What’s Changing?

This release note contains all changes made in the system required to allow legislative compliance from April 2020.

Release date: 12th March 2020.

Please note: This release note has been updated further now that the government has approved all rates.

Reason for the Change

Her Majesty’s Revenue and Customs (HMRC) are implementing changes to legislation agreed by the UK government, for the tax year beginning 6th April 2020.

Customers Affected

All customers with the Payroll or Pension module with pay dates on or after 6th April 2020.

Release Notes - Contents

Release Notes

Payroll Statutory Information Page

Within the Payroll Module, there is a statutory information Page which contains the rates and allowances for the current, plus previous tax years. This page is updated annually with the new tax years’ rates.

PAYE – Tax threshold rates for 2020

The current emergency tax code is 1250L.

The current UK rate of Income Tax (excluding Scotland and Wales).

The current Scottish rate of Income Tax (SRIT) - Scottish rates will apply from 11th May 2020

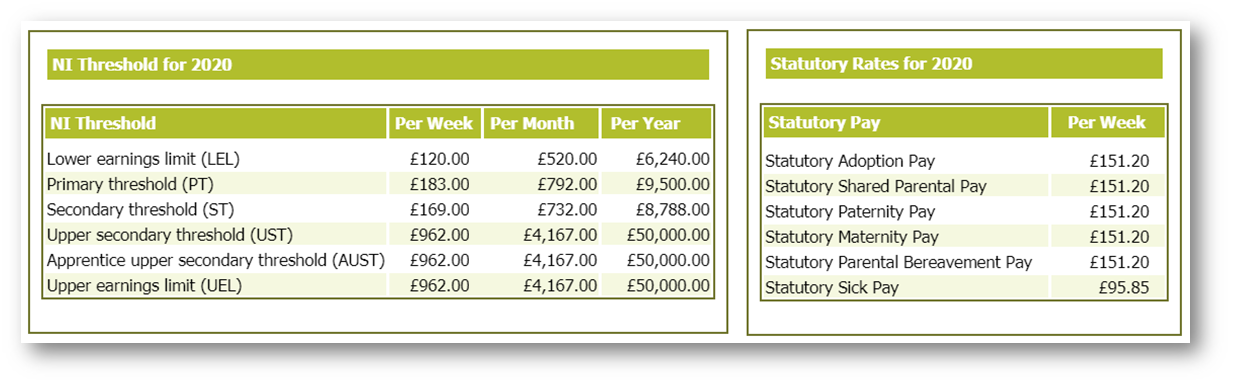

PAYE – National Insurance Threshold rates for 2020.

Student Loans and Post Graduate Loans

From 6th April 2020 the breakdown between the two Student Loan Types is:

From 6th April, the Thresholds for Post Graduate loans will be:

National Minimum Wage (NMW) and National Living Wage (NLW)

From 1st April 2020:

More information on the living wage and latest rates for NMW can be found at: http://www.gov.uk/national-minimum-wage-rates.

Statutory Payments - Sickness (SSP), Maternity (SMP), Paternity (SPP), Adoption (SAP), Shared Parental (ShPP), Parental Bereavement (SPBP)

Statutory Payment rates will update from 5th April 2020 (the 1st Sunday of April).

For April 2020, HMRC have released new legislation for Statutory Parental Bereavement Pay. There will be a separate release note outlining the system changes in relation to this.

Upon rolling over into the tax year 2020/2021, all Statutory Payment Schedules will be regenerated based on the above rates where applicable.

Pension

The Pension Diary will automatically update to 2020/2021 when your portal is rolled forward into 2020/2021.

For 2020/2021 there are no planned rises in the contribution percentages, so the rates remain the same as the 2019/2020 tax year.

Tier Certification

You may have pension schemes that operate according to tier certification. The Standard Contribution rates for each tier are shown below.

If you require any changes to your pension scheme’s default percentage rates because you have tier certification, please send details to your payroll specialist who will ensure the changes are made from the start of the new tax year.

Tax Code Uplift

In October 2018, HMRC introduced the Finance Bill 2018-2019 which set the Personal Allowance for 2019/2020 at £12,500. And the basic rate limit at £37,500. These thresholds will remain the same for 2020/2021 and will increase in line with the Consumer Price Index (CPI) thereafter.

Therefore, the Emergency Tax Code of 2020/2021 will remain 1250L.

All Week 1 Month 1 Indicators will not be taken forward into 2020/2021 for any tax code.

