What’s Changing?

The ability for P45s to be sent by email as a password-protected PDF. For customers not using Fourth’s current email payslip solution this will also include the employee’s final payslip as a separate password protected PDF.

Release Date: 26th October 2017

Reason for the Change

To allow employees to receive their P45 and final payslip securely via email.

Customers Affected

All payroll customers.

Release Notes

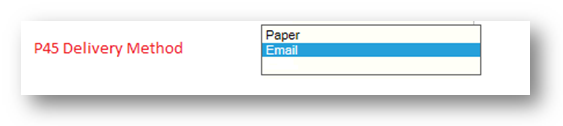

As per previous communication, the Company Pay Basis Details page has been updated to allow the user to set the P45 delivery method at Pay basis level.

- Go to Payroll > Administration > Company Setup > Select Company > View Pay Basis > Select Pay Basis

Fig.1 – P45 Delivery method options at Pay Basis level

As with Payslip Delivery Method, once set it will default to this delivery method for all new starters.

The 'Pay Basis' details page of an employee has also been updated to allow the user to set the P45 delivery method at employee level.

- Go to Payroll > Employees > Employee List > Select an Employee > Employee Payroll Info > Pay and Tax Details > select the required P45 Delivery Method

Fig.2 – P45 Delivery method options at Employee level

On the day of deployment the above delivery methods will be set to paper.

When set to 'Email' P45 delivery method, the system will use the personal email address of an employee to email them their P45 on the pay date of the employee.

Any employees set to 'Paper' will not be sent by the automated process and would either have to be manually triggered through the HMRC data exchange or updated from paper to email at employee level which will then be picked up in the following Payroll process.

There will be an automated and a manual process for the processing of P45s. The automated process will email out P45s and the manual process will email and print out the P45 based on the delivery method set at Employee Level.

Automated Process

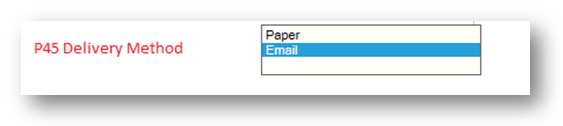

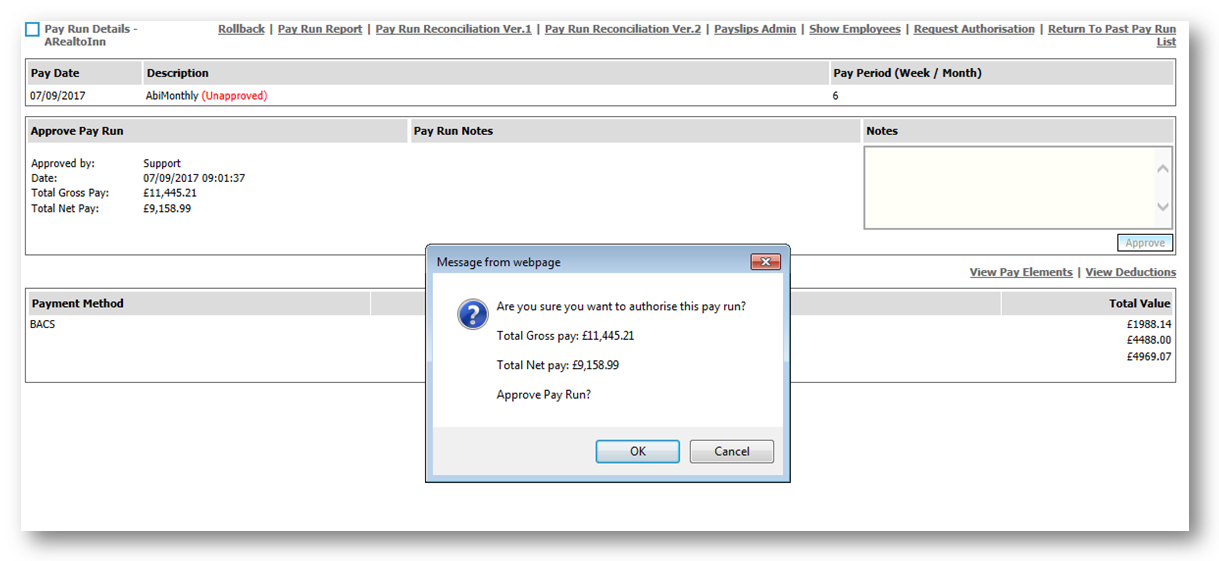

Customers using Fourth’s Payroll Approval process will, upon approving the Payroll, have a request generated for email P45s to be processed.

