Description

In anticipation of the emergency change to legislation, this article details how to pay Statutory Sick Pay (SSP) from day 1 to employees who are off sick, or self-isolating as a result of Covid-19.

Process

Absence Types

It is recommended that a new Absence Type is created that relates specifically to Covid-19. To do this, please refer to WFM Administration Drop-Down - Absence Types

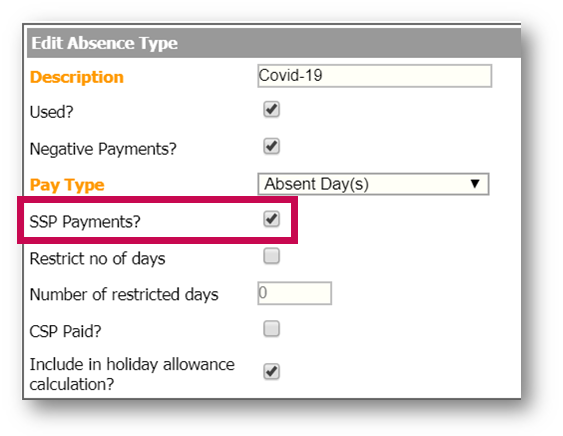

- Ensure that SSP Payments? Is selected so that SSP is calculated and paid

Please note, the system will calculate SSP using standard legislative rules so will automatically set the first three ‘Waiting days’ to unpaid

Fig.1 - Covid-19 Absence Type

When an employee is off work due to Covid-19, this absence type can be used for the whole period of the absence.

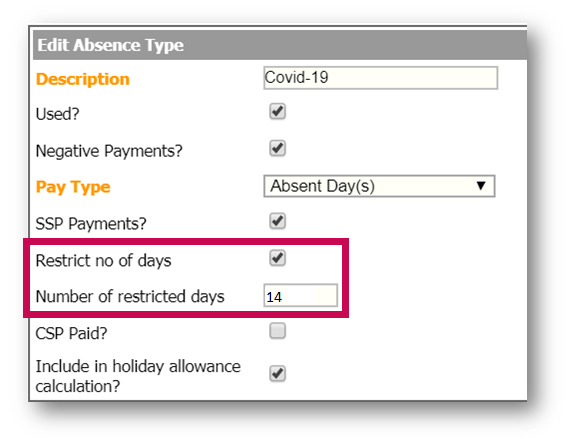

For small employers who will qualify to claim back 14 days of SSP from the government, it is possible to restrict an absence type to 14 days so that reports can be run to identify the number of payments in relation to Covid-19 once HMRC have confirmed how the reclaim will be available.

- To restrict an absence for 14 days, go to the Covid-19 Absence type

- Select the checkbox to Restrict no of days

- Enter 14 in the box next to Number of restricted days

Fig.2 - Restricted days for future reporting purposes

The standard SSP calculation will be done against this absence type to establish the following:

- If the employee qualifies to receive SSP

- If the absence is linked to a previous absence – in which case, the SSP will pay for the whole absence and no adjustment is required.

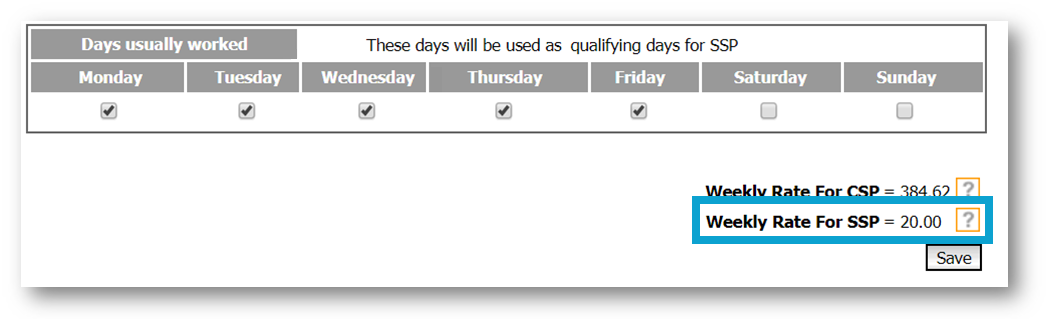

Please note when creating an absence, the days ticked within the absence should represent the days that are usually worked by the employee, or the days they were supposed to work. The calculation for the amount, and day rate, of SSP is calculated according to the number of days within the absence.

