What’s Changing?

Additional functionality to calculate Class 1a National Insurance on termination payments exceeding £30,000.

Release date: 12th March 2020

Reason for Change

In April 2020, new rules about calculating Class 1A National Insurance on Termination Payments come into force.

Customers Affected

All HR & Payroll customers using the Payroll module.

Please note – the functionality will be available only after portals have been rolled forward into the 2020/2021 tax year

Release Notes

A new flag has been created within the Payment Type which, if ticked, will automatically calculate both tax and Class 1A National Insurance on any payments over £30,000.

To create a Termination Payment Type:

The payment type will then be available to assign to employees.

Employee Payments

When the ‘Termination’ Payment Type is used, it will show as normal against an employee record.

The calculation for both tax and Class 1A National Insurance is based on any amount over £30,000.

When Class 1A is calculated, it will show under 'Class 1A (Term Awards)'

Reporting

Further information regarding reporting will be released soon.

Additional functionality to calculate Class 1a National Insurance on termination payments exceeding £30,000.

Release date: 12th March 2020

Reason for Change

In April 2020, new rules about calculating Class 1A National Insurance on Termination Payments come into force.

Customers Affected

All HR & Payroll customers using the Payroll module.

Please note – the functionality will be available only after portals have been rolled forward into the 2020/2021 tax year

Release Notes

A new flag has been created within the Payment Type which, if ticked, will automatically calculate both tax and Class 1A National Insurance on any payments over £30,000.

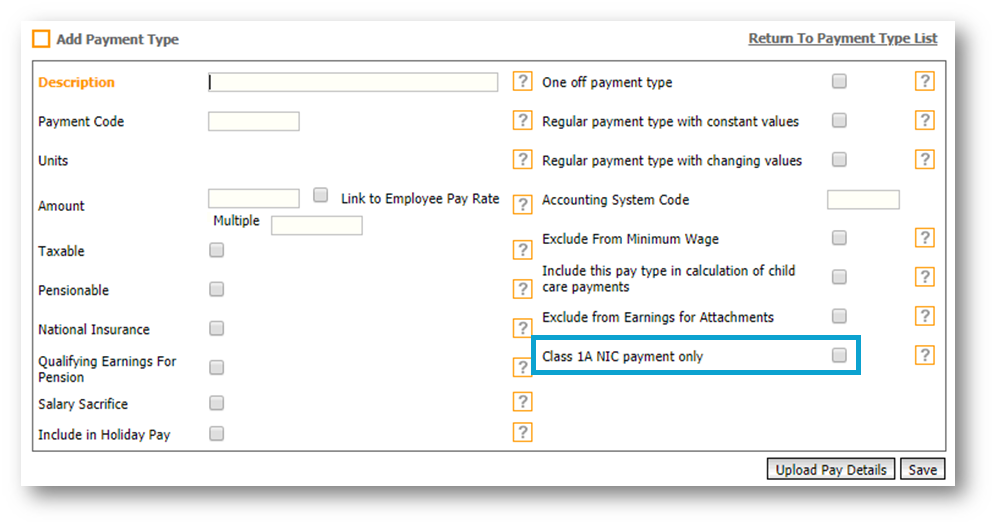

- To find the Payment Type flag, go to Payroll Administration > Payment types > Add New Payment Type

