The Multiple Employment functionality within the HR and Rota modules allows for the setup of secondary or multiple roles that an employee may work within other locations or divisions. This document will detail how these can be set up and how the cost of a salaried employee can be configured so it is charged to different divisions or locations.

HR Multiple Employment Setup

Global Settings and Configuration

There are a few settings that affect how Multiple Employments can be set up.

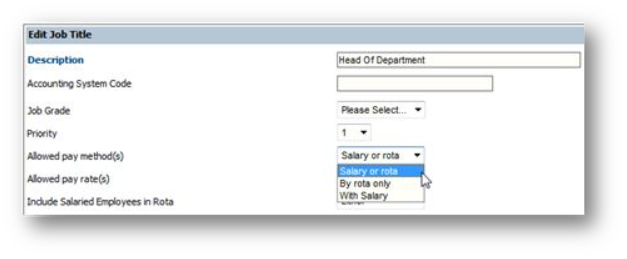

The first of these settings is within the Job Title setup. If a salaried employee is to have a Multiple Employment that is hourly/shift paid, it must first be ensured that the employee’s new secondary role has been configured to allow an hourly/shift rate and a salary.

- To do so, go to HR > Company Admin > Job Titles > select Job Title

Other settings which can affect setup are found in the HR Global Settings. These settings control if the employee’s main Job Title and Pay Rate are automatically available and used for a Multiple Employment in another location or division.

- Go to HR > Administration > Global Settings > Edit Default Employee Settings

Keep Employee Job Titles In All Locations.

If selected, this setting will make the employee’s main Job Title available in any other location or division when setting up a Multiple Employment. For example, a Supervisor could have a Multiple Employment within another location as a Supervisor, even if this Job Title had not been assigned to that location.

Keep Same Rate For Same Job Title In All Locations

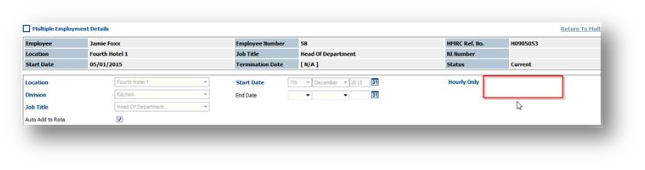

If selected, this setting will mean that an employee’s main rate of pay will be automatically applied to a Multiple Employment if the Multiple Employment is set up with the employee’s main Job Title in any location. An example of what this would look like on the Multiple Employment creation screen is shown in Fig.3, where there is no option to enter a pay rate.

How to Set Up a Multiple Employment

Within the employee’s HR record, there is the Multiple Employment screen. On this screen a list of any past or current Multiple Employments for the employee is visible with a summary of each one.

To create a new Multiple Employment:

- Go to HR > Employees > Employee List > select Employee > Employee HR Info > Multiple Employment > Create New Job

- On the next page, select Location, Division and Job Title for the employee’s extra role

- The option to enter an Hourly/Shift rate of Pay may be visible

Please note: Any salaried employee having a Multiple Employment created for a Job Title which can only be salaried paid will automatically have their main salary used as the rate of pay for the Multiple Employment.

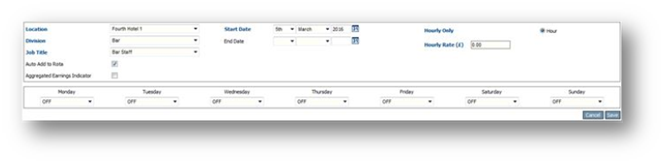

There are a number of other options that will need to be chosen as part of the process of setting up a Multiple Employment.

-

Auto Add to Rota – Tick this option for the employee’s Multiple Employment to be added to the rota automatically for the full duration of the employment

- If this is left un-ticked, the manager will need to add the employee to the rota using the Add Employee link found at the top right hand corner of the main Rota page

- Start Date – Enter the date of the first day that the employee will be working on the Multiple Employment. This field is mandatory

- End Date – Enter the date of the last day that the employee will be working on this Multiple Employment. This field is not mandatory and can be left blank for a long running role or one where the end date is unknown

- Shifts – If using set shift types and the employee’s shifts are known, these can be entered and will appear when they are added to the rota. This is a useful function for any employee that is due to work a regular shift pattern in another location or division.

Things to Consider

If an employee’s pay type is changed, from Salary to Hourly for example, it is important to review an employee’s Multiple Employments to ensure that any pay rates within these have changed accordingly. It may sometimes be necessary to end a Multiple Employment and create a new one so that the correct pay type and rate can be set up.

It is not possible to delete a Multiple Employment, so if one is created in error it will be necessary to enter an end date and then create a new job with the correct details.

