Summary

| Feature 1 |

HMRC Generic Notification Service MessagingA new screen to help users manage messages from HMRC without having to log into their Government Gateway. |

Release date: 17th June 2021

HMRC Generic Notification Service Messaging

- Enabled by Default? - Yes

- Set up by customer Admin? - No

- Enable via Support ticket? - No

- Affects configuration or data? -No

- Roles Affected: - Admin Users

What's Changing?

A new screen is being added to the HMRC Data Exchange menu, where Generic Notification Service (GNS) messages from HMRC can be downloaded and displayed.

Reason for the Change?

To allow users to manage their GNS messages from the Payroll module, removing the need to log into Government Gateway.

Customers Affected

All customers using the Payroll module who have linked Fourth to their Government Gateway.

Release Note Info/Steps

- To view the new page, go to Payroll > HMRC Data Exchange > Generic Notifications (GNS)

Within the page, messages sent by HMRC over a specific date range can be viewed and downloaded.

Fig.1 - Generic Notifications (GNS) screen

- Select the Company

- Select the Message Type (to download all messages, leave as ALL)

- Select the message status - Unread, Read or All

- Select a Date Range

- Select Search

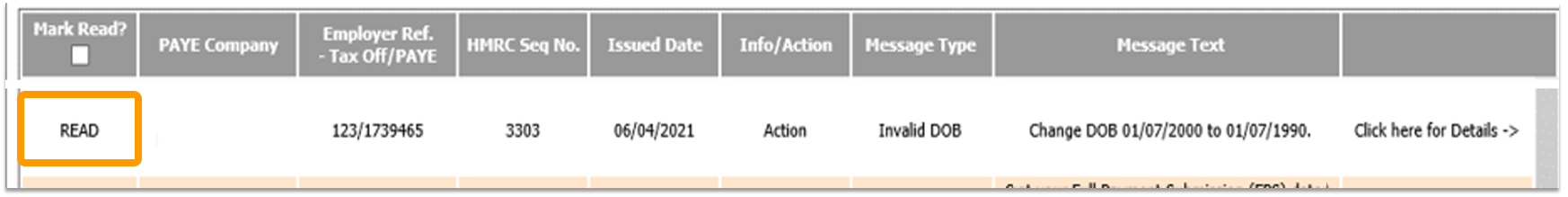

Messages will display onscreen, as shown in Fig.2. The actual message is shown under 'Message Text'.

- If the message text is too long to be displayed, use Click here for Details to view it in full

Fig.2 - Generic Notifications display

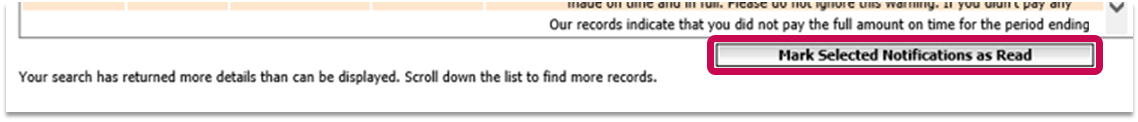

Once any notifications have been dealt with/actions taken, messages can be marked as 'read'.

- Tick Mark Read? against required message(s)

- Select Mark Selected Notifications as Read

Fig.3 - Mark Notifications as read

Fig.3 - Mark Notifications as read

Message status(es) will then change to show as 'READ'.

Fig.4 - Notification marked as 'READ'

Fig.4 - Notification marked as 'READ'

GNS Message Types

The choices when using the Message Type drop-down will depend on the messages available to view. Types will only display if that particular notification has been received from HMRC.

Message types include:

- Late filing notice

- First Plan Type Prompt

- Second plan Type Prompt

- No Student Loan deduction Prompt 1

- No Student Loan deduction Prompt 2

- Invalid DOB

- Late payment notice

- Incorrect use of National Insurance Category M

Student Loan Notifications

There are four types of Student Loan Notifications that will be sent via the GNS messages.

- A reminder to start deductions where an SL1/PGL1 has already been sent but there is no deduction on the FPS

- A notification to start a particular loan type, if the one reported on the FOS does not match the records held by HMRC

- A reminder to stop deductions, where an SL2/PGL2 has already been sent but there are still deductions on the FPS

- A notification to stop deductions for off-payroll workers or those receiving occupational pensions, where a contribution amount has been reported on a previous FPS

New Terms/Acronyms

-

- GNS Messaging - Generic Notification Service Messages - these are messages that are sent from HMRC to a company through the Government Gateway. They contain notifications relating to student loan types, late filing penalties and other related issues.

- FPS - Full Payment Submission

- SL1/PGL1 - Notification from HMRC to start Student Loan or Post Graduate Loan deductions

- SL2/PGL2 - Notification from HMRC to stop Student Loan or Post Graduate Loan deductions

Additional Resources

For more information about HMRC GNS Messages, please follow this link.

Comments

Please sign in to leave a comment.