Overview

Before changing an employee’s holiday status it is important to understand the impact the changes may have. This article will help to explain the changes that can occur, but please contact a member of the Fourth team before any alterations are made.

Please note: Since this article was first written, new functionality has been introduced to the system that, when enabled, pro-rates employees' holiday allowance when their status changes from Full-Time to Part-Time. Details can be found at the bottom of this article.

Employment Status

An employee’s holiday is calculated based on their Employment status:

- Full-Time – An employee who is salaried or hourly paid and has a basic holiday allowance driven from the job title settings. Hours worked on the Rota do not affect these employees' holiday entitlement

- Part-Time – An employee who is salaried or hourly paid whose Full-Time Equivalent (FTE) is overridden with their days and hours per week

- Flexible – An hourly paid employee who works regularly but does not have a set weekly working hours

- Casual – An hourly paid employee who works on an ad hoc basis and does not have a standard weekly working pattern.

Accrual

- Employees' holiday accrual is calculated based on the pro rata holiday allowance

- If holiday allowance is not pro rata, the employees' holiday accruals remain unchanged

- If holiday is pro rata, the employees' accruals will change

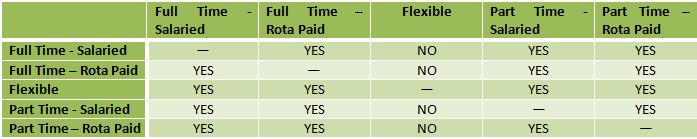

- For a summary of whether or not holiday is pro rata, see Fig.1

Fig.1 - Table shows YES for pro rata holidays

Changing from Casual to:

Full Time or Part-Time

- All casual holiday accrued should be paid out before the status is changed, as previous holiday accrued does not carry over to the new status

- The system will calculate holiday allowance from the date the Full Time or Part-Time employment starts, ignoring the previous casual employment

- The system will now look at the job title FTE and Basic Holiday Allowance to calculate holiday rather than hours worked

- Holiday can now be paid in days or hours depending on portal settings

Flexible

- Once changed the system will start calculating holiday based on the last 52 weeks worked on the rotas

- Holiday Allowance will not be calculated pro rata

- Holiday may be negative if the employee has taken more holiday than entitled to before the change

- To include absence in the holiday calculation, select the global setting and ensure this is selected in each relevant Absence Type

Changing from Flexible to:

Full Time/Part-Time

- Holiday will no longer be calculated based on the last 52 weeks worked

- The system will now look at the job title FTE and Basic Holiday Allowance to calculate holiday rather than hours worked

- Holiday will be calculated pro rata from the effective date

- Run the HYTD report before making the change to ensure a record is kept of holiday taken and remaining before the change as there will be no record of it after the change

Casual

- All previous holiday accrued is ignored and entitlement is set to 0

- It is best to change to casual at the end of the holiday year due to the fact that all holiday entitlement will be set to 0. However if wishing to make this change, please speak to Fourth for assistance

Changing from Full Time to:

Flexible

- Holiday will no longer be calculated based on the job title

- Holiday will be calculated based on the last 52 weeks worked on the rota. Allowance is calculated considering only the current employment (that is flexible) and assumes the employee is on this employment type for the entire holiday year. The system doesn’t consider the period the employee was Full Time and doesn’t calculate the holiday on a pro rata basis

- Run the Holiday-Year to Date (HYTD) report before making the change and check how many days the employee has accrued and taken

- To include absence in the holiday calculation, select the Global Setting and ensure this is selected in each relevant Absence Type

Casual

- All previous holiday is ignored

- It is best to change to casual at the end of the holiday year due to the fact that all holiday entitlement will be set to 0. However if wishing to make this change, please speak to Fourth for assistance

Scenarios

Scenario 1: Flexible to Full Time

Employee’s employment type was flexible and this was changed to full time / salaried during the holiday year.

Holiday allowance was 11.5 days before the employment type change and after the change it shows 16.5 days.

Summary: Holiday allowance is calculated pro rata based on the employment type change in the holiday year.

Scenario 2: Flexible to Part-Time

Employee’s employment type was flexible and this was changed to part-time / salaried during the holiday year.

Holiday allowance was 17 days before the employment type change and after the change it shows 15 days.

Summary: Holiday allowance is calculated pro rata based on the employment type change in the holiday year.

Scenario 3: Full Time to Flexible

Employee's Employment type changed from Full Time to Flexible.

Holiday allowance changes based on the number of days worked over the last 52 weeks.

Daily rate is based the last 52 weeks pay and hours.

Summary: Holiday allowance is not calculated pro rata, as it is assumed the employee is on this employment type for the entire holiday year.