Creating a Multiple Employment has no effect on the employee’s access. If the employee is a manager who requires access to multiple locations or divisions, this would need to be adjusted as normal using the ‘Assign Access Levels’ page within the employee’s HR record.

Rota Configuration, Scheduling and Cross Charging

Global Settings

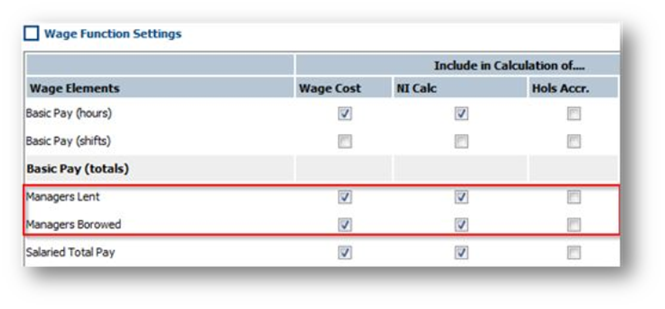

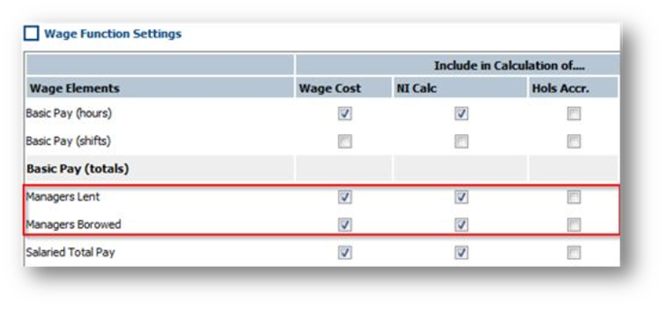

For the cost of a salary paid employee to be cross charged to different locations or divisions, ensure that the Wage Function Settings within the Rota module have been configured accordingly to calculate this.

Any hourly/shift paid employees will have their costs automatically charged to the location or division in which they are scheduled, so there is no extra configuration required for this.

- To change the Wage Function Settings, go to Rotas > Administration > Wage Function Settings

- For the relevant cost elements, select Managers Lent and Managers Borrowed

If the cost of salaried employees who are working across multiple divisions within the same location are to be cross charged, the Global Settings will need to be adjusted for this to be calculated.

- To do so, go to Rotas > Administration > Global Settings > Edit

Fig.7 – Cross Charge Multiple Employment Global Setting

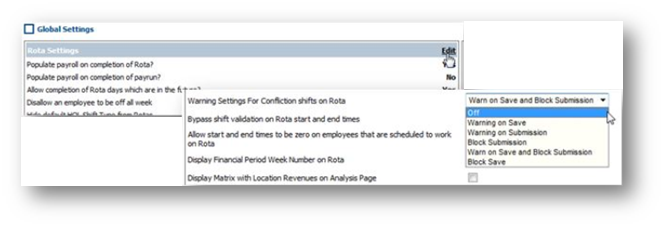

Where an employee is scheduled for two separate shifts over two different roles at the same time, on the same page as explained in the step before there will be a setting available to choose.

Information on what each of these settings mean can be found below:

-

Off – The manager will not be warned or prevented from saving the Rota or submitting the Rota to Payroll

-

Warning on Save – This setting will mean that the manager will be warned of any conflicting shifts at any point in which they save the Rota, however they will not be prevented from saving a page or submitting the Rota to Payroll

-

Warning on Submission – This setting will mean that the manager will be warned of any conflicting shifts at the point in which they try to submit the Rota to Payroll, however they will not be prevented from doing so

-

Block Submission – This will prevent the manager from submitting the Rota to Payroll, however will not provide any warning before this point

-

Warn on Save and Block Submission – This will warn the manager when saving the Rota, however will not prevent them from doing so. The manager will then be prevented from submitting the Rota to Payroll if they have not actioned this

-

Block Save – This will prevent the manager from saving the page, however if they do not have access to the division that needs to be corrected, they will be unable to correct it. We do not advise this option is used

Fig.8 – Warning for Conflicting Shifts Global Setting

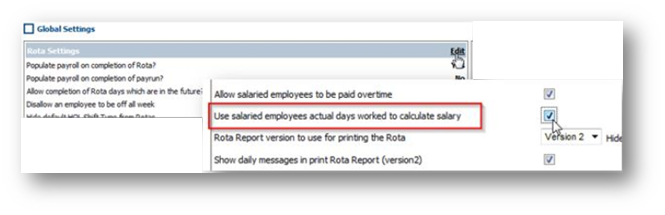

The separation of the cost of a salary paid employee across the week can also affect Multiple Employments.

