What’s Changing

The average earnings and daily rate calculation stored within the Furlough Status screen is being updated with the new calculation from May 2021.

Proposed release date: 20th May 2021

Reason for change

HMRC updated their furlough guidance in April to detail the calculations for employees who qualify for furlough under reference date 2nd March 2021. Part of this guidance was a change to the average earnings calculation for 2019/2020, which has been used since the original guidance was released in 2020.

Customers Affected

All HR & Payroll users with the Furlough functionality enabled.

Information

Since March 2020, the average earnings calculation used for employees on Statutory Sick or Maternity Leave for the 2019/2020 tax year included days and pay.

For example, if an employee was off sick for 7 days, and received £92.05, these values would have been included in the total days and total pay used within the calculation

Version 1 Calculation

Total pay from 6th April 2019 to Furlough date 2020

÷

Number of calendar days from 6th April 2019 to Furlough date 2020

Version 2 Calculation

From May 2021, the guidance has changed so that these days should not be included in the calculation.

(Total pay from 6th April 2020 to furlough date 2020 - £92.05 SSP)

÷

(Number of calendar days from 6th April 2019 to Furlough date 2020 – 7 Sick days)

Considerations

- This change is applicable for furlough pay claimed from 1st May 2021 to 30th September 2021, for all employees whose average pay is higher than their ‘lookback’ pay (same period in 2019)

- In some cases, employees may notice a difference in the pay that they receive whilst on furlough

- More information can be found here

Release Notes

Once the new average pay has been calculated, the values will be uploaded for all relevant employees on their Furlough Status screen.

- To view the Furlough Status screen, go to HR > Employees > Employee list > select employee

- Select Furlough Status

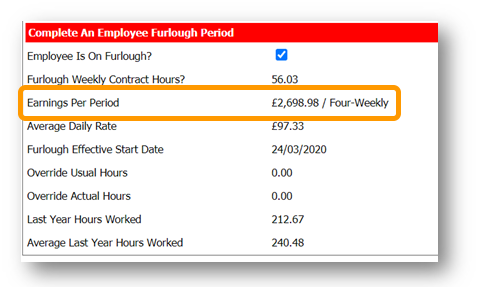

Fig.1 – Furlough Status screen

The ‘Earnings Per Period’ is currently populated with Version 1 of the Average earnings for 2019/2020 tax year.

Once this release is made, ‘Earnings Per Period’ will update with the new, Version 2 values.

Average Daily Rate

The ‘Average Daily Rate’ is calculated based on the ‘Earnings Per Period’ value. The value is divided by the number of days in the employee’s pay period.

For example, a four-weekly paid employee’s average daily rate will be calculated as follows:

Earnings Per Period

÷

28

Furlough Batch Update

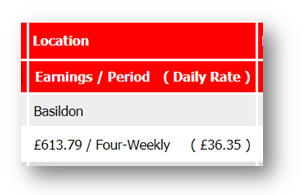

The ‘Earnings Per Period’ that are shown within the furlough Batch Update screens will also be updated with the amended value.

- To view the Furlough Batch Update screen, go to HR > Employees > Employee List > Batch update employees COVID19 Furlough status: Batch Update

- Select Furlough Periods > Started Initial Furlough Period

- Select Search

The Earnings Per Period Version 2 calculation will be displayed against the employee record.

Fig.2 – Earnings Per Period Version 2 calculation in an employee record

Furlough Status Export

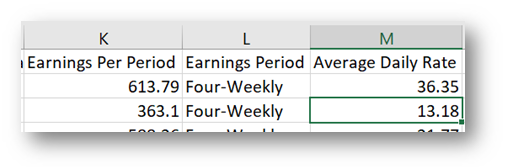

The values for ‘Earnings per Period’ within the Furlough Status Export will also display the Version 2 calculation.

- To view the Furlough Status export: From the Batch Update screen, select Furlough Status export

- Select the data to be returned

- Select Search

- Select Download Export

Fig.3 – Furlough Status Export

The data in columns K and M reflect the Version 2 calculation.

Further Information

The Version 1 calculation is not being removed from the database tables. The change effects where the fields within the furlough pages are pointing. The Furlough Status – list all furlough employees Export (that can be accessed via the payroll module) will be updated with both calculations in the future. Release notes will be published once this change has been made.

Comments

Please sign in to leave a comment.