Overview

Receipting orders can help with keeping track of stock levels, as well as invoices and credits from suppliers. It is possible to receipt a delivery as soon as the order is placed, but of course it is best practice to wait until the delivery is actually made so as to confirm exactly what goods have arrived.

This article will guide through the receipting process, depending on whether orders have been invoiced or not.

Pending Deliveries

- Go to the Stock Management tab to view all pending deliveries

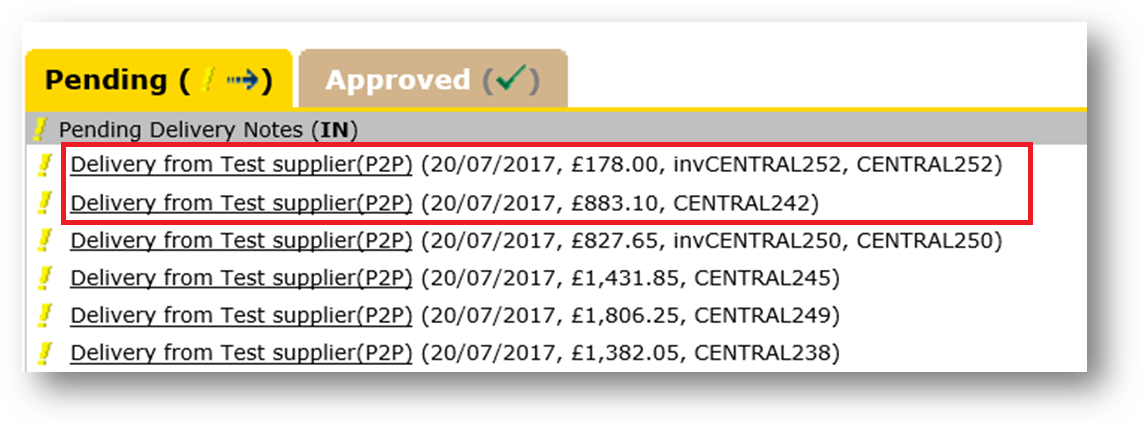

All pending deliveries will display, along with their original order date, NET value and original purchase order (PO) reference. If a delivery has been invoiced, the invoice reference number will also be shown.

As can be seen in Fig.1, the information is displayed in the following order:

Order date / NET cost / Invoice reference (if exists) / PO reference.

Fig.1 - Two deliveries on the Pending tab, one with an invoice reference number

Receipting a Delivery

- Select a delivery (invoiced or non-invoiced) from the Pending tab

If the delivery has been invoiced, the Invoice Number field will be auto-populated

Please note: Only one invoice can be placed against one Delivery/Goods Received Note (GRN). If receiving multiple invoices for a singular GRN/Delivery Note it will be required to create a manual delivery/GRN to insert the excess invoice. (This tends to only happen if the supplier uses multiple departments for purchases and require to invoice them seperately).

Invoices With no Discrepancies

The status field below the invoice number will show as Pending if there are no discrepancies.

It is advisable to check that the Invoice matches the Product details, as FnB assumes the goods ordered will match those delivered.

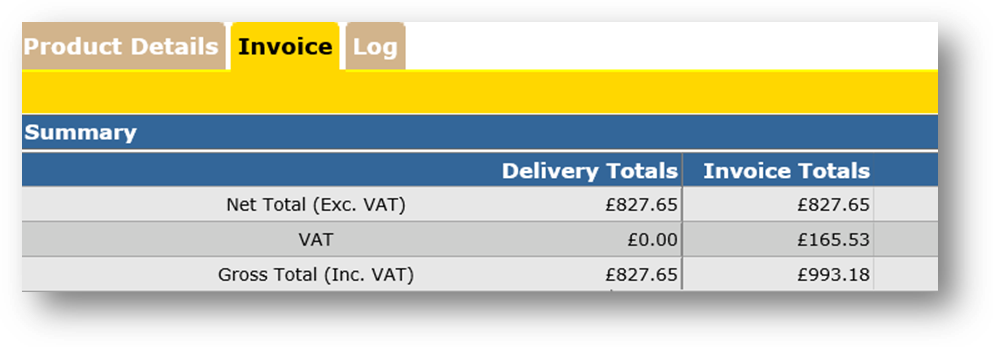

Fig.3 – The Product Details and Invoice tabs

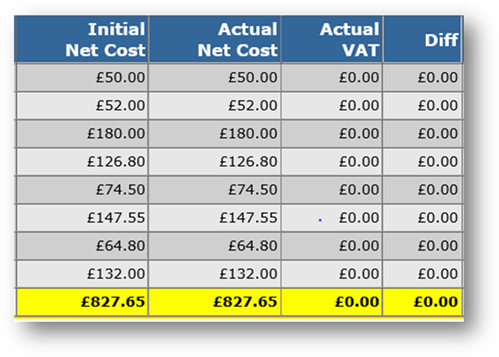

- Check the Net values match by switching between the tabs.