The way in which this setting is configured does not prevent the setup of Multiple Employments, however it can affect the amount that is cross charged between different locations and divisions. It is a Global Setting and should be only be changed once consideration has been taken on how this would affect reporting across the business.

This setting can be found within the Global Settings, and the impact of it is further explained on following pages relating to cross charging.

Fig.9 – Use Salaried Employee’s Actual Days Worked to Calculate Salary Global Setting

Rota Scheduling

When scheduling hours for an employee on a Multiple Employment, the system will show each role as a separate line on the Rota. These will also be clearly marked by a symbol to help identify what type of Multiple Employment the role is.

A Multiple Employment that is for an employee working within the same location will show with a symbol next to their name as shown below.

Fig.10- Shows the symbol for Multiple Employment at own location

A Multiple Employment for an employee working in a different location to their main one, will show with a symbol next to their name as shown below.

Fig.11-Shows the symbol for Multiple Employment at a different location

Cross Charging of Salaried Employees

Based on the configuration explained previously, the system will add or deduct the salary cost for an employee based on where they are scheduled. All Cross Charging of salary costs are based on the days in which the employees are scheduled, and are not influenced by the number of hours scheduled.

If an employee has been scheduled in multiple locations for the same day, examples below will show what the effect is on the wage cost.

Employees Working Across Multiple Locations for Full Days

In all of the examples below the employee is paid £26,000 per year, therefore a weekly cost of £500 will be applied to Rotas.

In the following examples, the Global Setting has been set to use the employee’s actual days worked to calculate salary.

The below example shows an employee working 3 days within their home location and 2 days in another location. The home location has a total salary cost for the week of £300, which is 3/5ths of the employee’s weekly salary. In the Multiple Employment location, a cost of £100 per day (1/5th) will be added to the rota for the 2 days that the employee worked in that location.

Fig.12 – Analysis Report – Home Location

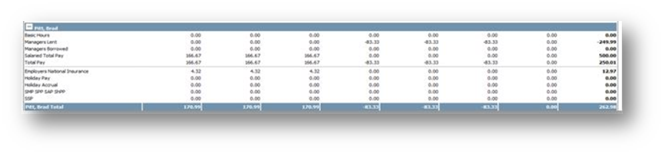

The below example shows an employee working 3 days within their home location and 3 days in another location. The home location has a total salary cost for the week of £250, which is half of the employee’s weekly salary. In the Multiple Employment location, a cost of £83.33 per day (1/6th) will be added to the rota for the 3 days that the employee worked in that location.

Fig.13 – Analysis Report – Home Location

In the following examples, the Global Setting has been set to not use the employee’s actual days worked to calculate salary. This means that the employee’s weekly salary is evenly split between all 7 days of the week.

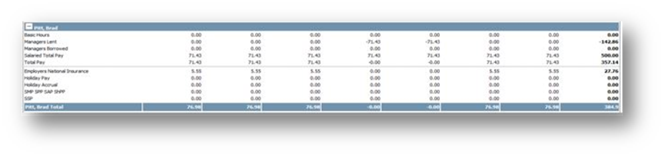

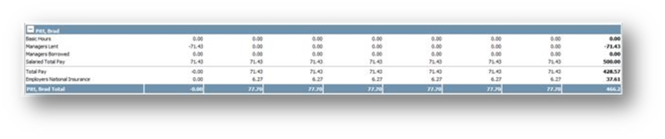

The below example shows an employee working 3 days within their home location and 2 days in another location. The home location has a total salary cost for the week of £357, which is 5/7ths of the employee’s weekly salary. In the Multiple Employment location, a cost of £71.43 per day (1/7th) will be added to the rota for the 2 days that the employee worked in that location.

Fig.14 – Analysis Report – Home Location

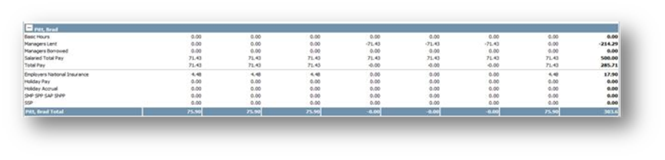

The below example shows an employee working 3 days within their home location and 3 days in another location. The home location has a total salary cost for the week of £285, which is 4/7ths of the employee’s weekly salary. In the Multiple Employment location, a cost of £71.43 per day (1/7th) will be added to the rota for the 3 days that the employee worked in that location.

Fig.15 – Analysis Report – Home Location

Employees Working Across Multiple Locations on the Same Day

In the example below the employee is paid £26,000 per year, therefore a weekly cost of £500 will be applied to Rotas.

When an employee works in multiple locations on the same day, the system will calculate and cross charge the salary as if every shifts worked is a separate day. This means that an employee working 5 days, but working 1 of those days in two different locations would be seen as working 6 days and the charge separated as such.