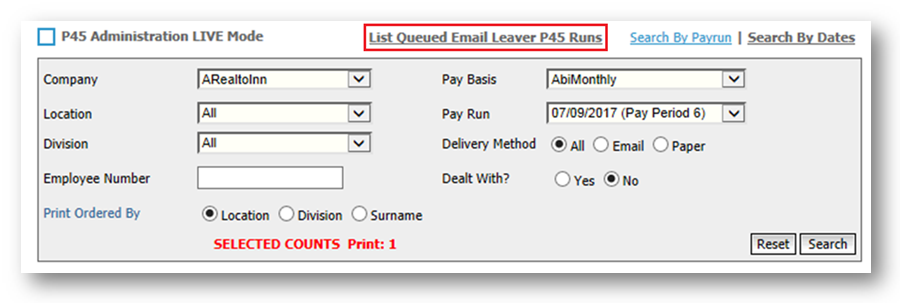

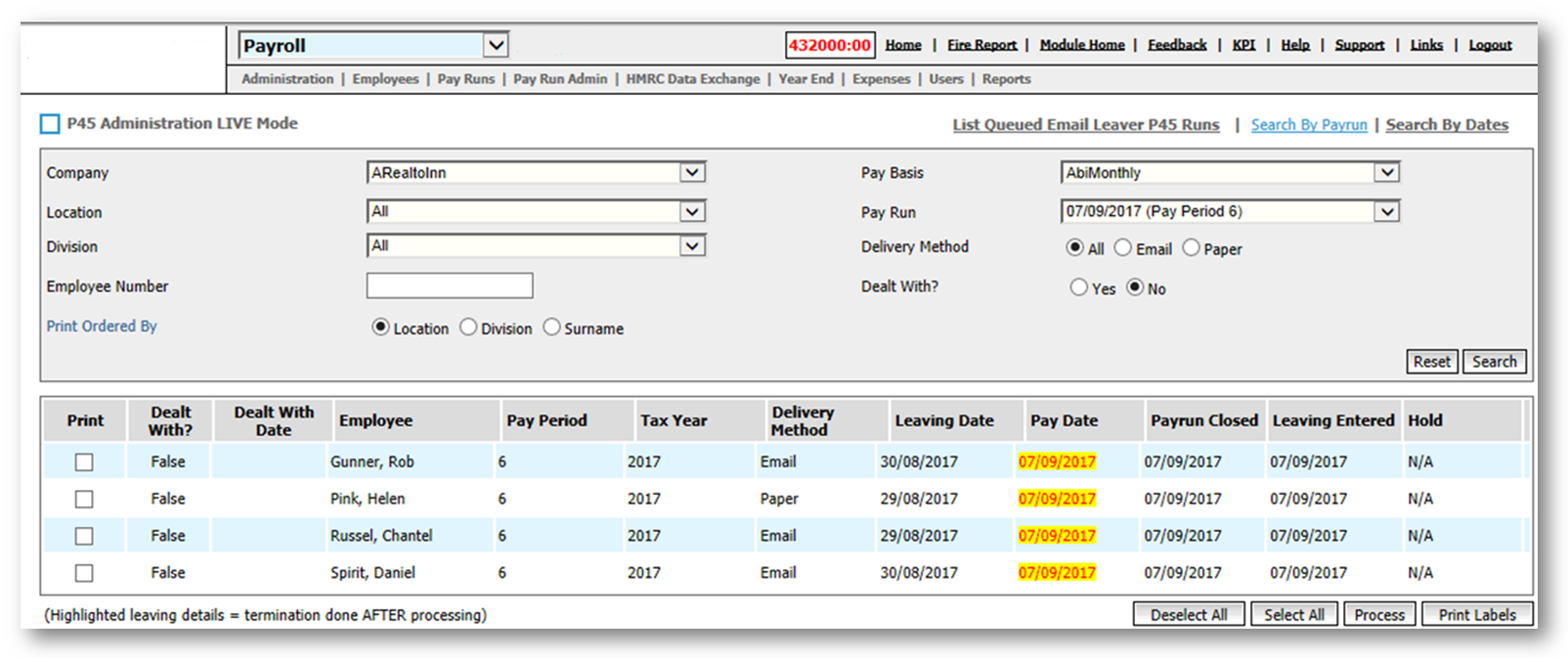

- Once created, this request can be viewed within Payroll > HMRC Data Exchange > P45 Administration > List Queued Email Leaver P45 Runs

Fig.3 – Authorise pay run message

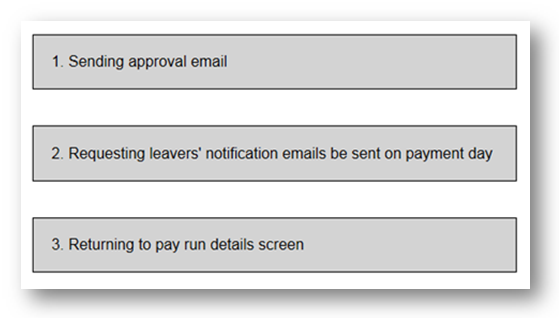

To ensure that the process is allowed to finish and the user does not request more than once the following messages, Fig.4 will be displayed on screen.

Fig.4 – Process status messages

Whilst the P45s are awaiting processing, they will be queued in Payroll > HMRC Data Exchange > P45 Administration

