The Change

From 6th April 2014 employers can claim the Employment Allowance and reduce their employer Class 1 National Insurance contributions (NICs).

The Fourth payroll system has been changed to allow customers to claim this allowance. There will be two releases to

Release Date: 10-Apr-2014 – Updates to Company, P32 & HRMC Payments screens.

Release Date: 01-May-2014 – Updated Nominal ledger screen, Nominal Ledger reports, Super Journal, Balance sheet, P30 Summary report to reflect the allowance.

Reason for the Change

Full governmental information around this change may be found on this link:

Fourth has introduced changes to the Payroll Module to accommodate this allowance.

Fourth customers who are eligible for the allowance may activate this through the Payroll Module. It is the customer’s responsibility to check that they are eligible for this allowance and to activate the allowance on the system.

To understand if your Company is eligible please reference the Government source on excluded employers by using this link:

The Allowance claim is reported on the FPS file, HMRC will carry forward this allowance each tax year. It is the customer’s responsibility to set the flag back to NO, if they no longer are eligible to claim the allowance.

Customers Affected

This is available to all People System customers using the Payroll Module.

Release Notes

Three Screens have been changed to accommodate the new functionality:

- Company Set Up

- P32 Details

- HMRC Payments

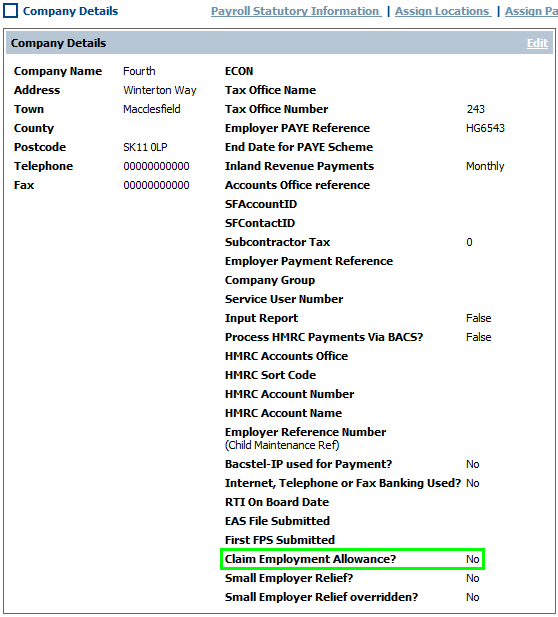

Company Set Up

The Customer may claim the allowance by ticking a new option under the Payroll Company Details screen.

Payroll > Administration > Company Setup > Claim Employment Allowance.

By default this flag is set to No.

When editing this page, tick the box, and on save function, the tick will be displayed as “Yes” and the system will check that:

- Only 1 PAYE is set to receive the allowance per Company. A Company can only claim the allowance against one PAYE scheme, even if the Company runs multiple schemes.

- Only £2,000 is being claimed in a Tax Year.

Fig 1- Updated Company Details Screen

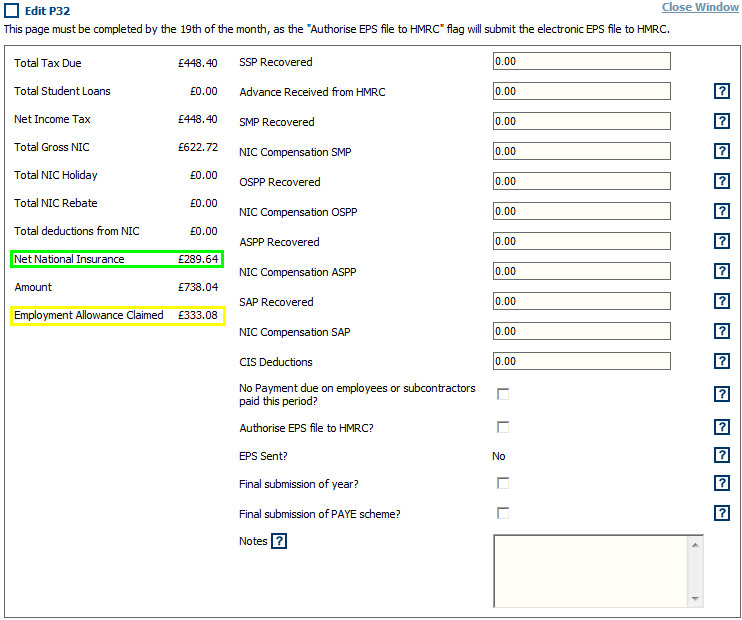

P32 Details

Follow the path: Payroll > Administration > Company Setup > View P32 Details

The system will calculate the “Employment Allowance” from the Employers NI due. If the Employers NI is more than £2,000 the full allowance will be displayed, if the Employers NI is less than £2,000 it will claim as much employers NI as possible for the current tax period. The Net National insurance figure is reduced by the Employment allowance claimed.

Fig 2 - Edit P32 Screen

Once the “Authorise EPS file to HMRC?” is set to yes, the YTD figures at the bottom of the P32 screen will be updated, and will display the outstanding Employment allowance due to be claimed in the next Tax period.

Fig 3 - Year to Date (YTD) Totals

HMRC Payments

Follow the path: Payroll > Administration > Company Setup > View HMRC Payments.

There are no fields in this screen, however the new functionality will display the NIC due figure less the Employment allowance Claimed for the tax period. The “NIC due” figure will not display the net figure after the Employment allowance claimed, unless the “authorise EPS file to HMRC” is set to yes.

Fig 4 - Edit HRMC Payment Screen

Comments

Please sign in to leave a comment.