Allowances

Employment Allowance - The rules around this are changing as of April 2020. There will be a separate release note outlining the system changes in relation to this.

Rolling Over the Portal

Your Payroll Specialist will contact you near to the completion of your final pay run for the 2019/2020 tax year, to arrange for your portal to be rolled forward to the 2020/2021 tax year. When rolled forward, all rates and allowances will automatically update for the 2020/2021 tax year.

This release note contains all changes made in the system required to allow legislative compliance from April 2020.

Release date: 12th March 2020.

Please note: This release note has been updated further now that the government has approved all rates.

Reason for the Change

Her Majesty’s Revenue and Customs (HMRC) are implementing changes to legislation agreed by the UK government, for the tax year beginning 6th April 2020.

Customers Affected

All customers with the Payroll or Pension module with pay dates on or after 6th April 2020.

Release Notes - Contents

Payroll Statutory Information Page

PAYE – Tax threshold rates for 2020

Student Loans and Post Graduate Loans

National Minimum Wage (NMW) and National Living Wage (NLW)

Statutory Payments - Sickness (SSP), Maternity (SMP), Paternity (SPP), Adoption (SAP), Shared Parental (ShPP), Parental Bereavement (SPBP)

Pension

Tax Code Uplift

Allowances

Rolling Over the Portal

PAYE – Tax threshold rates for 2020

Student Loans and Post Graduate Loans

National Minimum Wage (NMW) and National Living Wage (NLW)

Statutory Payments - Sickness (SSP), Maternity (SMP), Paternity (SPP), Adoption (SAP), Shared Parental (ShPP), Parental Bereavement (SPBP)

Pension

Tax Code Uplift

Allowances

Rolling Over the Portal

Release Notes

Payroll Statutory Information Page

Within the Payroll Module, there is a statutory information Page which contains the rates and allowances for the current, plus previous tax years. This page is updated annually with the new tax years’ rates.

- To view this page, go to Payroll > Administration > Payroll Statutory Information

Fig.1 – Payroll Statutory Information Page - rates for 2020/21

PAYE – Tax threshold rates for 2020

The current emergency tax code is 1250L.

| Earnings Period | Threshold |

|---|---|

| Weekly | £240 |

| Monthly | £1,042 |

| Anually | £12,500 |

The current UK rate of Income Tax (excluding Scotland and Wales).

|

Tax Rate

|

Rate

|

Income after allowances from

|

Income after allowances to

|

|---|---|---|---|

|

Basic Tax Rate

|

20%

|

|

£37,500

|

|

Higher Tax Rate

|

40%

|

£37,501

|

£150,000

|

|

Additional Tax Rate

|

45%

|

£150,001+

|

|

The current Scottish rate of Income Tax (SRIT) - Scottish rates will apply from 11th May 2020

|

Tax Rate

|

Rate

|

Income after allowances from

|

Income after allowances to

|

|---|---|---|---|

|

Starter Basic Tax Rate

|

19%

|

£1

|

£2,049

|

|

Basic Tax Rate

|

20%

|

£2,050

|

£12,444

|

|

Intermediate Tax Rate

|

21%

|

£12,445

|

£30,930

|

|

Higher Tax Rate

|

41%

|

£30,931

|

£150,000

|

|

Additional Tax Rate

|

46%

|

£150,001 +

|

The current Welsh rate of Income Tax (WRIT).

|

Tax Rate

|

Rate

|

Income after allowances from

|

Income after allowances to

|

|---|---|---|---|

|

Basic Tax Rate

|

20%

|

|

£37,500

|

|

Higher Tax Rate

|

40%

|

£37,501

|

£150,000

|

|

Additional Tax Rate

|

45%

|

£150,001+

|

PAYE – National Insurance Threshold rates for 2020.

| NI Threshold | Weekly | Fortnightly | Lunar | Monthly | Annually |

|---|---|---|---|---|---|

| Lower Earnings Limit (LEL) | £120 | £240 | £480 | £520 | £6,240 |

| Primary Threshold (PT) | £183 | £366 | £731 | £792 | £9,500 |

| Secondary Threshold (ST) | £169 | £338 | £676 | £732 | £8,788 |

| Upper Secondary Threshold (UST) | £962 | £1,924 | £3,847 | £4,167 | £50,000 |

| Apprentice Upper Secondary Threshold (AUST) | £962 | £1,924 | £3,847 | £4,167 | £50,000 |

| Upper Earnings Limit (UEL) | £962 | £1,924 | £3,847 | £4,167 | £50,000 |

Student Loans and Post Graduate Loans

From 6th April 2020 the breakdown between the two Student Loan Types is:

- Plan 1 has an Earnings Threshold of £19,390 per year

- Plan 2 has an Earnings Threshold of £26,575 per year

From 6th April, the Thresholds for Post Graduate loans will be:

- Earnings Threshold - £21,000 per year

National Minimum Wage (NMW) and National Living Wage (NLW)

From 1st April 2020:

| Age Range | Old Rate per hour | New Rate per hour |

|---|---|---|

| Apprentices | £3.90 | £4.15 |

| Apprentices over 19 but in 1st year of apprenticeship | £3.90 | £4.15 |

| Under 18 years old | £4.35 | £4.55 |

| 18 t0 20 years old | £6.15 | £6.45 |

| 21 to 24 years old | £7.70 | £8.20 |

| 25 years old and over | £8.21 | £8.72 |

More information on the living wage and latest rates for NMW can be found at: http://www.gov.uk/national-minimum-wage-rates.

Statutory Payments - Sickness (SSP), Maternity (SMP), Paternity (SPP), Adoption (SAP), Shared Parental (ShPP), Parental Bereavement (SPBP)

Statutory Payment rates will update from 5th April 2020 (the 1st Sunday of April).

| Statutory Pay | Per Week Rate |

|---|---|

| Statutory Adoption Pay | £151.20 |

| Statutory Shared Parental Pay | £151.20 |

| Statutory Paternity Pay | £151.20 |

| Statutory Maternity Pay | £151.20 |

| Statutory Parental Bereavement Pay | £151.20 |

| Statutory Sick Pay | £95.85 |

For April 2020, HMRC have released new legislation for Statutory Parental Bereavement Pay. There will be a separate release note outlining the system changes in relation to this.

Upon rolling over into the tax year 2020/2021, all Statutory Payment Schedules will be regenerated based on the above rates where applicable.

Pension

| Qualifying Earnings Lower Threshold | Qualifying Earnings Upper Threshold | Automatic Enrolment Trigger | |||

|---|---|---|---|---|---|

| Period | Amount | Period | Amount | Period | Amount |

| Weekly | £120 | Weekly | £962 | Weekly | £192 |

| Fortnightly | £240 | Fortnightly | £1,924 | Fortnightly | £384 |

| Lunar | £480 | Lunar | £3,847 | Lunar | £768 |

| Monthly | £520 | Monthly | £4,167 | Monthly | £833 |

The Pension Diary will automatically update to 2020/2021 when your portal is rolled forward into 2020/2021.

For 2020/2021 there are no planned rises in the contribution percentages, so the rates remain the same as the 2019/2020 tax year.

| Minimum Contributions for Qualifying Earnings | |

|---|---|

| Minimum Total Contributions | 8% |

| Minimum Employer Contribution | 3% |

| Required Member Contribution where Employer is minimum | 5% |

Tier Certification

You may have pension schemes that operate according to tier certification. The Standard Contribution rates for each tier are shown below.

| Certification for Pensionable pay for | |||

|---|---|---|---|

| Tier 1 | Tier 2 | Tier 3 | |

| Minimum Total Contributions | 9% | 8% | 7% |

| Minimum Employer Contribution | 4% | 3% | 3% |

| Required Member Contribution where Employer is minimum | 5% | 5% | 4% |

If you require any changes to your pension scheme’s default percentage rates because you have tier certification, please send details to your payroll specialist who will ensure the changes are made from the start of the new tax year.

Tax Code Uplift

In October 2018, HMRC introduced the Finance Bill 2018-2019 which set the Personal Allowance for 2019/2020 at £12,500. And the basic rate limit at £37,500. These thresholds will remain the same for 2020/2021 and will increase in line with the Consumer Price Index (CPI) thereafter.

Therefore, the Emergency Tax Code of 2020/2021 will remain 1250L.

All Week 1 Month 1 Indicators will not be taken forward into 2020/2021 for any tax code.

Allowances

Employment Allowance - The rules around this are changing as of April 2020. There will be a separate release note outlining the system changes in relation to this.

- Employment Allowance - £4,000

- Apprenticeship Levy Allowance - £15,000

Rolling Over the Portal

Your Payroll Specialist will contact you near to the completion of your final pay run for the 2019/2020 tax year, to arrange for your portal to be rolled forward to the 2020/2021 tax year. When rolled forward, all rates and allowances will automatically update for the 2020/2021 tax year.

Comments

Please sign in to leave a comment.