The List Queued Email Leaver P45 Runs link will only be displayed within this screen when a Company is selected.

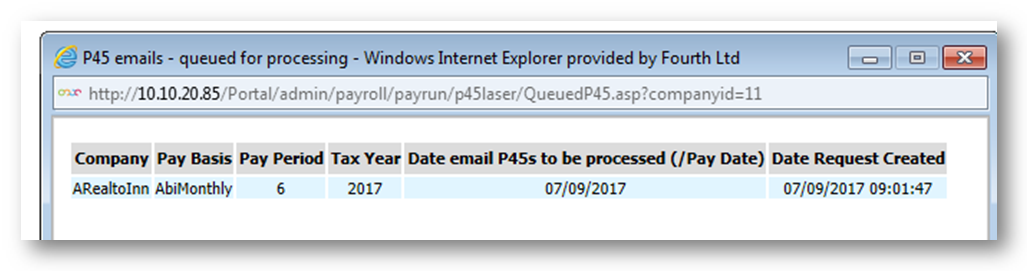

Any request that has not yet been processed will display within this link (Figs 5 & 6).

Fig.5 – List Queued Email Leaver P45 Runs

Fig.6 – P45 request queued

Once the P45s have been processed this request will be removed from this screen (see Fig.7)

Fig.7 – P45 request no longer showing

Manual Process

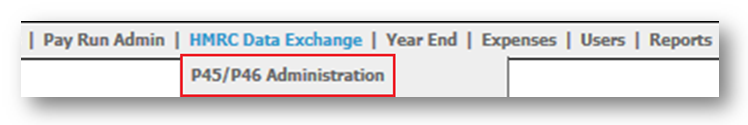

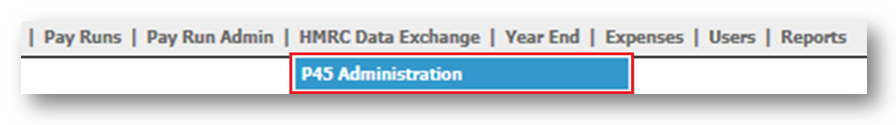

Payroll > HMRC Data Exchange > P45/P46 Administration has been renamed to Payroll >HMRC Data Exchange > P45 Administration

