What’s Changing?

The ‘Existing Furlough Payments’ (August to October 2020 Onwards) export has been amended to accommodate the extension to the Coronavirus Job Retention Scheme (CJRS) beyond October 31st 2020.

- The export name has been amended to be called Furlough Payments (August 2020 Onwards)

- The export can now be run for dates beyond October 31st 2020

Release date – 12th November 2020

Reason for change

On 5th November 2020, the UK Government announced that the CJRS will be extended across the UK until the end of March. The original export was developed to calculate the CJRS claim up to the end of October 31st 2020.

Customers Affected

All HR & Payroll customers using the Payroll module.

Information

CJRS claims will involve:

- 80% of furloughed hours paid by the Government

- Employers to pay employer National Insurance and pension contributions

Release Notes

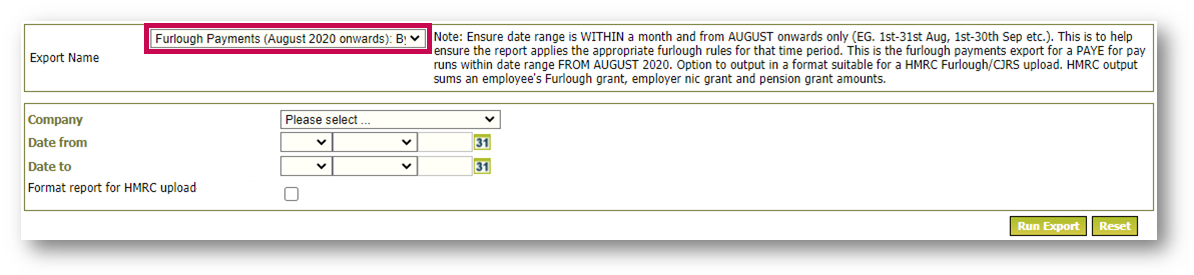

The existing Furlough Payments (August to October 2020 Onwards) export has been renamed and is now called Furlough Payments (August 2020 Onwards).

- To view the export, go to Payroll > Reports > Exports > Furlough Payments (August 2020 Onwards)

Fig.1 - Furlough Payments (August 2020 Onwards) export

Fig.1 - Furlough Payments (August 2020 Onwards) export

The export can still be run, if required, for August, September and October using the relevant calculation for the period. The change made now allows for the export to be run for November and beyond if required.

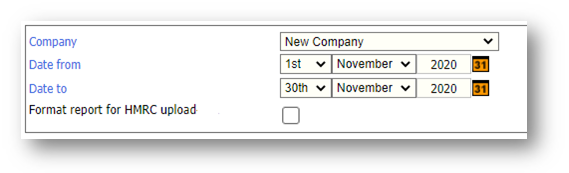

- To run the claim export for November, select the Company

- Select the Date from (the date must fall in November)

- Select the Date to (the date must fall in November)

- Select Run Export

Fig.2 - Selecting Company and Dates

The Export will show the following fields:

- Employee Number

- First name

- Surname

- NI Number

- HMRC Reference

- Location

- Division

- Pay Basis

- Pay Frequency

- Pay Date

- NI Category

- Furlough Payment Gross Total (total of payments flagged as a furlough pay type)

- Total ER NIC

- Furlough ER NIC (will be zero)

- Furlough AE Contributions (will be zero)

- Niable Pay

- Pensionable Pay

- ER Pension

- Total Furlough days in the period

- EE Furlough start date

- EE Furlough End Date

- Pay Period start date

- Pay Period End date

- Normal Hours

- Actual Hours

- Furlough Hours

- Total Furlough Days

- Furlough Gross Full Pay Run

- Normal Hours Full Payrun

- Actual Hours Full Payrun

- Furlough Hours Full Payrun

- Hs Override Used?

The information towards the end of the export is used to calculate the pro-rata amounts for the days within the claim period where a pay period spans two claim periods.

HMRC Claim Template

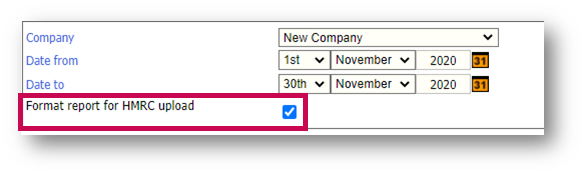

As with the previous version of the export, it is possible to run the same data as above, but in the template that is required for submission to HMRC using their claim portal.

- To run the HMRC template, select the Company

- Select the Date from

- Select the Date to

- Tick the box against Report Format for HMRC Upload

- Select Run Export

Fig.3 - Format report for HMRC upload

The export will show the following fields:

- Employee Name

- Employee National Insurance Number

- Employee Number

- Furlough Start Date

- Furlough End date

- Employee Claim Amount

- Normal Hours

- Actual Hours

- Furlough Hours

This export can be downloaded and used to upload into HMRC’s claim portal for claims for 100 or more employees.

Further Information

Further details about the CJRS Claim export can be found in the two articles below:

WFM – Flexible Furlough – CJRS2 Claims

WFM Release Notes – Employer Claim Export – July 2020 Onwards

Comments

Please sign in to leave a comment.