The Change

Release Date: 2nd March 2017 (Will only be visible once the portal has rolled over).

Reason for the Change

Businesses with an annual wage bill of over £3 million will be required to pay a levy to assist funding the training of apprentices.The annual wage bill is all payments to employees that are subject to class 1 secondary national insurance contributions. This does not include earnings of employees under the age of 16, benefits in kind, and earnings not subject to NICs.

The allowance can be split between connected companies but this must not exceed £15,000 – customers are responsible for this.

If no allowance is entered into the system, companies will pay the levy as 0.5% of their annual wage bill without an offset.

Customers Affected

All payroll customers.

Release Notes

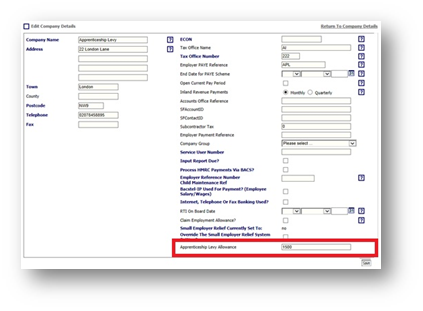

Once the portal has been rolled into the New Tax Year, the company allowance will need to be entered into the relevant Company settings.

- Payroll > Administration > Company Setup > Select Company > Edit

Fig.1 - Company Details

The system will divide the allowance by the number of tax periods to calculate how much can be offset against the Tax and NI contributions paid monthly. The monthly allowance will be deducted from the monthly wage bill and the levy will be calculated on the remaining amount.

E.g. A Company has an allowance of £15000 and operates a monthly pay run. Their monthly pay bill is £270,000

The levy of 0.5% will be calculated on £270,000

£270,000 x levy 0.5% = £1,350

Minus the monthly allowance (£15,000 ÷ 12) £1,250

Levy £1,350 – Allowance £1,250 = £100 payable to HMRC

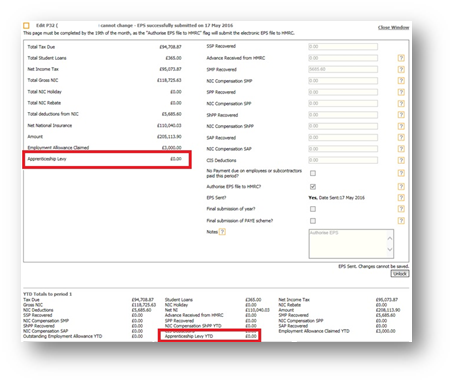

- The levy amount for the tax period and the YTD figure can be viewed on the P32.

Fig.2 – Levy amounts showing on the P32

The levy amount will be reported to HMRC via the EPS, which should be authorised between the 6th and 18th of every month.

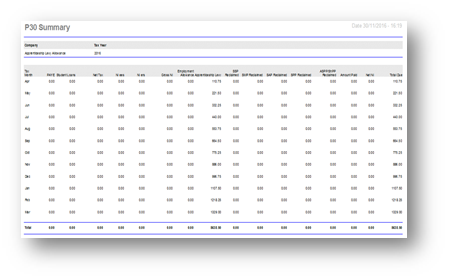

The Levy will not display on the Super Journal as it is not an employee cost, however it can be viewed on the P30 Summary and exported to Excel.

Fig.3 – P30 Summary

Comments

Please sign in to leave a comment.