What’s Changing?

This article contains all changes made in the system required to allow legislative compliance from April 2019.

Release Date: 14th March 2019

Reason for the Change

Her Majesty’s Revenue and Customs (HMRC) are implementing changes to legislation agreed by the UK government, for the tax year beginning 6th April 2019.

Customers Affected

All customers with the Payroll or Pension module with pay dates on or after 6th April 2019.

Release Notes – Contents

PAYE - Tax and National Insurance

Rates and Thresholds

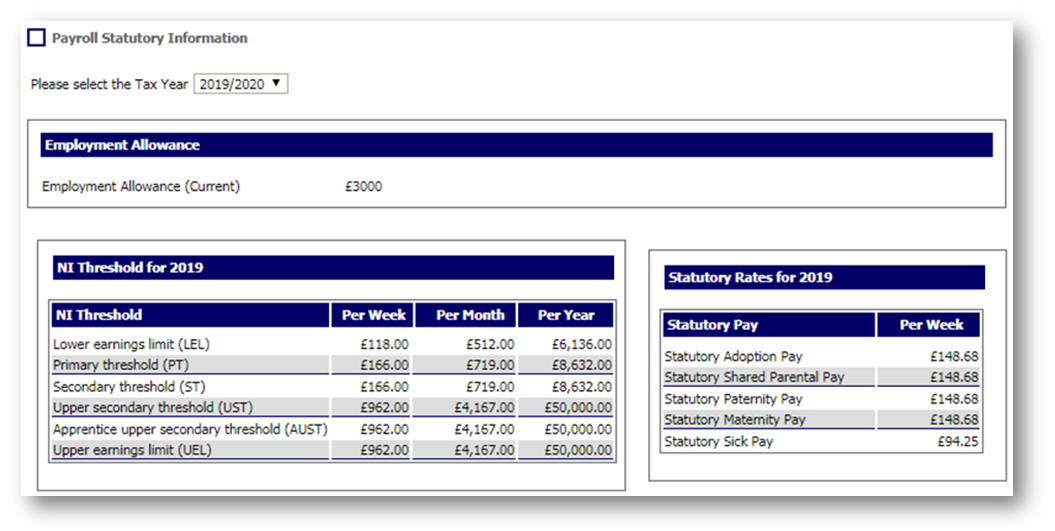

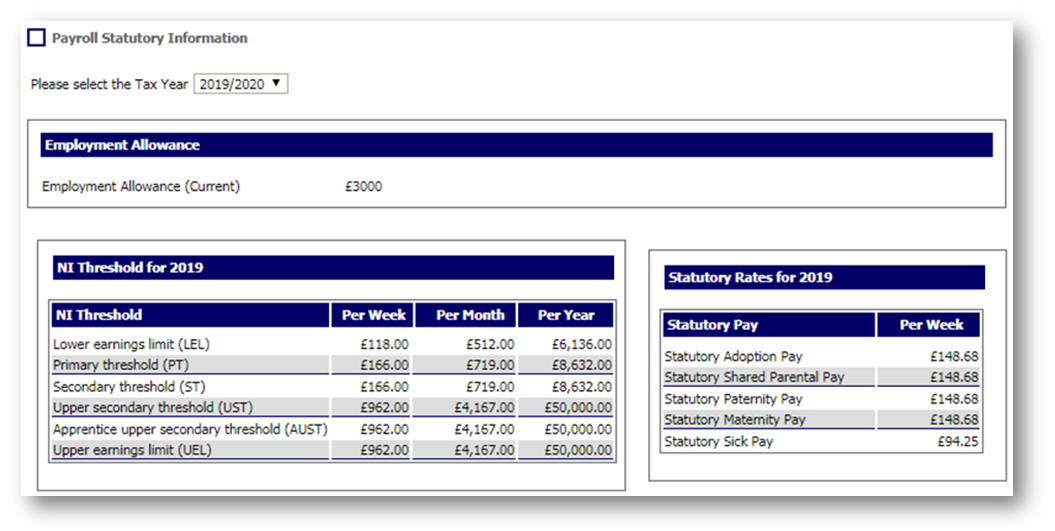

The Payroll Statutory Information screen has been updated to provide details of rates and thresholds for Tax and National Insurance for 2019/20.