Fig.4 – The NET costs on the Product Details tab

- Check this information on the Invoice tab

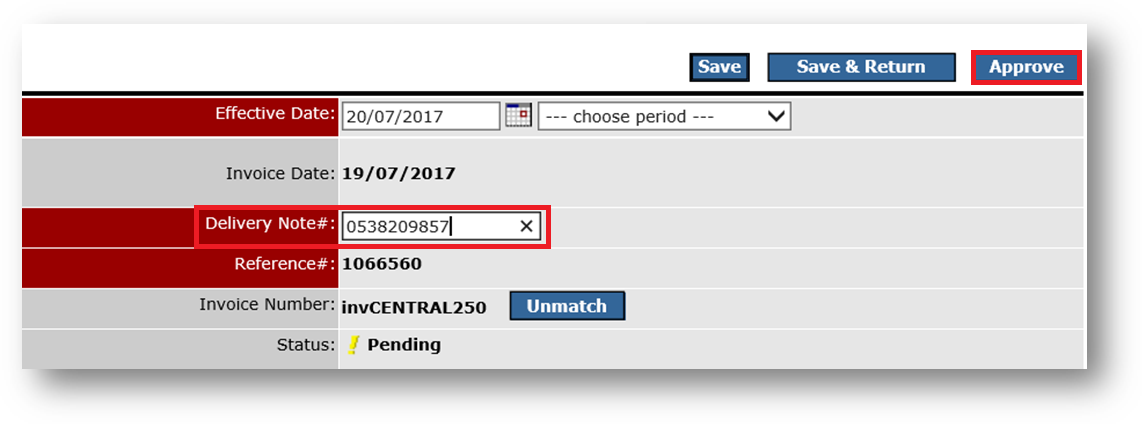

- If there are no changes to the goods actually received, record the Delivery Note# and Approve the delivery

Fig.6 – Adding a delivery note number and approving goods into stock

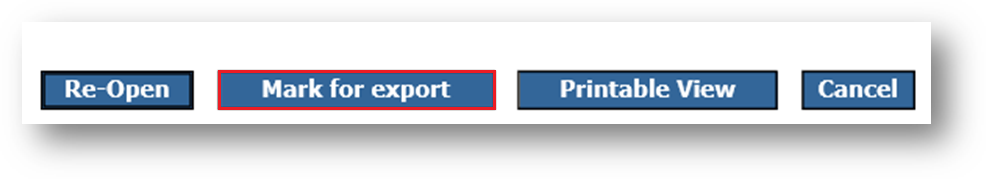

- The Invoice should then be Marked for Export

Fig.7 – The Mark for export button

Invoices which do not match the Product details tab

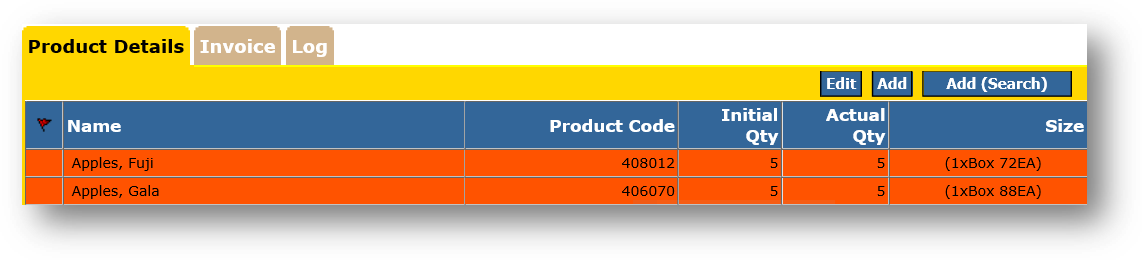

The Product Details tab lists ordered goods with quantities. FnB expects the same goods and quantities to be delivered.

