What’s Changing?

A new export is being added to the Payroll module to help with furlough claims in line with the new HMRC guidance from July 2020.

Proposed release date: 17th July 2020

Reason for the Change

The way that employer claim calculations are calculated is changing from 1st July 2020. This new export will help customers with their Coronavirus Job Retention Scheme (CJRS) claims for July, August, September and October 2020.

Customers Affected

All customers using the Payroll module and the Furlough functionality.

Information

From July 1st 2020, the export will use new calculations and will contain different information due to the change in guidance from HMRC.

For July, the employee claim amount within the export will be the total of the furlough pay, the employer National Insurance and the employer pension.

From August onwards, the employee claim amount will be the furlough pay only.

The calculations for this claim export can be viewed in Flexible Furlough Scheme - July 2020 Guidance

Release Notes

Normal, Actual and Furlough Hours

The new export includes some different fields in order to record Normal Hours, Actual Hours and Furlough Hours.

Normal Hours

The HMRC guidelines state that the calculation of usual hours should be done for each claim period.

For Salaried employees, it should be their contracted hours divided by 7 days, multiplied by the number of days in the claim period.

For Variable hours employees, it should either be the average hours for the 2019/2020 tax year, or the hours for the same period, previous year – whichever is higher.

The export will automatically populate the Normal Hours field, using HMRC’s guidelines (as shown above), so the data will be correct according to the information within employees’ records. All calculations used rely on the hours and holidays being processed through the rotas. Some employees may have incorrect figures if, for example, they have periods of time not included in a rota.

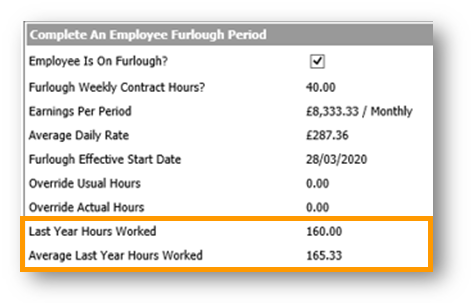

- To view the current period’s average hours and same period/previous year hours for an employee, go to HR > Employees > Employee List

- Search for and select an Employee and then select Covid19 Furlough Status

Fig.1 – Example last year and average last year hours worked for an employees

Both ‘Last Year Hours Worked’ and ‘Average Last Year Hours Worked’ will prorate automatically within the claim export according to the number of days in the claim period.

Please note – If an employee is salaried and not included in the rota, these fields will display as zero.

Should the calculated hours or last year hours be incorrect (due to employees not being setup correctly or customers have not used Fourth’s rotas for over a year), there is an upload functionality available which will override the system calculations.

Please see https://help.hotschedules.com/hc/en-us/articles/360045339332-WFM-Release-Note-Upload-Usual-and-Actual-Hours-for-Flexible-Furlough-Claims for more information.

- When overriding the hours, make sure that the hours being uploaded are the prorated amount for the number of days in the claim period. According to HMRC guidelines, take the weekly amount, divide by 7 and multiply by the number of days in the period

- Should a pay date cover a range that spans 2 months (July and August for example), upload the July hours only against the pay date, then after the July claim export has been run, upload the August hours against the pay date to run the August Claim export

Actual Hours

Actual hours will be taken from the hours that are entered into the rotas, Labour Productivity or Advanced Schedules for both hourly and salaried employees.

For customers who don’t use Workforce Management to record hours worked, there is an upload functionality available which will override the system calculations.

Please see WFM Release Note - Upload Usual and Actual Hours for Flexible Furlough Claims for more information.

- When overriding the hours, make sure that the hours being uploaded are the prorated amount for the number of days in the claim period. According to HMRC guidelines, take the weekly amount, divide by 7 and multiply by the number of days in the period

- Should a pay date cover a range that spans 2 months (July and August for example), upload the July hours only against the pay date, then after the July claim export has been run, upload the August hours against the pay date to run the August Claim export

Furlough Hours

Furlough hours will be calculated by the export using the usual hours minus the actual hours.

Employer Claim Export from July 2020 Onwards

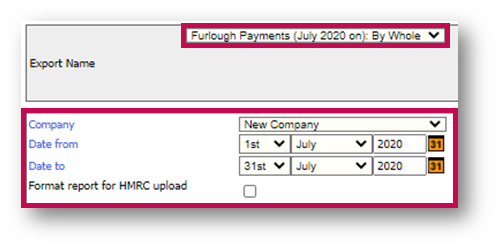

A new export has been added to the list of exports within the Payroll module.