Fig.1 - Payroll Statutory Information

Fig.2 - NI Rates for 2019

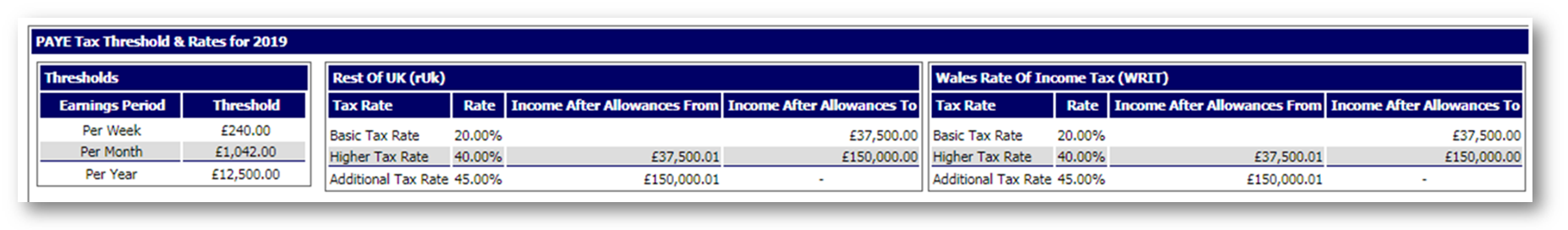

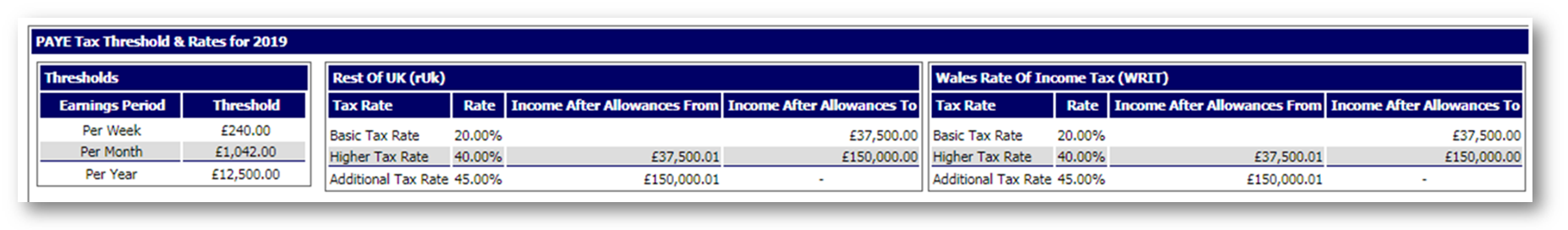

Fig.3 - PAYE Tax Thresholds & Rates for 2019

The Welsh Rate of Income Tax

The Welsh Rate of Income Tax (WRIT) will be effective from 6th April 2019. Employers are not expected to make a decision and determine if WRIT applies. If an employee should pay WRIT HMRC will issue a tax code (P6 or P9) notification to indicate WRIT is applicable. Employees residing in Wales will be issued a new tax code, indicated with a prefix ‘C’ e.g. C1250L is the equivalent of 1250L for the rest of the UK (rUK) and S1250L for Scotland. The Welsh Rate of Income Tax will display in the table shown in Fig.3.

Post Graduate Student Loans

6th April 2019 sees the introduction of Post Graduate Student Loans. There will be a separate release note outlining the system changes.

The earnings threshold will be £21,000

The recovery rate will be 6%

See https://www.gov.uk/government/publications/payroll-technical-specifications-student-loans/collection-of-student-loan-from-6-april-2019 for more information.

Student Loans

From 6th April 2019 the breakdown between the two Student Loan Types is:

