The Change

A new report, additional “Pay Run Reconciliation Ver.2”, has been added to the Payroll Module. This new report provides more information for the pay period and includes year to date figures. The report can be run to reconcile payments / deductions / net pay and payments to HMRC.

The new report can be balanced back to the following payroll reports, which are found in Payroll > View Reports:

- Payroll Summary - Individual Pay Period

- Payroll Summary – YTD

- Payroll Summary P30

- FPS Files

The name of the existing report has been changed to “Pay Run Reconciliation Ver.1”.

Release Date: 14- Aug-2014

Reason for the Change

Customers requested a report which would show all payment and deduction figures balancing back to net pay for the pay period selected, and the year to date figures to be in the same format.

Customers Affected

This is available to all People System customers using the Payroll Module.

Release Notes

Path

Fig 1 - Report Links

- The path to the reports remains the same location as the existing report.

- The existing report is: Payroll >Pay Runs >Past Pay Runs >select pay period > Pay Run Reconciliation Ver.1.

- The new report is: Payroll >Pay Runs > Past Pay Runs >select pay period > Pay Run Reconciliation Ver.2.

What’s New?

The report is broken down into 3 main parts.

- Details of the Pay Period Selected

- Details of the Year to Date Information

- Details by Location for the Pay Period Selected

Within each main part, there are the following sub sections:

- Employers Information

- Net Pay Details

- Payments to HMRC

- Deductions Report

- Payments Report

Employers Information

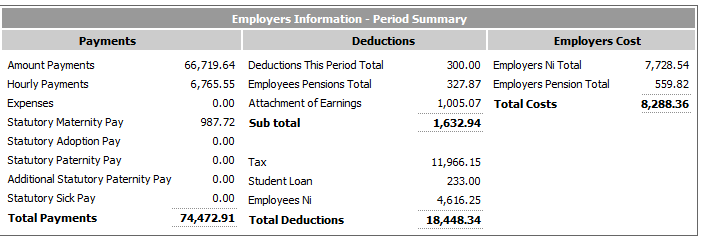

Fig 2 - Employee Payments Section

- Payment types have been split into ‘Amount Payments’ and ‘Hourly Payments’.

- Expenses have been added, and statutory payments are shown within payments for the period.

- The Total Payments is the gross total of all payments made to the employees.

- Deductions are displayed in 3 sections, ‘Deductions This Period Total’ (sum of normal deduction payment types), ‘Employee Pension Total’ (Sum of Pension deductions) and ‘Attachment of Earnings’ (sum of attachment deductions).

- Total deductions include the statutory deductions from the employees pay (Tax, NI and so on.)

- Employers cost now includes employers pension costs.

Net Pay Details

Fig 3 - Net Pay Details Section

- ‘Tax Credits’ has been removed from this section as it is no longer valid.

- The breakdown of Full Time / Part Time, Gender of employees being paid and Total Pay slips has also been included.

Payments to HMRC

Fig 4 - Payments to HMRC Section

- The Payments to Inland Revenue has been renamed to “Payments to HMRC”.

- The “Less NI Compensation” replaces the “Less recovery @ 92%”.

- The reclaim figures making up the NI compensation is shown.

- Additional Statutory Paternity Pay has been added to the reclaim figures.

- The Year to Date figures for Statutory payments has been removed from this section and appears in the new “Year to date Summary” section.

Deductions Report

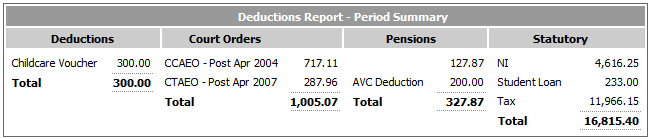

Fig 5 - Deductions Report Section

- The Deduction’s section is split into the different types of deductions, including the statutory deductions.

Payments Report

Fig 6 - Payments Report Section

- The Payments section has been added similar to the deductions section, detailing the different types of payments.

- Hourly payment types will show the number of hours (in parentheses) and the amount. In the example shown in Fig 6 above, 100.33 is the total hours for the hourly payment.

- The Payment total includes the statutory totals. Note: This means that it will not balance back to the payments total on the Employers Information report.

Comments

Please sign in to leave a comment.