What’s Changing?

Addition of a new field: Irish PPS Number

Currently the NI Number field in HR & Payroll accepts only the UK National Insurance number and cannot record Irish PPS numbers. This can cause issues for customers who have Irish operations.

Release Date: 1st August 2019

Reason for the Change

To allow customers with Irish employees to record their PPS numbers.

Customers Affected

All HR & Payroll customers.

Release Notes

Global Setting

A new Global Setting will be created.

The setting is un-ticked by default. If left this way, the system will continue to function as it does currently.

Location

In addition to the above, when creating a new employee, on the second page during the process, the Location will be automatically filtered based on whether a NI or PPS Number has been entered.

PPS Validation Format

The PPS number format will have the same validation process as the existing National Insurance one, but following Irish validation rules instead.

Attached to Payroll

If a customer is using auto-attach, any employees associated to an Irish location will not get attached to payroll.

ATS

The ATS API will be updated to include the new PPS values. The PPS validation will be based on the location that the new employee will have:

1. When the new starter will have a UK location, the validation will be done against a NI number

2. When the new starter will have an Irish Location, the validation will be done against a PPS number and the employee will not be attached to Payroll

Addition of a new field: Irish PPS Number

Currently the NI Number field in HR & Payroll accepts only the UK National Insurance number and cannot record Irish PPS numbers. This can cause issues for customers who have Irish operations.

Release Date: 1st August 2019

Reason for the Change

To allow customers with Irish employees to record their PPS numbers.

Customers Affected

All HR & Payroll customers.

Release Notes

Global Setting

A new Global Setting will be created.

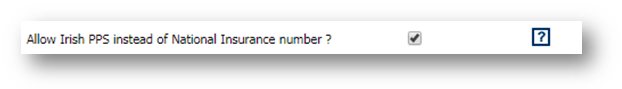

- Go to HR > Administration > Global Settings > Edit Default Employee Settings

- The setting is called Allow Irish PPS instead of National Insurance number? – see Fig.1

Fig.1 – New Global Setting

The setting is un-ticked by default. If left this way, the system will continue to function as it does currently.

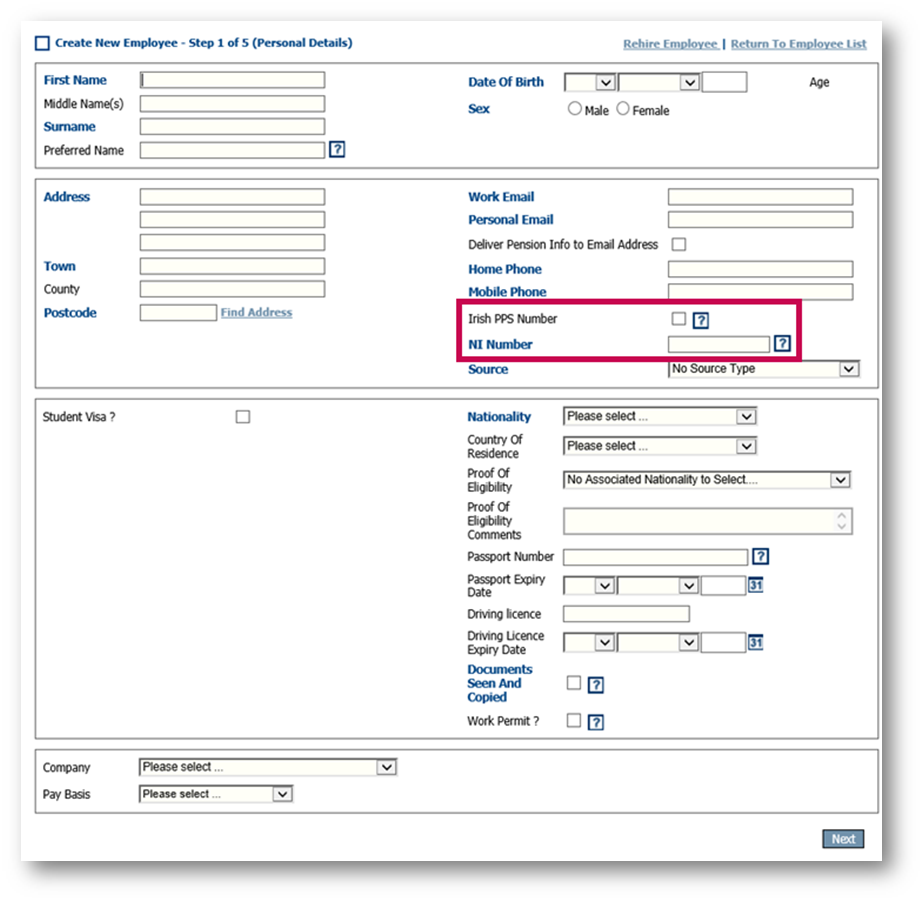

- When the setting is ticked, a new tick box will appear in Employees’ Personal Detail pages called Irish PPS Number – see Fig.2.

- When this box is ticked, users will be able to enter an Irish PPS Number into the existing NI Number field when editing an existing employee or creating a new one.

Fig.2 – Irish PPS Number tickbox and NI Number field

- If a PPS number is entered into the NI Number field and Irish PPS Number is not ticked, an error will be shown and the number will not be validated.

Location

In addition to the above, when creating a new employee, on the second page during the process, the Location will be automatically filtered based on whether a NI or PPS Number has been entered.

- When a UK NI Number is used, the Location field will only show a UK Location

- When an Irish PPS Number is used, Location field will only show an Irish Location

PPS Validation Format

The PPS number format will have the same validation process as the existing National Insurance one, but following Irish validation rules instead.

Attached to Payroll

If a customer is using auto-attach, any employees associated to an Irish location will not get attached to payroll.

ATS

The ATS API will be updated to include the new PPS values. The PPS validation will be based on the location that the new employee will have:

1. When the new starter will have a UK location, the validation will be done against a NI number

2. When the new starter will have an Irish Location, the validation will be done against a PPS number and the employee will not be attached to Payroll

Comments

Please sign in to leave a comment.