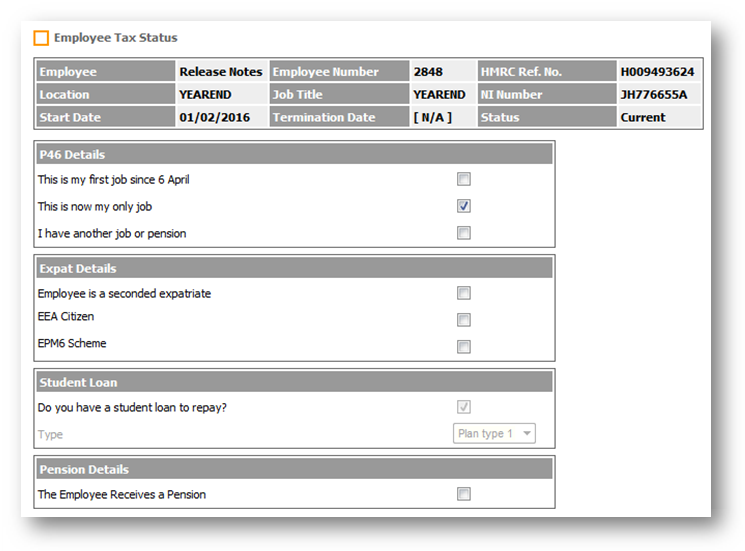

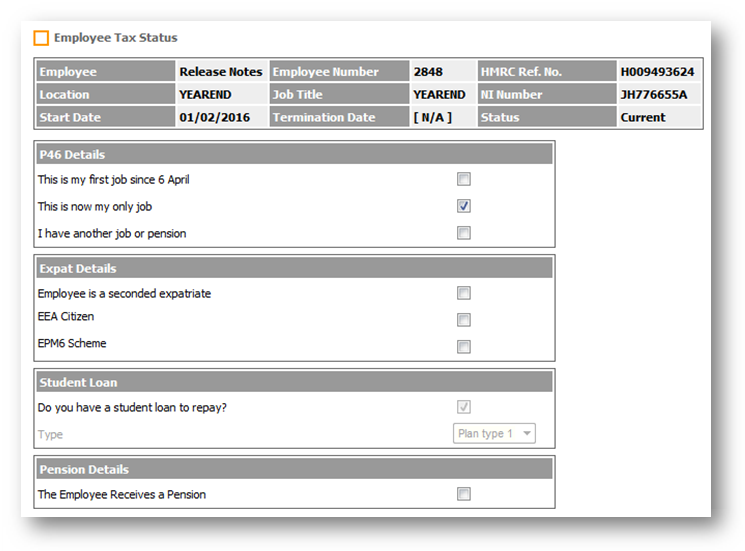

If the employee knows they have a Student Loan but not which Plan Type, you should select Plan Type 1 as a default. HMRC will correct this with an SL2\SL1 as appropriate:

Fig.4 – Employee Tax Status

Alternatively, time permitting, it may be decided to refer employees to the Student Loan Company website for them to work out which plan type they should be paying, and make a choice which type to deduct as a result.

National Minimum Wage (NMW) and National Living Wage (NLW)

From 1st April 2019:

21 to 24 year olds from £7.38 to £7.70 per hour

18 to 20 year olds from £5.90 to £6.15 per hour

Under 18 £4.35 per hour

Apprentices from £3.70 to £3.90 per hour

25 and over from £7.83 to £8.21

More information on the living wage and latest rates for NMW can be found at: https://www.gov.uk/national-minimum-wage-rates.

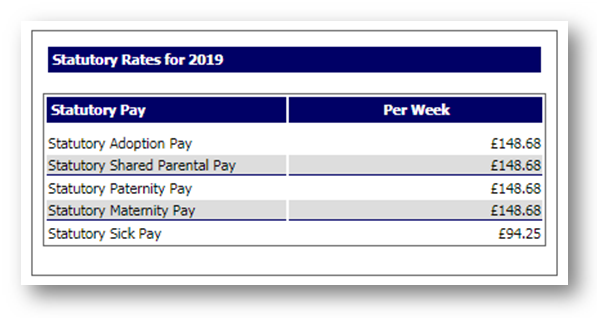

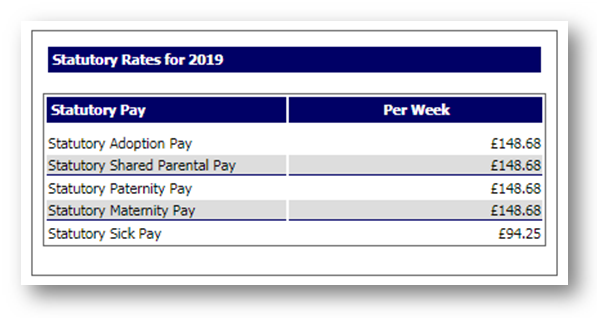

Statutory Payments – Sickness (SSP), Maternity (SMP), Paternity (SPP), Adoption (SAP), Shared Parental (ShPP)

Fig.5 - Payroll Statutory Information

Upon rolling over into tax year 2019/2020, all Statutory Payment schedules will be regenerated based on the above rates where applicable.