Once the absence is created, the page will display a ‘Weekly Rate for SSP’ which is the amount that is used to calculate whether the employee is entitled to SSP or not.

Fig.3 - Average Weekly Rate for SSP

If the weekly rate for SSP is below the earnings threshold (see Table 1), the employee is not entitled to SSP.

| 2019/2020 | 2020/2021 | |

| Earnings Threshold | £118 | £120 |

Table 1 - SSP Earnings Threshold

Please note that the earnings threshold will change from £118 to £120 on 6th April 2020.

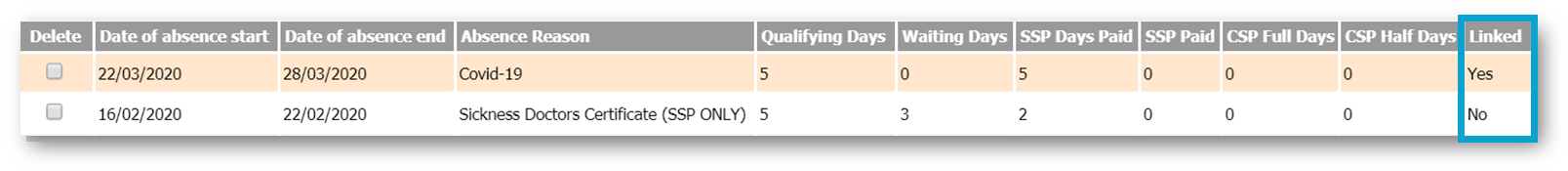

To understand if the absence is linked to a previous one, once the absence is created, the page will display ‘Yes’ under the ‘Linked’ column – see Fig.4.

Fig.4 - Linked Absence

If the employee is entitled to SSP, the payment will automatically generate in the next pay run.

Waiting Days

If the absence is not linked to a previous one, then 3 days will not be paid automatically. To pay these to employees, it is recommended to use a manual Payment Type.

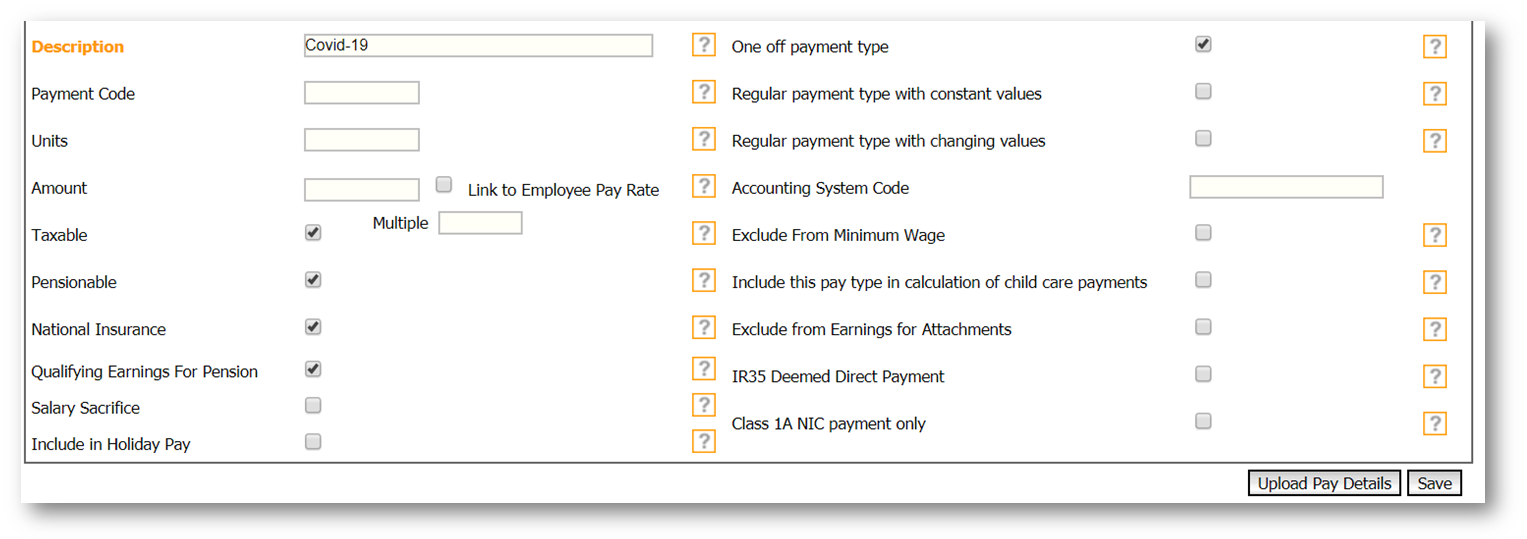

A new Payment Type should be created which specifically relates to Covid-19.