Scenario 4: Part-Time to Flexible

Employee’s employment type is part-time/salaried and changed to flexible during the holiday year.

Allowance is then calculated based on the last 52 weeks.

Other Considerations

Pay Basis

If a business is using the Payroll module and has a different pay basis for hourly and salaried staff, this will also need to be changed in the employees’ payroll records. A new payment type will also need to be reassigned.

Pensions

If using the Pension module, and an employee's pay basis has changed, ensure the employee is transferred to the new Pension scheme.

Mid-Pay Period Changes

The system will not allow changes to be made that affect the Payroll module midway through a pay period.

- This can be changed in Global Setting: Administration > Global Settings > Mid Pay Period Changes

Fig.2 – Edit Mid Pay Period Change Settings

- Deselect the option Do not allow mid pay period changes ?

This allows the required changes to be made and will deselect all boxes.

Ensure that the change is made swiftly and the option is re-selected as soon as the change has been made

Ensure that the change is made swiftly and the option is re-selected as soon as the change has been made

Appendix

Flexible Holiday Calculation

To calculate a flexible employee's day rate, the following calculation is used.

Day Rate = Average Summery Rate x Hourly Rate

Accrual Calculation

An employee’s holiday accrual is the amount they have earned up to the current date it is calculated as follows:

For those employees that started before the start date of the current holiday year:

For those employees that have started after the holiday year start date:

Also See

- How Does The Employment Status Affect Holiday

- Flexible Holiday Calculations Sheet

- People System Holiday Matrix by Employment Status

Pro-Rata Holidays from Full Time to Part Time

It is possible to enable employees changing from Full Time to Part Time (salaried to hourly) to have their Holiday allowance pro-rated and totalled based on the time worked in each of their respective employments.

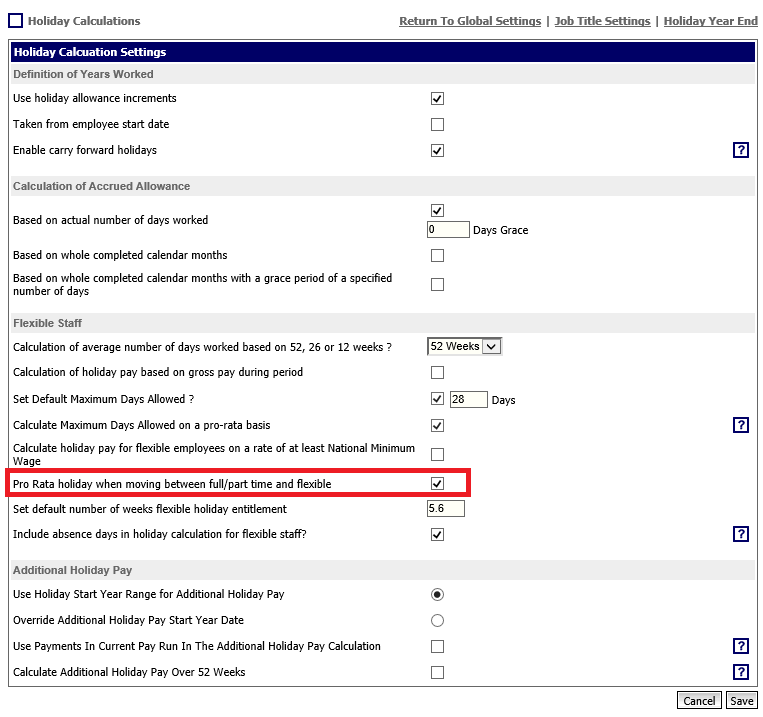

To do this a Global Setting must be applied.

- Go to HR > Administration > Global Settings > Edit Default holiday settings > scroll to the Holiday Calculations section (see Fig.3)

- Tick the box against Pro Rata holiday when moving from full/part time and flexible

This Global Setting will be un-ticked by default.

Fig.3 - Pro-Rata Holidays when moving from Full Time/Part time to Flexible Setting

Fig.3 - Pro-Rata Holidays when moving from Full Time/Part time to Flexible Setting