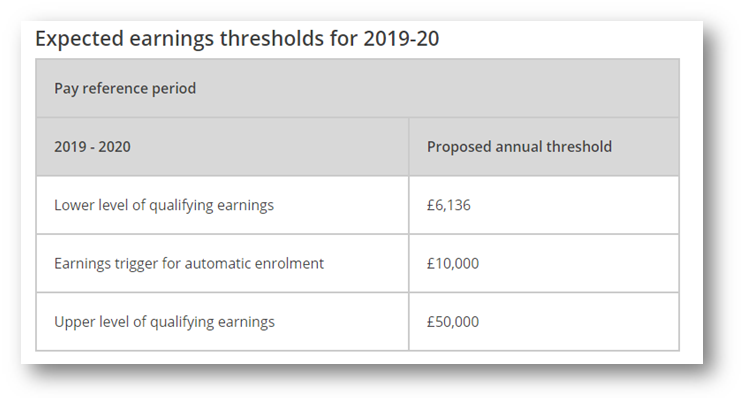

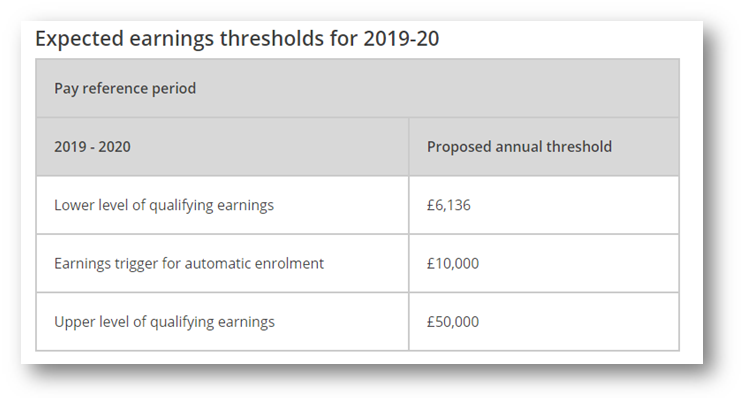

Pensions

The Department of Work and Pensions (DWP) has announced the proposed earnings thresholds for the 2019 - 2020 tax year. These values have been published in an Order (a form of secondary legislation) by the DWP and laid before Parliament and so are subject to Parliamentary approval.

We received an update from The Pension Regulator (TPR) in February confirming that Parliamentary approval is still pending.

We do not expect the rates and thresholds to change from the proposed rates, as shown in the table below, as these fall in line with National Insurance rates (as in previous tax years).

As soon as we receive confirmation from TPR, we will amend the system with the confirmed earnings thresholds and inform you with an additional release note.

Fig.6 – Expected Pension Rates

If your Pension Diary has not already been manually updated for tax year 2019/2020 this will happen when your portal is rolled over into 2019/20.

In some circumstances you may have to edit the dates that are scheduled by the system. Therefore, when the diary is generated, it is important that you check and verify the dates, editing dates as appropriate using the edit option on each row.

2019 Pension Phasing

From 6th April 2019 The Pensions Regulator is increasing the minimum contribution rates for auto enrolment and qualifying pension schemes for all members. The new percentage rates are below.

Fourth has been working to ensure there is minimum disruption to the final phasing increases and has developed automation that will uplift contribution levels automatically when your portal is rolled over to the new tax year.

When the portal is rolled over, the pension module will perform the following uplifts to ensure your schemes are meeting the minimum requirements.

We understand that some companies offer a higher employer contribution rate in order to offer additional benefits to their employees. We have tried to accommodate these default percentage increases too which should mean that you continue with your employee benefits.

These changes will be made automatically to:

Please note - the changes will be made to both Auto Enrolment and Qualifying pension schemes.

