Addition of new functionality to allow for the new Statutory Parental Bereavement Pay (SPBP).

Proposed Release Date: 12th March 2020

Reason for Change

‘Jack’s Law’ is coming into effect on 6th April 2020, which allows parents who suffer the loss of a child or have a stillbirth after 24 weeks, two weeks Parental Bereavement Leave and, for those who qualify, a statutory payment.

Customers Affected

All HR & Payroll customers using the Payroll module.

Information

Statutory Parental Bereavement Leave (SPBL) is available for all employees regardless of their length of service.

Statutory Parental Bereavement Pay (SPBP) is dependent on the employee’s average earnings and length of service, as with all other statutory payments.

A maximum of two weeks can be claimed per employee per child, which means there is no limit to the number of Bereavement records that can be created at any one time.

SPBP cannot interrupt any other statutory parental payment but can be added to the end if the dates fall within the 56-week period from the date of bereavement.

SPBP cannot be paid for a period where the employee is entitled to Statutory Sick Pay (SSP) but can be added to the end of the SSP period if the dates fall within the 56-week period from the date of bereavement.

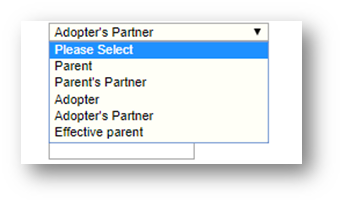

There is no limit on the number of people who can apply for SPBL for each child but each person applying must be:

- A Parent or a Parent’s partner

- An Adopter or an Adopter's Partner

- An Effective Parent – a person who has had day-to-day responsibility for the child for a continuous period of 4 weeks, ending with the child’s death.

Release Notes

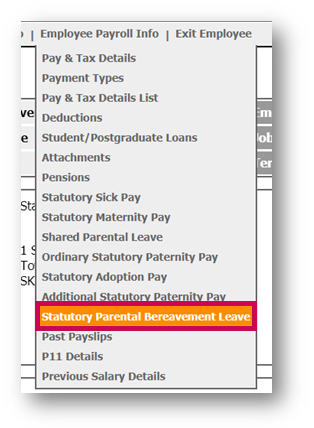

Following the introduction of the new legislation, new pages have been added to the Employee’s Payroll Information section of their record.