- To create a Payment type, go to Payroll > Administration > Payment types > Add new payment type

Fig.5 - Create New Payment Type

- Use this Payment Type to pay the 3 waiting days manually to employees

Calculating the Amount

The amount due for each waiting day depends on the number of days an employee works. To calculate this, use the weekly rate of SSP, divide by the number of days usually worked, and multiply by 3.

| Days worked per week | 2019/2020 | 2020/2021 |

| 1 | £94.25 | £95.85 |

| 2 | £47.13 | £47.93 |

| 3 | £31.42 | £31.95 |

| 4 | £23.56 | £23.96 |

| 5 | £18.85 | £19.17 |

| 6 | £15.71 | £15.98 |

| 7 | £13.46 | £13.69 |

Table 2. Daily Rate for SSP

If an employee usually works 4 days per week, the weekly rate (£94.25) is divided by 4, giving £23.56 – as shown in Table 2 above.

So, the payment would be 3 x £23.56 = £70.69

Payment

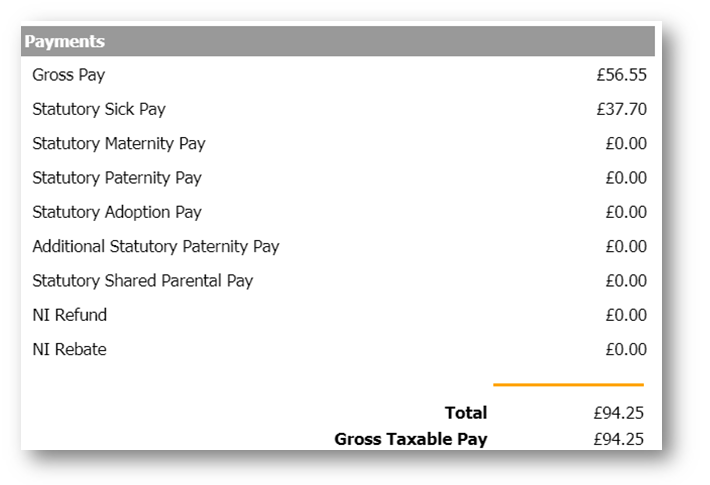

When the payment is made, the employee’s payslip will show 2 payments - one for standard SSP, and another for the 3 waiting days.

Fig.6 - Employee Payroll Summary – two payments

Company Sick Pay (CSP)

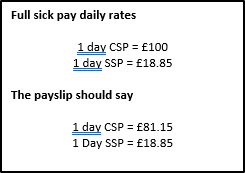

Employers who currently pay CSP from the first day of absence will continue to pay CSP as normal to employees off work because of Covid-19.

If employers decide to make SSP payments to employees who will also receive CSP, it is important to remember to reduce the CSP day rate by the daily rate of SSP to ensure employees are not overpaid.

For Example:

Employers who currently pay Company Sick Pay (CSP) from the 2nd, 3rd or 4th day of sickness, may want to amend the eligibility in line with the emergency legislation and pay from day 1.

Amendments can be made to contracts to change the payments to pay from day 1 of sickness. Please see WFM Release Note: Ability to Pay CSP from 1st, 2nd, or 3rd Day of Absence for more information.

Please note: If CSP is paid via manual payments, the entitlement for employees will not reduce, which may result in employees receiving more CSP than they are allowed.