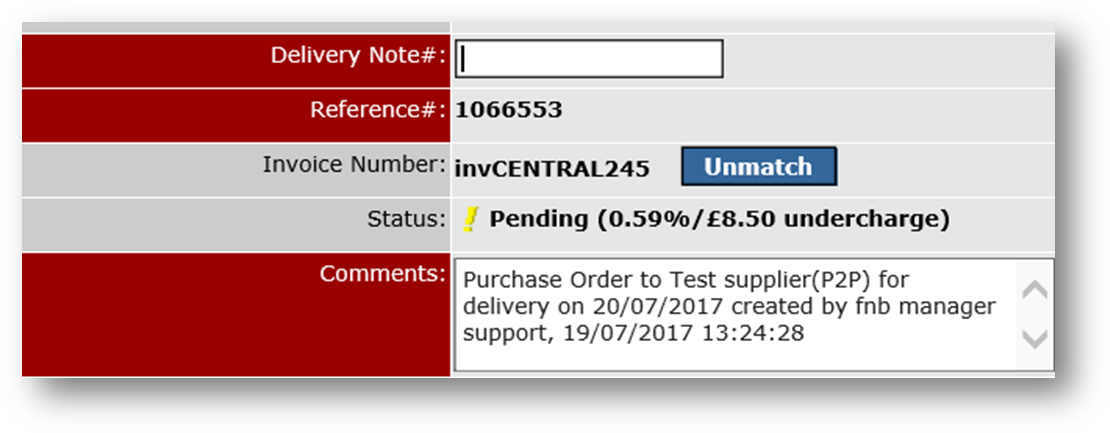

If the invoice Status field shows a discrepancy, this will be a change of quantity or cost of goods and will have to be reconciled.

Fig.8 – An uploaded invoice showing a discrepancy - an undercharge

Product lines with changes will also be highlighted.

Fig.9 – Highlighted product lines

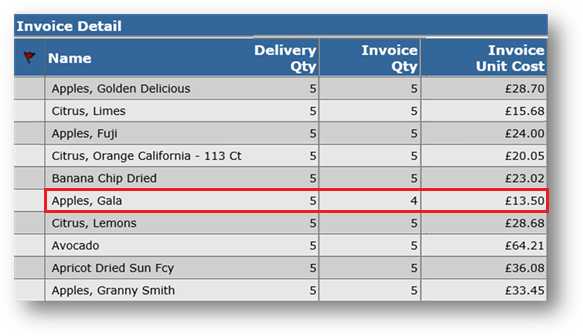

The details of these changes will be found on the Invoice tab.

- Move to the Invoice tab and take note of any differences

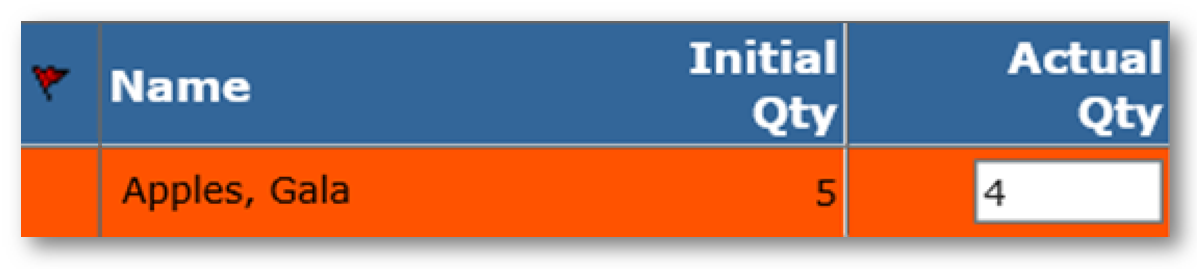

In this example (Fig.10) the Gala Apples are showing with a variance.

Fig.10 – Variance between Delivery and Invoice quantities on the Invoice tab

- Once the variances have been noted, navigate back to the Product Details tab and use the Edit option to update the quantities

Fig.11 – Updating quantities received

Once quantities have been amended, any cost variances can be balanced out.