- To find these pages, go to Payroll > Employees > Employee List

- Search for and select an employee

- Go to Employee Payroll Info > Statutory Parental Bereavement Leave

Fig.1 - Statutory Parental Bereavement Leave

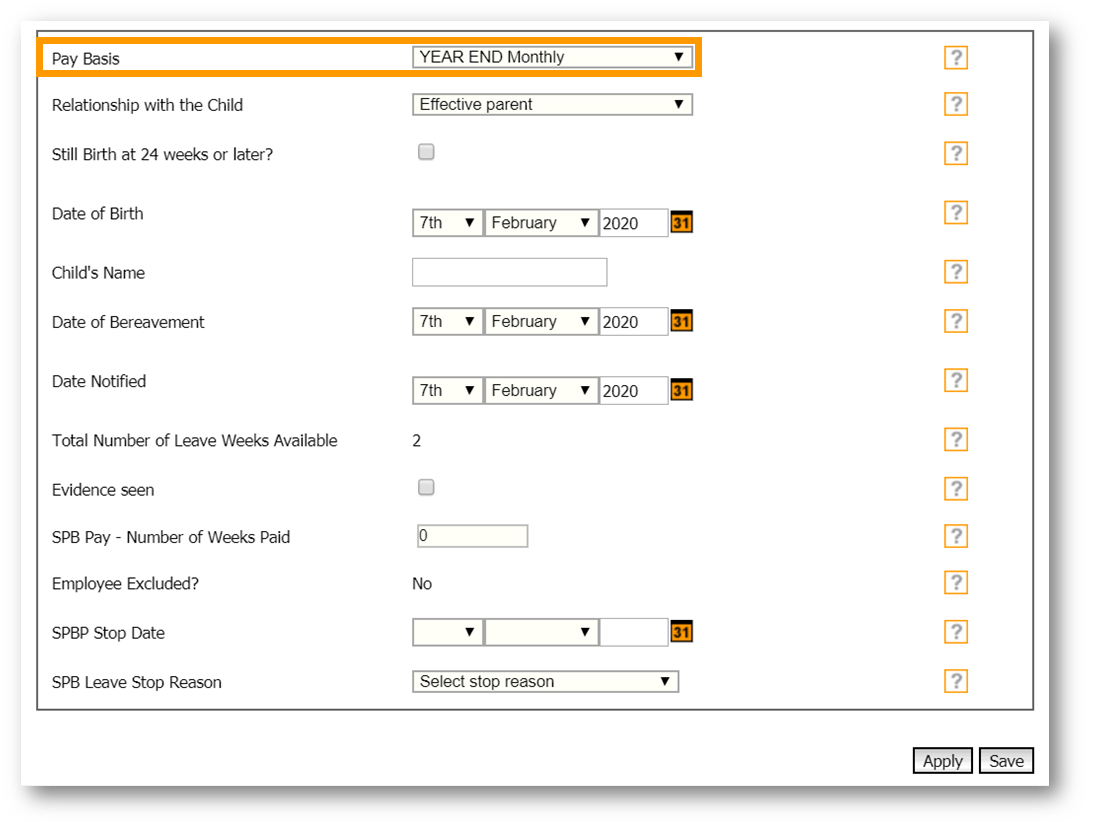

When the page is selected, a new page will display where a new Statutory Parental Bereavement Leave record can be created.

- Select Add New Statutory Parental Bereavement Leave

- The Pay Basis will automatically populate with the pay basis that the employee is assigned to

Fig.2 – Pay Basis on the Add New Statutory Bereavement Leave page

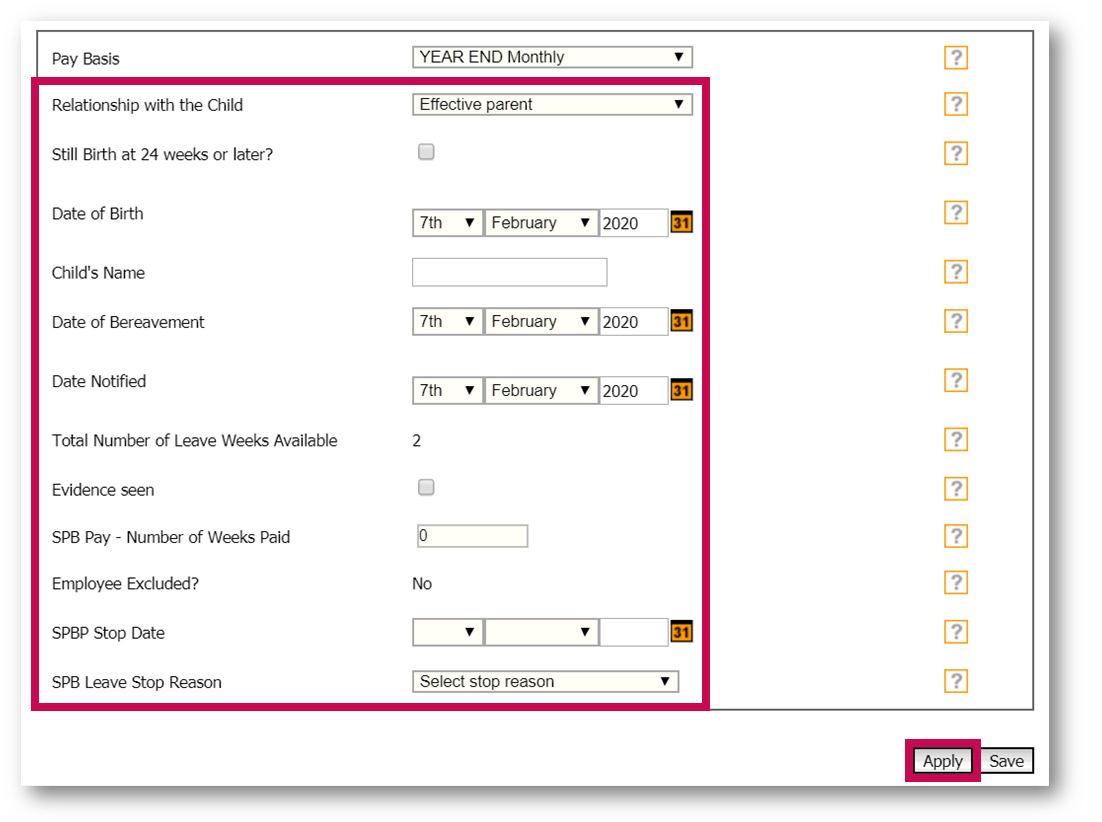

- Select the appropriate Relationship with the Child from the drop-down list

Fig.3 - Relationship with the Child drop-down

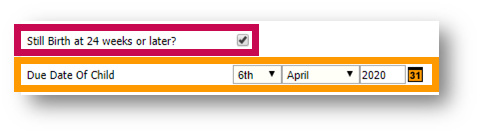

- If the employee has had a stillbirth, tick the box against Still Birth at 24 weeks or later?