Fig.8 – Old P45/P46 Administration button

Fig.9 – New P45 Administration button

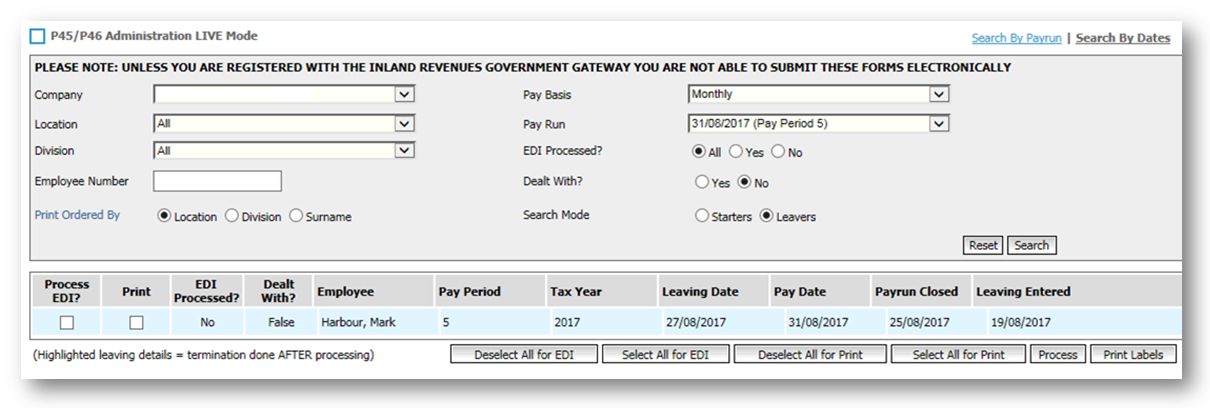

The P45/P46 Administration screen has been refactored to remove redundant functions and is now solely used for the processing of P45s.

Search mode and EDI processed options have been completely removed as this screen only relates to leavers and not starters.

Delivery Method has been added to allow the user to filter employees that are both email and paper or to select either email or paper employees to process.

The following columns/buttons have been removed:

- Process EDI?

- EDI Processed?

- Deselect All for EDI

- Select All for EDI.

The following Columns have been added:

- Dealt With date – This date is the date the P45 was printed or emailed

- Delivery method – This will show the employees P45 delivery method

Fig. 10 - Before

Fig.11 - After

As per Fig.11, some dates get highlighted. Any of the following columns could have dates highlighted in yellow:

- Leaving Date

- Pay Date

- Payrun Closed

The reason these employees get highlighted is to alert the user to the fact that these employees could be due a final payment in the following scenarios.

1.

Termination date < payroll closure date AND

Date employee was terminated > Payroll closed date

2.

Termination date < payroll closure date AND

Termination date < Date employee was terminated AND

The automated process will not email out these employees until the following pay run is approved. If the user wishes to email this out sooner they can do this manually through the HMRC Data Exchange > P45 Administration option within the system.

PDF Password

For security reasons the password or how the password is arrived at is not included in the email that leavers receive. The makeup of the password will be the employees Date of Birth in the format DDMMYYYY. So for example an employee with a DOB of 01/10/1985 would have a password of 01101985 to access both their P45 and final payslip that they receive.

Please Note: It will be the responsibility of customer Administration/Head Office to ensure that this is communicated internally as this information will not be given out via Fourth support channels to a leaver querying how to access their P45.

The email that is received by the employee will have the following text within it:

“Dear [employee name]

Please find attached your leaving document(s). Should you have any queries, please contact your previous employer. Please do not reply to this email address as this mailbox is not monitored.

If any technical issues are encountered with this process, please raise a Technical Case with our Support Team regarding the issue. To do so, either escalate to the member of your business who is responsible for raising cases with Fourth or raise a Technical Case in the Customer Community.

Comments

Please sign in to leave a comment.