In the following examples, the Global Setting has been set to use the employee’s actual days worked to calculate salary.

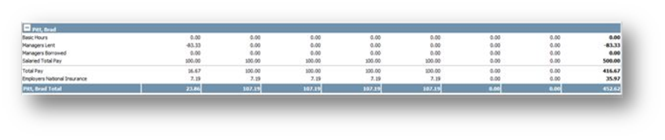

The following example shows an employee working 5 days within their home location, and working on one of those days in another location as well. The home location has a total salary cost for the week of £416, which is 5/6ths of the employee’s weekly salary. In the Multiple Employment location, a cost of £83.33 per day (1/6th) will be added to the rota for the 1 shift that the employee worked in that location.

Fig.16 – Analysis Report – Home Location

In the following examples, the Global Setting has been set to not use the employee’s actual days worked to calculate salary. This means that the employee’s weekly salary is evenly split between all 7 days of the week.

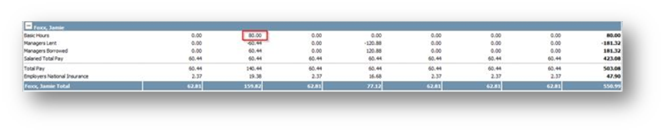

The following example shows an employee working 5 days within their home location and working on one of those days in another location as well. The home location has a total salary cost for the week of £428, which is 6/7ths of the employee’s weekly salary. In the Multiple Employment location, a cost of £71.43 per day (1/7th) will be added to the rota for the 1 shift that the employee worked in that location.

Fig.17 – Analysis Report – Home Location

Salaried Employees Working an Extra Hourly/Shift Paid Role

Within the business, there may be a need for some salary paid employees to work an extra role that is hourly/shift paid and the hours/shifts worked on this role would be paid on top of their salary.

This role would be treated separately to an overtime contract that would pay extra pay based on contracted or FTE hours.

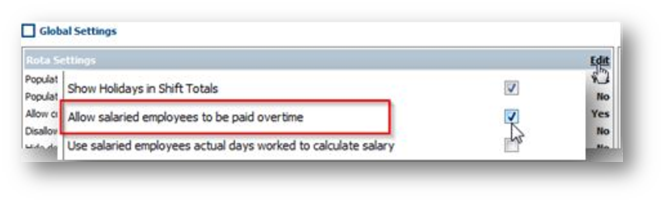

For employees in this situation to be paid an extra hourly/shift rate on top or their usual salary, a Global Setting must first be changed. Due to the impact of changing this, only Fourth are able to change this, so please contact the relevant Fourth contact to request that the below setting be changed.

Fig.18 – Allows Salaried Employees to be Paid Overtime through Global Settings

When setting up a Multiple Employment for an employee in this scenario, it must be ensured that the Job Titles for their current role and Multiple Employment role have been set up to allow an hourly/shift rate. This is explained in detail at the beginning of this article.

-

When setting up the Multiple Employment itself, ensure the Multiple Employment Job Title is different to the employee’s main role, and an hourly/shift rate is entered

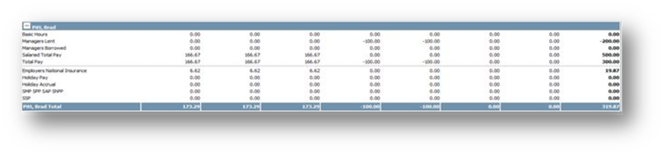

Once the Multiple Employment has been created, it will be necessary to schedule the employee in the usual manner. The cost will be added to the rota as shown below and the extra payment will feed into Payroll once the Rota has been submitted.

Fig.19 – Analysis Report

Things to Consider

For a salary cost to be correctly added to the Rota wage cost and cross charged to other locations, ensure that all locations have been correctly configured to include the salary of the particular Job Title(s) in the wage cost.

-

To do so, go to Rotas > Administration > Configure Locations > select Location > Edit Job Title Salary

If a Multiple Employment has an end date entered and shifts have been scheduled after this date, these shifts will be automatically removed.

If changing the setting to allow salaried employees to be paid an hourly/shift rate on top of their salary, all open Multiple Employments should be reviewed to ensure that any Multiple Employments that had previously been set up with the expectation that they would not result in extra payment, do not begin to pay an extra hourly/shift rate as a result of this change.

Please consult with the relevant Fourth contact for any queries on the reporting of cross charging of Multiple Employments within the Payroll module. Reports such as the ‘Cross Charge Journal’ or ‘Super Journal’ should allow for reporting and entering cross charges of salaries into the accounting system, however based on different versions that are available, please seek advice for more information about this.

Also See

Comments

Please sign in to leave a comment.