Once selected, the Date of Birth box will change to Due Date of Child

Fig.4 - Still Birth at 24 weeks or later?

- Enter the Date of Birth or Due Date of the child

- The Child’s name is optional, but it is recommended to record it if known

- Enter the date of death or stillbirth in Date of Bereavement

- Enter the date that the employee gave notification of the death/stillbirth in Date Notified

- Total number of Leave Weeks Available will automatically populate with “2”

- Evidence seen should be ticked when bereavement has been confirmed (non-mandatory field)

- SPB Pay – Number of weeks paid will automatically update after each week of SPBP paid

- Employee Excluded? Will automatically be flagged if the employee is excluded from receiving SPBP

- SPBP Stop Date should be entered if the employee has stopped their leave before the end

- SPB Leave Stop Reason should be selected if a stop date has been entered

- Once all data has been entered, select Apply

Fig.5 - Populating all fields

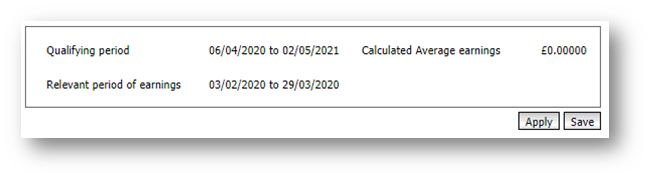

The bottom section of the page will update to show qualifying criteria, as shown in Fig.6.

Fig.6 - SPBP qualifying criteria

- Qualifying period is the timeframe in which the leave must be taken (56 weeks following the date of death)

- Relevant period of earnings is the period 8 weeks prior to the Saturday, before the week in which the date of death falls

- Calculated Average Earnings are the average of the total earnings within the Relevant period of earnings

Override Earnings

The Override Earnings page allows for the average earnings to be overridden, if necessary, so that the qualifying calculation is correct for SPBP payments.

- Go to Override Earnings

- Enter the average earnings in the Average Earnings Override box

- Select a reason from the Average Earnings Override Reason drop-down

- Select Save

Fig.7 - SPBP Override Earnings

View Entitlement

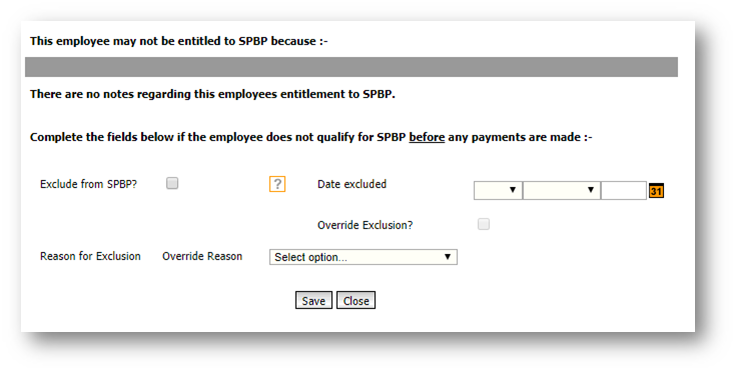

If the employee is not entitled to Statutory Parental Bereavement Pay, the details of why will show in the View Entitlement page

- Go to View Entitlement

Fig.8 - SPBP View Entitlement

If excluded, the Exclude from SPBP? tick box will be flagged and a date populated in Date excluded automatically according to the information entered in the SPBP record.

It is possible to override the exclusion if necessary.

- To override the exclusion, tick the Override Exclusion? box

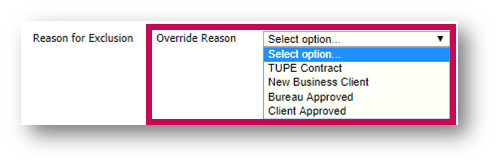

- Then select a Reason for Exclusion from the Override Reason drop-down list

Fig.9 - SPBP Reason of Exclusion

If the employee is excluded, they will not be due the statutory payment for SPBP

Booking Statutory Bereavement Leave

Employees can book two weeks of Statutory Bereavement Leave, which can be taken together or separately.