- To access the new export, go to Payroll > Reports > Exports > Furlough Payments (July 2020) By whole Month Date Range

- Select the Company

- Select the From and to dates (start and end dates must fall within the same month)

- Select Run export

Fig.2 – Running the Furlough Payments (July 2020) By whole Month Date Range export

The export will show the following fields:

- Employee Number

- Firstname

- Surname

- NI Number

- HMRC Reference

- Location

- Division

- Pay Basis

- Pay Frequency

- Pay Date

- NI Category

- Furlough Payment Gross Total

- Total ER NIC

- Furlough ER NIC

- Furlough AE Contributions

- NIable Pay

- Pensionable Pay

- Total furlough days in period

- Employee Furlough Start Date

- Employee Furlough End Date

- Pay Period Start Date

- Pay Period End Date

- Report start-end date

- Company Name

- PAYE Reference

- Tax Office

- Normal Hours (for claim period)

- Actual Hours (for claim period)

- Furlough Hours (for claim period)

Because the claim export can now only be run for dates within a single month, the calculation is done using the number of days in the claim month.

The export will also display:

- Full Name

- Total Furlough days in full payrun

- Furlough Gross for full payrun

- Furlough ER NIC for full payrun

- Furlough Pension Full Payrun

- Normal Hours full payrun

- Actual Hours full payrun

- Furlough Hours full payrun

- Hrs Override used?

HMRC Upload Template

For employers who have 100 or more employees on furlough, the HMRC upload template can be used.

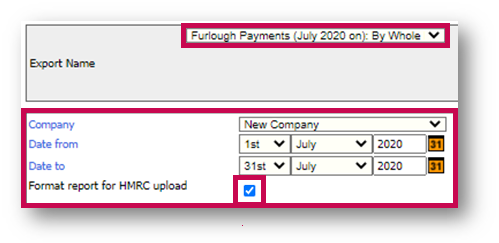

- To run the HMRC Upload template, go to Payroll > Reports > Exports > Furlough Payments (July 2020) By whole Month Date Range

- Select the Company

- Select the From and to dates (start and end dates must fall within the same month)

- Select Format report for HMRC upload

- Select Run export

Fig.3 – Running the Furlough Payments (July 2020) By whole Month Date Range export, formatted for HMRC upload

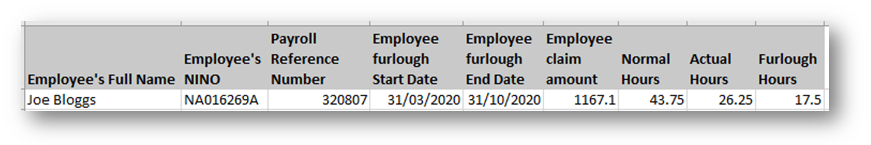

The export will show the following fields:

- Employee’s Full Name

- Employee’s NINO

- Payroll Reference Number

- Employee Furlough Start Date

- Employee Furlough End Date

- Employee Claim amount

- Normal Hours

- Actual Hours

- Furlough Hours

Fig.4 – Example HMRC-formatted export

Fig.4 – Example HMRC-formatted export

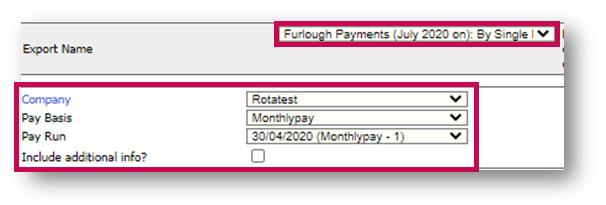

Furlough Payments (July 2020 on) by Single Pay Run

The export can be run by pay run, to make reconciliations easier.

- To access the new export, go to Payroll > Reports > Exports > Furlough Payments (July 2020) By single payrun

- Select the Company, Pay Basis and Pay Run

- Select Run export

Fig.5 - Running the Furlough Payments (July 2020 on) by Single Pay Run export

The export will show the following fields:

- Employee Number

- Surname

- Firstname

- NI Number

- HMRC Reference

- Location

- Division

- Pay Basis

- Pay Frequency

- Pay Date

- NI Category

- Furlough payment Gross Total

- Total ER NIC

- Furlough ER NIC

- Furlough AE Contributions

- NIable Pay

- Pensionable Pay

- Normal Hours

- Actual Hours Furlough Hours

Comments

Please sign in to leave a comment.