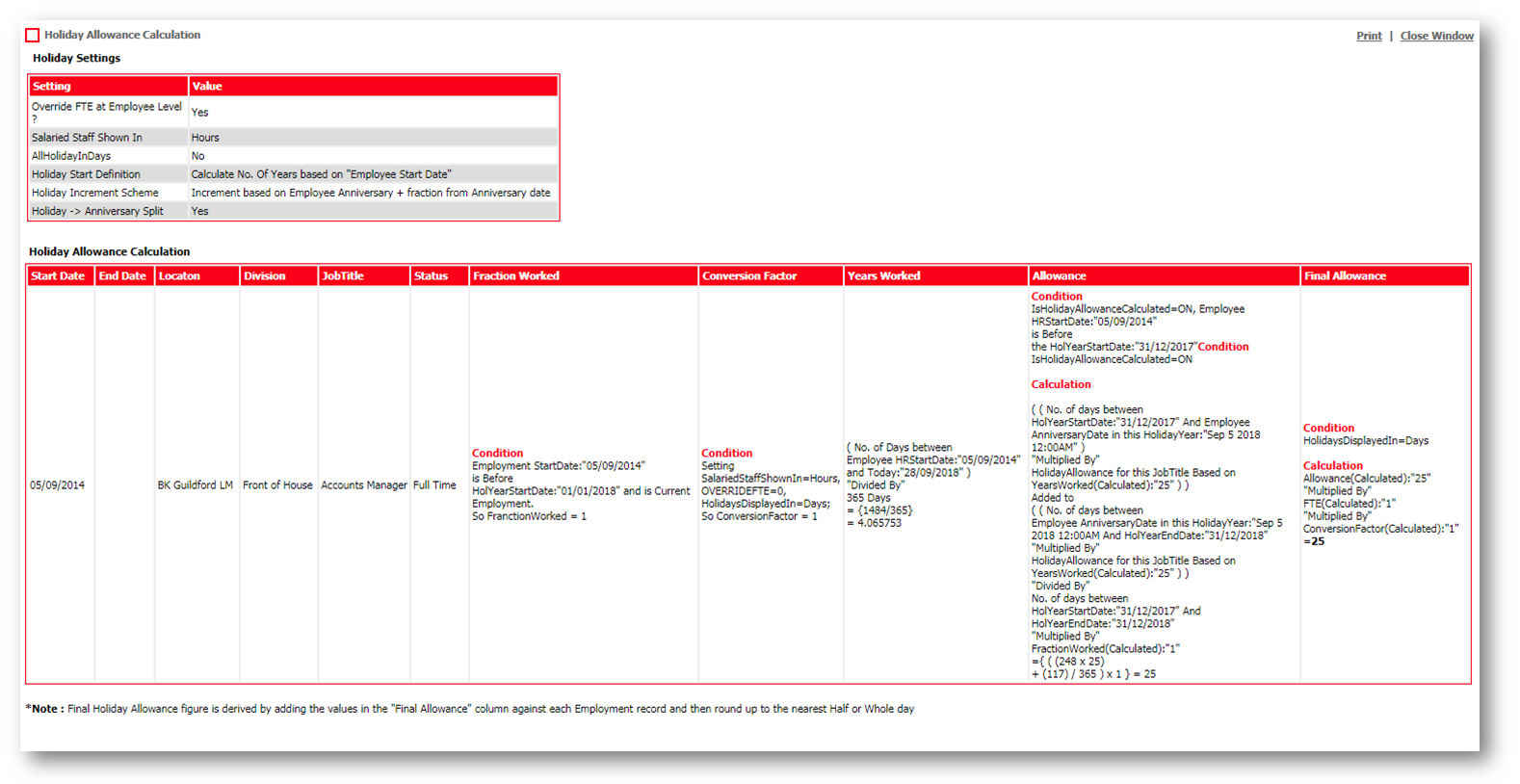

Holiday Allowance Calculations

To help understand the Holiday allowance calculation, the ‘Holiday Allowance Calculations' page can be used.

- When viewing an employee's details, go to Employee HR Info > Holidays > Days Allowed

Fig.4 – Holiday Allowance Calculations Page

Any changes in Career History will result in an Employee’s employment allowance being recalculated.

This means that those employees who have always been flexible, but have multiple Career History changes, may result in a slightly different total allowance as it considers the average in each Historical period. These are then summed up and rounded up to the nearest whole number. Therefore 0.1 would become 1.0 for flexible employees.

All other employment types are rounded to the nearest half day.

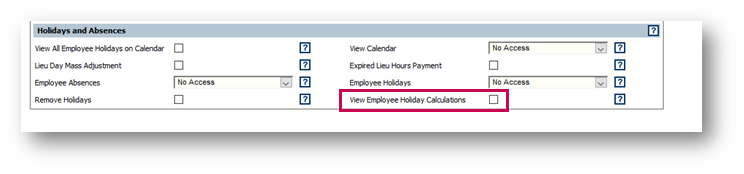

Access to the Holiday Allowance Calculations Page

A User Access permission is required to view the Holiday Allowance Calculations page.

- Go to HR > User > Assign User Access > select Employee > User Profile

- In the ‘Holidays and Absences’ section, tick the box against View Employee Holiday Calculations

Fig.5 - View Employee Holiday Calculations Setting

Fig.5 - View Employee Holiday Calculations Setting

Comments

Please sign in to leave a comment.