The Change

From the 6th April 2016 employers of apprentices under the age of 25 will no longer be required to pay secondary Class 1 (employer) National Insurance contributions (NICs) on earnings up to the Upper Earnings Limit (UEL), for those employees.Release Date: 18-Feb-2016

Reason for the Change

This change is due to the HM Revenue and Customs abolition of National Insurance contributions for apprentices under 25Customers Affected

All People System customers with employees who are apprentices under the age of 25Release Notes

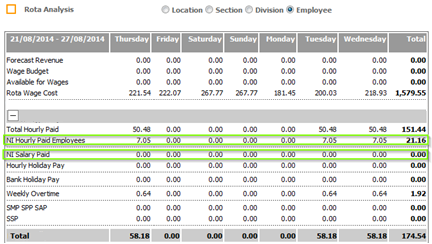

From the 6th April 2016 Employer’s National Insurance Contributions will not be calculated on Rota for Employees who are apprentices and who are under 25. The National Insurance calculation for all other employees will remain the same. The system will use the rota end date to determine the age and status of the employee for the NI calculation. This change will only take affect if an employee has been set as an apprentice in their employment details page in the HR Module.This change will be reflected at all Levels of the Analysis Page i.e. By Location, By Division.

Fig 1 – Rota Analysis Page

Note: To set up an employee as an apprentice please read the release notes previously sent out titled Release Note: Apprentices & National Living Wage.

Comments

Please sign in to leave a comment.