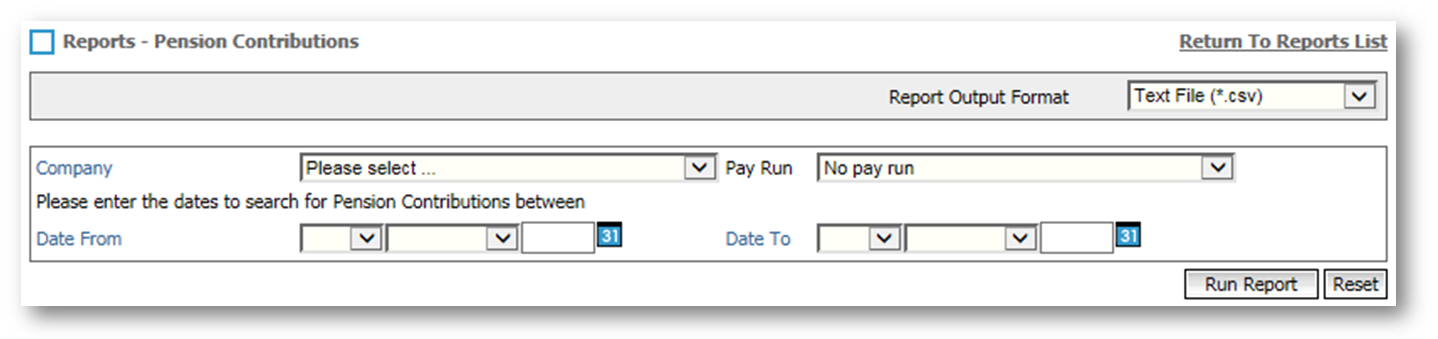

Fixed Contribution Amounts

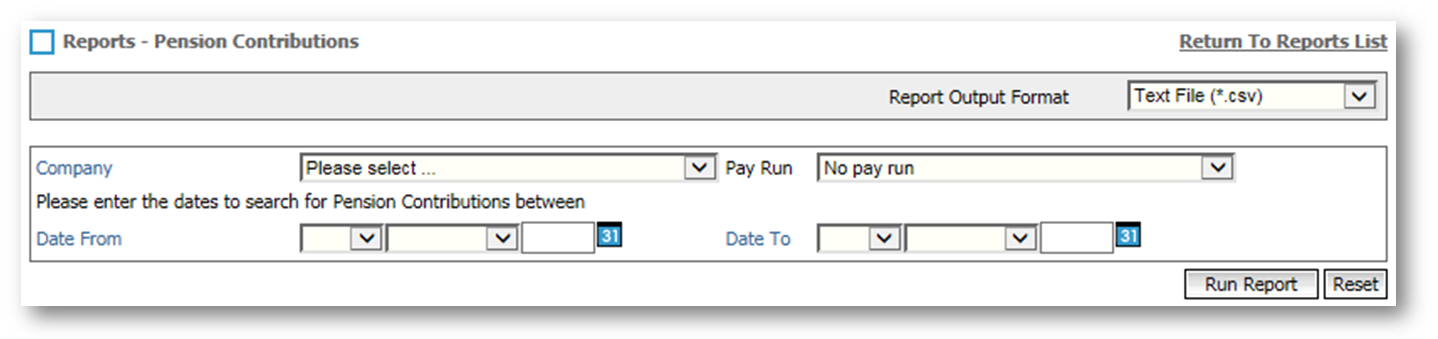

The automated changes will not apply to any employees who have fixed amounts set at employee level. Normally, an employee has agreed a fixed amount and so they cannot be updated without further agreement. To find out whether you have any employees on a fixed amount, you can run a report from the payroll module.

Fig.7 – Running the Pensions Contributions Report

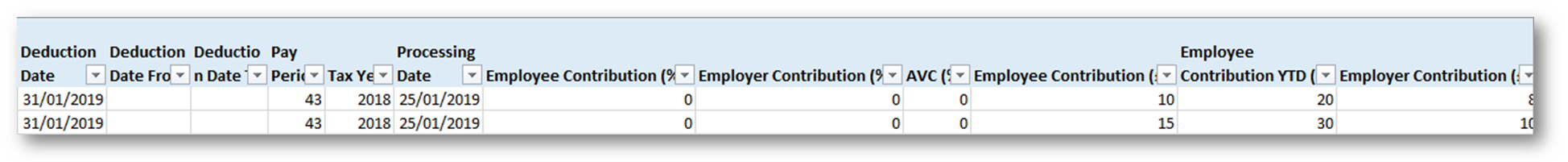

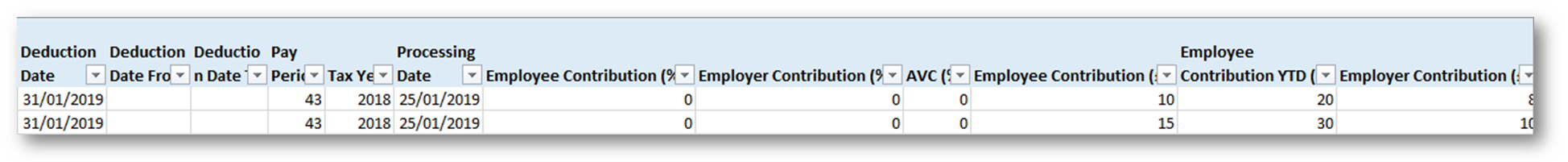

Fig.8 - Example Pensions Contributions Report csv export

This will give a list of employees with a fixed Employee Contribution amounts

This will give a list of employees with fixed Employer Contribution amounts

You will need to make sure that the fixed contributions calculate to the minimum contribution amounts and may have to contact your employee if they fall below.

Because employees’ pay can fluctuate quite drastically we do recommend that you change employee fixed amounts to a percentage amount within their employee record.

If you require any changes to employees’ fixed amounts, please send details to your payroll specialist who will ensure the changes are made from the start of the new tax year.

Tier Certification

You may have pension schemes that operate according to tier certification. Fourth’s automated changes will not change rates according to tier certification. From 6th April 2019 onwards, the standard contribution rates are as shown below.

If you require any changes to your pension scheme’s default percentage rates because you have tier certification, please send details to your payroll specialist who will ensure the changes are made from the start of the new tax year.

Rolling Over the Portal:

Your payroll specialist will contact you near to the completion of your final pay run for the 2018/2019 tax year, to arrange for your portal to be rolled forward to the 2019/2020 tax year.