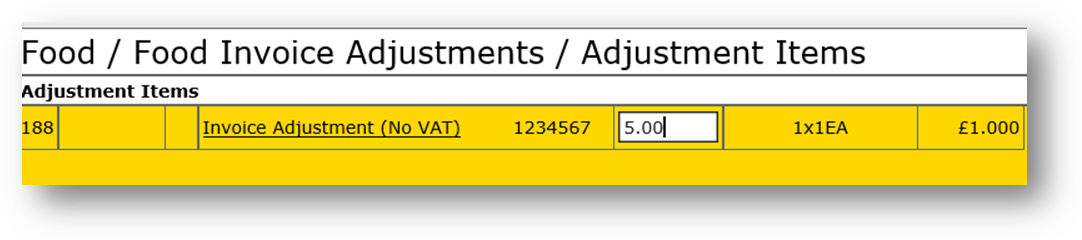

- Use the Add option to add additional costs and balance the product details to the invoice

FnB will open the supplier’s product list. To adjust the cost of an invoice, the Invoice Adjustment should be used.

Invoice Adjustments show as a ‘Dummy’ product, with its own category.

- Add the difference in cost and move to Next

Fig.12 – Adding a difference in cost to an Invoice Adjustment

Once the Invoice has balanced, the status will show as ‘Pending’.

- The delivery note number can then be added and the delivery approved

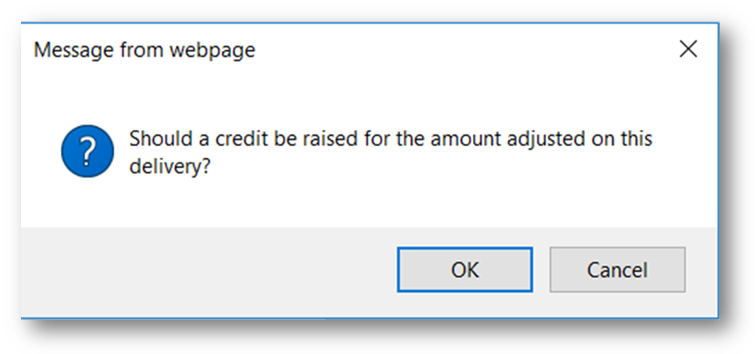

- When Approve is chosen, FnB will prompt the creation of a credit for the adjustment.

Fig.13 – The system prompt to raise a credit request

- If the difference in cost is an overcharge, select OK

- If the cost increase is genuine, select Cancel and no credit request will be raised

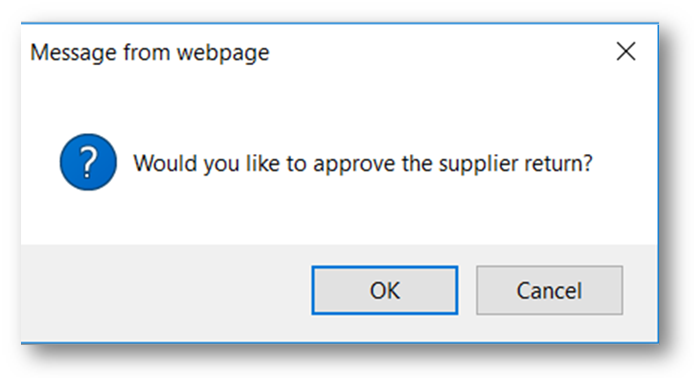

If OK is selected, the system will ask if the ‘Supplier Return’ should be approved.

Approving a supplier return will adjust the cost of goods purchased and ensure the cost of goods received matches the cost applied to the stock period.

It is advisable to approve any returns.

Fig.14 – The option to approve or cancel a return

The system will refresh showing the approved supplier return.

When the credit arrives from the supplier, it can be reconciled by following the regular reconciliation procedure.

Invoices are added after a delivery has arrived and the goods approved into stock.

The supplier will not always upload an invoice before a delivery arrives.

In this instance, the goods should be received and the delivery approved.

- Use the Edit and Add options to balance out the quantities of goods received

- If the delivery note states costings, balance these out using the invoice adjustments

- Approve the delivery into stock

The delivery will show under ‘Approved’ green tick.

When the invoice is uploaded, and matches the delivery note, it will show in the Approved tab with a yellow box around the green tick. This means it has been auto-marked for export.

If the invoice does not match the delivery, the delivery will show with the invoice uploaded but will not be marked for export.

Fig.15 – Invoices both marked and not marked for export

The delivery will need to be re-opened and the process of Edit and Add followed to match the invoice to the Product Details tab.

When the delivery has been balanced against the invoice, approve and follow the ‘credit request’ process.

Comments

Please sign in to leave a comment.