Fig.1 –New ‘Class 1A’ flag in Add Payment Type screen

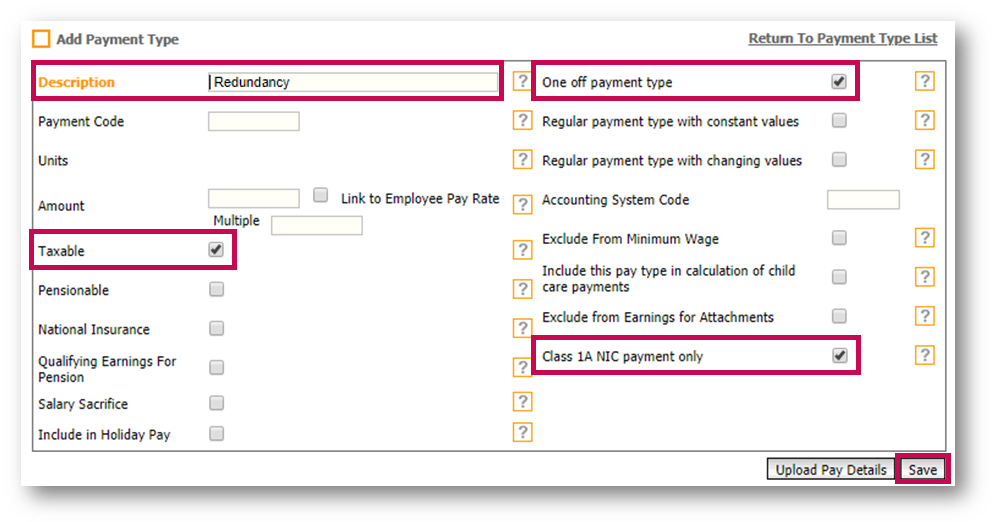

To create a Termination Payment Type:

- Enter a Description

- Tick Taxable

- Tick One off Payment Type

- Tick Class 1A NIC payment only

- Select Save

Fig.2 - Termination Payment Type

The payment type will then be available to assign to employees.

Employee Payments

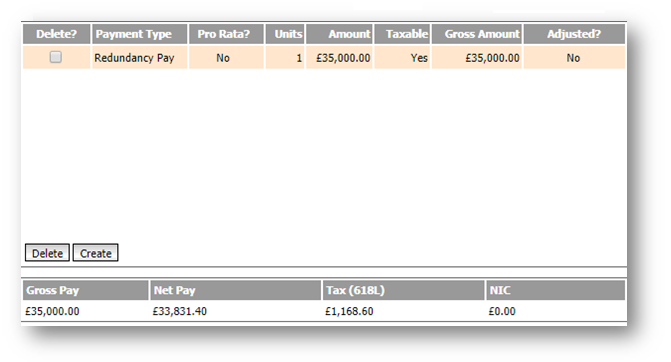

When the ‘Termination’ Payment Type is used, it will show as normal against an employee record.

- To view the payment go to Payroll > Pay Runs > Current Pay run list > select Pay Run

- Search for the Employee

Fig.3 - Employee Payment Type

The calculation for both tax and Class 1A National Insurance is based on any amount over £30,000.

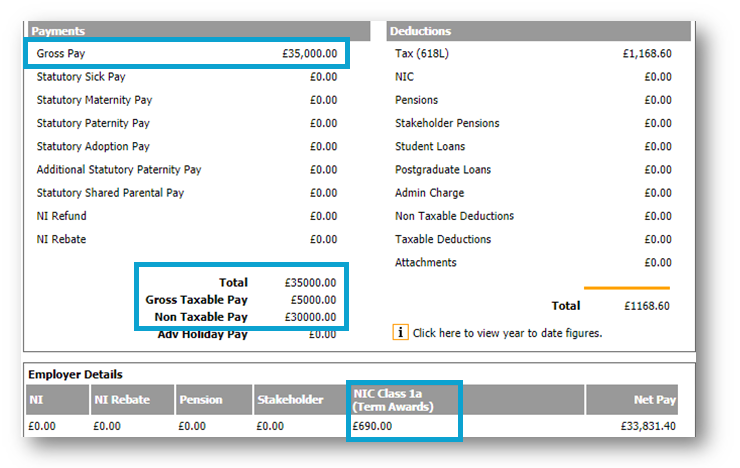

- To view the Class 1A and Tax, go to Summary

When Class 1A is calculated, it will show under 'Class 1A (Term Awards)'

Fig.4 - Employee Payroll Summary

Reporting

Further information regarding reporting will be released soon.

Comments

Please sign in to leave a comment.