What the Rollover will do:

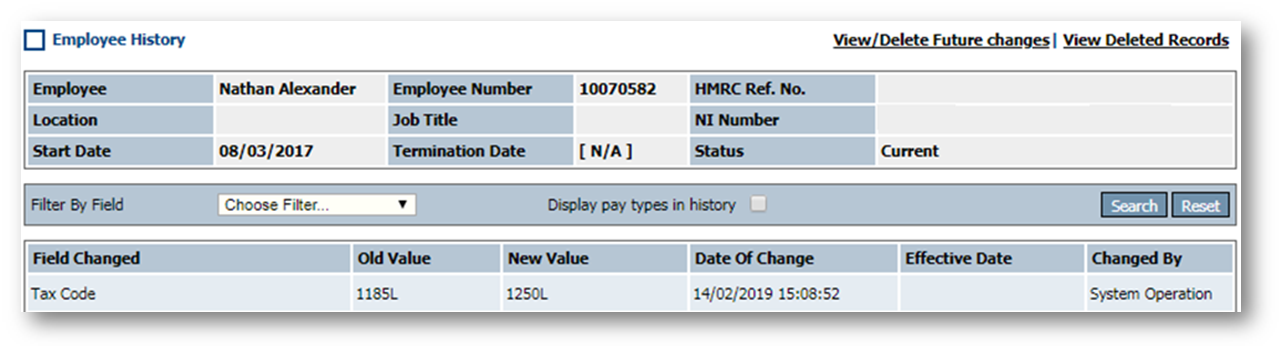

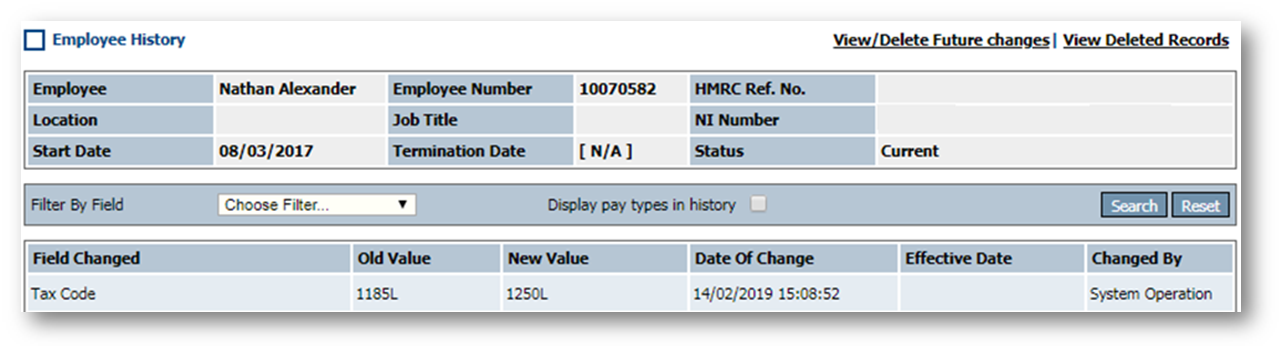

This section describes the changes made by the system when the Portal is rolled over into the new tax year. When viewed on the Employee History screen, these changes are indicated as a “System Operation” as per the example below:

Fig.9 - Employee History

Tax Code Uplift

From 6th April 2019 tax codes will be uplifted as per the following table:

For example:

11850L becomes 12500L

13035M becomes 13745M

10665N becomes 1255N

Week 1\Month1 Indicators will not be taken forward into 2019/20 on any tax code.

PAYE Rates and Thresholds

Rates and thresholds for Tax in the UK (rUK) and Scotland (SRIT) and National Insurance will be updated for the new tax year as part of the portal rollover. As result, pay will be calculated accordingly for 2019/20 pay dates on or after 6th April 2019.

See Payroll > Admin > Payroll Statutory Information Screen or Fig.2&3 above for actual rates and thresholds for 2019/20.

The system will carry out a check on Payroll Preview to ensure that employees do not have any of the Contracted-Out NI categories as a current value and amend the category to the standard rate equivalent, as per the table above.

Allowances

Employment Allowance: £3,000

Apprenticeship Levy Allowance: £15,000

This article contains all changes made in the system required to allow legislative compliance from April 2019.

Release Date: 14th March 2019

Reason for the Change

Her Majesty’s Revenue and Customs (HMRC) are implementing changes to legislation agreed by the UK government, for the tax year beginning 6th April 2019.

Customers Affected

All customers with the Payroll or Pension module with pay dates on or after 6th April 2019.

Release Notes – Contents

PAYE - Tax and National Insurance

Student Loans

National Minimum Wage (NMW) and National Living Wage (NLW)

Statutory Payments – Sickness (SSP), Maternity (SMP), Paternity (SPP), Adoption (SAP), Shared Parental (ShPP)

Pensions

Rolling Over the Portal

Student Loans

National Minimum Wage (NMW) and National Living Wage (NLW)

Statutory Payments – Sickness (SSP), Maternity (SMP), Paternity (SPP), Adoption (SAP), Shared Parental (ShPP)

Pensions

Rolling Over the Portal

PAYE - Tax and National Insurance

Rates and Thresholds

- Go to Payroll > Administration > Payroll Statutory Information

The Payroll Statutory Information screen has been updated to provide details of rates and thresholds for Tax and National Insurance for 2019/20.

