What’s Changing?

New functionality to allow the calculation of Flexible workers’ holiday allowance and pay to be done over 52 weeks, in line with new legislation.

Release date: 12th March 2020

Reason for the Change

New Legislation will come into force on 6th April 2020 as part of the ‘Good Work Plan’ whereby holiday allowance and pay for Flexible employees must be calculated over a 52 week period.

For more information about the Good Work Plan, please see: https://www.gov.uk/government/publications/good-work-plan

Customers Affected

All HR & Payroll users.

Release Notes

Configuration

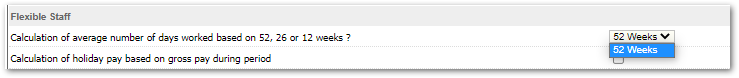

To switch on the 52-week holiday calculation:

- Go to HR Module > Administration > Global Settings > Edit Default Holiday Settings > Holiday Calculations

![]() The setting will default to 52 Weeks. No other option is available.

The setting will default to 52 Weeks. No other option is available.

Fig.1 - 52 week holiday calculation for flexible staff

Fig.1 - 52 week holiday calculation for flexible staff

Holiday Pay for Flexible Employees

The legislation states that the calculation for holiday should be done using an average of both hours and days worked per week over a period of 52 worked weeks.

The definition of worked, according to the Department for Business, Energy & Industrial Strategy (BEIS) is:

“A week in which the worker was paid any amount for work undertaken during that week.”

If an employee does not have 52 weeks’ service, then the calculation will use the total number of weeks worked.

If an employee has periods of absence where no hours were worked within the last 52 weeks, the calculation will look over the past 104 weeks in order to calculate the average hours and days. If there are still not 52 weeks worked, the calculation will use the total number of worked weeks available.

Flexible Employees – Calculating Holidays Allowed

Average Days per week

The calculation will look back over the last 52 weeks that the employee has worked to establish the total days worked within the period.

The calculation is as follows:

(total number of days worked in period) ÷ (number of weeks in period)

Examples

|

Alice Alice has worked consistently over the past 52 weeks.

Average days per week = 254 ÷ 52 = 4.88 |

Ben Ben has only been employed for 30 weeks. He has worked consistently for those 30 weeks.

Average days per week = 145 ÷ 30 = 4.83 |

Calculation – Days Allowed

The Days Allowed shows the number of available holiday days an employee has in the current holiday year.

The calculations are as follows:

- For employees whose employment started before the holiday year start date:

(average days per week)*(the number of weeks holiday allowed for employee)*(days difference between holiday year start date and holiday year end date ÷ days difference between holiday year start date and holiday year end date)

- For employees whose employment started after the holiday year start date:

(average days per week)*(the number of weeks holiday allowed for employee)*(days difference between employee start date and holiday year end ÷ days difference between holiday start date and holiday year end date)

Examples

|

Alice Start Date – 01/10/2019 Number of weeks holiday allowance = 5.6 Calculation: 4.88*5.6 = 27.33 27.33 * 366 ÷ 366 = 27.33 (round up to 27.5) |

Ben Start Date – 01/05/2020 Number of weeks holiday allowance = 5.6 Calculation: 4.83*5.6 = 27.05 27.05 * 245 ÷ 366 = 18.11 (round to 18.5) |

Flexible Employees – Calculating Holiday Daily Rate

The calculation is as follows:

(holiday days taken in current period)*(average summary rate)*(hourly rate of pay)

To calculate the average summary rate:

((total pay over previous 52 weeks) ÷ (number of days worked over previous 52 weeks)) ÷ (hourly rate of pay)

|

Alice Pay over previous 52 weeks = £18,130.5 Average Summary Rate = (£18,130.50 ÷ 254) ÷ £9 = 7.93 1 day Holiday requested 1 * 7.93 * £9 = £71.37 per day

|

Ben Pay over previous 30 weeks worked = £9,817.50 Average Summary Rate = (£9,817.50 ÷ 145) ÷ £8.5 = 7.97 1 day Holiday requested 1 * 7.97 * £8.5 = £67.75 per day |

Comments

Please sign in to leave a comment.