Identifying Covid-19 Absences

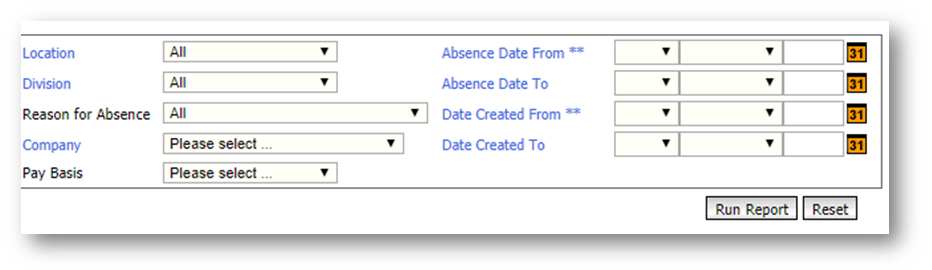

Within the HR module, there is a report called Absence Analysis which can be run to identify whether an employee is off work due to Covid-19.

- To run the Absence Analysis, go to HR Module > Reports > View Reports > Absence Analysis

Fig.7 - Absence Analysis

• Enter the criteria to search for, and select Run Report

The report will give details of all absences created, according to the selected criteria.

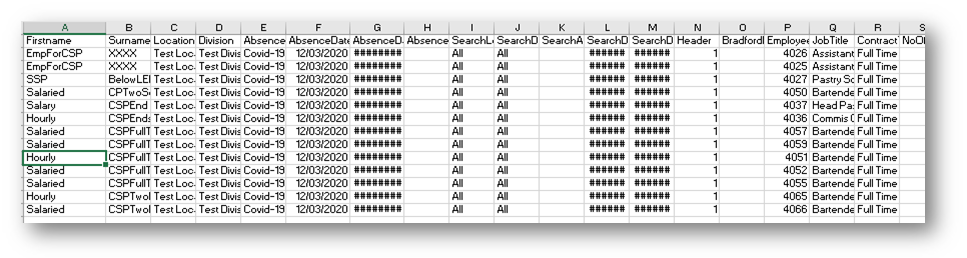

Fig.8 - Absence Analysis Report

There are many columns on the report. The main ones are listed below:

A – Firstname

B – Surname

E – Absence Type

F – Absence Start Date

G – Absence End Date

P – Employee Number

S – Number of days absence

T – Employee Type (Rota paid or non-rota paid)

U – Entitled to CSP

AA – SSP1 form required?

AE-AK – Days usually worked

AL – Is absence linked to a previous one?

AN – Waiting days

Filtering column E on the absence type that has been created to manage Covid-19 absences will show which employees need to be considered when calculating the first 3 days of SSP.

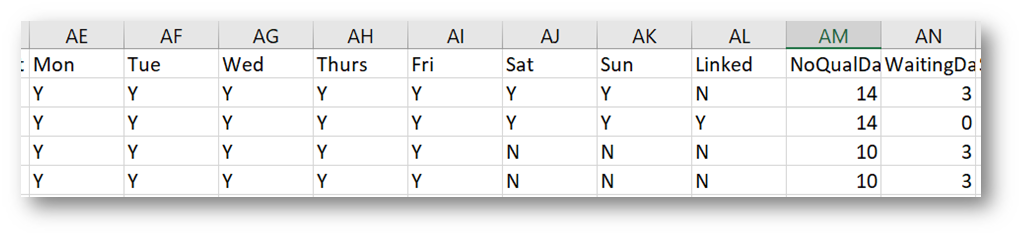

To understand whether employees require a manual payment for the first 3 days of SSP, look at Column AJ which will show the amount of waiting days required.

Fig.9 - Absence Analysis Report

If Column AJ shows 3 days, the employee should be paid the 3 days as a manual payment.

- To calculate the daily rate, use columns AE to AK to understand how many days the employee works per week

- Using the table below, find the SSP daily rate

- Amount due to be paid is Waiting days due x the daily rate

| Days worked per week | 2019/2020 | 2020/2021 |

| 1 | £94.25 | £95.85 |

| 2 | £47.13 | £47.93 |

| 3 | £31.42 | £31.95 |

| 4 | £23.56 | £23.96 |

| 5 | £18.85 | £19.17 |

| 6 | £15.71 | £15.98 |

| 7 | £13.46 | £13.69 |

If column AN shows a 0, then either:

- The absence is linked to a previous absence and the 3 waiting days do not apply

or

- The employee is not entitled to SSP

To confirm whether the employee is not entitled to SSP, look at Column AA to establish whether an SSP1 form is required.

Bureau Customers

Please contact your Payroll Specialist who will help you to process these absences and payments.

Comments

Please sign in to leave a comment.