The Change

New functionality has been developed that will allow customers to report on Salary Sacrifice payments or deductions for an employee as well as store Pre and Post salary sacrifice figures for the employee.A salary sacrifice arrangement is an agreement between an employer and an employee to change the terms of the employment contract to reduce the employee's entitlement to cash pay. This sacrifice of cash entitlement is usually made in return for some form of non-cash benefit.

Statutory earnings-related payments such as SMP and SSP are calculated on cash earnings so will be affected by reductions in cash pay in return for non-cash benefits-in-kind. Whilst SMP and the other statutory payments must be based on cash earnings, employers can, of course, make payments over and above any statutory entitlement and may choose to base those additional payments on the original salary (often referred to as the 'notional' salary). The employer can only reclaim statutory amounts calculated on cash pay in accordance with the statutory payment rules.

How other salary-related payments are calculated is usually up to the employer to decide, for example occupational pension contributions, overtime rates, pay rises, etc. It is up to the employer to decide whether such payments should be based on a figure of notional salary or on the new, reduced cash salary. It is important that employees understand how a salary sacrifice may affect other payments and, where appropriate, unions are consulted in the construction of salary sacrifice scheme rules.

Release Date: 05-Nov-2014

Reason for the Change

With Automatic Enrolment becoming legislation, and the introduction of salary sacrifice pension schemes, the ability to report and analyse this information is a real benefit.Customers requested improved reporting functionality in the People System around how salary sacrifice is setup, to understand the impact to employees and how employers may wish to implement such schemes.

Customers Affected

All People Systems customers with the Payroll module enabled.Release Notes

Payment Types & Deductions

A new field, Salary Sacrifice, has been added to payment types and deductions.

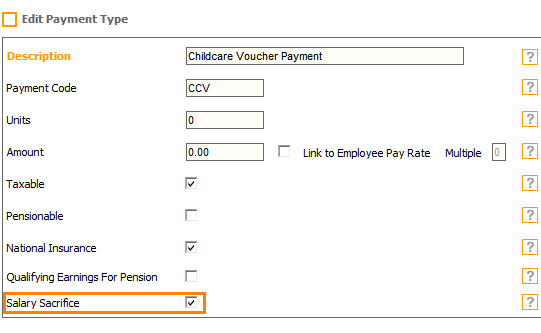

Fig 1 - Salary Sacrifice Field on a Payment Type

- Follow the path: Payroll > Administration > Payment Types > Edit or Create a Payment Type.

- If the ‘Salary Sacrifice’ field is set to yes upon saving, the system will check if the ‘National Insurance Field is also set to yes. If is not set to yes, the system will not save the changes.

- Salary sacrifice payment types reduce the National Insurance NI liability the Employee & Employer pays therefore the payment type must have the ‘National Insurance’ field set to Yes.

- There may be occasions when a certain benefit may not be subject to both tax and NI. If upon saving the ‘Taxable’ field is not set to yes, then the system will product the following warning: “This is a salary sacrifice reduction, please check if ‘Taxable’ should be set to yes”.

- As long as the National Insurance field is set to yes the change is saved.

NOTE: For Payment types, the salary sacrifice is entered as a negative payment, to ensure the tax and NI liability is reduced.

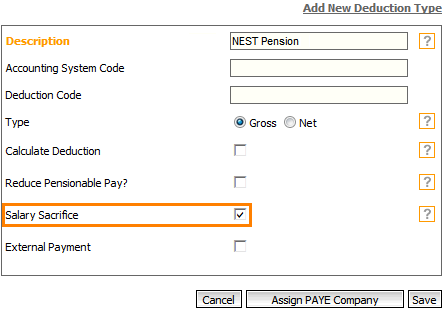

Fig 2 - Salary Sacrifice Field on a Deduction Type

- For deductions follow the path: Payroll > Administration > Deduction Types > Edit or Create a deduction type.

- Set the Salary Sacrifice field to Yes and ensure that the ‘Type’ field is set to “Gross” as the deduction should be made from gross pay.