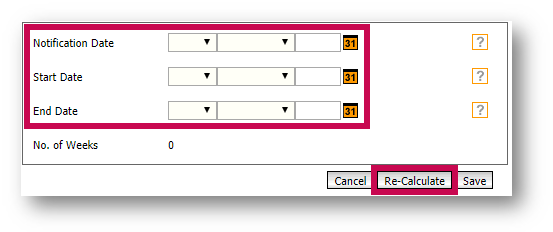

- To book leave, go to Book SPB Leave

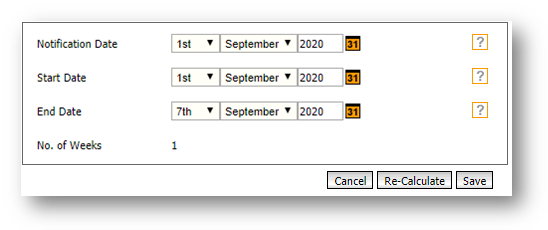

- Enter the Notification date

- Enter the Leave Start date

- Enter the Leave End Date

- Select Re-Calculate

Fig.10 - Book SPB Leave page

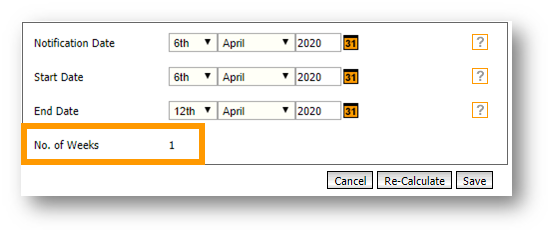

The No. of Weeks will populate with the number of full weeks requested

Fig.11 - SPBP Number of Weeks calculated

- If required, the End Date can be amended, which will change the No. of weeks if extended to two weeks or reduced from two to one

- Select Save

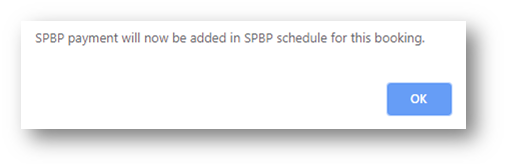

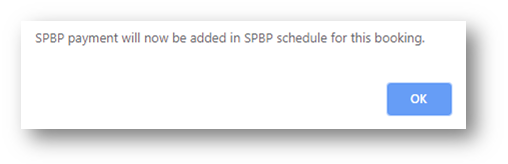

A dialogue box will appear to advise that SPBP payment will now be added in SPBP schedule for this booking.

Fig.12 - SPBP Booking confirmation

- Select OK

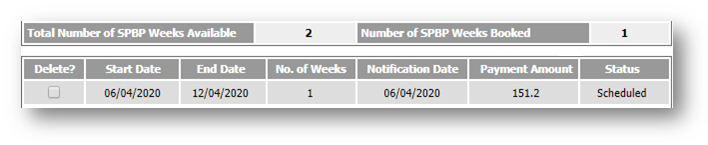

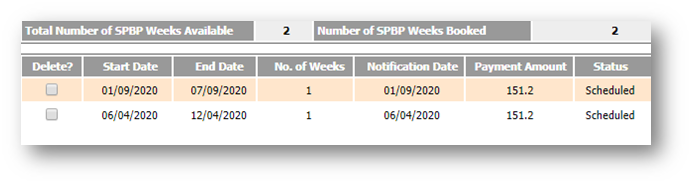

The booked week will then appear in the SPBP schedule.

Fig.13 - SPBP schedule showing week 1

- To book a second week, go to Add a New SPBP Leave

- Enter the dates of the second leave period

Fig.14 - Book SPB Leave page

-

Select Save

The dialogue box will appear again.

Fig.15 - SPBP Booking confirmation box

- Select OK and both leave periods will appear in the SPBP schedule

Fig.16 - SPBP schedule showing week 2

It is possible to book the two weeks separately or in a full two-week block. It is not possible to book more than two weeks leave or any leave that ends after 56 weeks since the date of bereavement.

- To view booked leave details directly from an employee record, go to Employee Payroll Info > Statutory Parental Bereavement Leave > select the row from the List

- Select View SPB Leave Bookings

Statutory Parental Bereavement Payments

The Statutory payment for Parental Bereavement is the same amount for other Parental Payments.

-

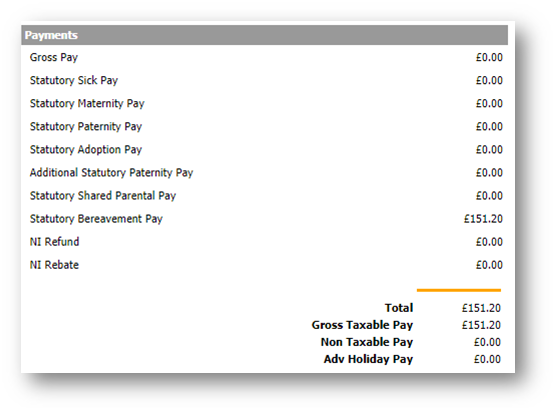

To view the payment for SPB within the payroll summary, go to Employee Info > Employee Summary > View Payroll Summary

The Payment amount will appear next to Statutory Bereavement pay on the payslip summary.

Fig.17 - Payslip Summary

Comments

Please sign in to leave a comment.