Fig.1 - Payroll Statutory Information

Fig.2 - NI Rates for 2019

Fig.3 - PAYE Tax Thresholds & Rates for 2019

The Welsh Rate of Income Tax

The Welsh Rate of Income Tax (WRIT) will be effective from 6th April 2019. Employers are not expected to make a decision and determine if WRIT applies. If an employee should pay WRIT HMRC will issue a tax code (P6 or P9) notification to indicate WRIT is applicable. Employees residing in Wales will be issued a new tax code, indicated with a prefix ‘C’ e.g. C1250L is the equivalent of 1250L for the rest of the UK (rUK) and S1250L for Scotland. The Welsh Rate of Income Tax will display in the table shown in Fig.3.

Post Graduate Student Loans

6th April 2019 sees the introduction of Post Graduate Student Loans. There will be a separate release note outlining the system changes.

The earnings threshold will be £21,000

The recovery rate will be 6%

See https://www.gov.uk/government/publications/payroll-technical-specifications-student-loans/collection-of-student-loan-from-6-april-2019 for more information.

Student Loans

From 6th April 2019 the breakdown between the two Student Loan Types is:

- Plan 1 with an earnings threshold of £18,935 per year

- Plan 2 with an earnings threshold of £25,725 per year

If the employee knows they have a Student Loan but not which Plan Type, you should select Plan Type 1 as a default. HMRC will correct this with an SL2\SL1 as appropriate:

Fig.4 – Employee Tax Status

Alternatively, time permitting, it may be decided to refer employees to the Student Loan Company website for them to work out which plan type they should be paying, and make a choice which type to deduct as a result.

National Minimum Wage (NMW) and National Living Wage (NLW)

From 1st April 2019:

21 to 24 year olds from £7.38 to £7.70 per hour

18 to 20 year olds from £5.90 to £6.15 per hour

Under 18 £4.35 per hour

Apprentices from £3.70 to £3.90 per hour

25 and over from £7.83 to £8.21

More information on the living wage and latest rates for NMW can be found at: https://www.gov.uk/national-minimum-wage-rates.

Statutory Payments – Sickness (SSP), Maternity (SMP), Paternity (SPP), Adoption (SAP), Shared Parental (ShPP)

- The rates for 2019/20 in this area can be viewed for 2019/20 in Payroll > Administration > Payroll Statutory Information

Fig.5 - Payroll Statutory Information

Upon rolling over into tax year 2019/2020, all Statutory Payment schedules will be regenerated based on the above rates where applicable.

Pensions

The Department of Work and Pensions (DWP) has announced the proposed earnings thresholds for the 2019 - 2020 tax year. These values have been published in an Order (a form of secondary legislation) by the DWP and laid before Parliament and so are subject to Parliamentary approval.

We received an update from The Pension Regulator (TPR) in February confirming that Parliamentary approval is still pending.

We do not expect the rates and thresholds to change from the proposed rates, as shown in the table below, as these fall in line with National Insurance rates (as in previous tax years).

As soon as we receive confirmation from TPR, we will amend the system with the confirmed earnings thresholds and inform you with an additional release note.

Fig.6 – Expected Pension Rates

If your Pension Diary has not already been manually updated for tax year 2019/2020 this will happen when your portal is rolled over into 2019/20.

In some circumstances you may have to edit the dates that are scheduled by the system. Therefore, when the diary is generated, it is important that you check and verify the dates, editing dates as appropriate using the edit option on each row.

- To view the Pension Diary, go to Pension > Administration > Pension Scheme {select scheme} > Pension Diary

2019 Pension Phasing

From 6th April 2019 The Pensions Regulator is increasing the minimum contribution rates for auto enrolment and qualifying pension schemes for all members. The new percentage rates are below.

| Date Effective | Employer minimum Contribution | Employee contribution | Total minimum contribution |

| Currently until 5 April 2019 | 2% | 3% | 5% |

| 6 April 2019 Onwards | 3% | 5% | 8% |

Fourth has been working to ensure there is minimum disruption to the final phasing increases and has developed automation that will uplift contribution levels automatically when your portal is rolled over to the new tax year.