Adding Salary Sacrifice Payment or Deduction Types to Employees

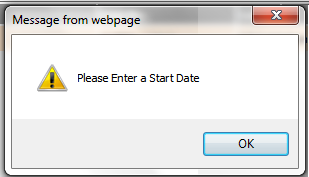

When creating new payment types or deduction types for an employee, where the salary sacrifice flag is set to yes, the start date of the payment / deduction type must be recorded. The start date will default to the start date of the current pay period. This will ensure the Employee’s salary sacrifice screen reports correct information.

Fig 3 - Enter a Start Date Warning Message

- On saving a warning message, “Please Enter a Start Date”, will be displayed if the start date is removed.

Employment Details Page

Salary Sacrifice Field & Link

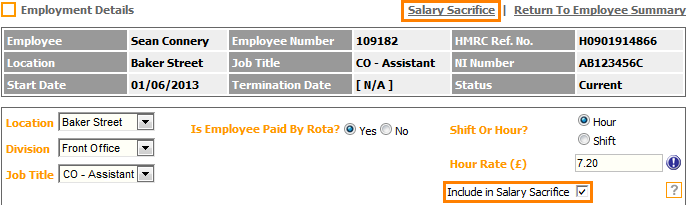

Fig 4 - Employment Detail Page with Salary Sacrifice Updates

- A new field, ‘Salary Sacrifice’, has been added to the Employment Details Page of an employee in both the HR and Payroll modules.

- Set this field to yes when setting up an employee if they will be participating in salary sacrifice scheme.

- After setting the field yes and saving, the system will show the ‘Salary Sacrifice’ link as shown in Fig 4 above.

- User permission permitting, it is possible to view this link in the HR and Payroll modules.

Salary Sacrifice Details Page

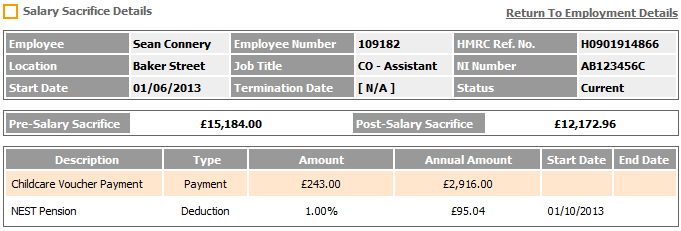

Fig 5 - Salary Sacrifice Details Page

- After clicking the link the Salary Sacrifice link, the Salary Sacrifice Details Page will be shown as Fig 5 above.

- The page shows real time data, it uses today’s date and the details held within the payroll module to calculation the data.

- Therefore if an amount for a payment or deduction type is changed, the changes will be reflected immediately on the salary sacrifice page.

- If the leave date is after today’s date, it will not be calculated in the post salary figure.

- Each of the columns are described below:

| Pre-Salary Sacrifice: | This field is updated by the Annual Salary. If the employee is paid either an hourly rate or shift rate, the system will use the [average weekly hours / shifts] from the holiday calculation multiplied by the Pay Basis type to calculate the annual figure. |

| Post Salary Sacrifice: | This field is updated by using the Pre-Salary Sacrifice figure and deducting the total annual salary sacrifice elements (displayed below). |

| Description: | The description is taken from the Payment type, Deduction type or Pension scheme, which has the salary sacrifice flag set to yes. |

| Annual Amount: | The annual amount is the payment type or deduction type multiplied by the employees pay basis type to calculate the annual amount. Eg: Child care vouchers flagged as salary sacrifice, the employee record displays the monthly amount as £243, multiply by 12 = £2,916. Where a % is recorded, the annual amount is the % from the Pre-salary sacrifice figure. This is from Pension Schemes, and the field is populated from the employee percentage record (if blank), the Worker group or Pension scheme. If at pension scheme level the contribution bands are used, these are deducted from the pre-salary sacrifice figure before the annual pension deduction is calculated. (see example below). |

| Start Date: | If a start date on the Payment / Deduction type / Pension Scheme is recorded, it populates this screen. |

| End Date: | If an end date on the Payment / Deduction type / Pension Scheme is recorded, it populates this screen. |

Example

| The employee paid £7.30 per hour, and works on average 40 hours a week, times by 52 = £15,184 (Pre Salary Sacrifice) Child Care Voucher of £243 x 12 monthly payments = £2,916.00 Pension is £15,184 - £5,676 (contribution band of £473 x 12) = £9,508 x 1% = 95.04 |

