furlough status - Override Usual/Actual Hours

The uploaded data will show as an override of either usual or actual hours.

The data can also be viewed in the Furlough Status export.

- To run the Furlough Status export, go to HR > Employees > Employee List > Batch Update COVID19 Furlough Status > Furlough Status Export

- Select the required selection criteria and then > Search

- Download to Excel

Three new fields will appear at the end of the export.

- Furlough Pay Date

- Furlough Usual Hours

- Furlough Actual Hours

When data is uploaded, this information will be used by the Claim Export calculation and will override any system-generated amounts for both usual or actual hours.

Uploads for actual hours can be done for the current and previous pay days only. They cannot be uploaded for future pay dates.

Comments

Please sign in to leave a comment.