When the portal is rolled over, the pension module will perform the following uplifts to ensure your schemes are meeting the minimum requirements.

| Employer Current % | Employer New % |

| 2% | 3% |

| 3% and over | Remains the same |

| Employee Current % | Employee New % |

| 3% | 5% |

| 4% | 5% |

| 5% and over | Remain the same |

We understand that some companies offer a higher employer contribution rate in order to offer additional benefits to their employees. We have tried to accommodate these default percentage increases too which should mean that you continue with your employee benefits.

| Employer Current % | Employer New % | Employee Current % | Employee New % |

| Under 3% | 3% | Under 5% | 5% |

| 4% | 4% | Under 4% | 4% |

| 5% | 5% | Under 3% | 3% |

| 6% | 6% | Under 2% | 2% |

| 7% | 7% | Under 1% | 1% |

| 8% | 8% | 0% | Remains the same |

These changes will be made automatically to:

- The default percentage rates within the pension scheme

- The default percentage rates within any worker groups

- The percentage rates at employee level if they are not set to look at the default rates within the pension scheme

Please note - the changes will be made to both Auto Enrolment and Qualifying pension schemes.

Fixed Contribution Amounts

The automated changes will not apply to any employees who have fixed amounts set at employee level. Normally, an employee has agreed a fixed amount and so they cannot be updated without further agreement. To find out whether you have any employees on a fixed amount, you can run a report from the payroll module.

- Go to Payroll > Reports > View Reports > Pension Contributions

Fig.7 – Running the Pensions Contributions Report

- Select the Company name

- Select the date range of your last payroll in Date From and Date To

- Select Text File (*.csv) as the Report Output Format

- Run Report when ready

- The csv file generated can then be opened in Excel

Fig.8 - Example Pensions Contributions Report csv export

- Add a Filter to Row 1

- Filter column N to only show 0 values

- Filter column Q and remove 0 amounts

This will give a list of employees with a fixed Employee Contribution amounts

- Filter column O to only show 0 values.

- Filter column S and remove 0 amounts

This will give a list of employees with fixed Employer Contribution amounts

You will need to make sure that the fixed contributions calculate to the minimum contribution amounts and may have to contact your employee if they fall below.

Because employees’ pay can fluctuate quite drastically we do recommend that you change employee fixed amounts to a percentage amount within their employee record.

If you require any changes to employees’ fixed amounts, please send details to your payroll specialist who will ensure the changes are made from the start of the new tax year.

Tier Certification

You may have pension schemes that operate according to tier certification. Fourth’s automated changes will not change rates according to tier certification. From 6th April 2019 onwards, the standard contribution rates are as shown below.

| Tier 1 Certification (Basic Pay) (April 2019 onwards): |

| Minimum contribution: 9 per cent. |

| The employer must pay at least 4 per cent of this. |

| The worker must pay at least 5 per cent of this. |

| Tier 2 Certification (Pensionable earnings = at least 85% of total pay) (April 2019 onwards): |

| Minimum contribution: 8 per cent. |

| The employer must pay at least 3 per cent of this. |

| The worker must pay at least 5 per cent of this. |

| Tier 3 Certification (Every pay element in an employee’s payroll) (April 2019 onwards): |

| Minimum contribution: 7 per cent. |

| The employer must pay at least 3 per cent of this. |

| The worker must pay at least 4 per cent of this. |

If you require any changes to your pension scheme’s default percentage rates because you have tier certification, please send details to your payroll specialist who will ensure the changes are made from the start of the new tax year.

Rolling Over the Portal:

Your payroll specialist will contact you near to the completion of your final pay run for the 2018/2019 tax year, to arrange for your portal to be rolled forward to the 2019/2020 tax year.

What the Rollover will do:

This section describes the changes made by the system when the Portal is rolled over into the new tax year. When viewed on the Employee History screen, these changes are indicated as a “System Operation” as per the example below:

Fig.9 - Employee History

Tax Code Uplift

From 6th April 2019 tax codes will be uplifted as per the following table:

| Tax Code Suffix | Increase |

| L | 65 |

| M | 71 |

| N | 59 |

For example:

11850L becomes 12500L

13035M becomes 13745M

10665N becomes 1255N

Week 1\Month1 Indicators will not be taken forward into 2019/20 on any tax code.

PAYE Rates and Thresholds

Rates and thresholds for Tax in the UK (rUK) and Scotland (SRIT) and National Insurance will be updated for the new tax year as part of the portal rollover. As result, pay will be calculated accordingly for 2019/20 pay dates on or after 6th April 2019.

See Payroll > Admin > Payroll Statutory Information Screen or Fig.2&3 above for actual rates and thresholds for 2019/20.

The system will carry out a check on Payroll Preview to ensure that employees do not have any of the Contracted-Out NI categories as a current value and amend the category to the standard rate equivalent, as per the table above.

Allowances

Employment Allowance: £3,000

Apprenticeship Levy Allowance: £15,000

Comments

Please sign in to leave a comment.