Reporting

Pension Reports

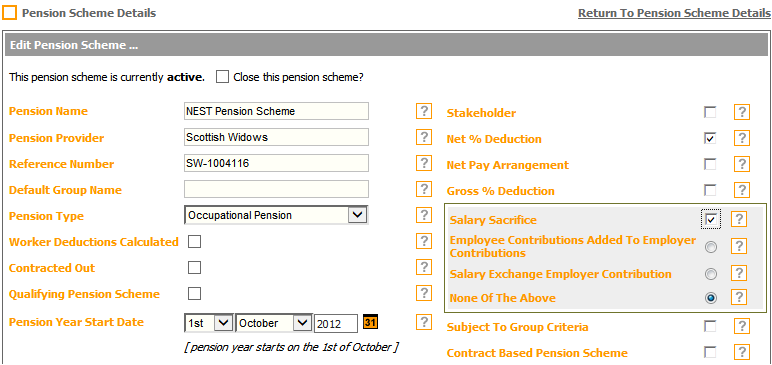

Fig 6 - Pension Scheme Details

- Additional fields are available when running reports if the ‘Salary Sacrifice’ field is set to yes for a pension scheme.

- To enable this follow the path: Pension > Administration > Pension Schemes > Edit > Enable the ‘Salary Sacrifice’ field.

- There are three additional fields:

1. Employee Contributions added to Employer Contributions

- If selected, when running Pension Exports / Pension Report, the Employee’s Pension Contributions are shown as 0.00 and the Employers Pension Contributions include the Employees and Employers Contributions.

- If not selected, the Employee’s Pension Contributions on the Exports / Reports, remain the same, and are displayed under the column “Employee Deductions”.

2. Salary Exchange Employer Contribution

- If selected, a new column appears on the Pension Exports / Pension Report named as above and the Employees’ Pension Contributions appear in this column.

3. None Of The Above

- If selected, no changes are made to the default pensions reporting.

- Select the desired radio button and click the “Save” button.

Export

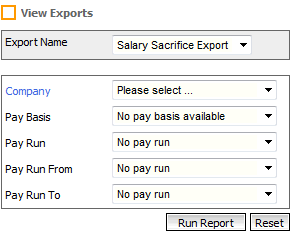

A new export has been created, which is viewable in HR or Payroll called “Salary Sacrifice”.

Fig 7 - Salary Sacrifice Export

- Follow the path: Reports > Exports > Salary Sacrifice.

- The report can be run for a specific pay period, or for numerous pay periods.

- A sample of the export is shown below.

| Employee Number |

HMRC Ref Number |

Surname | Forename | Pay Basis |

Location | Job Title |

Employment Start Date |

In Salary Sacrifice Scheme |

Pre Salary Sacrifice Amount |

Childcare Voucher Payment |

NEST Pension |

Post Salary Sacrifice Amount |

Payment Date |

Pay Period Number |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 109153 | H0901914833 | Test | One | Monthly | Test | Kitchen | 01-01-2000 | N | 3333.33 | 0 | -28.6 | 3304.73 | 26-12-2014 | 9 |

| 109153 | H0901914833 | Test | One | Monthly | Test | Kitchen | 01-01-2000 | N | 3333.33 | 0 | -22.88 | 3310.45 | 26-04-2014 | 1 |

| 109153 | H0901914833 | Test | One | Monthly | Test | Kitchen | 01-01-2000 | N | 3333.33 | 0 | -22.88 | 3310.45 | 26-05-2014 | 2 |

Alerts

Salary sacrifice cannot be deducted from statutory payments; therefore alerts have been developed to indicate when employees are on salary sacrifice and receiving a statutory payment. A list of the new alerts is shown below:

- Employee is on SMP and has the salary sacrifice flag set to yes on employment details page.

- Employee is on SAP and has the salary sacrifice flag set to yes on employment details page.

- Employee is on OSPP and has the salary sacrifice flag set to yes on employment details page.

- Employee is on ASPP and has the salary sacrifice flag set to yes on employment details page.

- Employee is on SSP and has the salary sacrifice flag set to yes on employment details page.

- Employee’s Niable pay is below LEL and has the salary sacrifice flag set to yes on employment details page.

- Employees NIable pay is above the UEL and has the salary sacrifice flag set to yes on employment details page.

Comments

Please sign in to leave a comment.